At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

What separates Experian’s syndicated audiences

- Experian’s 2,400+ syndicated audiences are available directly on over 30 leading television, social, programmatic advertising platforms, and directly within Audigent for activation within private marketplaces (PMPs).

- Reach consumers based on who they are, where they live, and their household makeup. Experian ranked #1 in accuracy by Truthset for key demographic attributes.

- Access to unique audiences through Experian’s Partner Audiences available on Experian’s data marketplace, within Audigent for activation in PMPs and directly on platforms like DirectTV, Dish, Magnite, OpenAP, and The Trade Desk.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

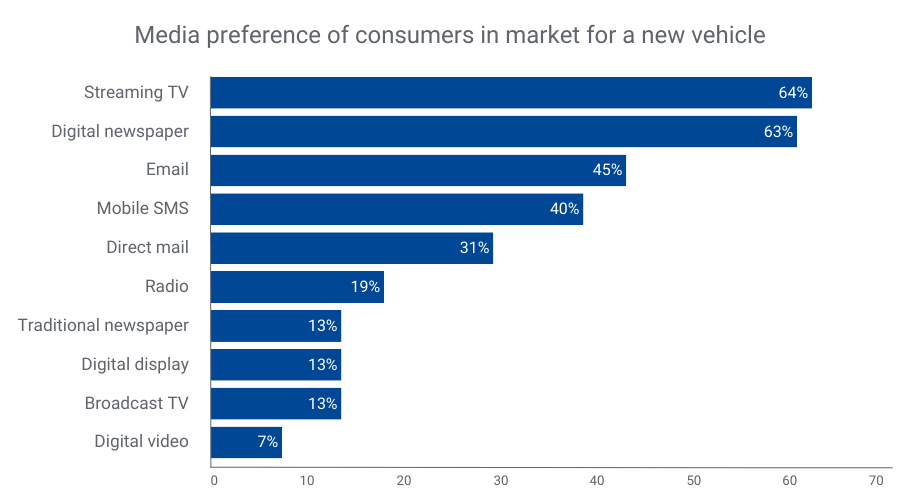

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Contact us

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Strong Revenue Performance and Thriving Culture Contribute to Industry Recognition NEW YORK, Sept. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, was named a top company on Inc. Magazine’s list of the 5000 fastest-growing private companies in the U.S. In addition, Tapad won the TMCnet 2016 Tech Culture Award. The exclusive Inc. 5000 ranking highlights the fastest-growing privately-held* companies in America. These distinguished companies have achieved success in strategy, service and innovation. TMCnet recognizes talented tech professionals who are committed to building a culture that prioritizes employee growth, collaboration and engagement. Tapad continues to broaden their presence into new markets, having launched in APAC earlier this year, as well as continuing their European expansion. Tapad’s proprietary technology, The Device Graph™ is leveraged by more marketers and brands to understand digital engagement across devices. The company’s rapidly expanding client base includes numerous Fortune 500 company brands as well as all four major advertising holding companies in the U.S. “We have an exceptional team of innovative people who are all working very hard to achieve the kind of results these publications are recognizing,” said Tapad CEO and Founder, Are Traasdahl. “Given that, we have an even greater responsibility to our talent to create an environment that fosters innovation and nurtures open communication. Ultimately, this is how we will continue to reach our very ambitious goals of becoming the world’s leading unified marketing technology provider.” Tapad’s award-winning work culture is defined by its gold-standard benefits which include a six-month parental leave policy, unlimited vacation time, company-sponsored meals and office space designed to facilitate collaboration and open communication. Tapad’s highly talented team has also received multiple customer service awards in 2016. These awards include the iMedia ASPY awards for Best Customer Service and Best Mobile Partner as well as recognition from The Communicator Awards of Excellence in Interactive Media. *Prior to Tapad’s acquisition by Telenor in February 2016. Contact us today

The Tapad Device GraphTM Had Twice the Precision and Three Times the Scale as Next Competitor New York, September 14, 2016 – Just-released findings of a Hotels.com® study revealed that Tapad’s (part of Experian) cross-screen marketing technology achieved the highest levels of precision and scale among competitors. According to the leading online accommodation booking website, after a rigorous, three-and-a-half month vendor analysis, Tapad achieved twice the precision of the next highest-scoring cross-screen offering and three times greater scale. The two other companies evaluated were not named. Said Helene Cameron-Heslop, Senior Manager of Analytics of the Hotels.com brand, “Our team implemented an extremely rigorous vetting of open, cross-screen technology vendors. At the outset, we assumed we would have to compromise on either scale or accuracy – particularly given the importance to our brand of operating in a privacy-safe setting. We were surprised to find a complete package, but Tapad’s Device Graph won out on scale, accuracy and privacy; making our choice of partners very clear.” In another metric critical to the Hotels.com brand, The Tapad Device GraphTM was eight times more “unique” than the next closest offering, meaning Tapad’s graph was found to have a much greater number of connections not seen in any of the other graphs. In addition to precision, uniqueness and scale, the Tapad Device GraphTM was found to have: ● 100% higher recall● 47% more incremental matches● 53% higher North American market coverage● 101% higher F-Score* “A valuable cross-device solution should enable partners to get everything they’re looking for from a single vendor,” said Tapad Founder and CEO, Are Traasdahl. “We are deeply impressed with how thorough Hotels.com was in their vetting, and we confidently tackle the complex challenges of the martech industry thanks to our superior technology. Everyone loves a bake-off, and Tapad is no exception – delivering best-in-class results in areas that really count.” *F-score is a statistical measurement that takes precision and recall together. The calculation is 2*(precision*recall)/precision + recall). It gives you one number instead of two numbers to look at and judge performance. Contact us today

Five Norwegian startups selected to establish U.S. presence NEW YORK, Aug. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, has announced its new entrepreneurial mentorship initiative, the Propeller Program. Five early-stage startups from Norway have been chosen by Are Traasdahl, native of Norway and Tapad’s CEO and founder. The selected companies will share Tapad’s New York City workspace, receive C-level guidance and help establish a U.S. presence. The following companies have been selected to participate in the inaugural Propeller Program – a 12-month program beginning September 19, 2016: Bubbly – Developers of a platform that enables in-store customer feedback with dashboards and tools that facilitate real-time store response BylineMe – A marketplace for freelancers, publishers and brands to connect for content creation and distribution services Eventum – A property-sharing group that digitally assists in securing venues for meetings and corporate events Xeneta – A database that organizes the best contracted freight rates in real time and on demand “We are supporting startups that we feel represent the future of service offerings,” said Traasdahl. “It is with incredible pride that we invite these entrepreneurial teams from Norway to join us in New York Citythis year. Mentorship opportunities for early-stage companies are so important, particularly for those based outside the U.S. I look forward to giving the Propeller Program participants access to the expertise of my seasoned team and to our wide network of resources. Hopefully, it will be a game-changing year for many of them.” Contact us today