At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

What separates Experian’s syndicated audiences

- Experian’s 2,400+ syndicated audiences are available directly on over 30 leading television, social, programmatic advertising platforms, and directly within Audigent for activation within private marketplaces (PMPs).

- Reach consumers based on who they are, where they live, and their household makeup. Experian ranked #1 in accuracy by Truthset for key demographic attributes.

- Access to unique audiences through Experian’s Partner Audiences available on Experian’s data marketplace, within Audigent for activation in PMPs and directly on platforms like DirectTV, Dish, Magnite, OpenAP, and The Trade Desk.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

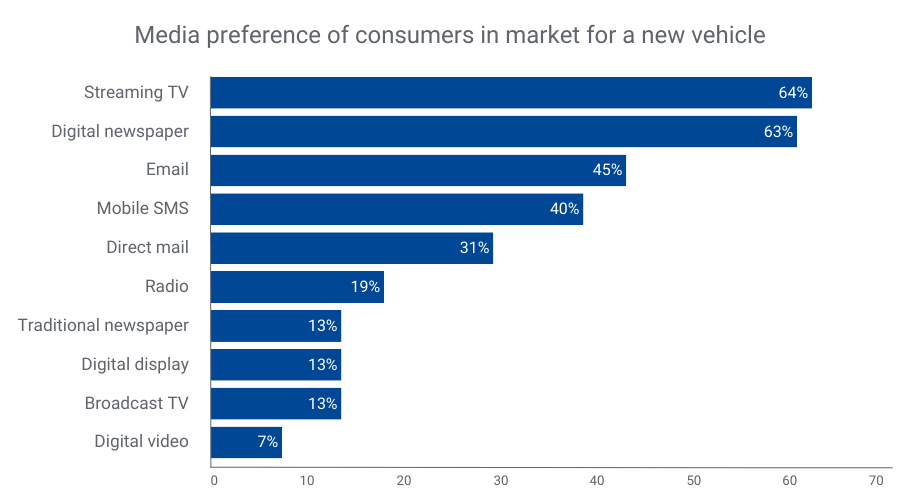

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Contact us

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Tapad, part of Experian, integrates with AcuityAds' current offering will complement cross-channel capabilities for brands and agencies in the U.S. and Canada NEW YORK, Jan. 23, 2020 /PRNewswire/ — Tapad, a global leader in digital identity resolution, has partnered with AcuityAds, a technology leader that provides targeted digital media solutions for advertisers to connect intelligently with audiences. The partnership will enhance AcuityAds' existing cross-device solution, especially with respect to its cross-channel Connected TV offering. Tapad's global, privacy-safe digital cross-device solution, The Tapad Graph, will compliment AcuityAds' own cross-device data set for enhanced marketing capabilities across their Demand Side Platform (DSP). For AcuityAds, this provides customers with unduplicated reach across desktop, tablet, mobile and CTV devices – while augmenting their video offering. Tom Woods, Vice President of Products at AcuityAds commented, "With increasing marketing complexities, consumer device usage and new data regulations, our decision regarding the partnership was an important one. The Tapad Graph's privacy-safe identifiers for consumer notice and choice, as well as the ability to opt-out at any point, were critical factors in our decision who to partner with." Chris Feo, Senior Vice President, Strategy and Partnerships at Tapad added: "Our integration with AcuityAds' DSP should not only help marketers within North America optimize current cross-device campaign initiatives and performance, but also increase reach across additional digital screens long term. We are excited to expand our partnership with AcuityAds." To learn more about Tapad and our digital identity resolution capabilities, visit our identity page. About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph and its related solutions provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Tapad is recognized across the industry for its product innovation, workplace culture, and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore, and Tokyo. About AcuityAds AcuityAds is a leading technology company that provides marketers a powerful and holistic solution for digital advertising across all ad formats and screens to amplify reach and Share of Attention® throughout the customer journey. Via its unique, data-driven insights, real-time analytics and industry-leading activation platform based on proprietary Artificial Intelligence technology, AcuityAds leverages an integrated ecosystem of partners for data, inventory, brand safety and fraud prevention, offering unparalleled, trusted solutions that the most demanding marketers require to be successful in the digital era. AcuityAds is headquartered in Toronto with offices throughout the U.S., Europe and Latin America. For more information, visit AcuityAds.com. Disclaimer in regards to Forward-looking Statements Certain statements included herein constitute "forward-looking statements" within the meaning of applicable securities laws. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Investors are cautioned not to put undue reliance on forward-looking statements. Except as required by law, AcuityAds does not intend, and undertakes no obligation, to update any forward-looking statements to reflect, in particular, new information or future events. Contact us today

Tapad, a part of Experian and the future of cookies Earlier this week, Google announced plans to create “.. a path towards making third-party cookies obsolete”; which will result in the phasing out of support for third-party cookies in its Chrome browser within two years. While there has been much discussion and debate on the future of the third-party cookie, an announcement from Google has been anticipated for some time. As many have said this week, the use of cookies and other identifiers has and will continue to evolve. What will never change is the value exchange between publishers and consumers that is enabled by relevant advertising. Notably, the need for independent companies to develop solutions that enable this value exchange has never been greater to ensure that publishers, consumers, and advertisers derive the most value from their relationship. We are well-positioned for the future From the start, Tapad, a part of Experian has led with a consumer-first, privacy-centric approach to technology as the use and proliferation of devices and global privacy regulations continue to evolve. Over the past two years, Tapad, a part of Experian has gone through a technical overhaul. Calling on almost ten years of expertise in identity resolution, we have created a modern platform that is flexible in terms of identity input as well as output. Anticipated change in the identity landscape was the driver behind our architecture decisions and what enables us to be responsive to a dynamic market. Consumer behavior and device use continue to change, bringing additional digital IDs into the equation – namely across the mobile and CTV environments. Our technology, however, is not tied to any specific type of identifier, but rather is focused on associating disparate identifiers at the individual and household level. Where do we go from here? Google’s announcement has been characterized as a conversation starter, but we see it more as a call to action. With a timeline set, there is a need to converge on one or more solutions that can scale across the web. In a post cookie world, publishers and advertisers will continue to require ways to create fair marketplaces across platforms and devices. Further, the platforms that currently power the programmatic advertising ecosystem will need to be able to invest and differentiate to bring value to their customers. Scaled privacy-safe identity solutions will be needed not only for classic targeting, attribution, measurement, and frequency capping use cases but also to carry consumer preferences and consent. Tapad, a part of Experian will continue to play a leading role here. However, we are not going to do this alone. As solutions around Google’s Chrome browser evolve, we will continue to take a leadership position and will work with Google, key industry groups, partners and customers to meet current and future needs for an independent identity solution at scale. In the meantime, we will continue to support an independent ecosystem where consumers come first and privacy standards are a priority. It’s business as usual…for now. There will not be any changes to our graph products or services as a result of Google’s announcement in the near term. Any changes related to the Chrome third-party cookie will evolve and will no doubt be subject to significant industry participation and feed-back, indeed at the invitation of Google. We will proactively communicate any changes and product updates during this time period. We look forward to the opportunities resulting from these changes and ushering in a new era of identity resolution in digital advertising. Contact us today

Tapad's integration with Knorex's XPO™ platform will complement cross-channel optimization capabilities for brands and agencies in the U.S. and APAC markets NEW YORK and SINGAPORE, Dec. 10, 2019 /PRNewswire/ — Tapad, part of Experian and a global leader in digital identity resolution, has partnered with Knorex, a leading provider of digital performance marketing. Knorex's self-service online advertising platform, Knorex XPO™, enables marketers to advertise globally in real-time across different media channels, formats, platforms and devices. Tapad's global, privacy-safe digital cross-device solution, The Tapad Graph, will compliment Knorex XPO™'s own device data set for enhanced marketing capabilities. For Knorex, the integration enables their brand direct and agency customers to gain a more accurate understanding of consumers across devices to reduce campaign inefficiencies and duplication, and to effectively manage frequency capping and attribution. Abhishek Kumar, VP of Engineering at Knorex commented, "Today's digital consumer is raising the bar for marketers. With increasing marketing complexities and consumer device usage, this integration enables marketers to understand the consumer decision journey with heightened ease. Our combined offering will empower agencies in the APAC and US markets, providing an improved marketing solution that will help to streamline their efforts." Abhay Doshi, Head of APAC at Tapad added: "The Tapad Graph, when integrated with the Knorex XPO platform, should not only help U.S. and APAC marketers optimize campaign performance through cross device marketing – but also increase the opportunity for brands to reach out to their target customers within a desired time." To learn more about Tapad and our digital identity resolution capabilities, visit https://www.experian.com/marketing/consumer-sync. About TapadTapad, Inc. is a global leader in digital identity resolution. The Tapad Graph and its related solutions provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Tapad is recognized across the industry for its product innovation, workplace culture, and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore, and Tokyo. About KnorexKnorex provides programmatic advertising products and technologies to advertising buyers worldwide. With its cloud-based online advertising platform, Knorex XPO™ enables ad buyers to self-serve and advertise real-time across the globe regardless of the media channels (social, search, OTT/CTV, video, web/mobile etc.), ad formats (display, native, search, social, video etc) and devices (desktop, laptop, smartphones and tablets) to deliver personalized marketing messages to the target audience in an automated way, powered by machine learning/AI. Underpinned by a multi-layered data-driven approach, XPO simplifies the execution and optimization of marketing campaigns, while delivering measurable and attributable performance. Contact us today