We believe financial decisions should feel empowering, not overwhelming. Choosing how to protect your family, planning your next move, building your future, these are personal milestones. Yet too often, the tools meant to help consumers navigate them create friction instead of clarity.

We are changing that.

Our Consumer-First AI strategy starts with a simple belief: technology should make life easier for people. We’re building AI-powered experiences that meet consumers where they are, cut through complexity, and provide guidance that feels intuitive, supportive, and genuinely helpful.

Reimagining Insurance Shopping Through Conversation

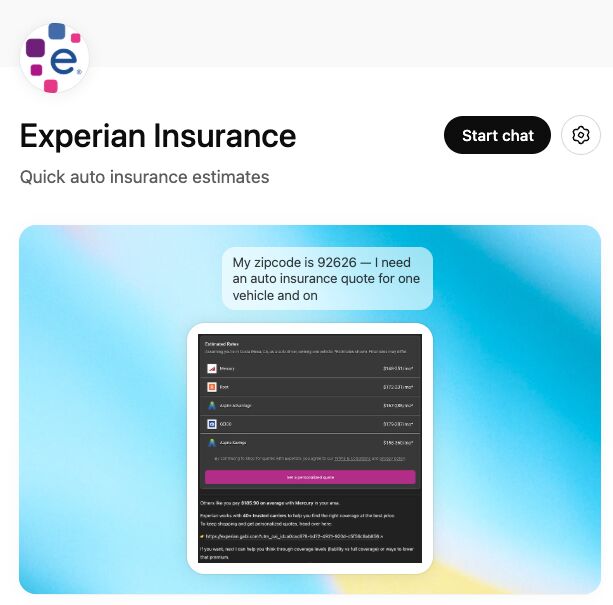

One example is the launch of our Experian Insurance Marketplace, a leading platform to find and compare auto insurance rates[i], within ChatGPT.

Shopping for insurance has long been a frustrating process. Consumers jump from site to site, repeatedly entering information and trying to decode policy differences, often still unsure if they found the right coverage at the right price.

Now the experience can begin with a simple question inside ChatGPT.

Consumers now can start their journey with Experian and compare estimated rates from more than 35 leading insurance carriers in our network, receive clear coverage explanations, ask follow-up questions in real time, and seamlessly transition into the Experian experience to explore personalized savings and switch carriers. What once took hours across multiple websites can now begin in one guided interaction.

Powered by Experian’s Innovation Engine

This experience is powered by Experian’s Insurance Marketplace platform and built on years of data expertise, advanced analytics, and strong carrier relationships. It reflects our ability to combine trusted data with emerging AI to create entirely new consumer experiences.

For example, consumers can start with a ZIP code to explore price comparisons and, if they choose transition securely to Experian’s website for a personalized quote.

This is Consumer-First AI in action. It is not technology for its own sake, but innovation designed to make life easier, build confidence, and give people greater control over their financial journey.

Just the Beginning

Experian has long helped people build credit, protect their identity, and improve their financial health. Bringing other capabilities, we offer like insurance into conversational AI is a natural extension of that mission.

Insurance is only the start in seeing Experian via other platforms. As AI becomes a bigger part of our financial lives, we will continue expanding solutions both within our ecosystem and in other properties like ChatGPT that simplify complex moments and deliver smarter, more personalized guidance wherever consumers are or prefer to engage.

Because at Experian, we are committed to being your BFF, your Big Financial Friend, showing up with trusted guidance, practical tools, and support exactly when it matters most.

To explore the Experian Insurance Marketplace within ChatGPT or learn more, visit www.experian.com/insurance

Insurance products are offered through Gabi Personal Insurance Agency, Inc., d/b/a Experian Insurance Services, a licensed insurance agency. Availability and savings vary by state. Savings are not guaranteed. For license information, visit https://www.experian.com/help/insurance-licenses-disclosure/

[i] Results will vary and some may not see savings.