Get Smart About Credit Day

Our weekly #CreditChat started in 2012 to help our community learn about credit and important personal finance topics (e.g. saving money, paying down debt, improving credit scores). Each chat is hosted by @Experian on X (formerly Twitter) and all are welcome to participate.DM us any questions.

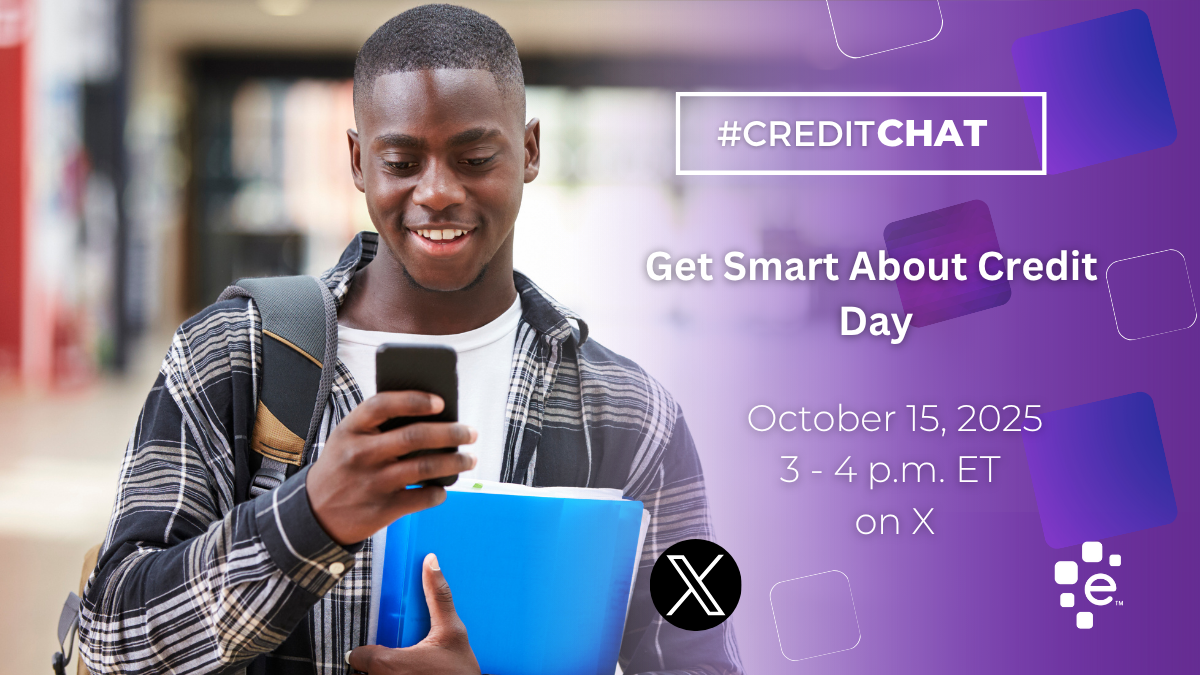

Join us on X for our Get Smart About Credit chat in celebration of annual Get Smart About Credit Day! In this interactive, hour-long conversation, we’ll cover the credit basics. Don’t miss this chance to boost your credit knowledge and join the discussion!

Topic: Get Smart About Credit Day

When: Wednesday, October 15, 2025 at 3 p.m. ET.

Where: Join the live hashtag discussion

The panel will include: Felicity Watts: Author at American Consumer Credit Counseling; Raya Reaves: Founder and Finance Coach of City Girl Savings, LLC; Nika Booth: Award-winning debt expert and founder of DebtFreeGonnaBe.com; Beverly Harzog: Credit Card Expert, Bestselling Author, columnist and podcast host at BeverlyHarzog.com; Nia Adams: Speaker, Real Estate Investor, Author and Founder of PerspectivesChange.com; Ilyce Glink: Real Estate and Financial Wellness expert, author, speaker, entrepreneur and founder of ThinkGlink.com; Jorrell Bland: Associate Wealth Advisor at Mitlin Financial, Inc.; Bruce McClary: Senior Vice President, Media Relations and Membership for the NFCC.org; Rod Griffin: Senior Director, Consumer Education and Advocacy, Experian; Jennifer White: Consumer Education and Advocacy Team, and Christina Roman: Consumer Education and Advocacy Manager at Experian.

Gift Card Giveaway

Join the conversation for a chance to win a $50 Amazon gift card! We will be announcing a winner at the end of the chat.

Questions we will discuss:

- Why is having good credit important, even for young adults just starting out?

- How can young adults or students start building credit responsibly?

- What’s one thing you wish you had learned about credit earlier in life?

- What’s the difference between a credit report and a credit score?

- What are the top factors that impact your credit score the most?

- What’s a common credit myth you’ve heard that you’d like to debunk?

- How often should you check your credit report, and where can you do it for free?

- What are some smart strategies for improving or rebuilding your credit if it isn’t where you want it to be?

- What steps should you take if you spot an error on your credit report?

- How can learning more about credit empower someone to make better financial decisions?

Check out our complete list of upcoming personal finance Twitter chats here.