Today Experian Business Information Services releases the Experian/Moody’s Analytics Main Street Report for Q1 2018. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what certain trends mean for credit grantors and the small-business community.

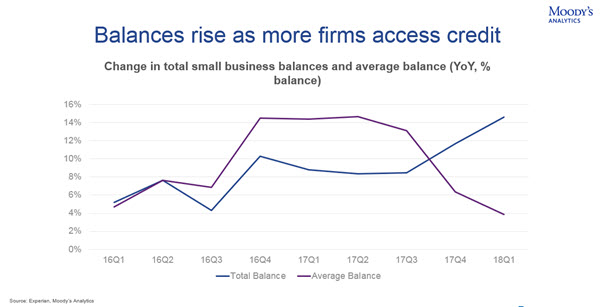

Q1 2018 saw credit conditions loosening and balances rising as more businesses access credit.

The report states the overall outlook for small-business credit is positive. Delinquencies were down and default rates rose slightly, suggesting that credit conditions have peaked as the economy is in a late-cycle expansion.

Continuing strength in the macroeconomy will keep small-business credit moving in the near term, along with higher profits from the recently passed tax legislation. Small-business credit will be less certain in the medium to long term as rising wages, interest rates and changes to the tax code take a toll.