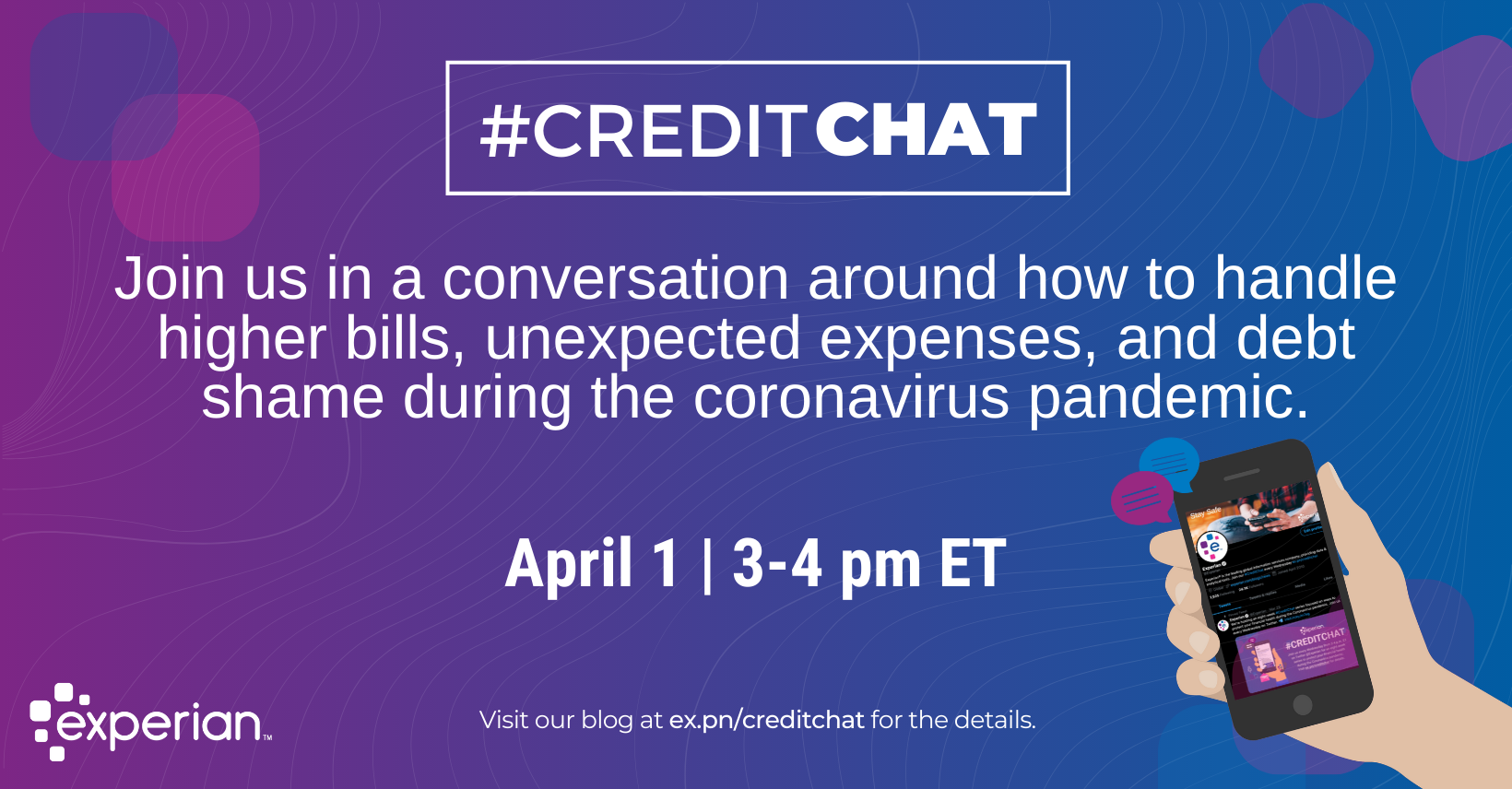

How to Handle Higher Bills, Unexpected Expenses & Debt Shame During the Pandemic

The panel included Rod Griffin: Director of Consumer Education and Awareness at Experian; Todd Christensen: Education Manager at Money Fit by DRS; Take Charge America; Athena Lent: Latina Personal Finance Expert; American Consumer Credit Counseling; Beverly Harzog: Credit Card Expert and Consumer Finance Analyst for U.S. News; Alicia R. Hudnett Reiss: CERTIFIED FINANCIAL PLANNER™; Sean Gillespie: Financial Advisor; Daniella Flores: Creator and Author at iliketodabble.com; Tremaine Wills: Financial Adviser; Consumer Federation of America; Molly Ford-Coates: Founder, Ford Financial Management; Patrina Dixon: Certified Financial Educator; and Leslie H. Tayne, Esq: Founder and Managing Director of Tayne Law Group, P.C. (f/k/a The Law Offices of Leslie H. Tayne, P.C.).

Questions We Discussed:

-

Q1: How is the coronavirus pandemic impacting your budget?

-

Q2: What are some of the financial concerns that many people have due to COVID-19?

-

Q3: What advice do you have for those struggling to manage a budget with unexpected spending and income changes?

-

Q4: What are some tools or ways to control and/or reduce spending during this difficult time?

-

Q5: What should we do if we need financial help and unable to pay a lender?

-

Q6: What should everyone know about debt relief services (e.g. debt consolidation)?

-

Q7: What debt and credit scams are out there?

-

Q8: What are some ways to deal with guilt and anxiety due to debt or financial struggles?

-

Q9: How do emotions impact our finances during this coronavirus pandemic (e.g. spending, investing)?

-

Q10: What are some ways to manage emotional spending and/or emotional investing strategies?

- Q11: Any final tips to encourage others struggling financially and emotionally right now?

What financial struggles are you hearing people talk about the most? #CreditChat

— Experian #StaySafe (@Experian) April 1, 2020

Retweet these insights from our community:

A1:

A1: Reducing/stopping spending on unnecessary stuff. Making sure emergency funds are maximized. I’m more worried for my family than myself at the moment. #creditchat

— Rod Griffin (@Rod_Griffin) April 1, 2020

A2:

A2: Many people are out of work right now or they are working with limited hours, and this is significantly impacting their ability to meet their financial obligations. #CreditChat

— Christina Roman (@Teena_LaRo) April 1, 2020

A3:

A3: Pay very close attention to everything you spend $ on. Pay essential bills only, like housing, food, utilities. Pay just the minimum due on your credit cards and loans. Don’t use up your cash to pay off debt in full if you need to conserve funds. #CreditChat

— Alicia R. Hudnett Reiss, CFP® (@AliciaRHudnett) April 1, 2020

A4:

A4. A simple budget is always the best tool to get a handle on your finances. Keep track of your spending using an app, the notes on your phone, or just pen & paper. Doesn’t have to be fancy to be effective. #CreditChat

— Take Charge America (@TCAsolutions) April 1, 2020

A5:

A5. Contact the lender. So many organizations have set new provisions during this time to assist borrowers with their payments. #creditchat

— Gabby Knows (@gabbyknows) April 1, 2020

A6:

A6: Before you go the debt consolidation route, you want to make sure you have read the fine print. Are you getting the best possible APR? Are there any penalties for paying your loan off early? Learn more: https://t.co/3rKFviqdft #CreditChat

— Christina Roman (@Teena_LaRo) April 1, 2020

A7:

A7: “Phone calls from the IRS.” Don’t fall for it! Don’t relay personal information! Await for appropriate correspondence via @USPS! #CREDITCHAT

— 🙃 (@dunndundon) April 1, 2020

A8:

A8. Keep reminding yourself that there are literally millions of people going through this the same thing right now. This is something unprecedented no one could have foreseen. We are all in this together. #CreditChat

— Jennifer White (@Jennifer_Wwhite) April 1, 2020

A9:

A9. A lot of shopaholics, or any addict, find that they would rather engage in their addictive behavior than face reality of the situation they are running from. I think we will see a lot more of this moving forward. #creditchat https://t.co/CQojSgDT43

— Athena (@accordingathena) April 1, 2020

A10:

A10: Don’t engage in emotional spending. Period. With investing, work with an adviser and don’t make decisions based on fear. I know, it’s hard! #creditchat pic.twitter.com/5hHQFPIAXw

— Beverly Harzog (@BeverlyHarzog) April 1, 2020

A11:

A11: Contact your creditors if you’re struggling due to the pandemic. Chat with a friend about what you’re dealing with and limit exposure to negative news. Seek out resources to help! Here are some more helpful tips: https://t.co/rklcxGwR9M #CreditChat pic.twitter.com/sL56OmpM64

— Leslie H. Tayne, Esq (@LeslieHTayneEsq) April 1, 2020

“Know that you’re not alone and there are resources out there to help you through this. Talk to a loved one, keep in mind that you can get through this. The problem won’t go away if you ignore it.” – @LeslieHTayneEsq #CreditChat pic.twitter.com/6KuFcKGL6o

— Experian #StaySafe (@Experian) April 13, 2020

“For those struggling financially, it can help to make a plan. You’ll feel better once you make a revised budget and talk to your lenders to see how they can help.”

– @Jennifer_Wwhite

Join our #CreditChat every Wednesday at 12 pm PT for more tips. pic.twitter.com/LeKV0NT3RH— Experian #StaySafe (@Experian) April 12, 2020