Business Information Blog

The latest from our experts

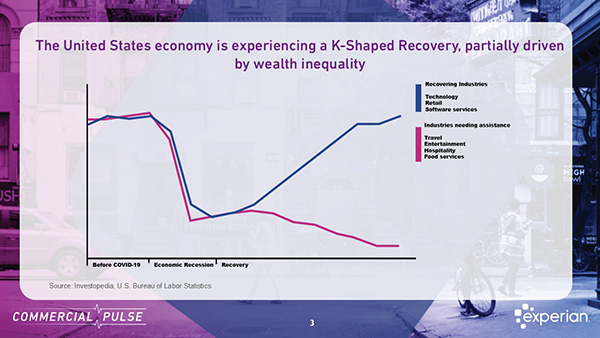

Discover highlights from Experian’s March 2025 Commercial Pulse Report: GDP dip, small business growth, and rising income inequality.

Hear the experts from Experian review Q1 2025 small business credit performance and offer an outlook on economic conditions.

The Experian Small Business Index™ rose by 1.8 points in March, reaching 47.2, marking the third consecutive month of modest gains.

April 2025 Pulse Report reveals trade disruption uncertainty, small business sentiment shifts, and a surge in manufacturing entrepreneurship.

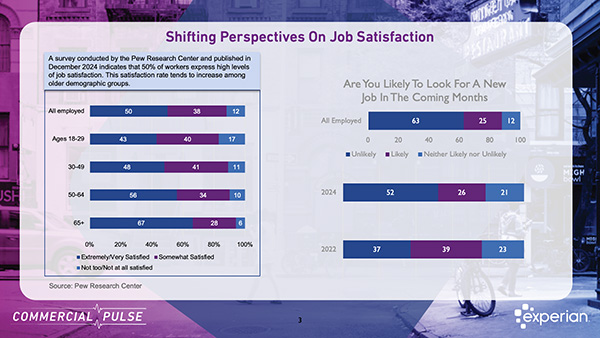

Despite concerns about a slowing job market, job satisfaction among American workers remains high.

This handy guide explains the practice of Credit Portfolio Management, managing, and monitoring all aspects of your company’s credit portfolio.

The Experian Small Business Index™ rose by 3.9 points in February, reaching 45.4, marking the second consecutive month of modest gains.

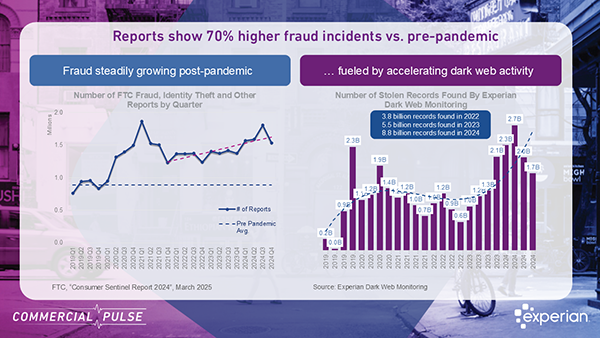

This week we focus on 2025 small business financial fraud, why it has increased, key stats, and strategies to protect your business.

The Experian Small Business Index increased by 1.0 pt in January signaling a modest improvement after December’s decline.

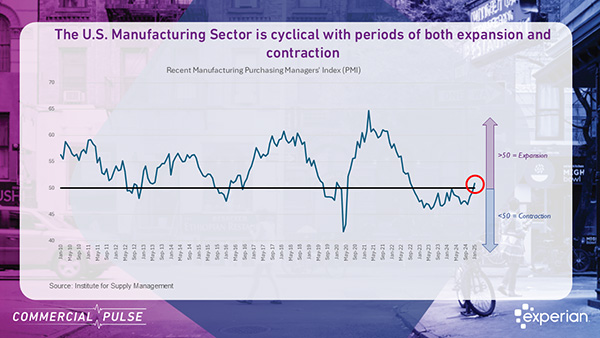

Experian reports the manufacturing sector may be on the verge of a shift after more than two years of contraction | Commercial Pulse Report

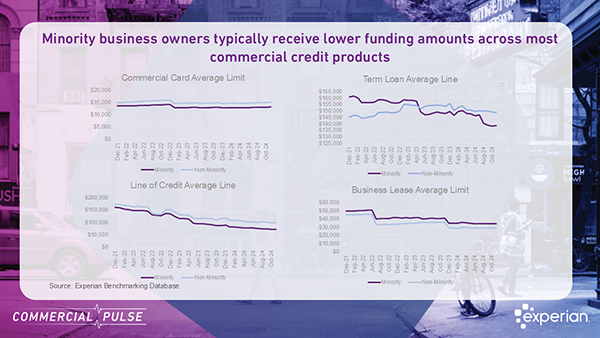

Commercial Pulse Report – minority-owned businesses are booming, yet they face a funding gap. A $2 trillion opportunity for lenders.

Experian Q4 Main Street Report reveals credit trends, lending shifts, and economic forces shaping growth amid policy changes and global uncertainties.