Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future.

In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic.

What I am watching

There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation.

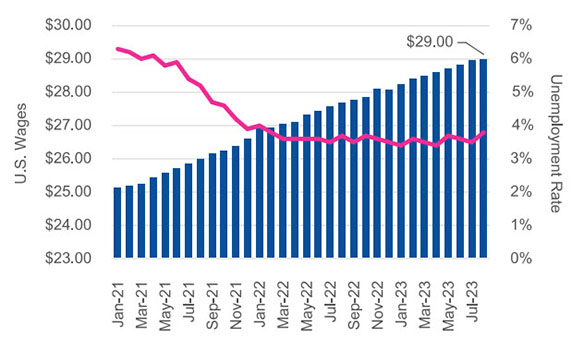

The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position.

Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you’ll get it in your inbox every time it releases, or once a month as you choose.