All posts by Gary Stockton

Small businesses have been opening at record rates during and following the pandemic. With so many new businesses seeking capital, and not all of them borrowing with good intentions, Experian thought it would be a good time to talk about mitigating fraud with one of the leading FinTech lenders. Ryan Rosett is the Founder and Co-CEO of Credibly, and he shares several valuable insights with us in this Business Chat. Watch Our Business Chat Interview What follows is a lightly edited transcript of our interview. Gary Stockton: Hello, and thanks for joining us for this business chat. I'm Gary Stockton from Experian Business Information Services, and I'm here with our Vice President, Dominic DiGiuseppe, and also Ryan Rosett, the founder of Credibly, a fintech dedicated to helping medium and small-size businesses grow via funding decisions that are based on the holistic health and potential of a business.And we're here today to discuss fraud as it relates to FinTech in the small business space. Gentlemen, welcome to Business Chat. So Experian has recently released some interesting new statistics on the impact of fraud across several industries, notably that over 39% of recent FinTech inquiries were rated as high risk by our commercial first-party fraud score.And that's a predictive score that can predict the likelihood of first-party payment default and the credit bust-out scenarios that we see. These inquiries are projected to carry 62% of all first-party fraud risk within the population. And if you would like to see more on that analysis, we'll be including a link in the blog post for this business chat.So Dominic, I wanted to get your reaction to this statistic, given our mission to serve small businesses and considering small businesses make up the greater part of our economy and economic output.Dominic DeGuiseppe: Yeah, Gary, thanks for that. First and foremost, I want to give a shout-out to our data sciences and product teams for being able to continue to innovate in this space.But really, when you look at post-pandemic, the amount of businesses that have been created, it's, we were somewhat surprised by the numbers as well. But the amount of businesses that are being created, the mission that we have an experience making sure that we can help provide capital and we can provide funding and get that into the hands of business owners quickly.So if we take a look at some of the trends here, the amount of businesses that are being formed since the pandemic is pretty surprising. We've continued to see that trend. Rise and stabilize a bit, but it's still much higher than pre-pandemic levels. So when you think about businesses that are looking to understand the type of fraud that's being perpetrated or making sure that these types of businesses are actually legitimate as they're looking to make credit decisions and provide these companies with lending or funding decisions, these are the types of tools that have been that the team has been creating. Rapid new business formation during pandemic To make sure that we're assessing and helping folks determine the levels of risk that are associated with these businesses. I know we've talked about this in the past, a few times in different conversations, but can you tell the folks tuning in here a little bit about the Credibly origin story I find it super unique and interesting.Ryan Rosett: Oh, absolutely. So my partner and I started the business in 2010. If you think about 2010, it was a contrarian time to start a business. It was coming out of, the Great Recession of 2008/2009, and they were always talking about this double-dip recession, but it was actually an opportune time to start just because small businesses were really looking for access to credit.And what we are is that we're a cash flow lender. So, we look at the cash flow and make decisions and determinations in a very quick manner to provide working capital at an affordable rate for the customer. So that means, it's important to us that the business can sustain the payments that we're providing, and we can maximize the amount of money working capital that we can give them.So it's just something that we're focused on, and we've had the wind in our back for a, I would say, eight years. And then there's something called the pandemic hit, which was like, which, I didn't sleep for, I don't know, four months. But it was a period of time that was really like an interesting time for a small business lender, but then recognizing also that the government money really boosted up the small businesses, and it worked well for alternative lenders like ourselves.Gary Stockton: The pandemic did accelerate rapid digitization, and it does seem like an opportunity for FinTechs to address lending for small businesses digitally. This stat that we were talking about, it's really quite astounding that there were that number of businesses that sprung up during the pandemic.It makes a lot of sense, though, when you consider there were quite a lot of people that were transitioning from maybe a different industry into another industry, home businesses springing up. But with so many new businesses coming online and the impact of cybercrime on small businesses, Dominic, how do lenders know whether or not they are dealing with a real business when they onboard new customers digitally?Dominic DeGuiseppe: Yeah, I think that's certainly a challenge. And I think one of the things that we're looking to answer is, really, three things — is the business real? Is the business active? And is the applicant that's applying for the loan or the type of funding are they actually linked to the business?I think we can certainly answer for that, but I think, since we've got one of the top FinTechs in the space out there, Ryan what is Credibly doing to understand different fraud trends and combat what's happening within the space with fraud?Ryan Rosett: What I can say is that fraud is pervasive right now. And, as we're an online lender, we make decisions in under four hours from app to decision and fund same day. The amount of data alternative data that we're pulling in to make decisions is really quick. And so the risk that there's a fraud application coming through is something that we that you know, I'd say that's largely what we work on.I would say the three largest fraud patterns that we're seeing and you addressed earlier, was an application mismatch. Which is against the verified sources that they listed. And then, we also have just altered documentation associated with the bank statements.And again, that would be something that would be illegal historically, but we're a nonbank lender. And we're just trying to make decisions based on the data that we have. And we want to verify that the applicant is the owner of the business. So those are the types of frauds that we're seeing, I'd say, like a high level and then there are certain things that we do to combat that.So we will call it stipulations to fund. So we may offer to make an offer subject to them supplying additional information. Maybe it's the articles of a corporation. Maybe it's a tax return. And oftentimes, it's not to say whether you're profitable or not profitable, we're looking at who's the owner, who's getting K1s on the tax returns?Those are examples of things that we are looking at. And I know Experian has been an excellent partner of ours in terms of matching and using a number of different data sources that you provide.Dominic DeGuiseppe: How have you seen fraud evolve pre-pandemic to post-pandemic and continue to take shape and take a different shape, from what's been happening as to now?Ryan Rosett: Yeah, that's a good question. So on a pre-pandemic basis today, we're back to the same level of losses. Okay. But the fraud is becoming a little bit more advanced. Okay. Whether it's be it through cyber attacks, whether it's online applications, there's a number of different things that we're working on that we're constantly combating. So it's not it's not something that we put a fix in and then we move away. It's something that we're constantly evaluating, whether it's a submitting partner, or whether we have an affiliate that provides a certain number of lead applications.Those are things that we're constantly measuring to see what the loss rates are, where the fraud is coming from, and then making decisions. So from a pre-pandemic to a post-pandemic, I'd also say that with the PPP, small businesses got a taste of working with alternative lenders through the PPP process, and they became a little bit more comfortable with working with lenders similar to Credibly. So you're seeing like a little bit more comfortability with small businesses having the ability to interface with us and then they're layering in fraud and things of that nature. So it's a constant something we're combating on a daily basis, and it's something that we're thinking about, very often.Dominic DeGuiseppe: Yeah, because when you start to look at it and all the new businesses that are being formed that are coming into the market, working with alternative lenders and FinTech's like yourself, and you guys continuing to shorten the cycle around the app to approval and all the data points that are coming into it. You guys are different than a bank and are able to do those types of things and move quickly. So obviously, with that comes some additional risk; with the FinTech community being tight-knit, how have you been able to benchmark what Credibly is doing against some of the peers that you guys work with in the industry?Ryan Rosett: We have and that's really through public data through asset-backed securitizations; there's reporting relating to the losses that each lender is seeing, of our losses, approximately 10% of our losses we attribute to fraud. The other 90% is, it could be a business that legitimately goes out of business, which happens. So, it's not necessarily fraud. We do benchmark it based on some of our competitors that have asset-backed securitizations and we see the performance in their loss rates and charge costs and things of that nature.Gary Stockton: So, what are you seeing in terms of an amplifying effect on fraud rates with generative AI in the mix and allowing for spoofed content and more access to triangulated private information on business entities?Ryan Rosett: You know, that's a great question. One thing, you're seeing fraudulent IDs. You're seeing IDs that are becoming a little bit more difficult to track and see, because they're creating an identity of someone and they're able to do that through gen AI.So that, that's one aspect. You're also seeing bank statements. We use a number of different bank statements, parsing, and machine learning that looks at these bank statements. It's looking at font type size. There are a number of things when somebody is attributing and oftentimes, sometimes the fraudster is making grave errors also. They're putting data in where data wasn't supposed to be. You're able to detect that really quickly and that's on an automated basis. So that doesn't even touch a human. We see fraud, we kick it out. And, it's declined. So it's a, it's, when we see a, when we fund a fraud application and it's noted as a fraud that we've determined fraud, we then report it we have a, there's a data matching system that we report into so that business owner would never be eligible for. Business financing through an alternative lender. Again,Gary Stockton: Dominic, any closing thoughts?Dominic DeGuiseppe: Yeah, Gary, I would say just in terms of, generally speaking, fraud continues to evolve. There's a number of different things that we're looking at from a business perspective to be able to help our partners. But, Ryan's pointed out a number of those things today, but as FinTechs continue to evolve, fraudsters will continue to evolve and Experian is on our journey to continue to help understand how we can benefit our business partners, making sure that they can combat fraud and keep it out of the business.Gary Stockton: That's great. I think that's a great place to leave today's chat. Dominic, and Ryan, thank you so much for taking time out to share your perspectives on fraud in the commercial space on Business Chat. Thanks for watching, everyone. Related Posts

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

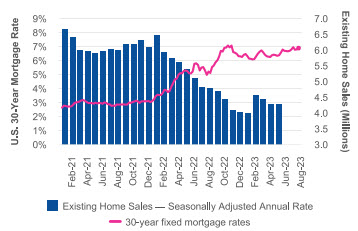

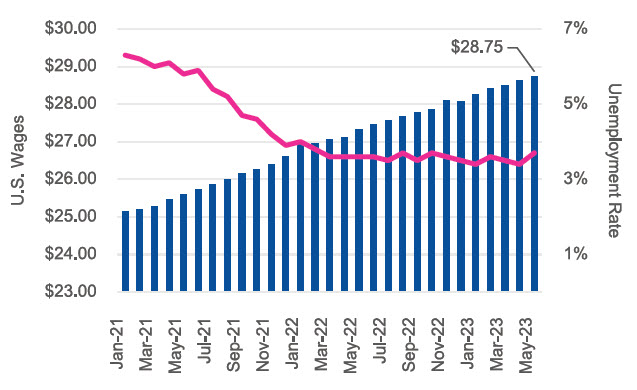

The Federal Reserve’s efforts to tame inflation with aggressive interest rate hikes over the past 15 months appear to be working with July’s core inflation rate reaching the lowest level since October 2021. The U.S. labor market remains strong with low unemployment and 187K knew jobs created in July. As inflation eases and the economy continues to be strong, it is becoming more likely that we could experience a soft landing.

Gain insight on small business credit conditions by attending our quarterly webinar.

Highlights from the latest Beyond the Trends report Are you curious about the trends affecting the small business economy? The just released Summer 2023 Beyond the Trends report is packed with valuable insights based on data from over 25 million active businesses and the expert opinions from Experian’s V.P. of Commercial Data Science. This post covers some of the report's highlights, download your copy for the full scoop. A word from the report’s author: Energy Prices and Consumer Relief One of the most crucial takeaways from the report is that consumers and small businesses can expect continued relief in fuel prices in the coming months. This relief is due to the increased production of fuel in the United States and other countries. This production, coupled with other global and domestic factors, will provide more affordability in fuel costs for consumers and small businesses. This will help them manage their expenses better and, in turn, help producer costs decline, leading to more positive economic developments. Small Business Delinquency Small businesses, especially those that were propped up by stimulus money, are beginning to feel the pinch of inflation that is eating into their margins. Due to this, their savings are running lean, and many businesses are experiencing a rise in delinquencies. Delinquency rates have now exceeded pre-pandemic levels. Still, the report suggests that this is where they would expect delinquencies to be as the economy begins to grow gradually. Optimism Amidst Challenges Despite the lingering challenges and uncertainties brought about by the pandemic, small business owners remain optimistic. The report shows that the overall sentiment among small business owners is still positive, and they continue to seek out opportunities and innovations that could lead to growth and success. This is a positive development, and it's critical for businesses to continue to be agile and open to new opportunities and ideas. In closing: Small businesses are facing challenges such as filling job openings, higher costs, delinquencies and rising debt, but they remain optimistic and focused on opportunities for growth. By staying true to their values and fundamentals, businesses can thrive even in uncertain times. Grab your copy of the Summer 2023 Beyond the Trends report for more interesting insights on small businesses and their challenges. Download Beyond The Trends Summer 2023 Report

The post-pandemic economic landscape is experiencing an alarming rise in fraudulent activity affecting both businesses and consumers. With 75% of creditors experiencing heightened fraud losses and a 50% increase in fraud reports as per the FTC, the situation grows increasingly challenging. The expansion of e-commerce and the increasing sophistication of the dark web as a marketplace for stolen data exacerbate cybercrime threats. Moreover, lenders struggle to differentiate vast numbers of newly-formed businesses from bad actors due to limited data history available for decisioning. Amidst this, while Artificial Intelligence offers substantial promise in combatting fraud, it also significantly expands fraudsters’ toolboxes and poses significant fraud risks to creditors and consumers. To address these pressing concerns, businesses must step up their fraud risk management game by proactively adopting new fraud detection data and capabilities, and by integrating commercial entity and consumer data into their fraud decisioning strategies. What I am watching: The latest inflation report and jobs report showed positive news for the economy. Unemployment remains low and job creation is slowing but still strong. Inflation was down to 3% in June, the lowest in over two years, and closing in on the Fed’s target of 2%. Despite earlier indications of more interest rate hikes this year, this encouraging news may lead the Fed to leave interest rates alone at their upcoming July meeting. Subscribe Today Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Job satisfaction, or the lack thereof, is causing a shift in the workforce. Over half of employees in the United States are “quiet quitting” and actively looking for other jobs. In part, this is driving the number of self-employed individuals to rise. Growth in the self-employment rate for females is outpacing that of males. Female business owners account for double the number of new businesses open less than two-years when compared with males. Female business owners are seeking credit but across most industries receive less funding. Male and Female business owners have comparable credit risk profiles and utilize a similar mix of commercial credit products, yet male business owners, on average, receive higher credit funding amounts. Even in most industries where new credit originations skew to one gender, male business owners are granted higher credit funding amounts. This disparity in commercial credit lending has an adverse affect on female business owners and forces them to pursue other financing options. What I am watching: As an impending recession approaches, the labor market is expected to constrict which will reduce options for employees. Job vacancies are likely to be limited, quits will decline and self employment will slow as individuals seek the security of more traditional jobs. While people may not take the leap to start their own business as much, it will be interesting to see if the vast number of new businesses created over the past couple of years can survive an economic downturn. Subscribe Now Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Women led businesses lag behind on venture capital funding, and are turning to commercial loans and lines to bridge the gap Start-ups founded or cofounded by women receive only 44% of financial backing, but generate more revenue. While it is very encouraging to see the progress of women in business advancing, the pace of progress is slow and more could be done to achieve parity. Women’s salaries are slowly catching up, but they are still only about 80% of men’s wages. There are continued barriers to mothers participating in the labor force due to the limited capacity of childcare facilities, the high costs to families for childcare, and the low wages for childcare workers making lower skilled work sometimes more attractive in a tight labor market. These forces disproportionately affect women whether they work for wages or work for themselves as a small business owner. In addition to the issues facing women as workers, there are unique challenges they face as start-up founders as well. There is a known disparity in the funding provided to start-up businesses pitched by a woman versus a man and that is leaving women without the full funding they need to launch new businesses successfully. Added diversity within venture capital and angel investor groups could help change this dynamic so women can access that capital and expertise when launching their businesses at the same rate as their male counterparts. Without this, they are left to rely on self-funding and loans from banks — if they can get approved. The good news is that many women are making it work and the number of successful women-owned businesses continues to climb. What I am watching: The debt-ceiling standoff continues to cause uncertainty in the financial system with no compromise in place and a looming June 1 deadline, according to Secretary Janet Yellen. This situation is going to dwarf all others until there is a resolution, so all eyes are going to be on Congress and the President. Other signs in the economy suggest that inflation may finally be responding to the aggressive interest rate hikes enacted by the Fed. The Fed will have a more difficult decision on whether to raise interest rates one more time in June or hold them steady and wait to see if inflation continues to improve. Subscribe Today Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out.

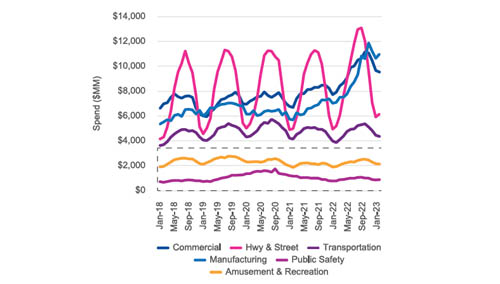

In its continued efforts to tame inflation, the Federal Reserve increased interest rates ¼ point last week, the tenth consecutive increase in just over a year. The cumulative increase is 500bps since March 2022, bringing the Fed Funds rate to 5.00%-5.25%, which is the highest since 2007. While inflation is still above the Fed’s target rate of 2%, they indicated a pause in rate increases. The labor market continues to be strong with April unemployment down to 3.4%, matching the low of January which is the lowest unemployment since 1969. Despite all the efforts by the Fed to have a soft landing, the economy could be upended if Congress does not increase the debt ceiling soon. With inflation slowing, and the labor market strong, a soft landing is possible. Treasury Secretary Yellen said the U.S. could default on debt as early as June 1st. If the U.S. defaults on outstanding debt, many forecast disastrous impacts to the world economy. Despite the recent decline in residential construction spending, construction spend remains strong in both residential and non-residential sectors. The construction industry is one of the few industries that saw a boom throughout the pandemic. Even though over the past few months both residential and non-residential experienced a decline in construction starts and construction spend, the volumes remain above pre-pandemic levels. High construction demand is being met with the formation of many new construction companies. New construction companies are seeking credit at a higher rate, but delinquencies in the construction industry are increasing. Higher risk and higher interest rates are causing commercial lending to tighten, and construction companies are seeing fewer loan originations and smaller loans/lines of credit. What I am watching: The non-residential construction industry is expected to see steady growth in 2023 due to project backlogs but could slow in 2024. Due to higher mortgage rates, the residential construction industry is expected to see a significant decline in housing starts through 2023 with the sector stabilizing in 2024. Aside from the immediate key drivers of interest rates and cost of capital, other areas of focus will be on the labor force and the demand for skilled vs. non-skilled labor. The number of skilled workers is decreasing yet the demand for skilled labor is increasing. The construction industry will have to attract the necessary talent to support the growth. Operational changes in the construction industry will be a driving factor. The construction industry is seeing a shift toward technology in all aspects of construction. Utilization of robotics is increasing which could replace portions of the workforce. Smart Cities, Smart Homes, Green Building are all trending which will materially change construction projects. The Construction Industry is experiencing a noticeable shift and companies will continue to adapt to keep up with demand.