At A Glance

Marketing in 2026 will hinge on connection: between AI and data accuracy, commerce media and category expansion, and curation and programmatic efficiency. These shifts mark marketing’s “6–7 moment,” when once-fragmented parts finally snap together. Experian’s 2026 Digital trends and predictions report outlines the forces shaping this more unified era.Remember when “6-7” was all over your feed and no one really knew why, but somehow everyone got it? In 2025, the internet proved that connection doesn’t always make sense — at least not at first. The “6-7” meme was random, ridiculous, and everywhere. It spread because it felt connected; an inside joke everyone could share.

Marketing in 2026 will have its own 6-7 moment. Experian’s 2026 Digital trends and predictions report explores how 2026 will be defined by connection: between activation and measurement, data and AI, platforms and outcomes. After years of fragmentation, the industry is finally unifying around shared foundations: data accuracy, identity resilience, and measurable performance.

Here are three connections to watch for in 2026.

1. AI is only as good as its data foundation

AI’s performance depends on the quality, recency, and integrity of its inputs. In 2026, marketers will recognize that the differentiator is not the algorithm itself but the data that informs it. As AI becomes embedded into workflows (from audience discovery to media optimization) accurate identity and privacy-safe data become essential.

Why it matters

Good data fuels responsible automation, predictive insight, and personalization that feels human. Without it, even the most advanced models will simply automate bad decisions faster.

What actions should marketers take to strengthen their data foundation?

To make AI adaptive, ethical, and aligned with real-world context, marketers need to strengthen the data foundation beneath it. In 2026, that means taking four core actions:

When these elements come together, AI becomes more than just automation: it becomes adaptive, ethical, and responsive to real-world context.

2. Commerce media expands beyond retail

Commerce media is no longer just a retail play. What began as retailers monetizing their data and media has evolved into a multi-sector movement uniting data, media, and transaction insights. Auto, travel, CPG, and even financial brands are launching their own media networks or partnering with existing ones to close the loop between exposure and conversion.

More than half (58%) of advertisers are interested in advertising on non-retail media networks.

eMarketer

Why it matters

In 2026, commerce media becomes a strategy for any brand with first-party data, measurable outcomes, and the need for closed-loop insight.

What should marketers do with this expansion?

3. Curation becomes the programmatic standard

Curation is reshaping programmatic advertising into something more focused, efficient, and accountable. In an era shaped by privacy regulation and signal loss, curation brings identity, quality, and control together, allowing marketers to target confidently across CTV, audio, and the open web.

More than 66% of open-exchange ad spend (over $100 billion annually) now runs through curated private marketplaces (PMPs).

eMarketer

Why it matters

Curation aligns with the industry’s need foraccurateidentity, transparent supply, and stable outcomes, especially as traditional signals fluctuate.

How can marketers use curation more effectively?

2026 will be the 6-7 era for marketing

The “6-7” meme didn’t need to make sense to go viral. But your marketing does.

2026 will be the year marketers move from fragmentation to connection. Download Experian’s 2026 Digital trends and predictions report to explore all five digital marketing trends shaping 2026.

Ready to get started? Connect with a member of our team

About the author

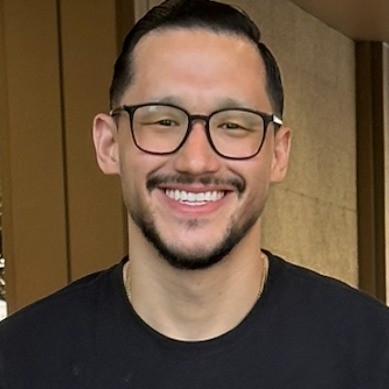

Fred Cheung

Director, Partnership Sales, Audigent, a part of Experian

Fred Cheung has spent over a decade in the programmatic advertising space, with roles at Mindshare, Jounce Media, Twitter, and The Trade Desk. His deep experience in trading and product management helps in his current function on the Experian Marketing Services’ Sales team where he focuses on data growth and adoption across the industries’ leading buy-side platforms.

FAQs

Experian uses this phrase to describe the inflection point where AI, identity, commerce media, and programmatic curation finally connect in practical, scalable ways. It reflects the shift from fragmentation toward unified activation and measurement. Experian covers five digital marketing trends to watch for in 2026 in our 2026 Digital marketing trends and predictions report.

Experian provides verified consumer data, identity resolution, and privacy-first frameworks that strengthen AI accuracy. AI tools require reliable inputs, and Experian’s data foundation helps marketers apply AI in predictive modeling, audience insight, and media optimization.

Identity allows brands and media networks to connect exposure to conversion across sites, screens, and environments. Experian supports this through resilient identity frameworks that maintain recognition even as signals shift.

Experian provides high-performing audience segments and outcome-based signals that improve curated PMP performance. These capabilities give buyers more control, more stability, and clearer pathways to measurable results.

Experian’s 2026 Digital trends and predictions report outlines the five forces shaping the year ahead, including AI’s dependence on data quality, commerce media expansion, and the rise of curation.

Latest posts

Ask the Expert Q&A with Ampersand on TV advertising | Experian

Discover how retail media standardization can streamline your marketing efforts, enhance campaign efficiency, and drive better results.

Discover Experian’s 19 new holiday shopping audiences designed for you to reach the most relevant shoppers this holiday season.