Experian Health works with many of the largest, most sophisticated collections teams in healthcare that consistently strive for high-performance by innovating and adopting best practices.

Our consultants are often asked to define “high-performance”. What separates high-performing collections teams from the rest and how do they impact the bottom line?

Being a leader in data and analytics, we used our expertise to conduct an in-depth analysis to answer these questions, quantify the impact of high-performance, and identify best practices common to high-performing collections teams. Here is what we learned:

1. Spend time collecting on the right accounts

Many health systems have developed collections workflows by segmenting self-pay accounts into varying buckets depending on the propensity to pay. However, not all segmentation models are created equal and ultimately a model is only as good as the data driving the decisions.

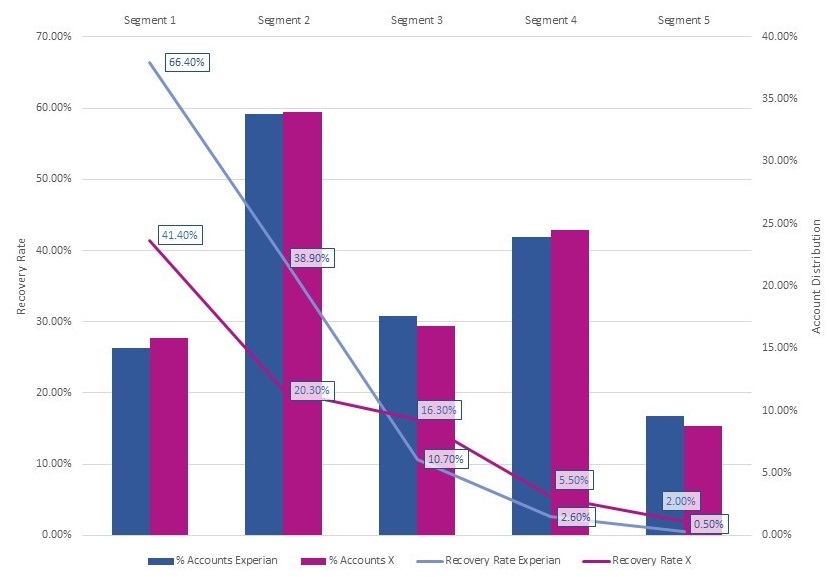

Segmentation models are supposed to identify high and low propensity-to-pay accounts so that resources can be focused on collecting from accounts likely to yield revenue, building out custom workflows when possible. In fact, in a head-to-head comparison, a health system using a segmentation model based solely on patient payment history significantly underperformed a health system using a comprehensive, multifaceted segmentation model built using our Collections Optimization Manager.

Here are the results:

- $60,000 in additional revenue generated from accounts in low payment likelihood segments

- 25% higher recovery rate in highest payment likelihood segments

- 100 more accounts worked in low payment likelihood segments

Multi-faceted segmentation models increase recovery rate an average of 76% for the highest payment likelihood segments

Using patient payment history within a single health system forces a decision to be made based on limited information. This leads to more time being spent on accounts that yield little to no revenue. Patient financial situations change rapidly and being able to see additional factors such as credit payment history, household income, and financial stress signals improves the ability to assess propensity-to-pay. This is particularly important for both new patients and those that visit infrequently.

Utilizing a comprehensive segmentation model enables collections from the accounts and increases recovery rates for segments with a high propensity-to-pay.

2. Use automated dialing

Imagine a world in which every collections call reaches the intended recipient. When comprehensive segmentation models are used in tandem with automated dialing technology, like Experian Health’s PatientDial product, the hypothetical can turn into reality.

High-performing teams take output from their comprehensive segmentation models and use it to focus call center activity. The logic is simple; more contact attempts are made to reach accounts likely to pay and fewer attempts are made for low yield segments. For example, if a health system with 100,000 new monthly accounts uses a data-driven call strategy, call volume can be reduced by up to 20,000 calls per month.

The highest-performing teams go a step further by pre-loading call lists into agent software and only allowing agents to join calls that successfully connect. This is where the real magic happens – valuable time is saved, and agents actually connect with more patients, ultimately increasing collections success.

3. Monitor agency performance

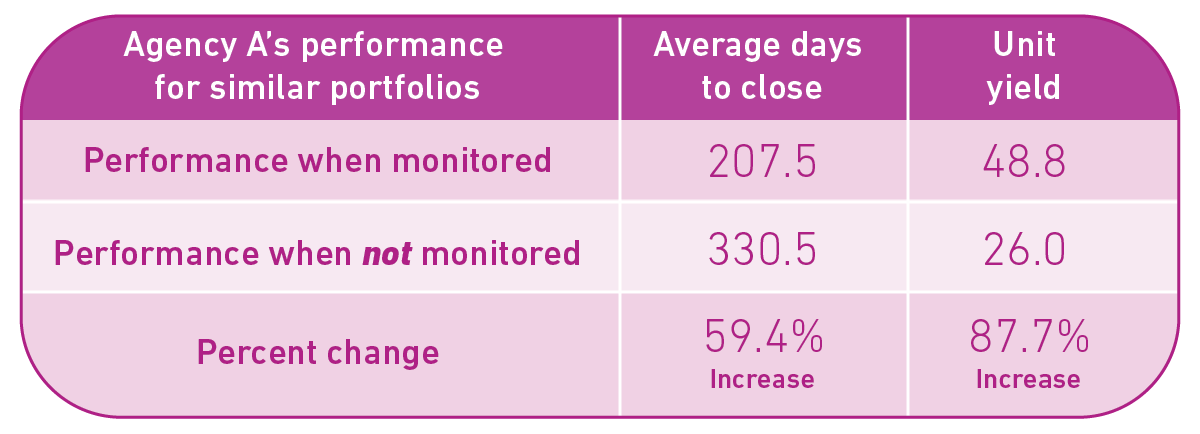

It is no secret that some agencies perform better than others. In fact, even a trusted agency’s performance can vary over time as portfolios are rotated between different collection teams. So, what do high-performing collections teams do to influence consistent agency results? They use robust reporting to monitor and track agency performance over time.

This helps direct account allocation decisions in a way that impacts the bottom line. It is Monitoring agency performance gives revenue cycle leaders the information needed to make better portfolio allocation decisions.

Another benefit of monitoring agency performance is that agencies perform better just knowing they are being monitored, per an Experian Health analysis of agency performance across similar portfolios.

Here are the key metrics:

Monitoring agency performance enables better account allocation decisions, pushes agency partners to perform at a higher level, and significantly increases collections.

4. Reduce bad debt through presumptive charity

Best-in-class providers automate the financial assistance process for low-income self-pay individuals. This has a significant impact on both patient and provider. Patients no longer receive statements or calls for an outstanding debt that they are unable to pay, and providers are able to save on variable expenses, such as statement and call costs, in addition to staff time spent manually inputting and verifying financial assistance applications.

Automating the charity award process enables health systems to reduce bad debt expense, regardless of when awards are granted. In a comparison between health systems using an automated financial assistance process and a similar portfolio of health systems without automated financial assistance, we discovered that automation could reduce bad debt expense by as much as 10-12% on a similar demographic mix of consumers. [1]

5. Identify accounts that require special handling

One of the most common mistakes that collections teams make is dedicating time and resources to accounts that are unlikely to yield revenue. Deceased or bankrupt accounts make up anywhere between 1 percent to 2 percent of self-pay portfolios. This means that for a monthly portfolio of 100,000 accounts, collections teams are unnecessarily calling or mailing statements for up to 2,000 accounts that require special handling and might produce no results at all. High-performing collections teams have automated processes in place to identify these accounts and either remove them from the AR file completely or place them with a specialty vendor as soon as possible.

High-performing teams also focus on identifying and resolving incorrect patient addresses. Although mailing patient statements is a key part of nearly every collections workflow, undeliverable mail often remains unworked. Since accounts are less likely to yield revenue over time, it is imperative to identify and resolve address discrepancies quickly. Returned mail typically impacts 1 percent to 4 percent of a self-pay portfolio. This means in a situation with 100,000 new accounts each month, an additional $30,000 can be recovered using an automated process to identify and update undeliverable addresses.

Interested in learning more?

For more information on our healthcare collections products, click here.

[1] Data Study Methodology:

In June of 2021, Experian Health performed an analysis on a nationwide sample of health systems to define industry best practices and quantify their impact.