Small Business Credit Insights

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

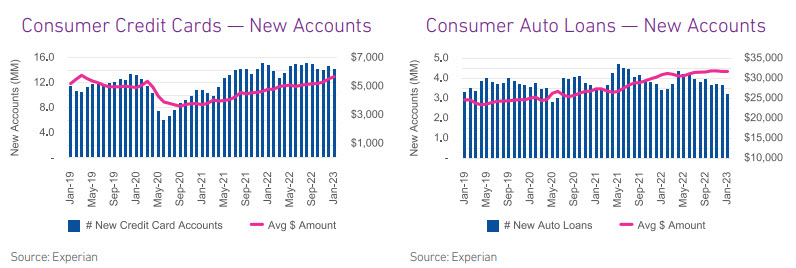

Consumers are borrowing to maintain spending levels even though higher interest rates make borrowing more expensive.

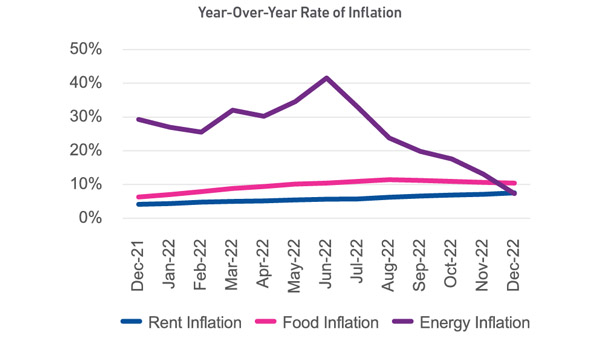

This week Experian and Oxford Economics released the Q4 2022 Main Street Report. The report provides insight into the financial well-being of the small business landscape. Critical factors in the Main Street Report include business credit data (credit balances, delinquency rates, utilization rates, etc.) and macroeconomic information (employment rates, income, retail sales, industrial production, etc.). Report Highlights Consumer sentiment improved in Q4 2022, despite a softening of spending behavior. This positive behavior has contributed to the positive health and growth perspective of small businesses heading into 2023, leading to stable cash flow performance. In addition, commercial lending markets remained open and commercial delinquencies returned to pre-pandemic levels. However, higher goods and services costs may pressure spending as affordability tightens and personal cash flows thin. The US economy grew strongly in Q4 2022, but the core of the economy was soft, indicating that a repeat performance in early 2023 is unlikely. The trend in job growth has decelerated, and the Fed needs to engineer a soft landing. The Fed is pushing back against market expectations of rate cuts and is likely to hike more than expected. Download Q4 2022 Report

Get the latest quarterly small business trends Mark your calendars! Experian and Oxford Economics will present key findings in the latest Main Street Report for Q4 2022 during the Quarterly Business Credit Review. Ryan Sweet, Oxford’s U.S. Chief Economist will share his take on Experian’s most recent small business credit data and a macroeconomic outlook for the coming quarter. Brodie Oldham, Experian’s V.P. of Commercial Data Science, will cover commercial credit trends. Presenters Brodie Oldham, V.P. Commercial Data Science Experian Ryan Sweet, U.S. Chief Economist Oxford Economics Q4 2022 Main Street Report The Q4 2022 Experian/Oxford Economics Main Street report will release at the end of February. If you are not already subscribed to thought leadership updates, be sure to sign up for updates on our Commercial Insights Hub. Event Details Date: Thursday, March 9th, 2023Time: 10:00 a.m. (Pacific), 1:00 p.m. (Eastern) Why you should attend: Leading Experts on Commercial and Macro-Economic Trends Credit insights and trends on 30+ Million active businesses Ask our panel questions in real-time Industry Hot Topics Covered (Inclusive of Business Owner and Small Business Data) Commercial Insights you cannot get anywhere else Peer Insights with Interactive Polls (Participate) Discover and understand small business trends to make informed decisions Actionable takeaways based on recent credit performance Save My Seat

So far, the economy has been extremely resilient, with Q4 GDP coming in above expectations at 2.9%, inflation cooling, supply chain issues easing, and unemployment remaining low.

After a busy holiday season, we are pleased to announce the publication of our Winter 2023 Beyond the Trends report. Holiday spending increases by 7.6% Small businesses' health and performance in 2022 was strong as consumers spent beyond their means, to prolong demand behaviors learned in an economy overflowing with stimulus, coming out of the pandemic where personal savings was running lean. Despite impact of inflation on incomes, spending continues Retailers will fight for consumer spending, but consumers will find their purchasing power limited as interest rates increase and assumption of unexpected debt payments. Other highlights Consumer credit overall decreased 16% month over month in the fourth quarter as delinquencies climbed as mortgage markets continue to slow. New unsecured credit card debt rose 4% as thin consumer savings forced more debt to the consumers credit card. New U.S. emerging businesses seeking credit is down 5.7% year over year as new business applications in the U.S. slow and commercial delinquencies rise. Experian saw a 61% YOY increase in the percentage of high risk small business credit inquiries with emerging business seeking credit up 78.5% year over year with limited commercial credit history in the 4th quarter leading to lower-than-normal average credit lines across the industry. Small business lenders will focus on four critical areas in the coming months to ensure their businesses remain stable and continue to grow. Market expansionDeterring fraud Limiting portfolio exposureDeveloping loyalty among profitable customers Download Winter 2023 Beyond The Trends Report

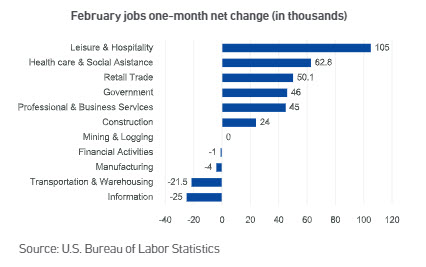

Happy New Year! The burning question for 2023 is whether the U.S. economy will fall into recession. A robust 2022 labor market has been a major factor in staving off recession culminating with a low unemployment rate of 3.5% in December. The number of people in the U.S. labor force surpassed pre-pandemic levels despite lower participation rates, indicating fewer job seekers. This can be explained in part by the increase in retirement of employees due generally to an aging population choosing to retire from the workforce during Covid. Over the past year, with higher demand for labor, easing of health concerns of the pandemic, financial pressure from inflation and 2022 financial markets experiencing their worst performance in 15 years, people are re-entering the labor force and the “unretirement” rate is on the rise. Individuals are returning to the work force in two forms; as employees, and as business owners, as new businesses continue to open at a rapid pace. New businesses continue to account for a growing portion of commercial trades with small businesses (under 10 employees) accounting for over 80% of new commercial credit account originations. New small businesses still require capital to operate however with inflation, high interest rates and decreases in consumer (sole proprietor) and commercial credit scores, average loan amounts are decreasing, driving commercial credit delinquencies up 95% year-over-year for businesses with fewer than 10 employees. What I am watching: In December, wages declined for the first time in almost two years, indicating that going forward, labor may not drive inflation to the same extent as before. When the Federal Reserve meets at the end of January, I will be watching whether interest rates are raised, or the slowing of the labor market is considered a positive sign for slowing inflation. The higher delinquencies and lower credit scores are pointing to a continued tightening of the commercial credit markets thereby making access to necessary capital more difficult and expensive. This negative pressure could stifle new business openings and increase business closures. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

The advanced Q1 2023 GDP numbers show that the U.S. economy grew an annualized 1.1%, down from 2.6% in Q4 2022.

Labor market gives the Fed cover to keep hiking Experian Business Information Services and the economists at Oxford Economics have just released the Q3 2022 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what specific trends mean for credit grantors and the small-business community. Report Overview Sustained consumer spending and strong job market performance have perpetuated U.S. small business health and positive market sentiment. The third quarter highlighted open and growing commercial lending markets, inclusive of all tiers of credit risk, even as measured commercial delinquencies returned to pre-pandemic levels. Signals in the financial market point to a heightened risk of a more significant U.S. economic slow-down in 2023, as consumers change spending behavior as affordability tightens and personal cashflows are challenged first in the lower income segments. Download Report