Financial Education

One of the largest barriers to financial inclusion is a lack of financial education. Experian is changing that. Our partnerships and initiatives are dedicated to getting the proper tools, resources and information to underserved communities so that consumers can best understand and improve their financial health. Read about our financial education news below:

This guest post is from Benjamin Feldman (@BWFeldman), writer and content strategist at ReadyForZero.com, a company helping people get out of debt.

Is personal debt an impossible problem to fix? No way! Thousands - actually, millions - of people across the U.S. are struggling with personal debt right now, but the situation is not hopeless for any of them. I know, because just last year I was one of them. In January of last year, I had over $3,000 in credit card debt and a vowed to get it paid off before the year was over. I’m grateful that I was able to accomplish my goal and along the way I learned a few things that can help others who are still on their way to being debt free. If that includes you, keep reading to learn the 5 steps that will help you get out of debt:

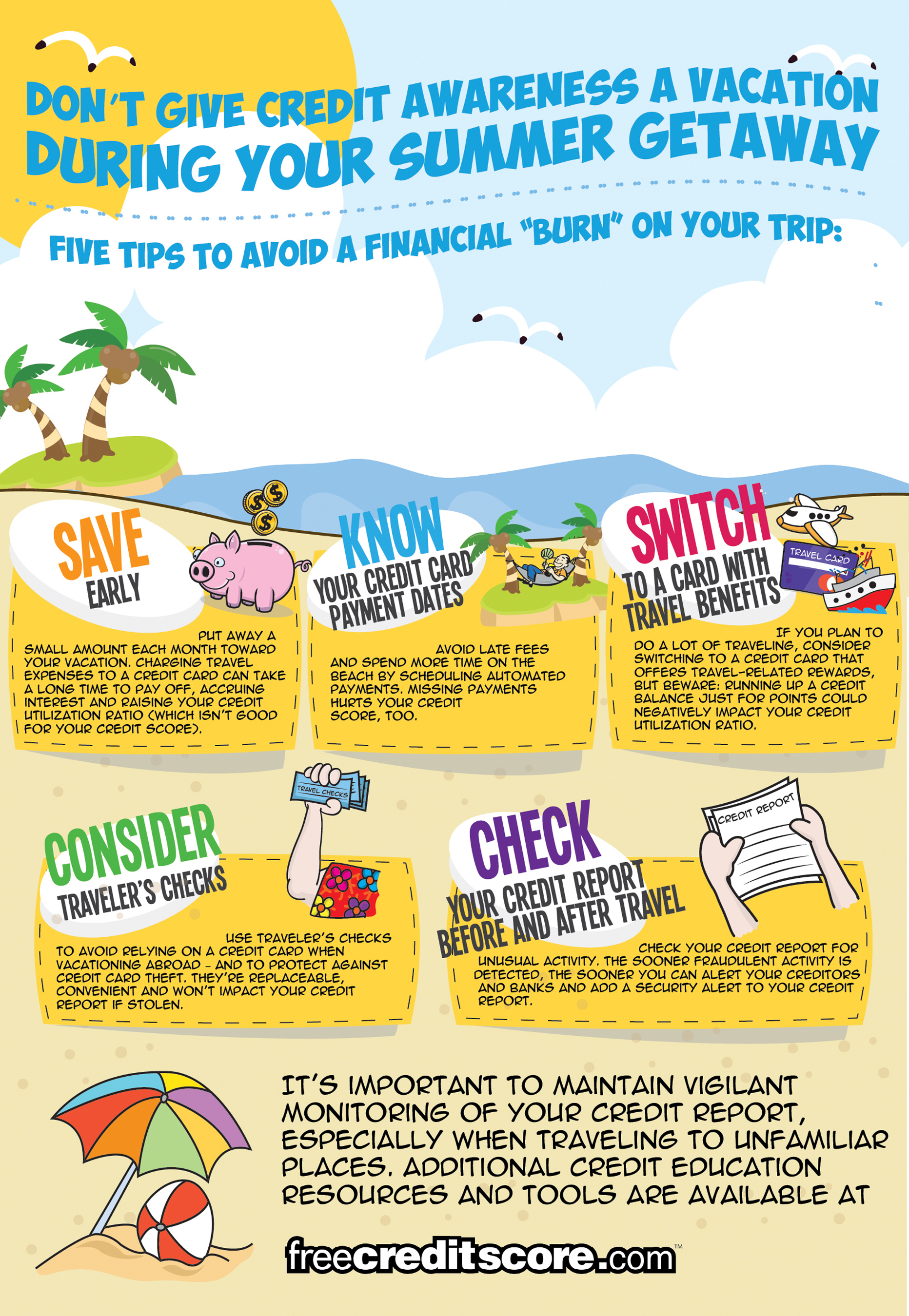

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn't at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it's really a chance for a lot of these bloggers who aren't professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren't sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn't at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it's really a chance for a lot of these bloggers who aren't professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren't sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.

As of 2011, the Hispanic population comprised 16.7% of the United States population, the largest minority group following African-Americans. In addition, 20.3% of U.S. households speak a language other than English. Recognizing the need for expanded financial resources to the Hispanic community, Experian provided a generous grant to translate the NFCC’s MyMoneyCheckUpTM tool into Spanish.

As of 2011, the Hispanic population comprised 16.7% of the United States population, the largest minority group following African-Americans. In addition, 20.3% of U.S. households speak a language other than English. Recognizing the need for expanded financial resources to the Hispanic community, Experian provided a generous grant to translate the NFCC’s MyMoneyCheckUpTM tool into Spanish.

Thanks to the new online tools and services found at SSA.gov, you no longer have to wait on the phone or in line at the Social Security Administration (SSA) to access your benefits.

Today, vital financial information such as your recorded earnings; social security benefits (or expected benefits), and disability and survivor benefits are instantly accessible online.

The SSA recently announced the online “My Social Security” account, a tool that provides access to benefit verification letters and statements. Signing up for an account is easy, free and secure.

Thanks to the new online tools and services found at SSA.gov, you no longer have to wait on the phone or in line at the Social Security Administration (SSA) to access your benefits.

Today, vital financial information such as your recorded earnings; social security benefits (or expected benefits), and disability and survivor benefits are instantly accessible online.

The SSA recently announced the online “My Social Security” account, a tool that provides access to benefit verification letters and statements. Signing up for an account is easy, free and secure.

At the beginning of this year, I had several thousand dollars in credit card debt and I was ready to pay it off. But I knew that I needed to cut down on my spending in order to have enough money left over to start paying down my credit card balance.

So I did some research and started finding ways to cut expenses. One of the things I realized is that your fixed expenses - the ones that seem to be locked in - like your auto insurance and rent, often have some flexibility after all.

Below are some tips I’ve found for reducing those fixed expenses:

At the beginning of this year, I had several thousand dollars in credit card debt and I was ready to pay it off. But I knew that I needed to cut down on my spending in order to have enough money left over to start paying down my credit card balance.

So I did some research and started finding ways to cut expenses. One of the things I realized is that your fixed expenses - the ones that seem to be locked in - like your auto insurance and rent, often have some flexibility after all.

Below are some tips I’ve found for reducing those fixed expenses:

When I speak to people about credit reports and credit scores one of the things I always do is ask the audience members to raise their hands if they’ve requested their free annual credit report.

Sadly, on a good night only about half the people in the audience raise their hands. A new report from the Consumer Financial Protection Bureau (CFPB) confirm

When I speak to people about credit reports and credit scores one of the things I always do is ask the audience members to raise their hands if they’ve requested their free annual credit report.

Sadly, on a good night only about half the people in the audience raise their hands. A new report from the Consumer Financial Protection Bureau (CFPB) confirm

Do you love saving money?

Do you ever use apps or online tools to help you cuts costs and stay on budget?

In our continuing quest to promote financial literacy and help consumers live credit smart, we asked some of our favorite personal finance writers to share a favorite app that helps them stay on budget and save money.

Check out these frugal-living apps:

Do you love saving money?

Do you ever use apps or online tools to help you cuts costs and stay on budget?

In our continuing quest to promote financial literacy and help consumers live credit smart, we asked some of our favorite personal finance writers to share a favorite app that helps them stay on budget and save money.

Check out these frugal-living apps:

In our busy lives, it is easy to miss paying a bill.

However, your lenders won’t accept excuses for why they you didn’t pay them as you agreed to do. For example, your bankcard company cannot make excuses for being late in paying the merchants where you made your purchases. When you don’t pay, they still have to pay on your behalf.

Missed payments can have a severe impact on your credit scores. And lower credit scores will often penalize you with higher interest rates - which can end up costing you tens-of-thousands of dollars throughout your life.

So here are five strategies to help you build the best credit scores . . .

In our busy lives, it is easy to miss paying a bill.

However, your lenders won’t accept excuses for why they you didn’t pay them as you agreed to do. For example, your bankcard company cannot make excuses for being late in paying the merchants where you made your purchases. When you don’t pay, they still have to pay on your behalf.

Missed payments can have a severe impact on your credit scores. And lower credit scores will often penalize you with higher interest rates - which can end up costing you tens-of-thousands of dollars throughout your life.

So here are five strategies to help you build the best credit scores . . .