Audio platforms that overcome consumer identity challenges are winning new advertisers and driving higher ROAS. In this article, you’ll hear from leading audio platforms that are solving these challenges—and seeing results.

Digital audio is evolving fast. What was once a niche channel of host-read sponsorships and direct buys is now a must-have in the modern media mix. Streaming platforms, podcasts, and digital radio are drawing more ad dollars thanks to audio’s ability to capture attention and connect with listeners.

But with growth comes new pressure. Advertisers expect accuracy, scale, and to see results. At the same time, listeners want more relevant content and more personalized ad experiences. That’s where identity becomes essential.

With Experian’s identity and audience solutions, audio platforms can:

- Bolster addressable audience targeting and personalization capabilities.

- Gain a comprehensive view of listeners’ digital identity to reach audiences across channels.

- Better understand consumer preferences, enabling advertisers to reach audiences with greater accuracy.

- Enhance the listening experience with more relevant content.

Let’s break down the key challenges in audio—and how Experian can help solve them.

Challenge 1: Anonymous listening limits addressability

Most listening happens in environments where people aren’t logged in—via apps, smart speakers, and mobile devices. Without logged-in data, platforms struggle to know who’s listening and advertisers are unable to reach those anonymous listeners who don’t have an addressable ID.

To overcome the identity gap in unauthenticated listening environments, leading audio platforms are turning to partners that connect fragmented signals—like device type, location, and behavioral patterns—to broader household and individual profiles. By using hashed emails and other alternative identifiers, platforms can begin to make anonymous sessions more addressable. This increase in addressability ensures the platform’s entire userbase can be reached, which leads to an increase in revenue.

Experian’s solution

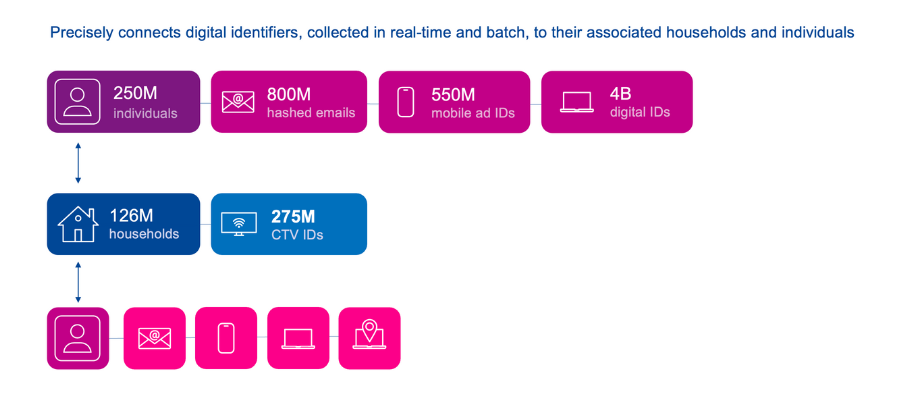

Experian’s identity spine, comprised of our Digital and Offline Graphs, helps you recognize listeners even when they’re outside your ecosystem. Platforms like Audacy are already leading the way. By integrating Experian’s Digital Graph, they’re gaining a more complete view of listeners’ digital identifiers—enhancing the experience across their app and website. With a better audience understanding, Audacy can deliver personalized content while helping advertisers reach specific groups with greater accuracy.

Challenge 2: IP-based targeting falls short

Audio has traditionally relied on IP addresses, but that’s no longer enough. A single IP could represent an entire household—or a public setting like a coffee shop. It’s not precise.

Forward-thinking platforms are moving beyond IP-based targeting by integrating identity resolution technologies that combine household-level data with device-level intelligence. These solutions help distinguish between shared devices and individual listeners, allowing advertisers to serve more relevant messages without over-reliance on a single signal like an IP address. This layered approach improves precision—especially in dynamic listening environments like vehicles or communal spaces.

Experian’s solution

Our identity spine links home IPs to households, then connects them to specific devices and individuals. This helps platforms move beyond basic IPs and target real people based on accurate signals—even in shared listening environments like smart speakers and cars.

We also help platforms and advertisers integrate alternative IDs—like Unified I.D. 2.0 (UID2)—into their programmatic audio campaigns. That means more reach, without compromising consumer trust.

Challenge 3: Audio buying is fragmented

From podcasts to streaming to radio, audio lacks consistency in how inventory is packaged and bought. It’s hard for advertisers to run scaled campaigns across channels—and harder still to measure performance.

Plus, advertisers don’t think in silos—they think in strategies. If audio can’t connect to their display, connected TV (CTV), and social buys, it loses ground. What they need is a way to define audiences once and activate everywhere.

To reduce friction in audio ad buying, platforms are investing in infrastructure that unifies audience insights across formats. By building a centralized view of the listener—regardless of whether they’re tuning in via podcast, stream, or radio—publishers can offer advertisers consistent targeting parameters, clearer reporting, and better campaign orchestration. Identity graphs and audiences are playing a growing role in streamlining this complexity and unlocking scale.

Experian’s solution

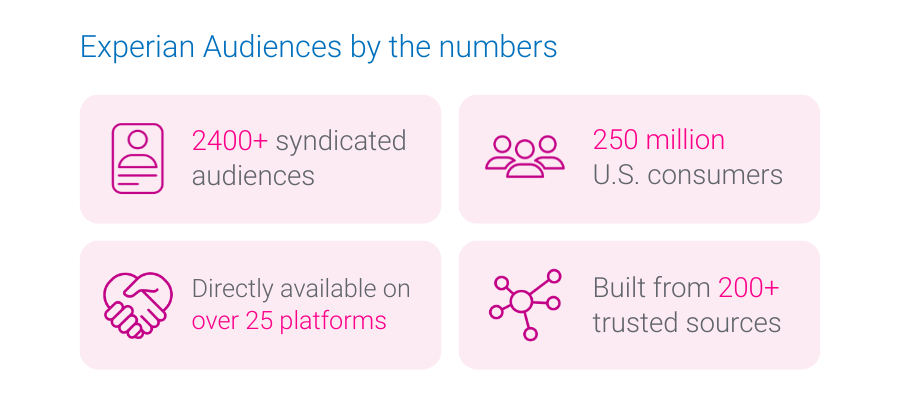

Experian helps simplify audio buying. Experian audiences are built on top of our identity graph and are expanded to a deep set of digital identifiers, ensuring accuracy, scale and maximum addressability across channels. Platforms can blend their first-party data with advertiser data and our audiences—then deploy those audiences onsite or activate programmatically across open web and CTV.

DAX is doing just that. DAX’s partnership with Experian combines Experian’s 2,400+ audiences for targeting and activation with DAX’s innovative audio advertising approach. We’re helping advertisers connect with passionate and engaged listeners nationwide.

“Through our partnership with Experian Marketing Services, advertisers can unlock deeper audience insights and execute more impactful digital audio campaigns. By combining our shared market presence, knowledge, and forward-thinking approach, we’re strengthening our digital audio network offering and delivering value to all our advertising partners.”

Brian Conlan, President of DAX United States

In addition to integrating Experian’s Digital Graph, Audacy is also integrating Experian’s syndicated audiences to unlock accurate insights like demographics, shopping behavior, and interests – providing listeners with a more personalized advertising experience and advertisers with a higher return on investment.

“Historically, audio advertising lacked precise targeting capabilities, making it challenging for advertisers to reach specific audiences. By integrating our digital identity graph and syndicated audiences with Audacy’s platform, we’re transforming how advertisers connect with listeners. This collaboration enables more effective audience targeting and delivers personalized, impactful audio experiences across all channels.”

Chris Feo, Chief Business Officer, Experian

Privacy is non-negotiable

Everything we do is privacy-forward by design. Backed by Experian’s Global Data Principles and decades as a regulated institution, we rigorously vet every data source to ensure compliance with all federal and state laws.

Build an audio strategy that performs with Experian

Your advertisers want more from their audio investments. With Experian, you can give it to them. We help you:

Audio has always been a powerful way to connect. Now, it’s ready to perform.

Let’s connect

Latest posts

Every year, the Experian team attends the Consumer Electronics Show (CES) in Las Vegas, to immerse ourselves in the world's most significant consumer tech showcase and stay at the forefront of the latest technological advancements and innovations that shape the AdTech industry. This year's event was a vibrant melting pot of innovation and vision, from streamers taking a bigger bite of the advertising pie to the emergence of AI-powered solutions and drone delivery services. Amidst these advancements, the dynamic interplay of technology, media, and advertising raised important questions, especially in the context of evolving regulations and cookie deprecation. During CES, we captured insights from various thought leaders, and in the coming months, we'll be sharing these valuable perspectives with you. Watch the video below for full insights coming from our content studio onsite during the event. Or, keep reading for a recap on four key trends from CES and what they mean for your business in 2024! “My first CES was a major success. You could feel the buzz in the air as new ideas and partnerships were being created within and across industries. The intersection of the different players within retail media, connected TV, retail technology, the demand and supply-side, and agencies all in an ever-changing world of regulation and privacy begs for a solution that can maximize a successful outcome for all.”anne passon, sr director, sales, retail & cpg 1. Audience targeting: How first- and third-party data work together A central theme at CES was the importance of audience targeting, highlighting the crucial role of first-party data. However, it’s clear that to maximize its potential, this data needs to be augmented with sophisticated identity solutions and enriched with third-party insights, all while navigating the complexities of privacy regulations. This integrated approach is vital to understanding audiences and for creating more effective marketing strategies that comply with privacy regulations. 2. Standardizing metrics in retail media networks The challenges around retail media networks, particularly in terms of standardizing metrics like incremental return on ad spend (iROAS), were a hot topic at CES. This complexity around this topic underscores the need for neutral, expert third parties to help bring clarity and consensus, aiding businesses in navigating this multifaceted domain. 3. The challenge of switching data solutions Discussions covered the broader challenges associated with transitioning to new data solutions. For businesses, this involves a critical assessment of the benefits versus the costs and complexities of adopting new platforms or systems. This decision-making process is increasingly significant as data strategies become integral to marketing success. 4. Identity solutions in a cookieless future With the industry moving toward a cookieless future, the spotlight at CES was on the importance of robust identity solutions. Understanding the functionality and necessity of various universal IDs is essential to minimize data loss and maintain effective targeting. Investing in flexible and adaptable identity solutions like the Experian Graph is essential to maintain effective targeting and audience engagement in this new landscape. Announcements and advertising innovations at CES 2024 CES was a stage for significant announcements and innovative marketing initiatives: Criteo and Albertsons announced their collaboration in retail media. Instacart's partnership with Google for enhanced shopping ads and AI shopping carts. NBCUniversal's advancements in streamlining programmatic advertising. Brands like Netflix, LG, Freewheel, and Amazon Ads also captured attention with their creative marketing strategies, ranging from unique collaborations to themed promotions and captivating events. These insights from CES provide a glimpse into the future of technology, media, and advertising. They highlight the need for adaptability, innovation, and informed decision-making in these dynamic industries, especially in the context of privacy regulations. Stay tuned for our series of posts where we'll dive deeper into these topics, sharing exclusive insights from industry thought leaders. Follow us on LinkedIn or sign up for our email newsletter for more informative content on the latest industry insights and data-driven marketing. Contact us Latest posts

Short-form video content is becoming more prevalent on video-sharing platforms. Keep up with trends and marketing strategies to stay relevant.

Since joining the Truthset Data Collective in 2023, Experian has consistently demonstrated leadership in data accuracy. The latest Q2 2025 analysis reaffirms this commitment.