Social Responsibility

Experian is deeply committed to making an important difference in each of the communities we operate and live all over the world. Through our relationships with nonprofit organizations, our dedication to consumer education and our encouragement of employee volunteerism, we are able to champion a number of important causes. Read about our latest corporate social responsibility news below:

2,500 university students across 16 cities have been trained by Experian's experts and young volunteers of the social responsibility project ‘Manage Your Future Now’ project. The project, which was launched by Experian to promote self-improvement among university students, female entrepreneurs, and SMEs, reached the milestone in December and the achievement was celebrated at a recent event at the Experian office in Turkey. Coming from 10 cities across the country, 42 participants gathered to share their experiences. Feedback was positive with everyone agreeing that the project has been beneficial in increasing awareness of social responsibility. The participants were presented with a certificate for their commitment and contribution to the project. ‘Manage Your Future Now’ is a partnership between Experian, the United Nations Development Program and the Habitat Association/Center and Credit Bureau. The initiative includes providing training on financial risks, responsible borrowing, financial management and the efficient management of relationships with banks and the financial sector. Didem Köprücü, Human Resources Manager for Turkey and the Middle East at Experian, said: “We are proud that more people are benefiting under the ‘Manage Your Future Now’ project. Our training is improving every year and I would like to thank all the volunteers and young trainers for their valuable contribution. “The third stage of our project in 2016 will cover financial risk management, as well as financial opportunities for entrepreneur candidates. For this stage of the project we plan to reach 3,000 students and entrepreneur candidates across 26 cities. “However, we intend to continue our project, reaching more people every year.” The project aims to reach 3,000 students by the end of March 2016.

Small Business Saturday is just around the corner, and as it approaches there are a growing number of advertising campaigns encouraging consumers to forego the big box retailers in favor of shopping local.

As a supporter of my own neighborhood small businesses, I can appreciate the effort. After all, the success of small businesses is what really drives our economy forward. Not only do they provide employment opportunities for those in the community, but small businesses often bring a level of innovation and can stimulate growth.

Small Business Saturday is just around the corner, and as it approaches there are a growing number of advertising campaigns encouraging consumers to forego the big box retailers in favor of shopping local.

As a supporter of my own neighborhood small businesses, I can appreciate the effort. After all, the success of small businesses is what really drives our economy forward. Not only do they provide employment opportunities for those in the community, but small businesses often bring a level of innovation and can stimulate growth.

I am part of a community that completely energizes me, makes me believe that there are good people in the world and that makes me want to be better. Over the course of four days in September, my co-workers and I were transported into the world of self-proclaimed “money media nerds” at FinCon, the Financial Influencers conference, where people share thoughts, best practices and update one another on the latest trends. FinCon is THE annual event for the financial media community.

I am part of a community that completely energizes me, makes me believe that there are good people in the world and that makes me want to be better. Over the course of four days in September, my co-workers and I were transported into the world of self-proclaimed “money media nerds” at FinCon, the Financial Influencers conference, where people share thoughts, best practices and update one another on the latest trends. FinCon is THE annual event for the financial media community.

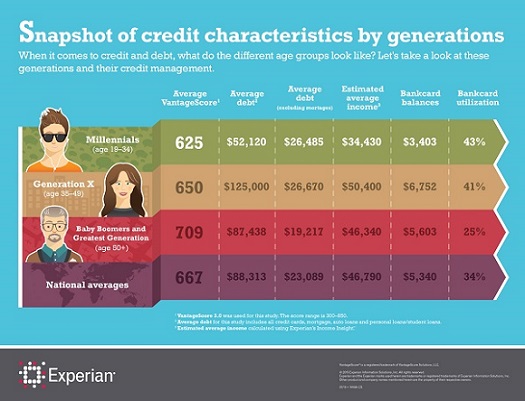

If we looked at current generations in a family structure, Baby Boomers are mom and dad, the Greatest Generation are grandma and grandpa, Generation X are the older siblings and Millennials are those overindulged younger siblings that always got later curfews and more relaxed rules. For that reason, there is a natural, friendly, sibling-type rivalry between Generation X and Millennials. And this week, millennials came out the victors because Generation X failed to school its younger sibling when it came to average debt load.

If we looked at current generations in a family structure, Baby Boomers are mom and dad, the Greatest Generation are grandma and grandpa, Generation X are the older siblings and Millennials are those overindulged younger siblings that always got later curfews and more relaxed rules. For that reason, there is a natural, friendly, sibling-type rivalry between Generation X and Millennials. And this week, millennials came out the victors because Generation X failed to school its younger sibling when it came to average debt load.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

A recent study conducted by Experian showed that a majority of vacationers overspend their budgets and rely on credit cards to provide extra funds. At the extreme end, more than half of millennial vacationers (52 percent) lean heavily on their credit cards, racking up vacation debt they’ll be repaying long after their trip comes to an end.

Confronted with a vast amount of incoming data, today’s digital marketers are facing an on-going battle to keep up. According to Experian Marketing Services’ 2015 Digital Marketer Report, the biggest hurdles and key priorities for marketers this year are dependent on having accurate, enriched data that can be linked together in a central location for a complete customer view.

The last decade was a tumultuous financial period for Americans.

In the mid-to-late 2000s, economic activity declined rapidly and marked the largest downturn since the Great Depression. It is estimated that Americans lost nearly $16 trillion of net worth during this time. To make matters worse, unemployment rates doubled. The booming U.S. housing market plummeted along with the stock market which caused a chain reaction in exposing significant flaws within the financial ecosystem.

The last decade was a tumultuous financial period for Americans.

In the mid-to-late 2000s, economic activity declined rapidly and marked the largest downturn since the Great Depression. It is estimated that Americans lost nearly $16 trillion of net worth during this time. To make matters worse, unemployment rates doubled. The booming U.S. housing market plummeted along with the stock market which caused a chain reaction in exposing significant flaws within the financial ecosystem.

Buying a home is one of the best times to know about your credit. According to a recent survey by Experian, many of those in the market for a home already know the wisdom of credit score insight. However, only half of recent buyers said they checked their credit when they first considered purchasing a home.