Delivering personalized customer experiences is essential, with 81% of customers preferring a personalized approach to their relationships with brands. However, 80% of consumers are concerned about how their data is used, presenting businesses with the challenge of balancing data collection and privacy with personalization.

Despite consumer appetite for personalization, many organizations lack the data to make data-driven decisions: 68% of businesses don’t understand how their customers think, and 82% don’t confidently know their customers’ pain points.

Without this critical data, businesses cannot effectively create personalized consumer connections. Experian offers businesses robust and unique data through our Marketing Attributes to empower businesses with the insights required to derive accurate insights into consumers and drive personalized experiences.

How Experian can help businesses with their data acquisition needs through Marketing Attributes

Experian’s Marketing Attributes allow businesses to license Experian’s data attributes in part or full to provide reliable and accurate data solutions. These solutions assist companies in finding, reaching, and influencing their customers. They are supported by rigorous quality and privacy controls which has earned Experian a #1 data accuracy ranking by Truthset helping our clients reach people based on who they are, where they live, and what they do.

Experian has built a strong foundation of consumer behavioral and demographic data with over 5,000 attributes available across over 15 categories and verticals, helping our clients gain deep insights into their consumers. Below we go through five common use cases we have seen using Experian’s data to power various business initiatives.

Exploring everyday use cases for Experian’s Marketing Attributes

1. Understand areas of the country where your products or services are underserved

For instance, a brand offers a diverse range of products that cater to various market segments and audience personas. They seek to gain a deeper understanding of geographic distribution to refine their marketing strategies. Specifically, they aim to identify which market areas are currently underserved, presenting a valuable opportunity for targeted marketing campaigns to boost product adoption in regions that have not fully embraced their offerings.

Utilizing Marketing Attributes from Experian, the brand can access detailed data aggregated at the geographic level. This data provides crucial insights into markets where their products have seen limited adoption yet show a strong potential for success based on the preferences of their target audiences. This approach will help the brand strategically direct its marketing efforts to areas with high growth potential.

2. Better understand consumers who purchase within a category

Brands frequently operate based on assumptions regarding their customers’ preferences and interests, yet they may lack the comprehensive data necessary to substantiate these beliefs.

Experian’s Marketing Attributes provides brands with access to extensive data across 15 diverse verticals and categories. This wealth of information allows businesses to develop a holistic understanding of their customer base, enabling them to validate their assumptions and uncover valuable insights into customer behaviors. By utilizing this data, brands can significantly enhance their marketing strategies, refine their product offerings, and implement personalized tactics that resonate with their audiences on a deeper level.

3. Reach a new segment of the market for a new product offering

Introducing a new product to a new segment of the market presents unique brand challenges. Without any historical customer data to draw upon, companies lack vital insights that could help them identify and reach their target audience. This absence of foundational knowledge makes it challenging to understand consumer preferences, craft suitable messaging, or determine the most effective channels for connecting with potential customers.

To navigate these hurdles, brands frequently turn to Marketing Attributes for consumer research within the new segment. Analyzing demographics, common behaviors within a geographic region, or previous purchase behaviors can uncover patterns and preferences among potential customers. This deeper understanding enables them to create tailored audience models, allowing brands to develop and activate customized messaging based on common interests, identify channels consumers are most likely to engage by using TrueTouch data from Experian.

4. Create custom lookalike models based on your current customers

We have found brands trying to launch an acquisition campaign to look at consumers whose behaviors and interests closely mirror those of their highest-converting customers. However, they often lack the necessary data to find new customers that look like their most loyal base.

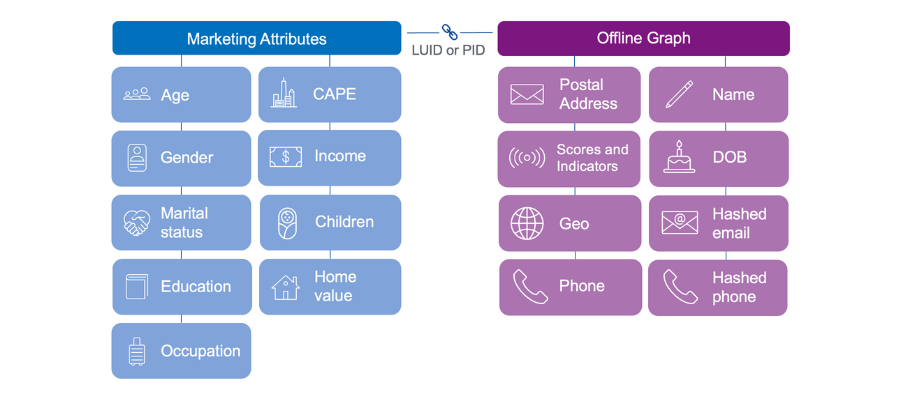

To address this gap, they turn to Marketing Attributes in combination with Experian’s Offline Graph or Digital Graph, which allow them to pinpoint and analyze the key characteristics and behaviors that define their top customers and reach these consumers on digital or offline channels. Marketing Attributes power the insights into their client’s behaviors and Experian’s Offline or Digital Graph create the linkage to their customer base. Using these insights, the brand can develop a distinct audience model tailored to reflect their most successful customers’ unique traits and preferences. This customized approach will help them reach potential new customers who will likely engage and convert.

5. Develop unique audience products

We have seen clients use their own first-party data alongside Experian Marketing Attributes and other data sets they own or lease. With Experian’s Offline Graph or Digital Graph, they can connect the different data sources together to create a tailored audience solution that meets the specific needs of the brand’s clients and the requirements of their market segment.

Exploring joint solutions

Combining Experian’s Offline Graph with Marketing Attributes

Many customers use Experian’s Offline Graph with Marketing Attributes to connect Experian’s data to the brand’s offline marketing strategy. Experian’s Offline Graph offers companies a license of stable offline data points, like name, address, phone number, email, geographic, date of birth, and more that provide a complete view of household and individual identities.

Powering use cases like:

- Regional consumer insights for marketing strategy, media activation, product and location planning

- Offline media activation, including direct mail, telemarketing, out-of-home, and more

- Client-driven enrichment

The combination of Offline Graph and Marketing Attributes provides unmatched consumer connectivity, enabling clients to generate custom insights, inform product strategy, and activate marketing campaigns. Offline Graph acts as the link between consumers insights and activation.

Combining Experian’s Digital Graph with Marketing Attributes

The uncertainty around third-party cookies in Chrome and the overall decline in signal complicates the industry’s ability to reach the right consumer. Omnichannel media consumption results in scattered data, making it harder for marketers and platforms to understand consumer behavior and reach them across channels. These challenges call for a comprehensive solution.

Our Digital Graph and Marketing Attributes solution addresses these challenges by providing identifiers for seamless cross-channel engagement. By adding Marketing Attributes, like demographic and behavioral data, marketers and platforms also gain a better understanding of their customers. This solution uses Experian’s Living Unit ID (LUID) to combine offline and digital data, giving customers deeper insights into consumer behavior, greater audience reach, and improved cross-channel visibility.

Transform insights into loyalty with Experian’s Marketing Attributes

Experian’s Marketing Attributes enable businesses to gain valuable insight into their prospects and customers. Through this deeper understanding, they can deliver personalized experiences while successfully navigating the complexities of data acquisition and privacy. This helpful information allows brands to make strategic, informed decisions that enhance their marketing efforts. Ultimately, these insights foster more substantial, meaningful connections between businesses and their customers, leading to enhanced customer satisfaction.

Get started today

Latest posts

Brands can leverage non-clinical factors, like the social determinants of health, to gain a holistic view of their patients and increase access to care.

Next up in our Ask the Expert series, we hear from Sarah Ilie and Lauren Portell. Sarah and Lauren talk about the internet’s value exchange – what we gain and lose when it’s so easy to share our information. Is convenience hurting or helping us? The age of connectivity Today, it’s almost unimaginable to think about how your day-to-day life would look without the convenience of the internet, smartphones, apps, and fitness trackers; the list goes on and on. We live in the age of connectivity. We have the convenience to buy products delivered to our homes on the same day. We can consume content across thousands of platforms. We also have watches or apps that track our health with more granularity than ever before. The internet's value exchange In exchange for this convenience and information, we must share various kinds of data for these transactions and activities to take place. Websites and apps give you the option to “opt in” and share your data. They also often let you know that they are collecting your data. This can feel like an uncomfortable proposition and an invasion of privacy to many people. What does it mean to opt-in to a website or app’s tracking cookies? What value do we exchange? What opting in means for you Opting in to cookies means that you are allowing the app or website to track your online activity and collect anonymous data that is aggregated for marketing analytics. The data provides valuable information to understand users better to create better online experiences or offer more useful products and content. Granting access to “tracking” offers several benefits to users such as a customized, more personal user experience or advertising that is more likely to be relevant. For example, let’s imagine you have recently been using an app or website to plan a camping trip. By sharing your data, the website or app has visibility into what is interesting or useful to you which can lead to related content suggestions (best campsites) or relevant advertising and product recommendations (tents and camping equipment). It’s important to know that the marketing data collected when you opt in is extremely valuable. The revenue that advertising generates is often very important to websites and apps because this is how they make money to continue providing content and services to consumers. Data privacy practices Privacy concerns regarding how companies and developers use tracking information have risen over the last couple of years and have resulted in additional protection for consumers’ privacy while still allowing companies to improve their products and advertising. One big step in this direction has been simply making people aware that their data is being collected, why it’s being collected, and providing users with the option to share this data for marketing analytics through opting-in or not. Other important steps to maintain online privacy include formal legal legislation and self-regulation. The right to privacy is protected by more than 600 laws between individual states and federal legislation and the U.S. House Committee on Energy and Commerce recently voted to pass the American Data Privacy and Protection Act. Additionally, marketing organizations such as the Interactive Advertising Bureau and Association of National Advertisers regulate themselves with codes of conduct and standards given there is so much attention on privacy issues. Is the internet's value exchange worth it? The data that we choose to share by opting in has a lot of benefits for us as consumers. There are laws in place to protect our data and privacy. Of course, it’s important to be aware that data is collected and used for marketing purposes, but it’s also reasonable to share a certain amount of data that translates into benefits for you as well. The best data unlocks the best marketing. Contact us to tap into the power of the world’s largest consumer database. Learn how you can use Experian Marketing Services' powerful consumer data to learn more about your customers, drive new business, and deliver intelligent interactions across all channels. Meet the Experts: Lauren Portell, Account Executive, Advanced TV, Experian Marketing Services Sarah Ilie, Strategic Partner Manager, Experian Marketing Services Get in touch

We asked the experts about hashed email. What is email hashing? Do we need to hash email addresses in databases? What can we expect for hashed identifiers?