Patient Access

Learn how to improve patient access by verifying critical patient information and collecting patient payments prior to service.

Experian Health and NCPDP (National Council for Prescription Drug Programs) have joined forces to introduce a vendor-neutral solution that powers a national patient identifier. Experian Health and NCPDP have announced a strategic alliance to provide a vendor neutral solution to address the complexities of managing patient identification. With a shared vision to create solutions and leverage data for the common good, this alliance brings an innovative matching solution that provides the framework for establishing a unique patient identifier to address patient safety, financial and operational challenges across the U.S. healthcare ecosystem. Read the press release here.

Below is a collection of some of most compelling article we've read in recent months. We hope you find these interesting, too! One Goal; One Contract: How a Nationwide Health Data Sharing Framework is Revolutionizing Interoperability https://www.himss.org/news/one-goal-one-contract-how-nationwide-health-data-sharing-framework-revolutionizing-interoperability 7 things to know about Aetna's ACA exchange exit https://www.beckershospitalreview.com/payer-issues/7-things-to-know-about-aetna-s-aca-exchange-exit.html 5 steps to cybersecurity for Internet of Things medical devices https://www.healthcareitnews.com/news/5-steps-cybersecurity-internet-things-medical-devices CMS: ICD-10 specificity kicks in Oct. 1, 2016 https://www.healthcareitnews.com/news/cms-icd-10-specificity-kicks-oct-1-2016 3 leadership skills crucial for a culture change http://www.beckershospitalreview.com/hospital-management-administration/3-leadership-skills-crucial-for-a-culture-change.html

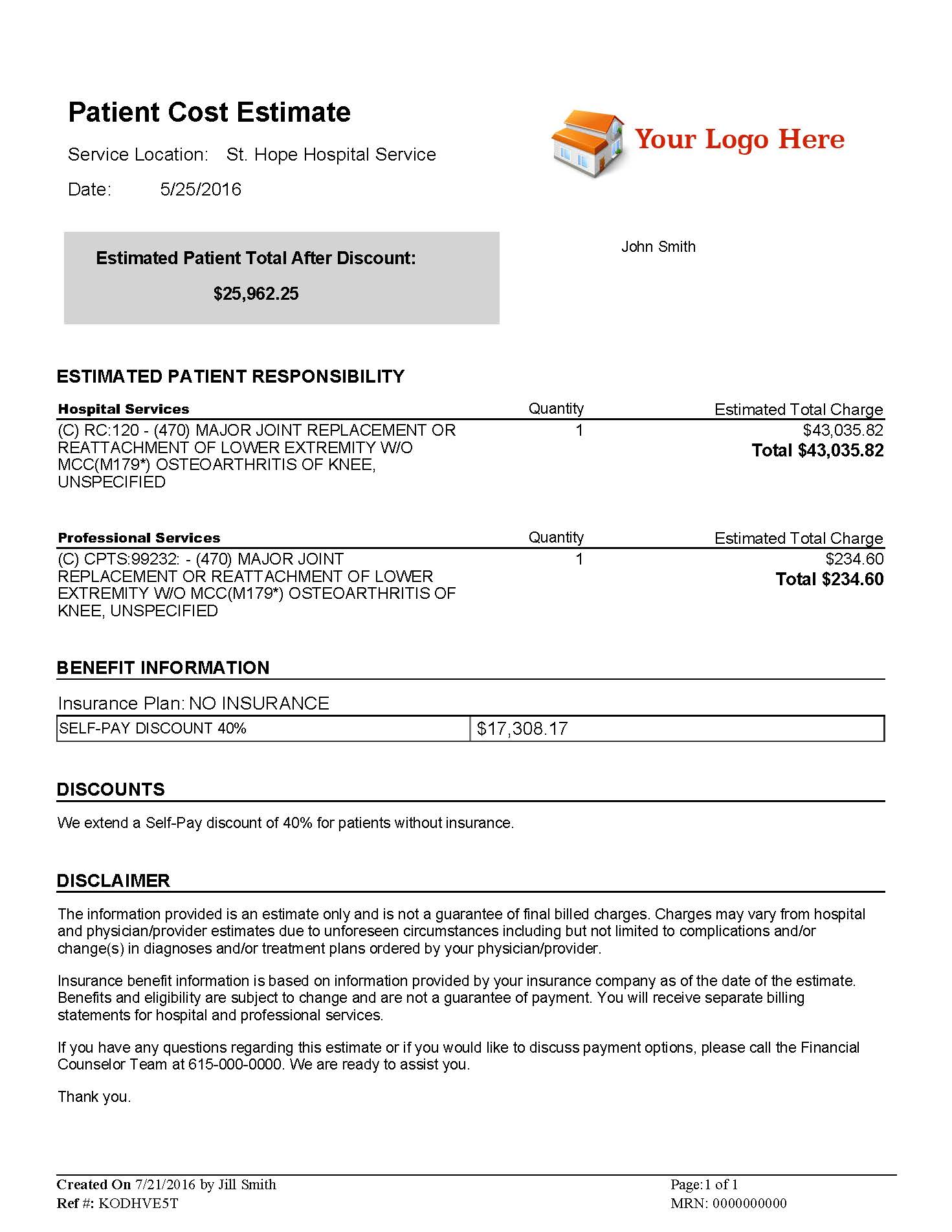

Undoubtedly, you have been monitoring progress toward legislation for healthcare providers to furnish patients with estimates for their cost of care. And if it’s not already in place, there’s a strong chance your state will be next on the list to require price transparency. Additionally, with the continued popularity of high deductible health plans, patients are looking to price shop for their healthcare services. Patients expect more healthcare cost information available online, like in every other industry. Helping patients know what they will owe prior to service can enable them to make more informed decisions about their care and increase patient satisfaction. As more states begin to mandate providing pre-service estimates to patients, it’s critical for healthcare providers to know what solutions are available to help them comply. According to a recent Fierce Healthcare article, “Real healthcare price transparency for consumers is dependent on rich data sources that provide meaningful price information on a wide range of procedures and services.1" Experian Health is here to help! Our Patient Estimates solution is a pricing transparency tool that enables you to create accurate estimates of services, before or at the point-of-service. Patient Estimates is also offered within our Patient Self-Service portal, allowing patients to access estimates on-demand. See how Patient Estimates helped St. Clair Hospital in the Pittsburgh market. According to the June 2016 KLAS Healthcare Price Transparency Solutions Performance Report, “…clients feel [Experian Health’s] Patient Estimates is a critical element in their efforts to help patients know up front what their costs will be, and clients report overall satisfaction with the product, services, and vendor engagement. The solution is seen as very complete and robust, with strong customer support.” Experian Health's Patient Estimates can help your organization: Increase up-front collections Provide patient’s pricing prior to service Increase patient satisfaction Let us help you prepare now for state requirements that will ultimately increase accurate up-front collections and more importantly improve patient satisfaction! Call us at 1 888 661 5657 or email experianhealth@experian.com to get started! 1Ron Shinkman, “A few more states get passing grades on price transparency,” Fierce Healthcare, July 28, 2016

Scott Lee oversees the Experian Health Reference Program. Scott graduated with a BA in Business Management from The University of Texas at San Antonio, and has been with the organization for 12 years, beginning with MPV, which was acquired by Experian in 2011. Scott lives in San Antonio with his wife and two children and says his second home is the San Antonio Zoo based on how much time he and his family spend there. Scott is a catalyst for fostering the connection between Experian Health’s current and potential clients to allow the former to share their positive experience and ROI using our solutions. Our clients also benefit from being a reference by learning about the workflow and best practices of similar organizations. Because of the importance of protecting our clients’ privacy, Scott schedules calls on behalf of our clients and ensures that the experience is mutually beneficial and minimally disruptive for all parties involved. “We’re very appreciative of our reference clients, and it’s a privilege for our potential clients to hear their experiences firsthand.” he said. Share your story by being an Experian Health Reference Client! Contact your Sales Director/Account Manager or contact Scott Lee at scott.lee@experian.com or (210) 582-6320.

Below is an update from the Experian Health Support Team. Network & System Performance Last six months: Upgrades to the network, compute and storage infrastructure have improved performance and scalability. Enhanced alerting and reporting to strengthen proactive measures for issues remediation Next six months: Data Center move and consolidation will localize production communications to improve efficiencies Automation improvements to reduce on-boarding times for new clients Subscribe to Receive Product Support Updates Opt in to receive emails about significant product updates or changes. Access the Experian Health Product Dashboard here.

Our congratulations and admiration go out to all Experian Health clients who were recently recognized by Hospitals and Health Networks (H&HN) magazine with the prestigious 2016 “Most Wired” distinction: http://www.hhnmag.com/articles/7393-2016-most-wired-themes. Following are two (of the MANY) Experian Health clients who were honored. Altru Health System has been recognized in the Advanced Category in this year’s HealthCare’s Most Wired™ survey. The survey, released on July 6 by the American Hospital Association’s Health Forum, is a leading industry barometer measuring information technology (IT) use and adoption among hospitals nationwide. It examined how organizations are leveraging IT to improve performance for value-based healthcare in the areas of infrastructure, business and administrative management, quality and safety, and clinical integration. St. Clair Hospital’s Patient Estimates tool, the only one of its kind in the greater Pittsburgh region, has garnered the Mt. Lebanon-based medical center Hospitals & Health Networks (H&HN) magazine’s prestigious Innovator Award for its co-development of the cost transparency software. Patient Estimates, which was made available to the public earlier this year at www.stclair.org, gives patients the ability to learn, in advance, what their estimated out-of-pocket costs will be for services at St. Clair or the Hospital’s Outpatient centers. Patient Estimates is highly accurate and based on information provided by each patient’s health benefit plan. Please contact us to add your organization’s Innovative Achievements to our future Shout Outs!

In case you missed them, below are some great tools to help you address key business challenges. Enjoy the read! Press Releases Innovative Mindset Enables Experian Health to Deliver New Capabilities Experian Health Rises to 45 On The 2016 Healthcare Informatics 100 List White Paper Why Start the Payment Process Prior to Service? As a patient’s financial obligation grows, it’s imperative to tailor payment strategies to each unique situation. In pre-service stages, data-driven solutions provide a higher likelihood of securing patient payment. Flexible patient payment plans contribute to a positive billing, payment, and overall engagement experience, as well as a provider’s financial health. Read our white paper to learn more about the importance of the Personalization in the Healthcare Consumer Payment Process. Read Now Article: Healthcare IT Transformation - How Has Ransomware Shifted the Landscape of Healthcare Data Security? Read Now

To avoid Civil Monetary Penalty (CMP) liability, health care entities need to routinely check the LEIE to ensure that new hires and current employees are not on Office of the Inspector General’s (OIG) excluded list. Mandatory exclusions: OIG is required by law to exclude from participation in all Federal health care programs individuals and entities convicted of the following types of criminal offenses: Medicare or Medicaid fraud, as well as any other offenses related to the delivery of items or services under Medicare, Medicaid, SCHIP, or other State health care programs; patient abuse or neglect; felony convictions for other health care-related fraud, theft, or other financial misconduct; and felony convictions relating to unlawful manufacture, distribution, prescription, or dispensing of controlled substances The effects of an exclusion are outlined in the Updated Special Advisory Bulletin on the Effect of Exclusions From Participation in Federal Health Programs, but the primary effect is that no payment will be provided for any items or services furnished, ordered, or prescribed by an excluded individual or entity. This includes Medicare, Medicaid, and all other Federal plans and programs that provide health benefits funded directly or indirectly by the United States (other than the Federal Employees Health Benefits Plan), but the primary effect is that no payment will be provided for any items or services furnished, ordered, or prescribed by an excluded individual or entity. This includes Medicare, Medicaid, and all other Federal plans and programs that provide health benefits funded directly or indirectly by the United States (other than the Federal Employees Health Benefits Plan. Search individuals in the Exclusions Database: https://exclusions.oig.hhs.gov/ Review the Updated Special Advisory Bulletin: https://oig.hhs.gov/exclusions/files/sab-05092013.pdf

The U.S. Department of Health and Human Services (DHHS) Office of Inspector General (OIG) recently released an updated Mid-Year Work Plan for fiscal year 2016. The updated Work Plan summarizes new and ongoing reviews and activities that OIG plans to pursue in the current year and beyond. This edition of the Work Plan describes OIG audits and evaluations that are underway or planned, and certain ongoing legal and investigative initiatives. Summaries of 9 new review activities to be awar of follow: CMS’ Implementation of New Medicare Payment System for Clinical Diagnostic Laboratory Tests – Mandatory Review We will assess CMS’s ongoing activities and progress toward implementing CMS’s new Medicare payment system for clinical diagnostic laboratory tests. CMS is required to replace its current system of determining payment rates for Medicare Part B clinical diagnostic laboratory tests with a new market-based approach that will use rates paid to laboratories by private payers (Protecting Access to Medicare Act of 2014, § 216). OIG is also required to conduct analyses of the implementation and effect of the new payment system Intensity-Modulated Radiation Therapy We will review Medicare outpatient payments for intensity-modulated radiation therapy (IMRT) to determine whether the payments were made in accordance with Federal requirements. IMRT is an advanced mode of high-precision radiotherapy that uses computer-controlled linear accelerators to deliver precise radiation doses to a malignant tumor or specific areas within the tumor. Prior OIG reviews have identified hospitals that have incorrectly billed for IMRT services. In addition, IMRT is provided in two treatment phases: planning and delivery. Certain services should not be billed when they are performed as part of developing an IMRT plan. Medicare Home Health Fraud Indicators We will describe the extent that potential indicators associated with home health fraud are present in home health billing for 2014 and 2015. We will analyze Medicare claims data to identify the prevalence of potential indicators of home health fraud. The Medicare home health benefit has long been recognized as a program area vulnerable to fraud, waste, and abuse. OIG has a wide portfolio of work involving home health fraud, waste, and abuse. National Background Check Program for Long-Term-Care Employees We will review the procedures implemented by participating States for long-term-care facilities or providers to conduct background checks on prospective employees and providers who would have direct access to patients and determine the costs of conducting background checks. We will determine the outcomes of the States’ programs and determine whether the checks led to any unintended consequences. This mandated work will be issued at the program’s conclusion as required, which is expected to be 2018 or later. Outpatient Outlier Payments for Short-Stay Claims We will determine the extent of potential Medicare savings if hospital outpatient stays were ineligible for an outlier payment. CMS makes an additional payment (an outlier payment) for hospital outpatient services when a hospital’s charges, adjusted to cost, exceed a fixed multiple of the normal Medicare payment (Social Security Act (SSA) § 1833(t)(5)). The purpose of the outlier payment is to ensure beneficiary access to services by having the Medicare program share in the financial loss incurred by a provider associated with individual, extraordinarily expensive cases. Prior OIG reports have concluded that a hospital’s high charges, unrelated to cost, lead to excessive inpatient outlier payments. Skilled Nursing Facility Prospective Payment System Requirements We will review compliance with the skilled nursing facility (SNF) prospective payment system requirement related to a 3-day qualifying inpatient hospital stay. Medicare requires a beneficiary to be an inpatient of a hospital for at least 3 consecutive days before being discharged from the hospital, in order to be eligible for SNF services (SSA § 1861(i)). If the beneficiary is subsequently admitted to a SNF, the beneficiary is required to be admitted either within 30 days after discharge from the hospital or within such time as it would be medically appropriate to begin an active course of treatment. Prior OIG reviews found that Medicare payments for SNF services were not compliant with the requirement of a 3-day inpatient hospital stay within 30 days of an SNF admission. Potentially Avoidable Hospitalizations of Medicare and Medicaid Eligible Nursing Home Residents for Urinary Tract Infections We will review nursing home records for residents hospitalized for urinary tract infections (UTI) to determine if the nursing homes provided services to prevent or detect UTIs in accordance with their care plans before they were hospitalized. A CMS-sponsored study identified UTIs as being associated with potentially avoidable hospitalizations and found that UTIs are generally preventable and manageable in the nursing home setting. UTIs acquired during the course of health and medical care could indicate poor quality of care. In a hospital setting, there are payment implications for hospital-acquired catheter-associated urinary tract infections. Nursing homes must develop and follow comprehensive care plans addressing each resident’s care needs, which includes urinary incontinence (42 CFR § 483.25(d)). Physician-Administered Drugs for Dual Eligible Enrollees We will determine whether Medicare requirements for processing physician-administered drug claims impact State Medicaid agencies’ ability to correctly invoice Medicaid drug rebates for dual eligible enrollees. Dual eligible describes individuals who are enrolled in both Medicare and Medicaid. States are required to collect rebates on physician-administered drugs. To collect these rebates, State agencies must submit to the manufacturers the National Drug Codes for all single-source drugs and for the top 20 multiple-source physician-administered drugs. For dual eligible enrollees, covered Medicare Part B prescription drugs received in a hospital outpatient setting (which include physician-administered drugs) require a copayment, which Medicaid is generally responsible for paying. If a State agency paid any portion of a drug claim to the provider, the State agency must then invoice the eligible drugs for rebate and the manufacturer would thus be liable for payment of the rebate. State Medicaid Fraud Control Unit FY 2015 Annual Report We will analyze the statistical information that was self-reported by the MFCUs for FY 2015, describing in the aggregate the outcomes of MFCU criminal and civil cases. We will identify common themes from onsite reviews of the 50 MFCUs that were published from FY 2011 through FY 2015. We will identify the potential costs and benefits of creating MFCUs in jurisdictions that currently do not have a Unit. OIG’s mission is to protect the integrity of HHS programs, as well as the health and welfare of program beneficiaries. In fulfillment of this mission, we promote provider compliance, recommend program safeguards, and follow up on those recommendations ...” — Inspector General Daniel R. Levinson The OIG Mid-Year Workplan can be reviewed here: https://oig.hhs.gov/reports-and-publications/archives/workplan/2016/WorkPlan_April%202016_Final.pdf