At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

What separates Experian’s syndicated audiences

- Experian’s 2,400+ syndicated audiences are available directly on over 30 leading television, social, programmatic advertising platforms, and directly within Audigent for activation within private marketplaces (PMPs).

- Reach consumers based on who they are, where they live, and their household makeup. Experian ranked #1 in accuracy by Truthset for key demographic attributes.

- Access to unique audiences through Experian’s Partner Audiences available on Experian’s data marketplace, within Audigent for activation in PMPs and directly on platforms like DirectTV, Dish, Magnite, OpenAP, and The Trade Desk.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

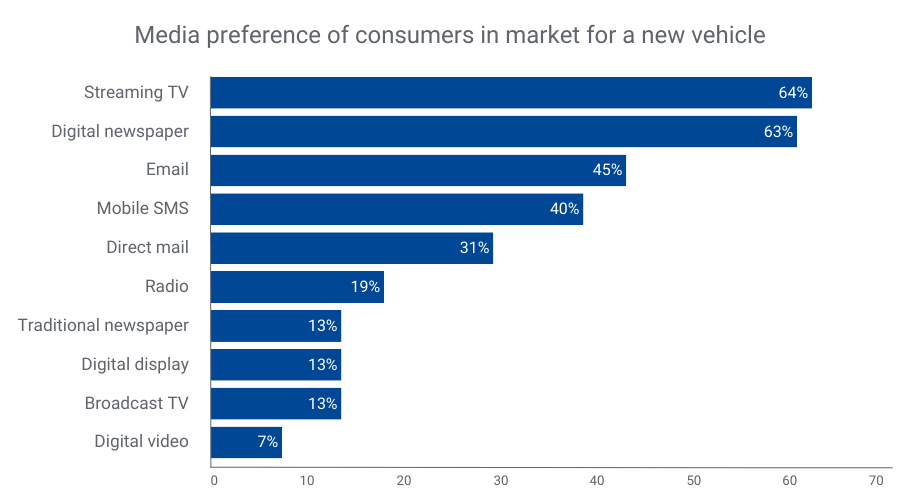

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Contact us

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Dextro clients to achieve increased accuracy in cross-device consumer measurement and engagement NEW YORK, Feb. 6, 2017 /PRNewswire/ — Dextro Analytics, a pure play analytics company that harnesses the power of human learning and artificial reasoning to drive more informed and effective consumer marketing, is partnering with Tapad, the leading provider of unified, cross-screen marketing technology solutions and now a part of Experian. The deal is effective immediately and the scope of the partnership covers North America. Additional terms were not disclosed. Leveraging Tapad's privacy-safe Device Graph™, Dextro Analytics will be able to significantly bolster its insight engine to decode complex customer journeys. Armed with more relevant, actionable insights, marketers can use Dextro's cross-screen, closed-loop measurement systems to reach and engage the right customer at the right time through the right channel. "Being able to accurately map consumer preferences, behaviors and journeys in a privacy-safe and unified way across devices is still one of the biggest pain points for marketers," said Ajith Govind, co-founder of Dextro Analytics. "At the same time, this partnership engages customers with the right message at the right time." "Detecting latent patterns and signals, and tracing backward- and forward-looking behavioral characteristics, are keys to sustaining a competitive advantage in a crowded space," said Manmit Shrimali, co-founder of Dextro Analytics. "With the proliferation of data and devices, connecting the dots is of paramount importance." "Dextro is solving some of the biggest challenges in analytics today," said Pierre Martensson, GM of Tapad's data division. "Our partners consistently see notable improvements in both budget allocation and device optimizations after integrating with the Tapad Device Graph, and I have every confidence that Dextro will be among them." For more information about Dextro Analytics' revolutionary approach to using human learning and artificial intelligence algorithms to solve business and analytical problems, please visit http://dextroanalytics.com/. For more information about Tapad's cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today

NEW YORK & LOS ANGELES / BUSINESS WIRE / Jan. 30, 2017– Tapad, part of Experian, and Rubicon Project (NYSE: RUBI) announced today a new global partnership offering a unified, cross-device campaign delivery solution within an automated advertising marketplace. Tapad is the leading provider of unified, cross-screen marketing technology solutions and Rubicon Projectoperates one of the largest advertising marketplaces in the world. The Tapad Device Graph™, which enables buyers to expand their high-value display data signals to associated mobile devices, will be integrated across Rubicon Project’s leading advertising exchange and Orders platform, significantly improving consumer mobile reach. The new global partnership will empower Buyers within Rubicon Project’s exchange to find and engage audiences across their entire digital experience. Rubicon Project operates one of the world’s largest mobile exchanges connecting to approximately 1 billion unique mobile devices globally. “We’re excited to partner with Tapad to continue to provide our customers the very best data for managing their advertising businesses,” said Harry Patz, Chief Revenue Officer, Rubicon Project. “Cross-device delivery is crucial for buyers today with more than 81% of internet users currently relying on more than one device for digital access[1]. Through our partnership, buyers will be able to extend their desktop private marketplace campaigns to mobile, allowing them to find and engage their audience across devices, anywhere in the world. The net result will also benefit sellers; the increase in mobile reach will better position publishers and app developers to strategically capitalize on their inventory, ultimately increasing bid rates and mobile revenue across the board.” “Our partnership with Rubicon Project marks the first time advertisers and publishers alike are able to use cross-device solutions at significant scale outside of Google and Facebook,” said Pierre Martensson, GM of Tapad’s Data Division and APAC. “Our Device Graph will help Rubicon Project’s advertisers make more informed buying decisions and find the audiences who matter most.” Barry Adams, VP of Commercial Development at Bidswitch, said, “As digital advertising moves away from desktop and increasingly toward a mobile-first model, cross device data becomes critical to finding consumers. The rich data buyers will now be able to leverage at scale through the Tapad and Rubicon Project integration will enable us to provide a state-of-the-art cross-screen solution for the 150+ buying platforms that use our service, and the tens of thousands of advertisers they represent.” For more information about Rubicon Project’s inventory, please visit www.rubiconproject.com. For more information about Tapad’s cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today

Tapad expands linear TV analytics solution, enabling optimal reach and frequency across TV and digital platforms NEW YORK, Jan. 24, 2017 /PRNewswire/ – Tapad, now a part of Experian, has partnered with WideOrbit, the leading provider of advertising management software for media companies, to develop the industry's first programmatic TV-buying platform powered by a device graph. Tapad is the leading provider of unified, cross-screen marketing technology solutions and was first to market with a device graph, the Tapad Device Graph™. WideOrbit's robust supply platform and industry-leading footprint offers access to premium TV inventory on top networks, reaching more than 99 million households across local affiliates. The partnership pairs Tapad's demand-side technology with WideOrbit's supply-side inventory. As a result, marketers can leverage cross-device audiences in their TV buys for the first time. Additionally, integrating the Tapad Device Graph™ with digital feedback loops and audiences both accelerates optimization and enables precise audience discovery for TV marketers. "The integration of WideOrbit's quality TV supply takes orchestrated cross-screen media buys to the next level," said Marshall Wong, Tapad's SVP of TV market development. "Marketers can now optimize TV campaigns within days instead of weeks. This also untethers them from buying against generic demographics like age and gender. By allowing brands to employ their own CRM or third-party data, we can move them much closer to audiences who will take action." "Integrating Tapad's device graph with WideOrbit's programmatic marketplace delivers enormous value to marketers looking to add TV to cross-device campaigns," said Ian Ferreira, EVP of programmatic at WideOrbit. "Television still delivers the most efficient reach of any medium, and Tapad's platform now allows marketers to purchase premium broadcast inventory that extends the power of cross-screen campaigns to TV with a single, unified solution." "Our clients build lasting relationships with consumers through thoughtful and pioneering marketing," said Jeff Giacchetti, VP of digital at Mediavest Spark. "The strategic partnership of demand-side technology and supply-side inventory makes it easier for brands to find efficient, incremental reach and are critical in this endeavor." For more information about Tapad's cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today