The world of consumer credit can feel complex. After all, our database represents 245 million credit-active consumers nationwide with 1.3 billion updates flowing through monthly. How can a business sort through this enormous dataset to identify consumers, decision on loans, market to prospects and collect?

Experian’s Consumer Information Services division offers a suite of solutions to assist lenders, government entities, retailers and beyond with all aspects of the customer credit lifecycle.

We want to help your business make smarter decisions, fueled by best-in-class data. Shall we get started?

Acquire and Decision with the Best Data

It starts with our credit profile and a host of other products to help you with consumer identification, decisioning and retention.

Find the Right Credit Customers

Our prospecting tools arm you with the accurate data needed to make informed decisions and take advantage of opportunities to acquire more of the customers you want.

Manage Your Accounts with Intelligence

Identify when to extend credit, discover when delinquency is eminent and receive negative and positive credit changes within your account system.

Recover More Debt

From locating hard-to-find debtors to predicting debtor behavior, our array of collections products can assist your business with strategy and recovering more debt.

Optimize Your Targeting Efforts

Combine the credit profile with trended data in ready-to-deploy, prescriptive solutions to increase response rates, optimize credit terms, and decrease attrition.

Alternative Data

View new, FCRA compliant alternative credit data sources to obtain a complete view of financial behavior for both thick- and thin-file consumers.

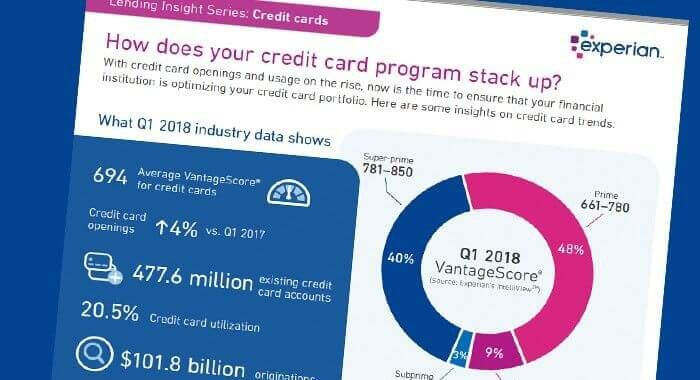

Infographic

Credit Card Insights

Latest video

Experian’s Sandbox: Direct Access to the Credit Universe

Whitepaper

Whitepaper: The universe of alternative credit data

New consumer and lending insights – uncover the state of alternative credit data, the regulatory landscape and use cases across the lending lifecycle.

Blog

Personal credit report assistance is not available here.

If you have questions or issues related to your personal credit report, disputes, identity theft or fraud alerts, visit Experian.com/help.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Solutions

- Advanced Analytics & Modeling

- Cloud Applications & Services

- Collections & Debt Recovery

- Customer Management

- Credit Decisioning

- Credit Profile Reports

- Data Reporting & Furnishing

- Data Sources

- Data Quality & Management

- Employer Services

- Fraud Management

- Identity Solutions

- Marketing Solutions

- Regulatory Compliance

- Risk Management