At A Glance

Third-party data has moved from a fast-growth, loosely governed environment into one defined by trust, transparency, and compliance. Marketers are now looking for partners with institutional experience and rigorous data standards—not opportunistic providers chasing short-term gains. The brands that win will treat responsible data sourcing as the foundation of their customer strategy.How third-party data has changed and why it matters in 2025

For years, third-party data operated in an expansive, lightly regulated marketplace: fast-moving, high-growth, and filled with players eager to capitalize on digital marketing’s demand for audience insights.

That era is over. Regulatory scrutiny, stricter compliance standards, and rising consumer expectations have already transformed the market. Today, third-party data belongs to partners with proven expertise and built-in compliance. This isn’t a space for opportunistic newcomers; it’s one that rewards long-term commitment and trust.

Even the rapid rise of retail media networks (RMNs) reflects this shift. These platforms are built on long-standing, trusted relationships between brands, retailers, and data partners, utilizing that foundation in new ways to reach audiences responsibly and effectively.

The best providers have already made this transition; those still “shifting” are catching up.

From growth to governance: A market defined by accountability

The third-party data ecosystem has matured. After years of rapid expansion and recalibration, the market has stabilized around a new standard: data quality and regulatory accountability.

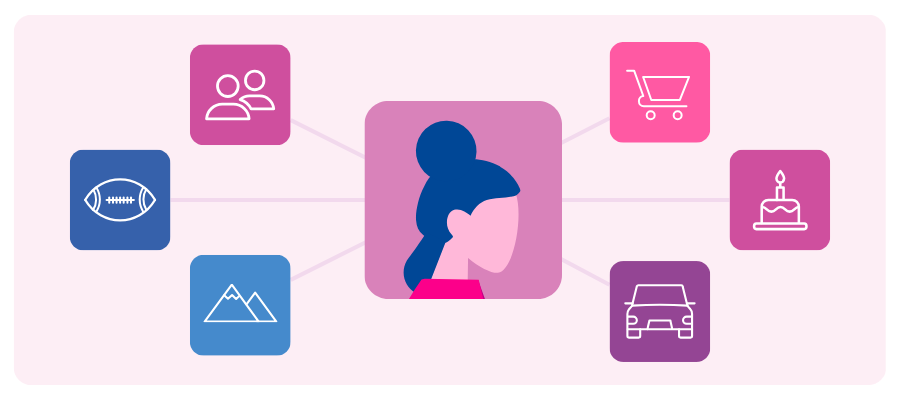

Third-party data enriches first-party insights with attributes such as income, gender, and interests that round out the customer view. But when the industry grew unchecked, unreliable providers diluted quality and trust. This resulted in a decline in the overall value and reliability of the third-party data marketplace.

That breakdown led directly to today’s privacy laws, now active across more than 20 U.S. states and numerous countries worldwide. These regulations reflect a permanent consumer expectation: relevance delivered responsibly. Consumers aren’t rejecting personalization; they’re rejecting how it’s been done in the past. They still want relevant, tailored experiences, but they expect brands to deliver them through ethical, transparent data practices.

Does third-party data still matter in a privacy-first era?

Third-party data isn’t disappearing, if anything, it’s become more important. Brands will always need additional insight to deepen customer understanding; first-party data alone only reflects what’s already known.

The industry has entered a mature phase where data quality and compliance are table stakes. The companies leading today built their data infrastructure on rigorous standards, regulatory foresight, and transparent governance.

That same foundation powers the next wave of innovation, including the explosive growth of RMNs. RMNs rely on responsibly sourced third-party data to enrich shopper insights, validate audiences, and extend addressability beyond their own walls. Trusted data partners make that expansion possible, connecting retail environments with broader media ecosystems while maintaining privacy and accuracy.

High-quality, compliant third-party data remains essential because it:

Advancements in AI and machine learning are reshaping how this data is used across the ecosystem. What was once primarily a buy-side tactic is now expanding into the sell-side, where publishers and platforms are using data to curate, package, and activate audiences more intelligently. As AI enhances modeling accuracy and automation, third-party data will play an even greater role in connecting brands and consumers in more meaningful, privacy-conscious ways.

The bottom line: it’s not about having more data; it’s about having better, verified data you can trust.

How can you spot a trustworthy data partner?

The strongest third-party data partners demonstrate accountability through experience, infrastructure, and integrity.

Look for providers that:

Why the future of third-party data depends on accountability

The third-party data industry has already crossed the threshold from expansion to accountability. The companies leading this era have established their credibility through governance and proof. The future belongs to providers that:

- Build with regulatory foresight

- Maintain rigorous quality assurance

- Prioritize partnership over profit

The Wild West days are long gone. The third-party data ecosystem is now defined by stability, transparency, and shared responsibility.

Partner with Experian for data you can trust and results you can prove

When accuracy and accountability define success, you need a partner built on both. Work with the company that’s setting the standard for responsible data-driven marketing and helping brands connect with people in meaningful, measurable ways.

Get started

About the author

Jeremy Meade

VP, Marketing Data Product & Operations, Experian

Jeremy Meade is VP, Marketing Data Product & Operations at Experian Marketing Services. With over 15 years of experience in marketing data, Jeremy has consistently led data product, engineering, and analytics functions. He has also played a pivotal role in spearheading the implementation of policies and procedures to ensure compliance with state privacy regulations at two industry-leading companies.

Third-party data FAQs

Third-party data is information collected by organizations that don’t have a direct relationship with the consumer. It supplements first-party data by adding demographic, behavioral, and interest-based insights.

Privacy regulations are reshaping data practices because consumers expect control over how their information is used. That expectation led directly to today’s privacy laws, now active across more than 20 U.S. states and numerous countries worldwide. These regulations reflect a permanent consumer expectation: relevance delivered responsibly. Consumers aren’t rejecting personalization; they’re rejecting how it’s been done in the past. They still want relevant, tailored experiences, but they expect brands to deliver them through ethical, transparent data practices. Laws like the CCPA and state-level privacy acts enforce this expectation, holding brands and data providers accountable for the ethical use of data.

Yes, brands can still use third-party data safely when sourced responsibly. Partnering with established, compliant providers like Experian ensures both legal protection and data accuracy.

Experian adheres to a set of global data principles designed to ensure ethical practices and consumer protection across all our operations. At Experian, privacy and compliance have long been built in. Every partner and audience goes through Experian’s rigorous review process to meet federal, state, and local consumer privacy laws. Decades of experience have shaped processes that emphasize risk mitigation, transparency, and accountability. Experian’s relationships with demand-side platforms (DSPs), supply-side platforms (SSPs), and even social platforms like Meta, ensures we are aware of any platform-specific initiatives that may impact audience targeting. We’re also active participants in many trade groups to ensure that the industry puts ethical data practices in place to ensure consumers still receive personalized experiences but their data usage and collection is opt-in, transparent and handled with their privacy at the center of the transaction.

Marketers should look for transparency, longevity, and evidence of compliance when looking for a data partner. The best partners can clearly explain how their data is sourced, validated, and maintained. Read Experian’s guide on how you can swipe right on the perfect data partner here.

Latest posts

Discover how Yieldmo uses Experian’s solutions for supply-side platforms (SSPs) to activate high-performing audiences at scale.

After another week at Cannes Lions 2025, one thing is abundantly clear: our industry is done talking about possibilities — it’s ready to act.

While Google’s U-turn on cookie deprecation is frustrating, it sparked innovations in privacy-first targeting and identity that will benefit marketers long-term.