Agencies, platforms, and marketers stand at the crossroads of transformation, as privacy regulations tighten, technology accelerates, and consumer behaviors evolve. Yet these challenges also present extraordinary opportunities.

Our 2025 Digital trends and predictions report highlights five trends that will shape 2025 and digs into:

- What’s changing in the market

- How to keep learning about your customers

- How to reach your customers in different places

- How to measure what’s really working along the way

In this blog post, we’ll give you a sneak peek of three of these trends — from cracking the code of signal loss to tapping into the buzz around connected TV (CTV) and stepping up your omnichannel game. Think of it as a taste test before the main course. Ready for the full menu? Download our report to get the lowdown on all five trends.

1. Signal loss: A rich appetizer of alternate ingredients

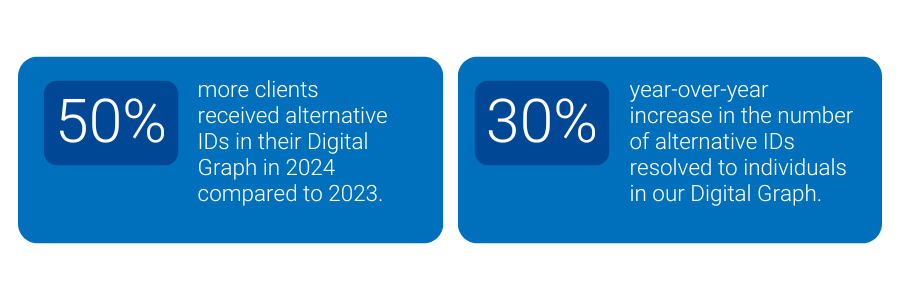

As traditional cookies crumble, marketers need fresh ingredients to keep the flavor coming. Already, about 40% of browser traffic doesn’t support third-party cookies, and marketers are spicing things up with first-party data, alternative identifiers like Unified I.D. 2.0 (UID2) and ID5, and contextual targeting strategies. In fact, 50% more of our clients received alternative IDs (UID2, ID5, Hadron ID) in their Digital Graph in 2024 compared to 2023. The number of alternative IDs resolved to individuals in our Digital Graph increased by 30% year-over-year – as everyone looks beyond the cookie jar.

There is no secret sauce to replace cookies. Instead, expect a multi-ID recipe that brings together different identifiers, unified by an identity graph. This approach turns a fragmented pantry of data into a cohesive meal, giving you a complete view of your customer on every plate.

2. The rising power of CTV: A hearty entrée of opportunities

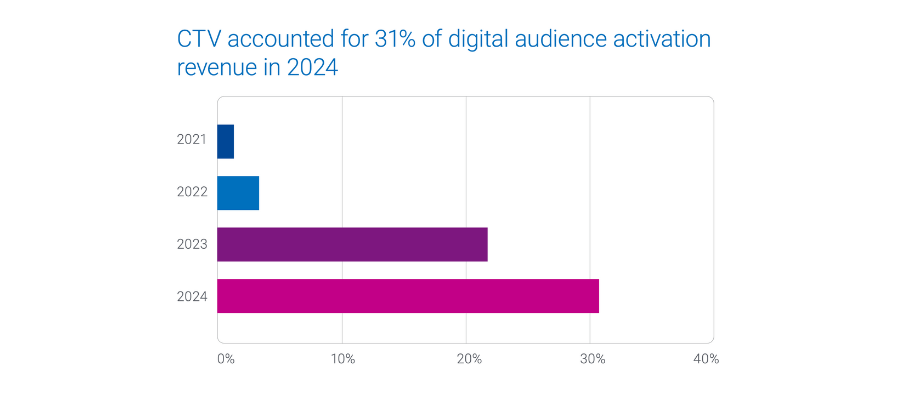

CTV is quickly becoming the main dish on the streaming menu, as viewers load up on their favorite shows. While CTV is slated to make up 20% of daily U.S. media consumption by 2026, advertisers are still holding back on pouring in the ad spend. To unlock its full flavor, marketers need to whip up solutions like frequency capping and unified audience activation.

Although CTV will account for 20% of daily U.S. media consumption by 2026, it’s projected to command only 8.1% of ad spend. Frequency capping and unified audience activation solutions will be key to unlocking CTV’s full potential.

By 2025, nearly half of CTV “diners” will choose free ad-supported streaming TV (FAST). Marketers need strategies to prevent ad overexposure. With 50% of U.S. consumers avoiding products due to ad overload, and 30% of marketers willing to increase their CTV spend if frequency capping improves, unified identity solutions help ensure every impression is served just right.

3. Omnichannel: A flavorful fusion plate

No one likes a one-flavor meal. Marketers are moving beyond single-channel “side dishes” to omnichannel “fusion feasts” that blend direct mail, digital, CTV, and retail media networks (RMNs) into a truly cohesive culinary experience. Even though only 21% of global B2C professionals currently put omnichannel at the top of their shopping list, the growing demand for seamless, audience-first campaigns is heating up.

In 2025, having an audience-first approach will be like having a perfect pairing for every course. Unified identity solutions act as your master sommelier, ensuring that each channel complements the next, and every customer enjoys a well-rounded, memorable journey.

Vertical trends: A dessert sampler from four unique kitchens

Different markets have their own signature flavors.

- In Auto, crossover utility vehicles (CUVs) claim 51% of new vehicle registrations, and consumers in the 35-54 age group and families are the primary buyers. Automotive marketers should prioritize CUV advertising with a strong focus on family-oriented and income-appropriate messaging

- In Financial Services, marketers need to anticipate shifts in consumer behavior tied to economic conditions, such as increasing demand for deposit products when interest rates are high. For insurance, aligning campaigns with life events, like new home purchases or marriage, can maximize engagement.

- In Healthcare, advertisers are prioritizing personalized, regulation-compliant campaigns that address social determinants of health (SDOH).

- In Retail, advertisers are increasingly activating on both CTV and social platforms, with many managing their own in-house campaigns. While larger brands often rely on media agencies, a shift toward in-house media buying is emerging among some bigger players, offering more control over audience targeting and performance metrics.

Our report covers each vertical’s unique menu, helping you select the right “ingredients” for your customers. With the top Experian Audiences on hand, you can create feasts that delight, nourish, and convert.

Download our new 2026 Digital trends and predictions report

Marketing in 2026 will be defined by connection: between activation and measurement, data and AI, platforms and outcomes. These connections are what turn innovation into impact, and they’re where Experian helps marketers lead with confidence.

What you’ll learn

- AI is only as good as its data : Find out why the marketers who shape how AI works, with high-integrity, human-centered data, will be the ones who lead.

- Activation and measurement are coming together: Explore how marketers are shifting from reporting after the fact to guiding performance in the moment.

- First-party data activation is becoming a foundational capability: See how it’s now possible to onboard and activate privacy-compliant audiences across channels, all from a single system.

- Commerce media is no longer just a retail play: Understand why auto, CPG, financial services, and travel brands are now adopting retail-style models to connect data, media, and sales outcomes.

- Curation is the new programmatic standard: Learn how curation brings identity, quality, and control together, allowing marketers to target confidently across connected TV (CTV), audio, and the open web.

Experian’s U.K. 2025 advertising trends

This article highlights the major advertising trends set to shape the U.S. market in 2025, but significant industry changes are happening on a global scale. For a more comprehensive look at worldwide trends, check out Experian’s U.K. 2025 advertising trends.

Contact us

Latest posts

Tapad's digital identity resolution offering enables Gimbal's platform to provide expanded insights for campaign optimization to U.S. brand and agency clients NEW YORK, Feb. 11, 2020 /PRNewswire/ – Tapad, part of Experian and a global leader in digital identity resolution, announced their partnership with Gimbal, a leader of location-powered marketing and advertising solutions. Gimbal now leverages Tapad's global, privacy-safe digital cross-device solution, The Tapad Graph, to further enhance its footfall attribution solution, Arrival. Arrival delivers dwell-based attribution for in-store foot traffic and by leveraging the Tapad Graph, Gimbal provides customers with a more holistic, attributable understanding of consumers across multiple devices, like desktop, smartphone, and tablet. With this, Gimbal's clients are enabled to make more informed media planning decisions for programmatic activations across the web, and mobile apps. "Today's consumers are utilizing their digital devices for research and comparison shopping before making a purchase. By leveraging The Tapad Graph, Gimbal's clients gain an even more complete view of the consumer decision journey across devices," said Chris Feo, SVP of Global Data Licensing and Strategic Partnerships at Tapad. "With the number of devices per individual rapidly increasing, understanding the customer decision journey is becoming more complex," said Kyle Wendling, SVP of Product at Gimbal. "We're excited to partner with Tapad to continue engaging consumers across multiple devices." To learn more about Tapad and our digital identity resolution products, visit our identity solutions page. About TapadTapad, Inc. is a global leader in digital identity resolution. The Tapad Graph, and its related solutions, provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Tapad is recognized across the industry for its product innovation, workplace culture, and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, Denver, London, Oslo, Singapore, and Tokyo. About GimbalGimbal translates location data into intent, measurement, and insights to help organizations transform their businesses, maximize marketing relevance, and humanize messaging for consumers. Gimbal is headquartered in Los Angeles and provides advertising and marketing technologies to the world's leading brands and retailers interested in understanding the physical world. To learn more, visit https://gimbal.com. Contact us today

Tapad, part of Experian, integrates with AcuityAds' current offering will complement cross-channel capabilities for brands and agencies in the U.S. and Canada NEW YORK, Jan. 23, 2020 /PRNewswire/ — Tapad, a global leader in digital identity resolution, has partnered with AcuityAds, a technology leader that provides targeted digital media solutions for advertisers to connect intelligently with audiences. The partnership will enhance AcuityAds' existing cross-device solution, especially with respect to its cross-channel Connected TV offering. Tapad's global, privacy-safe digital cross-device solution, The Tapad Graph, will compliment AcuityAds' own cross-device data set for enhanced marketing capabilities across their Demand Side Platform (DSP). For AcuityAds, this provides customers with unduplicated reach across desktop, tablet, mobile and CTV devices – while augmenting their video offering. Tom Woods, Vice President of Products at AcuityAds commented, "With increasing marketing complexities, consumer device usage and new data regulations, our decision regarding the partnership was an important one. The Tapad Graph's privacy-safe identifiers for consumer notice and choice, as well as the ability to opt-out at any point, were critical factors in our decision who to partner with." Chris Feo, Senior Vice President, Strategy and Partnerships at Tapad added: "Our integration with AcuityAds' DSP should not only help marketers within North America optimize current cross-device campaign initiatives and performance, but also increase reach across additional digital screens long term. We are excited to expand our partnership with AcuityAds." To learn more about Tapad and our digital identity resolution capabilities, visit our identity page. About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph and its related solutions provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Tapad is recognized across the industry for its product innovation, workplace culture, and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore, and Tokyo. About AcuityAds AcuityAds is a leading technology company that provides marketers a powerful and holistic solution for digital advertising across all ad formats and screens to amplify reach and Share of Attention® throughout the customer journey. Via its unique, data-driven insights, real-time analytics and industry-leading activation platform based on proprietary Artificial Intelligence technology, AcuityAds leverages an integrated ecosystem of partners for data, inventory, brand safety and fraud prevention, offering unparalleled, trusted solutions that the most demanding marketers require to be successful in the digital era. AcuityAds is headquartered in Toronto with offices throughout the U.S., Europe and Latin America. For more information, visit AcuityAds.com. Disclaimer in regards to Forward-looking Statements Certain statements included herein constitute "forward-looking statements" within the meaning of applicable securities laws. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Investors are cautioned not to put undue reliance on forward-looking statements. Except as required by law, AcuityAds does not intend, and undertakes no obligation, to update any forward-looking statements to reflect, in particular, new information or future events. Contact us today

Tapad, a part of Experian and the future of cookies Earlier this week, Google announced plans to create “.. a path towards making third-party cookies obsolete”; which will result in the phasing out of support for third-party cookies in its Chrome browser within two years. While there has been much discussion and debate on the future of the third-party cookie, an announcement from Google has been anticipated for some time. As many have said this week, the use of cookies and other identifiers has and will continue to evolve. What will never change is the value exchange between publishers and consumers that is enabled by relevant advertising. Notably, the need for independent companies to develop solutions that enable this value exchange has never been greater to ensure that publishers, consumers, and advertisers derive the most value from their relationship. We are well-positioned for the future From the start, Tapad, a part of Experian has led with a consumer-first, privacy-centric approach to technology as the use and proliferation of devices and global privacy regulations continue to evolve. Over the past two years, Tapad, a part of Experian has gone through a technical overhaul. Calling on almost ten years of expertise in identity resolution, we have created a modern platform that is flexible in terms of identity input as well as output. Anticipated change in the identity landscape was the driver behind our architecture decisions and what enables us to be responsive to a dynamic market. Consumer behavior and device use continue to change, bringing additional digital IDs into the equation – namely across the mobile and CTV environments. Our technology, however, is not tied to any specific type of identifier, but rather is focused on associating disparate identifiers at the individual and household level. Where do we go from here? Google’s announcement has been characterized as a conversation starter, but we see it more as a call to action. With a timeline set, there is a need to converge on one or more solutions that can scale across the web. In a post cookie world, publishers and advertisers will continue to require ways to create fair marketplaces across platforms and devices. Further, the platforms that currently power the programmatic advertising ecosystem will need to be able to invest and differentiate to bring value to their customers. Scaled privacy-safe identity solutions will be needed not only for classic targeting, attribution, measurement, and frequency capping use cases but also to carry consumer preferences and consent. Tapad, a part of Experian will continue to play a leading role here. However, we are not going to do this alone. As solutions around Google’s Chrome browser evolve, we will continue to take a leadership position and will work with Google, key industry groups, partners and customers to meet current and future needs for an independent identity solution at scale. In the meantime, we will continue to support an independent ecosystem where consumers come first and privacy standards are a priority. It’s business as usual…for now. There will not be any changes to our graph products or services as a result of Google’s announcement in the near term. Any changes related to the Chrome third-party cookie will evolve and will no doubt be subject to significant industry participation and feed-back, indeed at the invitation of Google. We will proactively communicate any changes and product updates during this time period. We look forward to the opportunities resulting from these changes and ushering in a new era of identity resolution in digital advertising. Contact us today