All posts by Marsha Silverman

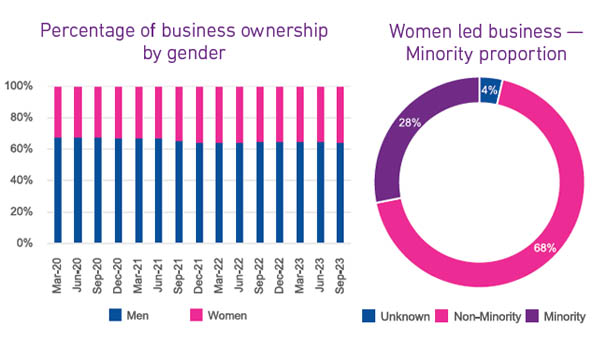

As of recent years, women-owned businesses in the United States have experienced significant growth and have become a substantial force in the economy. It is estimated that there are more than fourteen million women owned business generating over two trillion dollars in annual revenue. The growth in women owned businesses has been fueled by a myriad of reasons, is occurring across all age groups and serves a diverse number of industries. Even with the growth in the number of women owned businesses and the economic impact these business have, women owned businesses are still underserved in the commercial credit markets. Female business owners tend to operate in industries that have a greater need for continuous working capital, thus women owned businesses tend to rely on revolving credit lines. Even with this demand for capital, women business owners are hesitant to apply for financing, and when they do, they are receiving a growing proportion of commercial credit, but the amount of credit granted still trails that of men. The recent growth in women owned businesses could be a driving factor in this disparity. New business have limited to no commercial credit history forcing lenders to evaluate the guarantor’s personal credit. On average, female business owners have a lower consumer credit score, which could be because they are carrying more personal debt to fund their businesses, ultimately decreasing their access to commercial credit. There are a number of factors that when combined, are limiting equal access to commercial credit for female business owners. The good news is that the number of successful women owned businesses continues to climb, and more grants and loans are available to women business owners. What I am watching While inflation in the U.S. is easing, it is still above the Fed’s 2% target. It is widely expected that the Federal Reserve will begin to lower interest rates later this year. It appears that the anticipated recession which led lenders to tighten credit will not occur. Therefore, lenders will likely begin to loosen credit criteria and potentially provide more opportunities for women-owned businesses to obtain the credit they need to operate and expand.

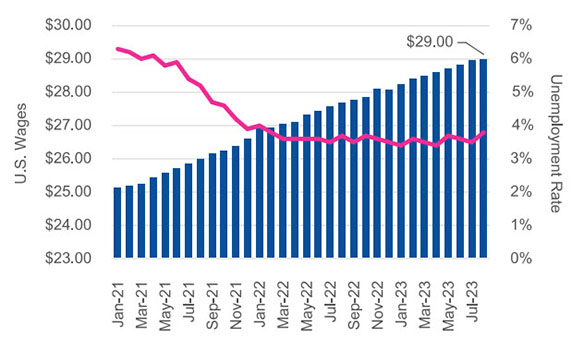

The November jobs report paints a picture of a robust yet nuanced job market. While job gains and a low unemployment rate inspire optimism for a soft-landing scenario, the cooling employment growth reflects the impact of Federal Reserve interest rate hikes on consumer and business activities. Labor shortages are gradually easing, but challenges persist, particularly in the service sector. Wage growth is slowing down, offering relief from recent highs and contributing to the mitigation of inflationary pressures. Moreover, a new layer of complexity emerges with a rise in layoffs, totaling over 16 million in the first 10 months of the year, representing a 12% increase from 2022. Although layoffs are expected to rise further as the job market normalizes, projections indicate that the numbers will stay "well within the norm." Examining specific sectors reveals unique dynamics. The health care industry, propelled by long-term structural factors, continues to add jobs, providing stability to the overall economy. Conversely, the retail trade sector experiences job losses despite strong sales, signaling the industry’s transition to online channels and COVID-related changes in retail behavior. Navigating this intricatelandscape requires keen insight into sector-specific trends and an awareness of the evolving dynamics shaping the broader economic trajectory. What I am watching: Following the positive November inflation and labor market reports, the Federal Reserve did not change interest rates at their December meeting. After the aggressive interest rate increases since March 2022, this is now the third consecutive meeting with no change, but the Fed indicated that there will be multiple rate cuts beginning in 2024 and beyond. One key to the economy will be how consumers approach holiday spending. With consumer confidence low and news of upcoming layoffs, people may tighten their belts, thereby slowing the economy. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

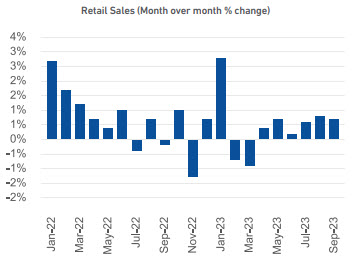

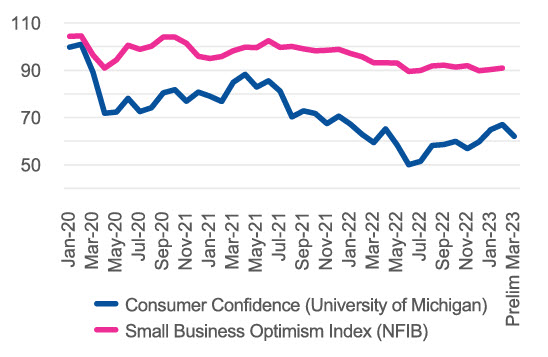

The perception of economic conditions among small business owners grows more pessimistic with the NFIB optimism index still well below the 49-year average and a persistent belief that access to borrowing is likely to get worse. With inflation coming in at 3.7%, still stubbornly above the Fed’s 2% target, it is possible there will be more rate hikes in the coming months, which will make the cost of borrowing even higher. At the same time, small businesses are facing higher financing costs, the cost of labor continues to increase as workers can demand higher wages as employers struggle to find qualified workers for all their open positions. Meanwhile, there are still many signs pointing to a strong economy despite these challenges. Unemployment is still very low by historical standards as noticed by employers trying to fill open positions. Consumer spending continues to be strong with retail sales experiencing their sixth month-over-month gain in a row. As for credit tightening, both businesses and lenders report tightening but it may not be as bad it seems. Regular borrowing by small businesses on a monthto-month basis has recovered to pre-pandemic levels suggesting that even as borrowing costs are higher, small businesses still do have access to credit. New term loans are showing the average loan amount increasing and the number of new originations is only down 3% from the last quarter. Revolving accounts are faring less favorably but are also more likely to have variable interest rates that are sensitive to the increase in Fed rates. What I am watching: The Fed will have a difficult decision to make about interest rates at their next meeting on November 1 and in the coming months. Inflation has come down dramatically from its peak, but progress has stalled in the last few months. Unemployment is still very low and consumer spending is strong, but consumer and small business optimism is down. Housing costs are very high and high interest rates have slowed home sales as the cost to enter is high and existing homeowners are reluctant to sell. All these mixed signals make the path forward to achieve the coveted soft landing difficult to navigate and different Fed chairpersons have indicated different ideas on the matter. How the economy continues to fair in the coming holiday season and the response of the Fed to those conditions will be very closely followed as a result.

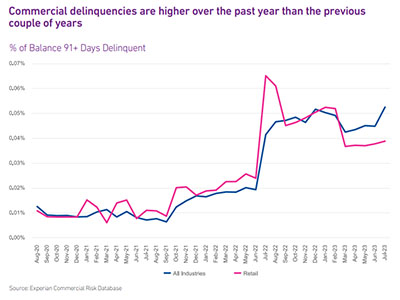

The labor market remains robust with low unemployment (3.8%) and 366K new jobs created in September. Job openings in the U.S. were 9.6MM as of the end of August, an increase of 690K or 5.8% since July. Retail sales in August had a month-over month increase for the fifth consecutive month. As we head into the holiday shopping season, despite headlines of large retailers struggling, the retail industry appears poised for success. It is likely that those retail businesses that survived the difficulties of the pandemic are the most financially sound and are driving the statistics. Over the past year, retailers are seeking less credit and taking on less debt than the previous few years. Despite inflation, consumers are still spending, and retailers are benefitting. Commercial delinquencies have been increasing over the past year. Delinquencies within the retail sector were trending above overall commercial delinquencies until just a few months ago when retailers exhibited lower rates than overall. These are all positive signs heading into the holiday shopping season which tends to make or break a retailer’s year. The September labor report was stronger than expected. Unemployment remained low at 3.8% and 366K new jobs were created which was the highest amount since January. In addition, the jobs created in July and August were revised upward significantly. What I am watching: With the labor market still tight, it will be interesting to see if the retail sector will be able to staff accordingly to support the holiday crunch. If staffing is difficult, retail stores may struggle to keep up with demand. Now that the student loan moratorium has ended, it will be important to monitor the impact to consumer spend. The increased expense of the student loan monthly payments will likely leave individuals with less discretionary income to spend on retail purchases. In addition, business owners who have student loans will have less money to invest in their business

Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future. August unemployment increased to 3.8% from 3.5% in July and is the highest since February 2022. Low unemployment continued to drive wages up with August wages reaching $29 per hour In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic. What I am watching There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation. The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

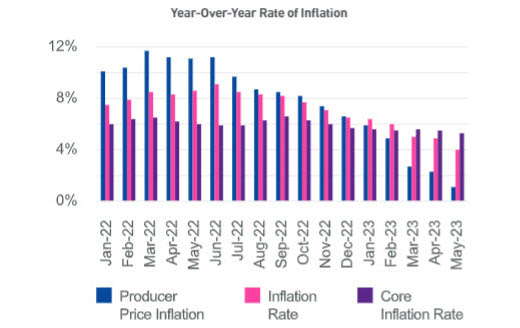

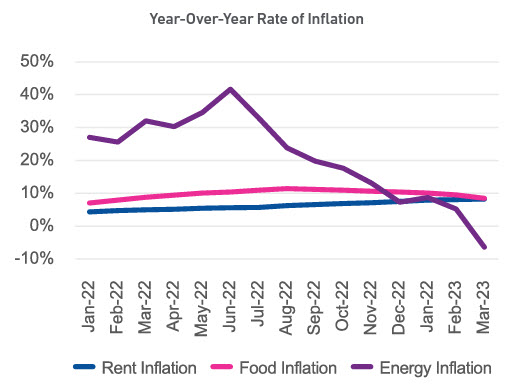

The annual inflation rate continued to decline with May coming in at 4% which was the eleventh consecutive monthly decrease and the lowest level since March 2021. Lower inflation is driven primarily by lower energy costs which decreased 11.7% year over year. Core inflation, which excludes volatile energy and food, slowed to 5.3%. Despite inflation still much higher than the Fed’s 2% target, the Fed paused interest rate hikes after 10 consecutive rate increases in the last 15 months. The Fed indicated that additional hikes may come later this year. New businesses continue to open at a high rate. Despite that these newer, and specifically smaller, businesses are making up a larger and larger portion of commercial credit, they have additional funding needs. According to the Federal Reserve’s 2023 Small Business Credit Survey, almost 70% of businesses with zero employees use personal funding sources for their business while only 27% of them obtain funding from financial institutions or lenders. Since the non-employer businesses reported on 36% had a decline in revenue in 2022 (vs. 38% of employer businesses’ revenue declined in 2022), there is a huge opportunity for financial institutions to tap into this market and support small business growth. What I am watching Small businesses with very few or no employees flourished coming out of the pandemic. It will be interesting to see how many of these micro-businesses will survive the headwinds of inflation, higher interest rates and less access to credit. With an economic slowdown on the horizon, the Fed actions in the coming months will be critical to the outcome. It is yet to be determined if the U.S. economy will achieve the hoped-for soft landing rather than a recession. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

As of Q1 2023, Metropolitan-Core contained 78.1% of businesses, up from 76.3% in Q1 2018. The growth came despite high vacancy rates in offices due to the rise in telecommuting. Remote working has been around for a long time, but became vastly more prevalent during the COVID-19 pandemic when people were required to stay home but employers wanted to continue business operations. As the height of the pandemic gets farther in the rearview mirror, more employers are requiring employees to come back to the office. However, more workers are still working remotely, at least part of the time, than before the pandemic. With fewer people going into offices, there is a shift of population clustering in metro-centers where office buildings are located to areas outside of the metropolitan-core in more suburban and rural areas. With more people spending more time closer to their homes, they patronize businesses near their homes, driving the post-pandemic growth rate of businesses opening to be much greater outside of the metropolitan-core areas. The labor market continues to be robust. 339K jobs were created in May, the most in four months, and way above market forecasts of 190K. On the flip side, unemployment ticked up in May 3.7% from 3.4% in April, and is now the highest level since October 2022. What I am watching: The high rate of post-pandemic new business openings is fueled by small businesses with fewer than 20 employees. Some of the businesses are even home-based side jobs by individuals working remotely for their primary job. It will be interesting to see how many of these small businesses can survive through the expected upcoming economic slowdown or recession. With higher interest rates and commercial lenders tightening criteria, businesses that are struggling will have a tough time securing financing to weather any upcoming storms. Now that the Federal government raised the debt-ceiling and averted a government default, all eyes will turn back to the Federal Reserve’s battle to fight inflation. They indicated a pause in interest rate increases starting with their June 14th meeting. However, with the labor market still robust, the Fed’s decision may be a swayed by the May inflation report that is scheduled for release on June 13th. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.