Are you a consumer interested in requesting a copy of your rental history report or filing a dispute?

Click here or call 1 877 704 4519 for rental history assistance.

Say yes to more renters, faster

Experian® RentBureau® is the largest and most widely used rental payment database.

We provide data detailing rental payment history on prospective residents so you can confidently approve more applicants, faster.

renter profiles

data furnishers

attributes

rental industry transactions per month

Positive and negative data

RentBureau receives reporting of both positive and negative data.

Daily, real time updates

We refresh our database daily so that you have the latest, up-to-date information.

FCRA-regulated specialty CRA

We have a proven track record on compliance, data privacy and security best practices.

Lease and property information

We provide complete tenant information, including renter history and payment records.

Looking to access Experian RentBureau data?

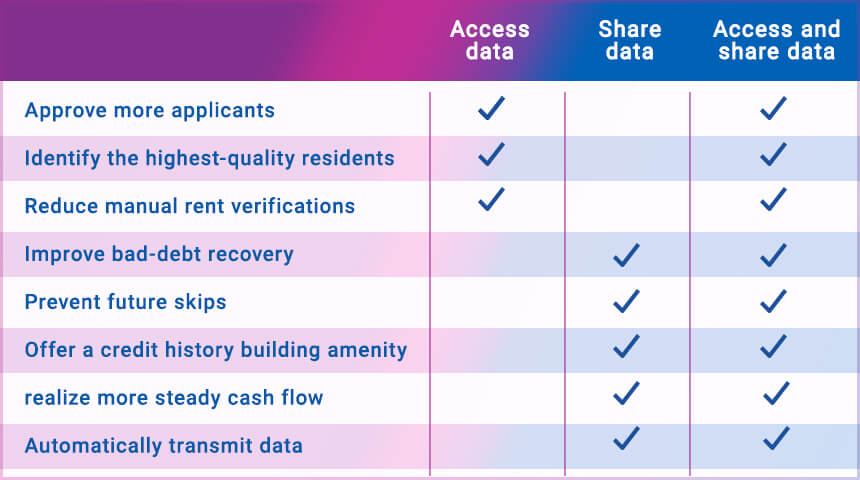

The benefits of rental payment data

From welcoming high-quality residents to empowering renters to establish credit history through punctual on-time payments, the rental industry and tenants both reap numerous advantages.

The form below is for business inquiries only.

Are you a consumer looking for rental history assistance? Click here or call 1 877 704 4519.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Solutions

- Advanced Analytics & Modeling

- Collections & Debt Recovery

- Customer Management

- Credit Decisioning

- Credit Profile Reports

- Data Reporting & Furnishing

- Data Sources

- Data Quality & Management

- Fraud Management

- Identity Solutions

- Marketing Solutions

- Regulatory Compliance

- Risk Management

- Workforce Management