All posts by Michael Delgado

Have you heard of #CreditChat? #CreditChat is an online discussion that happens on Twitter and YouTube every Wednesday at 3 p.m. ET. It's an educational and fun hour when we discuss credit and money issues with consumers, personal finance writers, academics, and financial organizations.

How does Experian use data to help people get a firmer steer on their financial lives? In this film, our Experian CreditExpert customer Claire Barron tells us how we helped her get back on her feet, and we look at what’s next for our Consumer Services business.

In Marketing Services, we help our clients understand consumers and communicate in the right way, to the right people. This film reveals how we’re helping global charity phenomenon Movember and Europe’s biggest attractions company, Merlin, to make better marketing decisions.

This film looks at how we’re helping client to expand banking services to new customers. It also uncovers how our expertise in software and analytics are helping financial services providers overcome some of their biggest challenges by making sound lending decisions.

Today, Experian operates across a number of different industry sectors known as Verticals. The US Automotive sector is a trillion dollar industry. Experian Automotive provides services to every part of the industry; manufacturers, lenders and dealers. In this film, we take a look at how our data can enable car dealerships to identify new customers and match them up with the right vehicle that they can afford.

Why is Experian so vital to economic life? This film explores the role our Brazilian Credit Services business has played in a rapidly growing economy, and looks at the impact we’re having on businesses and consumers in Australia with the introduction of Positive Data.

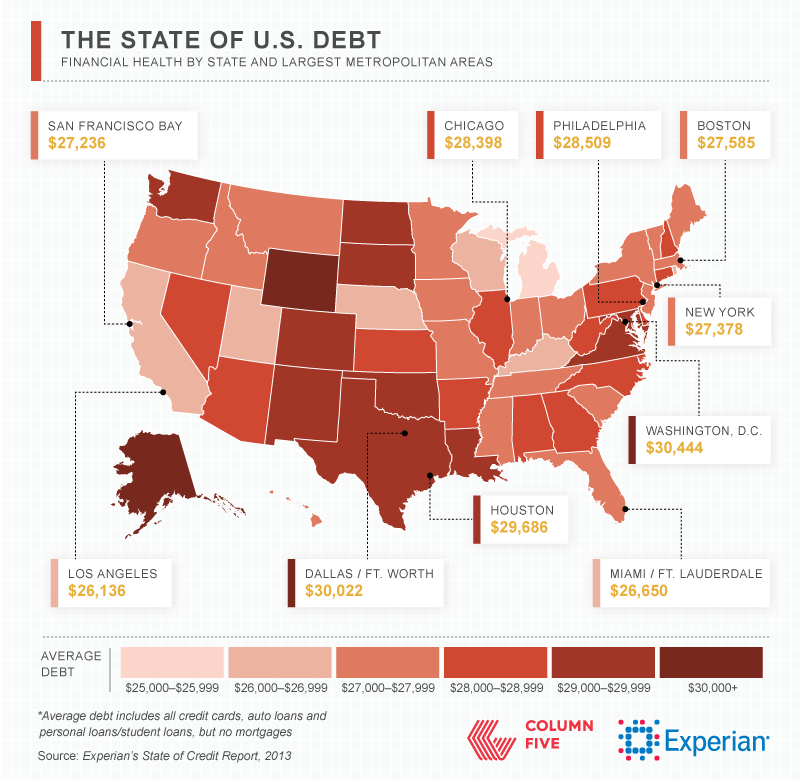

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian's Fourth Annual State of Credit Report

View interactive map: Experian's Fourth Annual State of Credit Report

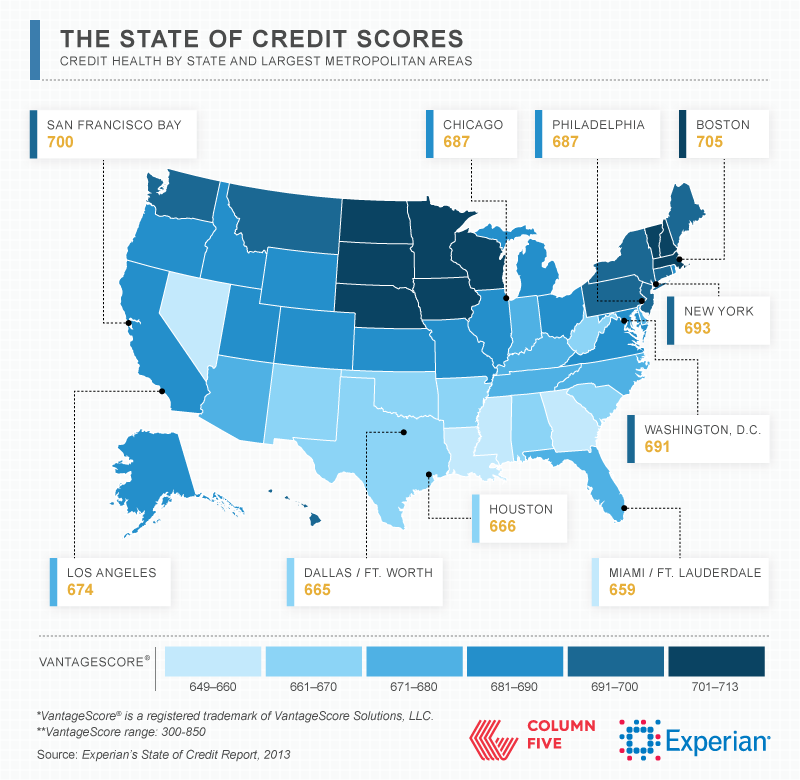

A glimpse at credit scores in the largest metropolitan areas ...

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

1. Think experience over tangible items

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com