Small Business Credit Insights

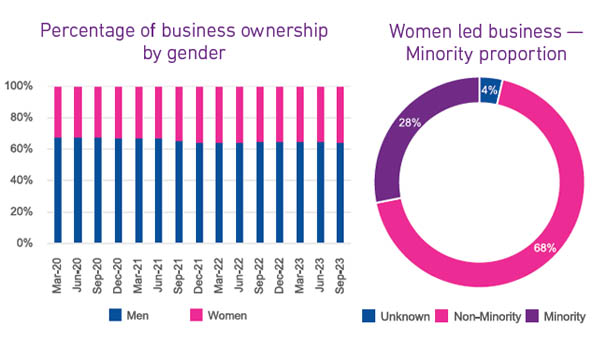

As of recent years, women-owned businesses in the United States have experienced significant growth and have become a substantial force in the economy. It is estimated that there are more than fourteen million women owned business generating over two trillion dollars in annual revenue. The growth in women owned businesses has been fueled by a myriad of reasons, is occurring across all age groups and serves a diverse number of industries. Even with the growth in the number of women owned businesses and the economic impact these business have, women owned businesses are still underserved in the commercial credit markets. Female business owners tend to operate in industries that have a greater need for continuous working capital, thus women owned businesses tend to rely on revolving credit lines. Even with this demand for capital, women business owners are hesitant to apply for financing, and when they do, they are receiving a growing proportion of commercial credit, but the amount of credit granted still trails that of men. The recent growth in women owned businesses could be a driving factor in this disparity. New business have limited to no commercial credit history forcing lenders to evaluate the guarantor’s personal credit. On average, female business owners have a lower consumer credit score, which could be because they are carrying more personal debt to fund their businesses, ultimately decreasing their access to commercial credit. There are a number of factors that when combined, are limiting equal access to commercial credit for female business owners. The good news is that the number of successful women owned businesses continues to climb, and more grants and loans are available to women business owners. What I am watching While inflation in the U.S. is easing, it is still above the Fed’s 2% target. It is widely expected that the Federal Reserve will begin to lower interest rates later this year. It appears that the anticipated recession which led lenders to tighten credit will not occur. Therefore, lenders will likely begin to loosen credit criteria and potentially provide more opportunities for women-owned businesses to obtain the credit they need to operate and expand.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

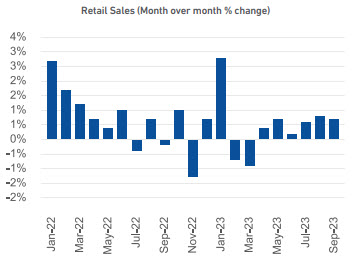

Retail sales reached a 4-year high of over $615B in December 2023 with yearly retail sales growing 4.6%. At the same time, lenders are tightening credit and businesses within the retail sector are showing signs of stress with higher late-stage delinquency rates and falling commercial credit scores. We see retailers seeking commercial credit less often, new originations slowing and lower lines over the past several months. As retail sales continue to rise so does the proportion of online retail sales. Online sales peaked during the COVID-19 pandemic and fell slightly once the lockdowns were lifted. Online retail sales remain approximately 56% higher than pre-pandemic levels and are trending up and may soon exceed 2020 levels. Growth in online retail sales has led to growth in retail returns. Retail returns peaked in 2022 at over $800MM and over 16% of total retail sales. Prior to 2021, retail returns as a percentage of retail sales averaged 8.9%, since 2021 that rate has grown to 14.6%. As returns increase so do fraudulent returns. Retailers have implemented strategies and solutions to address retail returns which resulted in a decrease in return dollars between 2022 and 2023 yet the percentage of returns that were fraudulent increased from 10.2% to 13.7% or over $100B. Increases in both legitimate and fraudulent returns are prompting retailers to identity solutions and operational strategies to slow growth across all returns. What I am watching: The U.S. economy expanded 3.3% in Q4 2023, and 2023 real GDP increased 2.5% over 2022. Strong consumer spending fueled the economy. Multiple sources are expecting The Federal Reserve to cut interest rates up to six times in 2024 with the rate cuts beginning in Q2 2024 and continuing into 2025. Lower interest rates likely means that consumer spending will continue at an elevated rate. As spending continues to increase, specifically in the retail sector, the need for commercial credit could continue to slow as cash-flows satisfy operational capital requirements. Cash on hand should begin to satisfy outstanding delinquencies, improving commercial credit scores resulting in improved access to commercial credit.

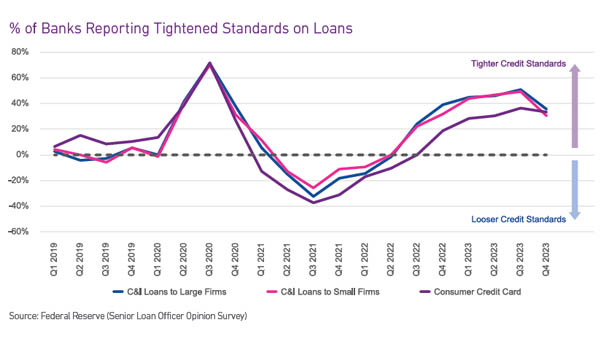

Small business owners’ optimism remains low due to concerns about the economy and credit conditions. According to the NFIB survey, business owners do not expect current business conditions to improve in the coming months and report that financing is their top business problem. Stringent credit underwriting policies are creating an environment where owners’ current borrowing needsare not met. According to the Federal Reserve’s SLOOS report, many lenders were loosening credit policies in mid-2022, making credit readily available to small business owners. As inflation and interest rates began to rise, commercial credit delinquencies began to increase at a rapid pace and lenders tightened credit underwriting criteria to mitigate accelerated risk. It appears that efforts have worked. Across most commercial credit financial products, the increase in delinquency rates slowed over the past few months. The loans originated under the tighter underwriting is proving to be lower risk. At the same time, account closures have increased suggesting that high risk default accounts are being removed from lenders portfolio’s thus leveling late-stage delinquency curves. As observed in the commercial credit cards space, late-stage delinquencies are leveling out. Lenders continue to issue commercial cards to lower-risk borrowers and while the average loan/line amount for all other financial products has been decreasing month over month, commercial card limits have increased. Monthly lower risk commercial card originations coupled with monthly high risk commercial card account closures is in part slowing and leveling late-stage delinquency rates in the commercial credit market. What I am watching The commercial credit market could shift in 2024. As reported in the SLOOS survey, while lenders are still tightening credit, fewer of them tightened in Q4 2023. If the economy can achieve a “soft-landing” rather than go into recession, lenders will be even more likely to loosen credit standards. The Federal Reserve is expected to start reducing interest rates in 2024, thereby making borrowingmore affordable. According to the December NFIB survey, business owners are planning capital outlays, increases in inventory, increases in hiring in the coming months but require commercial credit to do so. These business expansions will rely on the availability of credit.

The November jobs report paints a picture of a robust yet nuanced job market. While job gains and a low unemployment rate inspire optimism for a soft-landing scenario, the cooling employment growth reflects the impact of Federal Reserve interest rate hikes on consumer and business activities. Labor shortages are gradually easing, but challenges persist, particularly in the service sector. Wage growth is slowing down, offering relief from recent highs and contributing to the mitigation of inflationary pressures. Moreover, a new layer of complexity emerges with a rise in layoffs, totaling over 16 million in the first 10 months of the year, representing a 12% increase from 2022. Although layoffs are expected to rise further as the job market normalizes, projections indicate that the numbers will stay "well within the norm." Examining specific sectors reveals unique dynamics. The health care industry, propelled by long-term structural factors, continues to add jobs, providing stability to the overall economy. Conversely, the retail trade sector experiences job losses despite strong sales, signaling the industry’s transition to online channels and COVID-related changes in retail behavior. Navigating this intricatelandscape requires keen insight into sector-specific trends and an awareness of the evolving dynamics shaping the broader economic trajectory. What I am watching: Following the positive November inflation and labor market reports, the Federal Reserve did not change interest rates at their December meeting. After the aggressive interest rate increases since March 2022, this is now the third consecutive meeting with no change, but the Fed indicated that there will be multiple rate cuts beginning in 2024 and beyond. One key to the economy will be how consumers approach holiday spending. With consumer confidence low and news of upcoming layoffs, people may tighten their belts, thereby slowing the economy. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

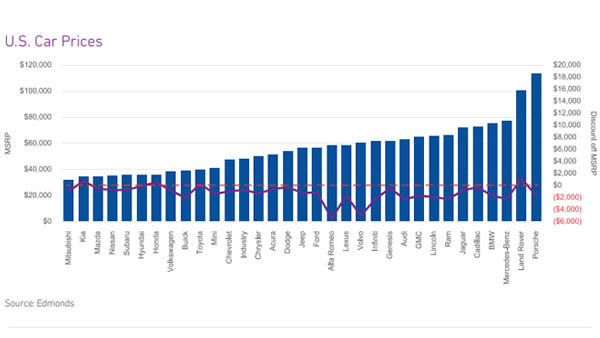

As new car production is finally nearing pre-pandemic levels, supply is catching up to demand. For many potential new car buyers that held off because of the tremendous mark-up on new and usedcars during the pandemic, the beginning trend of new car incentives and discounts is welcoming. However, the increase in car loan interest rates are eating up any incentives being offered, and those consumers who have patiently waited are actually worse off now than if they had purchased a car during the past couple of years. Many consumers did purchase cars during the pandemic, driven by necessity. During the pandemic, jobs were lost due to business shuts downs, and many were forced to seek new job opportunities. As remote work became the new normal and the demand for delivery of food and products skyrocketed, people purchased cars at marked up prices to employ themselves to meet this increasing demand. It turned out to be a good business decision as higher interest rates now make car purchasing an even more expensive experience. What I am watching: It will be interesting to see how quickly the automotive industry and car dealers increase the incentives to offset the increased cost of borrowing to purchase a car. After the aggressive interest rate increases by the Federal Reserve to combat inflation over the past 18 months, there is rumbling that the Fed will soon begin cutting rates. If interest rates come down and borrowing for auto loans is more reasonable, the increase in demand will be a welcome sight for the auto sector that finally was able to ramp up supply.

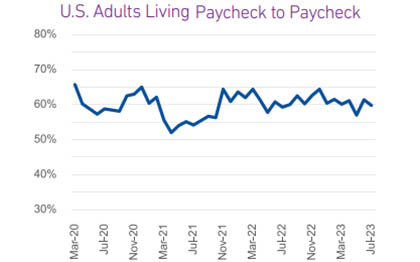

The aggressive interest rate hikes instituted by the Federal Reserve over the past year and a half may have achieved the desired goal. Easing inflation (3.2% in October) and strong GDP growth (4.9% in Q3) are some of the first indications that the economy may experience the “soft landing” hoped for instead of a recession. The consistently strong labor market produced low unemployment and increasing wages, enabling personal spending to increase. However, while spending continues to grow, the growth rate is on a downward trend. The high rate of spending has been driven by consumers digging into savings and borrowing more. As savings dwindle and the cost to borrow increases, it is likely that consumers will retreat and the pull-back will likely hit discretionary categories first. What I am watching: Heading into the holiday season, consumer spending is still strong but how long will it last? The National Retail Federation is projecting that November and December retail sales will grow 3-4% which is in line with the 3.6% average increase from 2010-2019 but lower than the past three years. People are already dipping into savings and borrowing more to continue their consumption but that well will run dry at some point. In addition, 36% of consumers cite December is a month for seasonal financial distress, according to PYMNTS. While consumers may continue spending through the holiday season, the tide may turn in early 2024 when bills hit with higher interest rates. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

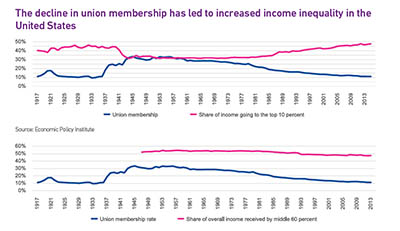

Since the COVID-19 pandemic, the U.S. labor market has shifted. Compared to pre-pandemic levels, there are more people employed yet a lower labor force participation rate, higher quit rates and more job vacancies which results in a tight labor market. A tight labor market is empowering workers, and they are exercising that power in the form of worker strikes. In addition, new technologies such as in the auto industry and new business models such as streaming in the entertainment industry, are creating driving the need for employers to address changes to worker contracts. Inequality in the employer/employee relationship over the past few years has fueled worker unrest and they are now exercising their power in a demand for higher wages and benefits or a greater share in profits. 2023 is proving to be a landmark year in terms of the number of strikes as well as union elections. The result of these strikes has proven beneficial to workers with employees at major companies receiving significant increases in yearly compensation and benefits. Labor union participation rates have been declining since 1983 and reached historic lows in 2022, however, the number of workers represented by unions increased for the first time since 2017. The United States is experiencing a shift in states and unionization rates with some historically low union states experiencing significant growth. While unionization rates in total are decreasing across most industries, others are increasing their union efforts and demanding and achieving results. It is a challenging environment for employers and employees as inflation and high interest rates put pressure on the United States economy. As unionization rates have declined it has increased income inequality and lead to reductions in middle class income. This pressure on many employees in the United States has driven union approval rates to the highest levels since the mid 1960’s, with the majority of adults seeing the decrease in unions as a bad sign for the country and the labor force. What I am watching: The power and effectiveness of union walk-outs and strikes is being recognized in the United States workforce. Earlier this year, UPS and the International Brotherhood of Teamsters representing more than 300,000 UPS employees, negotiated and approved a new 5 year-contract with more than 86% support. The union’s president stated, “the contract was the most lucrative ever at UPS and would serve as a model for other workers.” The success of this effort has resonated in the economy with most notably the United Auto Workers staging walk-outs across multiple auto manufacturing plants which has resulted in a tentative contracts with the three Detroit automakers. The results of unionization are being recognized and union efforts are spreading across multiple industries. With employees realizing there is power in numbers it is anticipated that unionization rates will continue to grow as employees seek equal representation in the labor force. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

The perception of economic conditions among small business owners grows more pessimistic with the NFIB optimism index still well below the 49-year average and a persistent belief that access to borrowing is likely to get worse. With inflation coming in at 3.7%, still stubbornly above the Fed’s 2% target, it is possible there will be more rate hikes in the coming months, which will make the cost of borrowing even higher. At the same time, small businesses are facing higher financing costs, the cost of labor continues to increase as workers can demand higher wages as employers struggle to find qualified workers for all their open positions. Meanwhile, there are still many signs pointing to a strong economy despite these challenges. Unemployment is still very low by historical standards as noticed by employers trying to fill open positions. Consumer spending continues to be strong with retail sales experiencing their sixth month-over-month gain in a row. As for credit tightening, both businesses and lenders report tightening but it may not be as bad it seems. Regular borrowing by small businesses on a monthto-month basis has recovered to pre-pandemic levels suggesting that even as borrowing costs are higher, small businesses still do have access to credit. New term loans are showing the average loan amount increasing and the number of new originations is only down 3% from the last quarter. Revolving accounts are faring less favorably but are also more likely to have variable interest rates that are sensitive to the increase in Fed rates. What I am watching: The Fed will have a difficult decision to make about interest rates at their next meeting on November 1 and in the coming months. Inflation has come down dramatically from its peak, but progress has stalled in the last few months. Unemployment is still very low and consumer spending is strong, but consumer and small business optimism is down. Housing costs are very high and high interest rates have slowed home sales as the cost to enter is high and existing homeowners are reluctant to sell. All these mixed signals make the path forward to achieve the coveted soft landing difficult to navigate and different Fed chairpersons have indicated different ideas on the matter. How the economy continues to fair in the coming holiday season and the response of the Fed to those conditions will be very closely followed as a result.