Audio platforms that overcome consumer identity challenges are winning new advertisers and driving higher ROAS. In this article, you’ll hear from leading audio platforms that are solving these challenges—and seeing results.

Digital audio is evolving fast. What was once a niche channel of host-read sponsorships and direct buys is now a must-have in the modern media mix. Streaming platforms, podcasts, and digital radio are drawing more ad dollars thanks to audio’s ability to capture attention and connect with listeners.

But with growth comes new pressure. Advertisers expect accuracy, scale, and to see results. At the same time, listeners want more relevant content and more personalized ad experiences. That’s where identity becomes essential.

With Experian’s identity and audience solutions, audio platforms can:

- Bolster addressable audience targeting and personalization capabilities.

- Gain a comprehensive view of listeners’ digital identity to reach audiences across channels.

- Better understand consumer preferences, enabling advertisers to reach audiences with greater accuracy.

- Enhance the listening experience with more relevant content.

Let’s break down the key challenges in audio—and how Experian can help solve them.

Challenge 1: Anonymous listening limits addressability

Most listening happens in environments where people aren’t logged in—via apps, smart speakers, and mobile devices. Without logged-in data, platforms struggle to know who’s listening and advertisers are unable to reach those anonymous listeners who don’t have an addressable ID.

To overcome the identity gap in unauthenticated listening environments, leading audio platforms are turning to partners that connect fragmented signals—like device type, location, and behavioral patterns—to broader household and individual profiles. By using hashed emails and other alternative identifiers, platforms can begin to make anonymous sessions more addressable. This increase in addressability ensures the platform’s entire userbase can be reached, which leads to an increase in revenue.

Experian’s solution

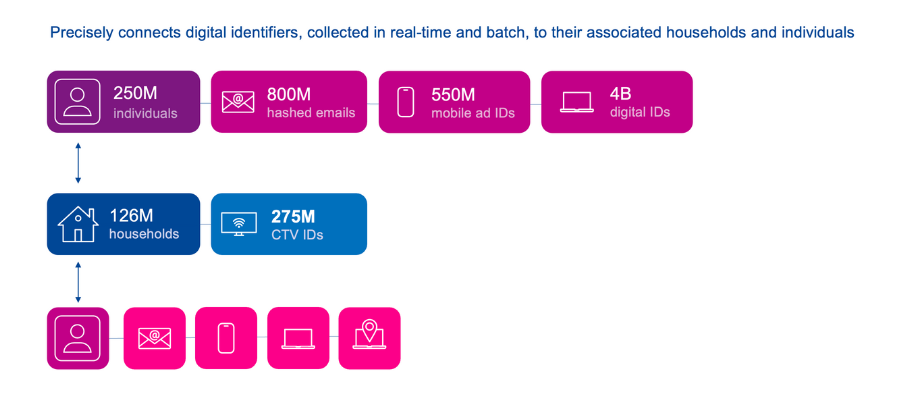

Experian’s identity spine, comprised of our Digital and Offline Graphs, helps you recognize listeners even when they’re outside your ecosystem. Platforms like Audacy are already leading the way. By integrating Experian’s Digital Graph, they’re gaining a more complete view of listeners’ digital identifiers—enhancing the experience across their app and website. With a better audience understanding, Audacy can deliver personalized content while helping advertisers reach specific groups with greater accuracy.

Challenge 2: IP-based targeting falls short

Audio has traditionally relied on IP addresses, but that’s no longer enough. A single IP could represent an entire household—or a public setting like a coffee shop. It’s not precise.

Forward-thinking platforms are moving beyond IP-based targeting by integrating identity resolution technologies that combine household-level data with device-level intelligence. These solutions help distinguish between shared devices and individual listeners, allowing advertisers to serve more relevant messages without over-reliance on a single signal like an IP address. This layered approach improves precision—especially in dynamic listening environments like vehicles or communal spaces.

Experian’s solution

Our identity spine links home IPs to households, then connects them to specific devices and individuals. This helps platforms move beyond basic IPs and target real people based on accurate signals—even in shared listening environments like smart speakers and cars.

We also help platforms and advertisers integrate alternative IDs—like Unified I.D. 2.0 (UID2)—into their programmatic audio campaigns. That means more reach, without compromising consumer trust.

Challenge 3: Audio buying is fragmented

From podcasts to streaming to radio, audio lacks consistency in how inventory is packaged and bought. It’s hard for advertisers to run scaled campaigns across channels—and harder still to measure performance.

Plus, advertisers don’t think in silos—they think in strategies. If audio can’t connect to their display, connected TV (CTV), and social buys, it loses ground. What they need is a way to define audiences once and activate everywhere.

To reduce friction in audio ad buying, platforms are investing in infrastructure that unifies audience insights across formats. By building a centralized view of the listener—regardless of whether they’re tuning in via podcast, stream, or radio—publishers can offer advertisers consistent targeting parameters, clearer reporting, and better campaign orchestration. Identity graphs and audiences are playing a growing role in streamlining this complexity and unlocking scale.

Experian’s solution

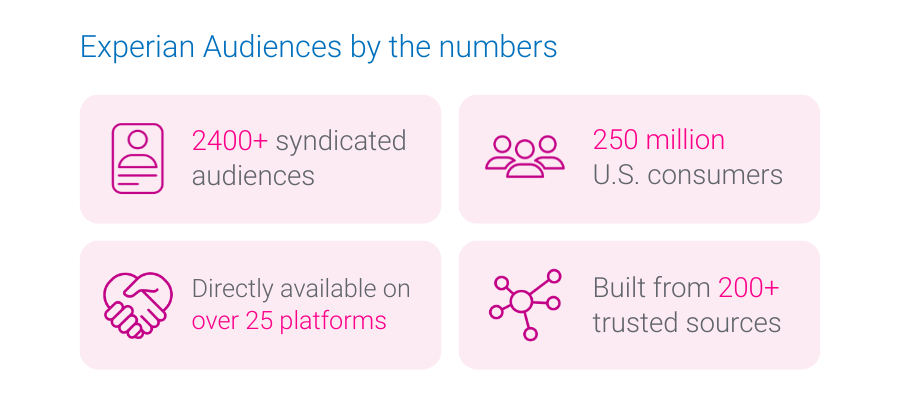

Experian helps simplify audio buying. Experian audiences are built on top of our identity graph and are expanded to a deep set of digital identifiers, ensuring accuracy, scale and maximum addressability across channels. Platforms can blend their first-party data with advertiser data and our audiences—then deploy those audiences onsite or activate programmatically across open web and CTV.

DAX is doing just that. DAX’s partnership with Experian combines Experian’s 2,400+ audiences for targeting and activation with DAX’s innovative audio advertising approach. We’re helping advertisers connect with passionate and engaged listeners nationwide.

“Through our partnership with Experian Marketing Services, advertisers can unlock deeper audience insights and execute more impactful digital audio campaigns. By combining our shared market presence, knowledge, and forward-thinking approach, we’re strengthening our digital audio network offering and delivering value to all our advertising partners.”

Brian Conlan, President of DAX United States

In addition to integrating Experian’s Digital Graph, Audacy is also integrating Experian’s syndicated audiences to unlock accurate insights like demographics, shopping behavior, and interests – providing listeners with a more personalized advertising experience and advertisers with a higher return on investment.

“Historically, audio advertising lacked precise targeting capabilities, making it challenging for advertisers to reach specific audiences. By integrating our digital identity graph and syndicated audiences with Audacy’s platform, we’re transforming how advertisers connect with listeners. This collaboration enables more effective audience targeting and delivers personalized, impactful audio experiences across all channels.”

Chris Feo, Chief Business Officer, Experian

Privacy is non-negotiable

Everything we do is privacy-forward by design. Backed by Experian’s Global Data Principles and decades as a regulated institution, we rigorously vet every data source to ensure compliance with all federal and state laws.

Build an audio strategy that performs with Experian

Your advertisers want more from their audio investments. With Experian, you can give it to them. We help you:

Audio has always been a powerful way to connect. Now, it’s ready to perform.

Let’s connect

Latest posts

Are Traasdahl, CEO and founder of Tapad, the leader in cross-device marketing technology and now a part of Experian, has been named Founder of the Year by the Global Startup Awards. The Global Startup Awards' Founder of the Year Award recognizes an individual that has pushed the boundaries of technology to empower new innovations and ideas. The Global Startup Awards places each year's regional category winners against each other to determine whose achievements stand out from the rest of the startup ecosystem through nomination, voting and jury evaluation. In May 2016, the Nordic Startup Awards named Traasdahl Founder of the Year. "Are is a force of nature and his creativity and passion know no boundaries, it seems," said George Tilesch, Global Startup Awards juror and U.S. managing partner of Innomine Group. "Extra kudos for the mentoring work and the Norwegian superfund plans. Are knows giving back is of the utmost importance." "Are is a superstar within the Norwegian startup ecosystem," said Kim Balle, founding partner and CEO of the Global Startup Awards. "From the jury feedback I could see that not only are his impressive achievements the reason for their rating, but also his focus and ability to give back to the startup scene played an important factor in him winning the category." "It is an enormous honor to be named Founder of the Year by the Global Startup Awards," said Traasdahl. "I am so committed to fostering entrepreneurship both at Tapad and throughout the startup space. This win is a remarkable bookend for a stellar year that began with our acquisition by the Telenor Group and continued with best-in-class product innovation, superior solutions for our clients and our Propeller Program that is so dear to my heart." Tapad's Propeller Program hosts five early-stage companies at Tapad's New York headquarters for one year to mentor them through global expansion. The participants of this inaugural program come from Traasdahl's native Norway. For more information on the Global Startup Awards, please visit: http://www.globalstartupawards.com/#gsa. Contact us today

NEW YORK, Nov. 29, 2016 /PRNewswire/ — For the second consecutive year, Tapad, part of Experian, has been listed among Deloitte's Technology Fast 500™, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences and energy tech companies in North America. Tapad, number 147 on the 2016 Deloitte list, is the leading provider of unified, cross-device marketing technology solutions. "It is an honor to once again be recognized by Deloitte for our growth and momentum, particularly given the stature of the other technology companies on the list," said Are Traasdahl, founder and CEO of Tapad. "Our product innovation, particularly in TV analytics and measurement, is a major contributor to our progress. I'm extremely proud of our hard-working, talented team for continually executing at such a high level." "Today, when every organization can be a tech company, the most effective businesses not only foster the courage to explore change, but also encourage creativity in using and applying existing assets in new ways, as resourcefully as possible," said Sandra Shirai, principal, Deloitte Consulting LLP and U.S. technology, media and telecommunications industry leader. "This ingenious approach to innovation calls for the encouragement of curiosity and collaboration both within and outside the office walls." "This year's Fast 500 winners showcase that when organizations are open to diverse perspectives and insights, they are able to create an environment for their employees and customers to see the possibilities and ingenious solutions that might lie ahead," added Jim Atwell, national managing partner of the emerging growth company practice, Deloitte & Touche LLP. "Entrepreneurial environments foster change and innovation within businesses, and we look forward to watching these companies continue to drive change across all sectors." Contact us today

Distribution via LiveRamp enables seamless cross-device customer experiences through more platforms NEW YORK, Nov. 15, 2016 /PRNewswire/ – Tapad, now part of Experian and the leading provider of unified cross-device marketing technology solutions, today announced an expanded partnership with LiveRamp™, an Acxiom® company and leading provider of omnichannel identity resolution, to make the proprietary Tapad Device Graph™ accessible beyond Tapad-hosted direct integrations. Through LiveRamp, Tapad's Device Graph Access now extends to more than 400 ad tech and mar tech platforms. Tapad's Device Graph™ enables marketers to understand, monetize and measure consumer engagement across all digital channels, and Tapad's unified consumer view is recognized as one of the most accurate, scalable cross-device solutions in the market today. Through the expanded partnership with LiveRamp, the Tapad Device Graph can be distributed to the hundreds of platforms used to reach consumers on digital channels and measure campaign performance – even as devices are added daily to Tapad's extensive graph. "Increasingly, marketers want access to cross-device targeting and measurement capabilities within their preferred platforms," said Anneka Gupta, chief product officer of LiveRamp. "Our expanded partnership makes it easy for marketers to access Tapad's graph through the rapidly growing set of integrations available in our partner ecosystem." This is the latest of several initiatives between the two technology platforms designed to make the integration of cross-screen platforms seamless, privacy-safe and easy to use for dynamic and engaging marketing efforts. "During the past year, Tapad has expanded its global presence and rapidly grown its data business – Tapad Coral – doubling the number of companies integrating our device graph into their platforms and growing our annualized run rate by 210%," said Pierre Martensson, GM of Tapad Coral and APAC. "Our expanded partnership with LiveRamp positions us to meet the increased demand for Tapad Device Graph Access and enable new platforms to apply our graph with unprecedented speed." Contact us today