Experian Commercial Pulse Report | 3/25/2025

Experian has released our March 25th Commercial Pulse Report. In addition to mixed economic conditions, we focus in on the growing problem of small business financial fraud.

Watch Our Commercial Pulse Update

Macroeconomic Highlights

In February, inflation dipped to 2.8%, with core inflation hitting its lowest level since 2021. The Fed held interest rates steady, reflecting ongoing caution about the economic outlook. Unemployment remained stable at 4.1%, and rising wages helped sustain consumer spending. Retail sales saw a modest rebound, though year-over-year growth slowed, and consumer sentiment dropped 27% from last year. The Experian Small Business Index rose slightly to 41.5 but remains down from a year ago, as easing inflation and credit conditions offer cautious optimism for small business lending.

The Rising Threat of Small Business Financial Fraud

According to the latest Experian data, financial fraud against small businesses has increased by 70% since the start of the pandemic, costing billions annually. As fraud tactics become more sophisticated and digital channels continue to expand, the pressure on lenders and small businesses is mounting.

During the pandemic, e-commerce surged to 16.4% of total retail sales. Although it briefly declined post-pandemic, this share has returned to its peak by the end of 2024. This shift has dramatically increased the size of consumers’ digital footprints, making them more vulnerable to cybercrime. A staggering 8.8 billion records were found on the dark web in 2024 alone—more than double the amount reported in 2022.

Among the most concerning statistics from the report:

- 65% of financial institutions reported an increase in fraud incidents in 2024.

- 46% of small business loan applications showed signs of first-party fraud.

- 31% of small businesses experienced fraudulent lenders or scams during the lending process.

- AI-driven scams are projected to result in $40 billion in losses by 2027.

- 80% of fraud events now occur on digital channels such as online or mobile banking.

- 64% of institutions plan to boost their fraud prevention investments in 2025.

These figures illustrate just how pervasive and costly commercial fraud has become. Yet, there is reason for cautious optimism. Experian notes that while fraud levels remain elevated, there are signs that the trends are beginning to normalize compared to the extreme conditions seen during the peak of the pandemic. This includes a reduction in “bust-out” fraud—scenarios where a business intentionally takes on debt it has no intention of repaying.

Financial institutions are responding by investing in AI-powered analytics and enhanced fraud detection platforms. These tools are proving critical in detecting and intercepting fraudulent applications in real time. Additionally, more organizations are forming cross-sector partnerships and joining fraud consortia to share intelligence and improve collective defenses.

To stay ahead of the latest trends:

✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis.

✔ Subscribe to our YouTube channel for regular updates on small business trends.

✔ Connect with your Experian account team to explore how data-driven insights can help your business grow.

Want to learn more? Download the full Commercial Pulse Report for March 25, 2025.

Related Posts

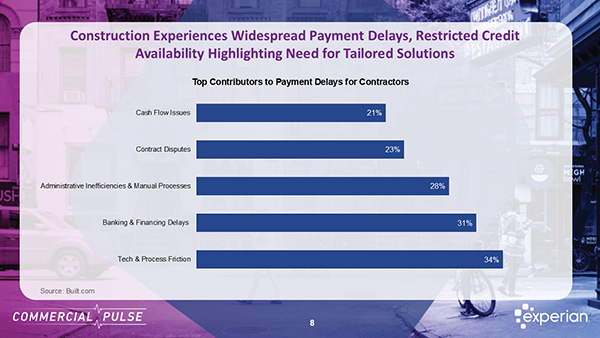

Experian's Construction Industry Risk Model Offers Greater Precision for CRO's Construction is building momentum in 2026 — but capital is becoming more selective just as demand accelerates. For Chief Risk Officers, this is not simply a growth story. It is a risk calibration moment. For Chief Risk Officers and commercial lenders, that combination creates a complex credit environment: expanding opportunity on one hand, rising sector-specific risk on the other. This week’s Commercial Pulse Report highlights why construction deserves close attention — and why traditional risk tools may not be sufficient in the current cycle. Watch The Commercial Pulse Update A Growing Sector with Structural Tailwinds Construction contributes approximately 4.8% of U.S. GDP and remains a foundational industry supporting infrastructure modernization, AI-powered data centers, renewable energy expansion, and multifamily housing demand. Since Q1 2013, the number of construction firms in the U.S. has grown by 28%, reaching nearly 950,000 establishments. Employment in the sector has increased 49% since January 2010, reflecting both demand expansion and increased new business formation. Construction spend peaked at just over $2.2 trillion in April 2024, contracted 3.3% in 2025, and is forecast to rebound 7% in 2026 to exceed $2.1 trillion. Construction businesses seek credit more than twice as often as companies in many other industries — a structural dynamic that fundamentally alters how risk signals should be interpreted. From a growth perspective, the fundamentals remain solid. Non-residential construction is particularly strong, driven by: AI-powered data center buildouts Renewable energy infrastructure Public infrastructure modernization Regional population and job growth For lenders, that growth trajectory signals continued credit demand — especially for working capital, equipment financing, and project-based lending. But growth alone doesn’t define risk. Payment Friction Is Structurally Embedded While construction is expanding, it is also experiencing persistent cash flow strain. According to a 2025 industry study referenced in the report: 70% of contractors regularly face delayed payments 41% have increased their use of credit to manage cash flow 1 in 4 contractors have reduced bidding activity due to financial strain Top contributors to payment delays include: Cash flow constraints Contract disputes Administrative inefficiencies Banking and financing delays Technology and process friction Construction projects are capital-intensive and milestone-driven — meaning liquidity depends on payment timing, not just performance. When developers delay payments, the effects cascade through subcontractors and suppliers. For lenders, this creates a recurring risk pattern: strong backlog with fragile cash flow. For CROs, this creates a distinct risk profile: businesses may show strong top-line growth but experience liquidity stress due to payment timing — increasing reliance on revolving credit and short-term financing. Construction Businesses Seek and Use More Credit Experian data reveals that construction businesses: Seek commercial credit more than twice as often as non-construction businesses Maintain a higher average number of commercial trades Exhibit higher 60+ day delinquency rates compared to other industries At the same time, commercial lenders continue reporting tightened underwriting standards, particularly for small firms. This dynamic — structurally elevated credit demand colliding with tighter credit conditions — increases the need for precise risk interpretation. Elevated inquiries and higher trade counts in construction are not inherently distress signals. In many cases, they reflect the capital-intensive, project-based nature of the industry. The risk is not high credit usage — the risk is misinterpreting what that usage signals. Construction firms are not homogenous. Risk varies significantly across: Trade specialty Project mix (residential vs. non-residential) Business maturity Regional economic exposure Capital structure and utilization patterns Generic commercial risk scores may not fully capture these industry-specific nuances, increasing the potential for both over- and under-estimating risk within construction portfolios. Why Generic Risk Models Fall Short in Construction Construction presents several characteristics that can distort traditional risk assessments: High inquiry and trade activity – Elevated credit usage may reflect normal operating structure, not necessarily distress. Cyclical delinquency patterns – Project-based payment timing can temporarily inflate delinquency metrics. Industry-specific trade relationships – Supplier networks and payment practices differ from other sectors. Material cost volatility – Construction input costs have tripled since the early 1980s and remain elevated relative to pre-pandemic levels. When underwriting models are calibrated to all industries collectively, they may under- or over-estimate risk within construction portfolios. In tightening credit cycles, imprecision compounds faster: Constraining high-quality borrowers Underpricing volatile segments Misallocating capital For CROs, this is not theoretical — it is a margin issue. The Case for Industry-Specific Risk Modeling Addressing this requires industry-calibrated analytics — models built specifically to reflect construction trade behavior and payment dynamics. For example, Experian developed the Small Business Credit ShareTM model for Construction — a purpose-built commercial risk score tailored specifically to businesses with construction trades. The model: Uses advanced machine learning methodology (XGBoost) Predicts the likelihood of becoming 61+ days beyond terms within 12 months Incorporates aggregate business data, public records, trade data, and construction-specific attributes Produces a score range of 300 to 850, where higher scores indicate lower risk Performance testing shows improved KS and GINI separation compared to generic all-industry models, as well as stronger bad capture rates in the lowest scoring deciles. In practical terms, that means: Better identification of high-risk borrowers Improved differentiation among mid-tier applicants More confident credit line sizing Smarter portfolio monitoring For lenders balancing growth objectives with capital discipline, industry-optimized analytics can materially improve decision accuracy. Learn More about Experian SBCS Construction Score Strategic Implications for Chief Risk Officers As we move further into 2026, construction presents a paradox: – Strong sector growth – Elevated credit demand – Tightening lending standards – Persistent payment delays – Increased reliance on alternative capital The strategic question for CROs is not whether to participate in construction lending — it is how to do so with precision. Key considerations include: Are your underwriting models calibrated to sector-specific risk patterns? Are you distinguishing between structural credit usage and distress signals? Are portfolio limits aligned to trade-level risk differentiation? Are you leveraging machine learning where appropriate to isolate “bads” earlier? In a tighter credit market, competitive advantage often comes from accuracy — not volume. Growth Requires Discipline Construction will remain a critical growth engine for the U.S. economy in 2026. Demand is real. Infrastructure investment is accelerating. Capital needs are expanding. But so are constraints. For lenders and risk leaders, the opportunity lies in balancing participation with discipline — using analytics sophisticated enough to separate resilient operators from liquidity-stressed borrowers. The cranes are rising.Capital is tightening. In 2026, growth will be available. Precision will be decisive. Learn more ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub

Published: Feb 23, 2026 by Gary Stockton

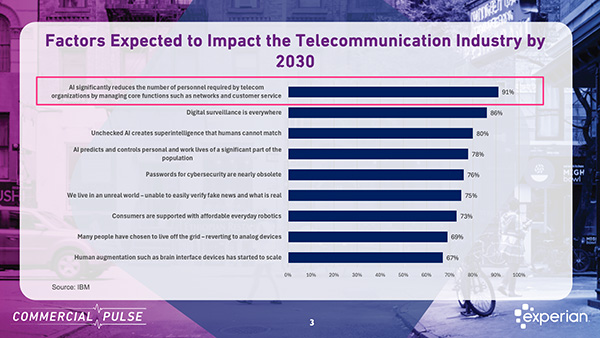

Is AI about to disrupt the telecommunications industry? In this week's Commercial Pulse Report, we explore potential AI disruption in the Telecommunications industry as the transition from analog to digital plays out, and industry consolidation takes hold. Watch The Commercial Pulse Update In 1979, a British new wave band called The Buggles released a song that would become an unlikely cultural landmark. Video Killed The Radio Star wasn’t just catchy—it was prophetic. The lyrics mourned the decline of radio as television and music videos began to dominate how audiences consumed content. Just a few years later, MTV launched, and the shift from audio to visual media was complete. Radio didn’t disappear, but it was permanently changed. One line from the song captures the unease of that moment perfectly “In my mind and in my car, we can’t rewind, we’ve gone too far,pictures came and broke your heart, put the blame on VCR.”The Buggles, 1979 It’s a lament about progress—about technology moving faster than society can comfortably absorb. And it’s a reminder that once disruption takes hold, there’s no rewinding the tape. Fast forward more than four decades, and the irony is hard to miss. MTV itself—once the symbol of disruption—has faded from cultural relevance, ending as it started by playing "Video Killed The Radio Star" on December 31st, 2025. That same cycle defines today’s telecommunications industry disruption, as AI, automation, and consolidation reshape how companies operate and compete. A Familiar Pattern of Disruption Telecommunications has lived through repeated waves of technological upheaval. The shift from analogue to digital fundamentally altered how networks were built, how services were delivered, and how companies competed. That transition drove efficiency, reduced headcount, and accelerated consolidation across the industry. Now, artificial intelligence represents the next inflection point. As highlighted in this week’s Commercial Pulse Report, AI is no longer a future concept for telecom—it’s a near-term operational reality. Industry research shows that a majority of telecom executives expect AI to materially reshape their organizations by automating core functions such as network management, customer service, and fraud detection. Just as video once replaced radio as the dominant format, AI is poised to redefine how telecom companies operate—faster, leaner, and increasingly software-driven. And as history has shown, efficiency gains often come with structural consequences. Consolidation, Scale, and Survival Disruption rarely happens in isolation. It tends to accelerate industry consolidation, and telecom is no exception. Over the past decade, mergers and acquisitions have reshaped the competitive landscape. In wireless, consolidation has resulted in three dominant players controlling the majority of the market. At the same time, the total number of private telecom establishments in the U.S. has declined sharply from its historical peak. This mirrors what happened in media. MTV consolidated attention, then streaming consolidated distribution, and now a handful of platforms dominate content delivery. Each wave reduced the number of viable players while raising the cost of participation. In telecom, AI may lower operating costs—but it also raises the bar for capital investment, data sophistication, and technological capability. Smaller firms face increasing pressure to either specialize, scale, or exit. What the Credit Data Is Telling Us One of the most telling insights from this week’s Commercial Pulse Report comes from telecom credit behavior. Telecom businesses tend to seek credit more frequently than companies in other industries, reflecting ongoing investment needs. However, the average size of credit lines has steadily declined, even as utilization rates have returned to pre-pandemic levels. In other words, telecom firms are doing more with less. This dynamic suggests that businesses may be turning to alternative funding sources, reallocating capital internally, or operating under tighter credit constraints—despite stable demand for connectivity and data services. For risk leaders and growth strategists, this creates a more complex environment. Traditional indicators alone may not fully capture resilience or vulnerability. Understanding industry-specific behavior becomes critical. We Can’t Rewind—But We Can Prepare The line from “Video Killed The Radio Star” still resonates because it captures a universal truth about disruption: We can’t rewind—we’ve gone too far. AI will not undo itself. The telecom industry will not revert to its pre-digital or pre-automation state. Just as radio adapted rather than disappeared, and MTV faded as new platforms rose, telecom companies will continue to evolve—some faster and more successfully than others. The question is not whether disruption will occur, but who is prepared for it. This week’s Commercial Pulse Report explores that question through the lens of macroeconomic conditions, small business credit health, and telecom-specific insights. Together, they offer a clearer picture of how innovation, consolidation, and credit trends are intersecting in early 2026. Because while technology may break hearts along the way, understanding the data helps businesses stay ahead of the next verse. Learn more ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Published: Feb 09, 2026 by Gary Stockton

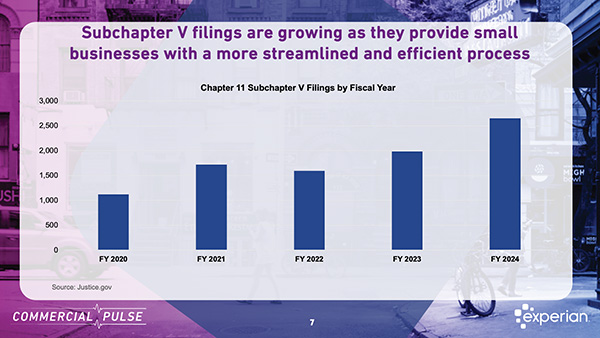

Bankruptcy isn’t just a back-page story anymore, it’s becoming the postscript to the startup surge. The January 27th Experian Commercial Pulse Report reveals a sharp contrast in the small business economy: while business formation remains historically elevated, bankruptcy filings are climbing to levels not seen in a decade. The data points to a critical inflection point—where entrepreneurial growth meets growing financial fragility. Watch The Commercial Pulse Update A Two-Sided Story: Formation and Failure The numbers we see highlighted in the news show a business ecosystem in flux. In December 2025, 497,000 new businesses were launched, a slight dip from November but still 53% above pre-pandemic averages. Since July 2020, an average of 446,000 new businesses have formed each month, underscoring an entrepreneurial surge that has become a defining feature of the post-COVID economy. However, this wave of new businesses comes with significant exposure. Many are lean operations, often led by first-time founders with limited access to capital and minimal financial buffers. These structural vulnerabilities are reflected in rising failure rates. In Q3 2025, business bankruptcy filings hit 24,039—the highest quarterly total since 2016. While some of this activity reflects larger firms restructuring through Chapter 11, a growing share involves smaller, younger businesses taking advantage of Subchapter 5, a newer option tailored for small business reorganization. Understanding Bankruptcy Types: Chapter 7, 9, 11, 12, 13, 15 and Subchapter 5 To better interpret the data, it helps to understand the bankruptcy options available to businesses: Chapter 7 – Liquidation: This is the most straightforward and final form of bankruptcy. Businesses cease operations and a court-appointed trustee sells off assets to repay creditors. Chapter 9 – Municipal Bankruptcy: Exclusively municipalities ( i.e. cities, counties, school districts.) Municipality retains control. No liquidation allowed. No need for disclosure statements. Chapter 11 – Reorganization: This allows a business to continue operating while restructuring its debt under court supervision. Often used by larger or financially complex companies. Chapter 12 – Family Farmer & Fisherman Reorganization: Exclusively for agriculture and fishing operations. Lower cost compared to Chapter 11. Owners keep farm/fishing operation. No need for disclosure statements or creditor committees. Chapter 13 – Individual Reorganization: Primarily for individuals but sometimes used for sole proprietors. Establishes 3 to 5-year repayment plan. Debtor keeps assets and continues operations. Debt limits apply. Chapter 15 – Cross-Border Insolvency: For businesses with assets and creditors in multiple countries. Facilitates cooperation between U.S. courts and foreign courts. Helps protect U.S. assets during international restructuring Subchapter 5 (of Chapter 11): Introduced by the Small Business Reorganization Act of 2019, Subchapter 5 simplifies and lowers the cost of reorganization for small businesses with less than $3 million in debt. Key advantages of Subchapter 5 include: No creditor committee or disclosure statement required Faster court timelines and higher plan confirmation rates Owners can often retain equity Subchapter 5 filings have more than doubled since 2020 and now account for a growing share of all Chapter 11 activity. Who’s Filing—and Why It Matters The report highlights a shift in the types of businesses filing for bankruptcy. These firms are: Small – fewer than five employees Young – under 10 years in operation Low-revenue – earning under $1 million annually These groups now represent the majority of business bankruptcies, showing that financial fragility is highest among the newest and smallest entrants in the market. Early Warning Signs: Commercial Credit Behavior Experian’s commercial credit database reveals clear behavioral patterns among at-risk firms: Higher credit seeking activity: These businesses are 3–4 times more likely to apply for credit before filing. Elevated commercial credit balances: They carry significantly higher balances than non-filing peers. Signs of financial stress: Increased delinquencies and utilization often appear months before a bankruptcy event. This creates an opportunity for lenders to proactively monitor portfolios and identify risk earlier, especially among firms that fit the high-risk profile. What This Means for the Small Business Economy The data paints a complicated picture. New business creation remains strong, driven by structural changes and a resilient entrepreneurial spirit. But these new firms are operating in an increasingly challenging environment, facing inflation, tighter credit conditions, and weakening demand. Subchapter 5 is helping many small businesses stay afloat by making reorganization more accessible. However, rising filings among small and young firms signal that financial strain is becoming more common at the foundational level of the economy. For lenders and risk professionals, the takeaway is clear: track not just the volume of small business activity, but the quality and sustainability behind it. Credit signals remain a powerful early indicator of distress and can help institutions support their small business clients more strategically. Learn More ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Published: Jan 26, 2026 by Gary Stockton