All posts by Michael Delgado

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments. Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

![]()

This guest post is from Rod Ebrahimi, CEO of ReadyForZero

At ReadyForZero, our focus has always been on helping people pay off debt and take control of their finances so they can begin building wealth. It’s a mission that has inspired us since our very first user. We started out very small, when I helped my girlfriend make a spreadsheet to organize her student loans. After that, my co-founder Ignacio Thayer and I realized that many of our friends and loved ones had debt. We decided it was our challenge to create a tool that would help them. Focusing on this mission has helped us create the best debt management tool in the industry. Our users are regular people all across the U.S. who are tired of being burdened by their debt and ready to become debt free.

This guest post is from Benjamin Feldman (@BWFeldman), writer and content strategist at ReadyForZero.com, a company helping people get out of debt.

Is personal debt an impossible problem to fix? No way! Thousands - actually, millions - of people across the U.S. are struggling with personal debt right now, but the situation is not hopeless for any of them. I know, because just last year I was one of them. In January of last year, I had over $3,000 in credit card debt and a vowed to get it paid off before the year was over. I’m grateful that I was able to accomplish my goal and along the way I learned a few things that can help others who are still on their way to being debt free. If that includes you, keep reading to learn the 5 steps that will help you get out of debt:

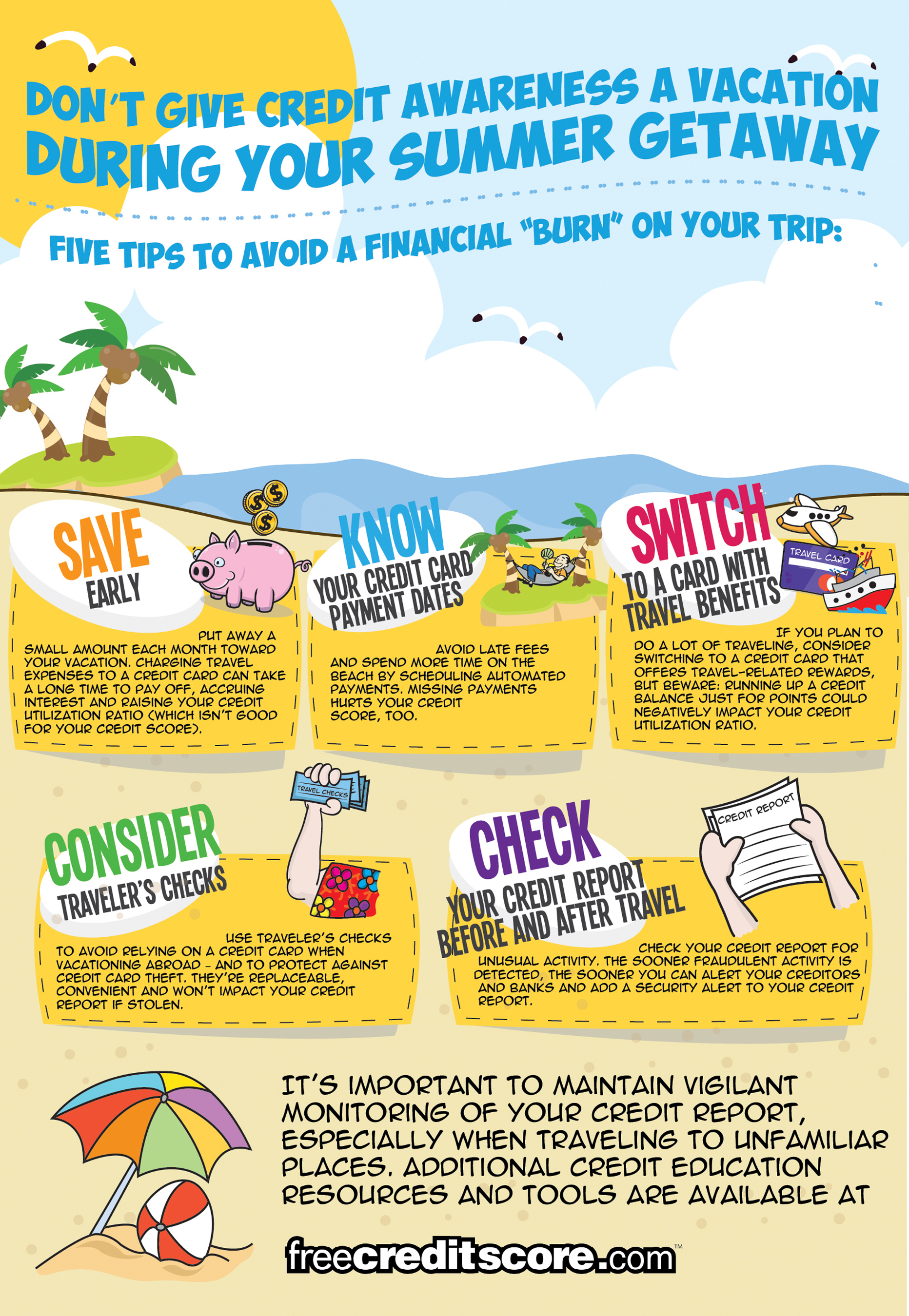

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

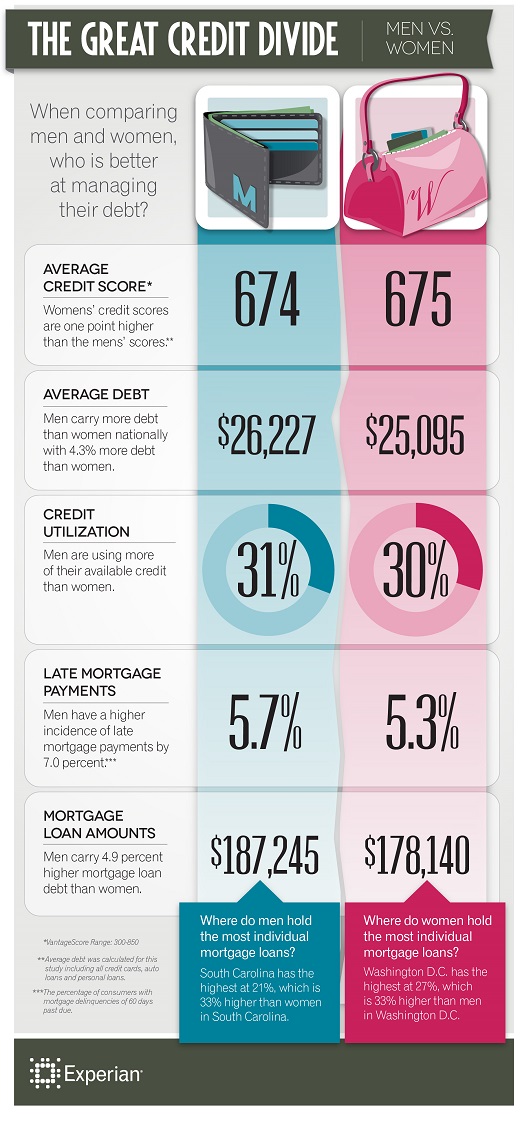

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

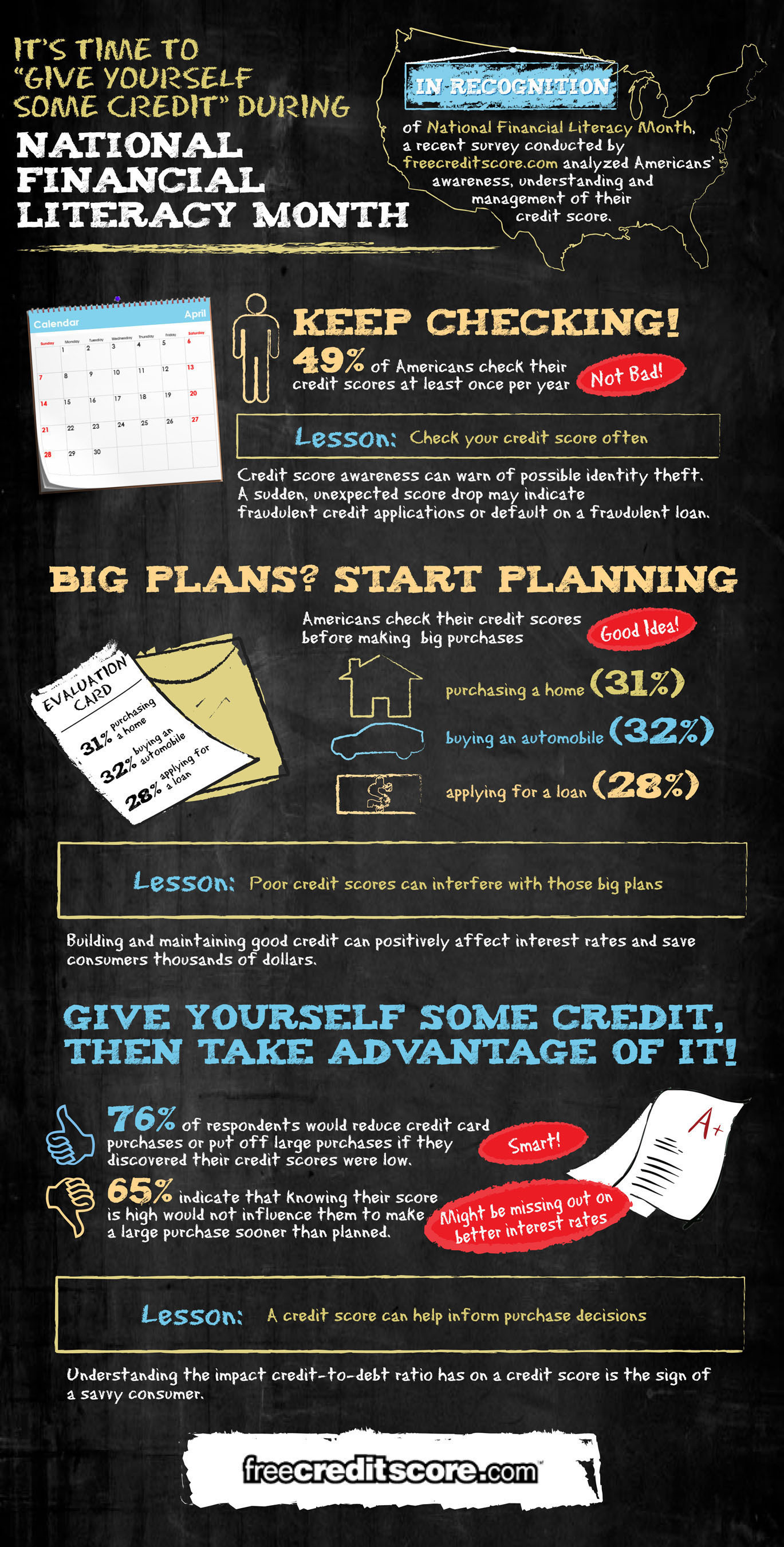

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn't at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it's really a chance for a lot of these bloggers who aren't professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren't sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn't at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it's really a chance for a lot of these bloggers who aren't professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren't sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.

At the beginning of this year, I had several thousand dollars in credit card debt and I was ready to pay it off. But I knew that I needed to cut down on my spending in order to have enough money left over to start paying down my credit card balance.

So I did some research and started finding ways to cut expenses. One of the things I realized is that your fixed expenses - the ones that seem to be locked in - like your auto insurance and rent, often have some flexibility after all.

Below are some tips I’ve found for reducing those fixed expenses:

At the beginning of this year, I had several thousand dollars in credit card debt and I was ready to pay it off. But I knew that I needed to cut down on my spending in order to have enough money left over to start paying down my credit card balance.

So I did some research and started finding ways to cut expenses. One of the things I realized is that your fixed expenses - the ones that seem to be locked in - like your auto insurance and rent, often have some flexibility after all.

Below are some tips I’ve found for reducing those fixed expenses:

Do you love saving money?

Do you ever use apps or online tools to help you cuts costs and stay on budget?

In our continuing quest to promote financial literacy and help consumers live credit smart, we asked some of our favorite personal finance writers to share a favorite app that helps them stay on budget and save money.

Check out these frugal-living apps:

Do you love saving money?

Do you ever use apps or online tools to help you cuts costs and stay on budget?

In our continuing quest to promote financial literacy and help consumers live credit smart, we asked some of our favorite personal finance writers to share a favorite app that helps them stay on budget and save money.

Check out these frugal-living apps: