Cuebiq’s mission, as an offline intelligence and measurement company, is to quantify how digital marketing impacts offline consumer behavior. This case study shows how Cuebiq partnered with Experian to continue delivering in-store lift analyses despite signal loss. To achieve this, Cuebiq used Experian’s Activity Feed to resolve digital ad exposures to mobile ad IDs, so that marketers could know the effectiveness of their media campaigns on in-store visits and purchases.

Even as Google backs away from third-party cookie deprecation, the need for flexible, future-proof identity solutions remains. By working with Experian, Cuebiq could help their clients more accurately measure their campaigns and optimize their media.

Challenge: Increasing match rates across digital platforms

Cuebiq wanted to enhance how well they connect digital ad exposures, across web, mobile, and connected TV (CTV), to mobile ad IDs (MAIDs), of consumers who visited their clients’ stores. They needed a single technology partner who could collect data across these environments and improve these connections.

With the ability to resolve exposures to households, individuals, and MAIDs to then facilitate attribution of digital exposures to offline store visitation, Cuebiq could continue to provide accurate reports on how digital ads impact offline consumer behavior. This clarity in data enables their clients to fine-tune their marketing strategies.

Cuebiq’s key objectives included:

- Resolving digital exposures to MAIDs

- Increase overlap of offline and online data

- Improving the effectiveness of offline measurement offerings

Activity Feed: The solution to increase match rates

Experian’s Activity Feed pulls together fragmented digital event data from all digital channels, including browsers like Safari and Firefox that restrict traditional tracking methods. Activity Feed ingests and ties digital ad exposure and website activity data to household or individual profiles hourly, helping client’s associate ad exposures to impact by a household or individual. Activity Feed plays a crucial role in overcoming fragmented data and helping marketers accurately measure their cross-channel marketing efforts.

Cuebiq used Activity Feed to resolve exposure data from all environments, even cookieless ones, to a single household or individual and saw significantly higher match rates. Cuebiq received their clients’ ad exposure data resolved to mobile ad IDs (MAIDs) and correlated it to their clients’ in-store visitation and sales. To do so, Cuebiq implemented the Experian pixel, which they placed to track all their marketers’ impressions (mobile, CTV, web traffic, etc.).

The Experian pixel collects information in real-time, such as:

- Timestamp

- Cookies

- Device ID (MAID/CTV) when available

- IP address

- User-Agent

- Impression ID

“Before we started working with Experian, we couldn’t fully maximize ad views across the complex digital landscape. In just a few weeks, they were able to maximize the match rate across the fragmented digital inventory, solving a huge problem when it comes to cross-channel attribution.”

Luca Bocchiardi, Director of Product, Cuebiq

Results

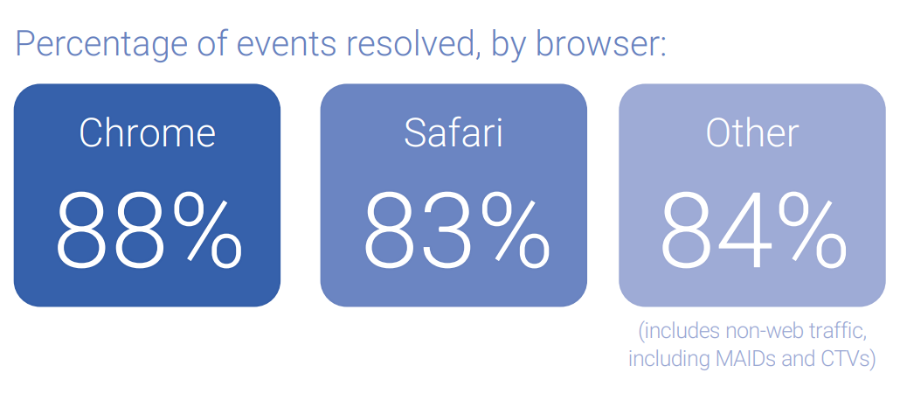

Activity Feed combines separate data streams and matches them back to a household. This enables Cuebiq to expand household IDs and accurately identify MAIDs that are seen in-store for cross-channel measurement. Over a 21-day period, Cuebiq passed ~1 billion events to Experian. Activity Feed resolved 85% of total events to a household, 91% of which were tied to MAIDs.

By implementing Activity Feed, Cuebiq was successfully able to:

- Gain clearer insights into the success of their client‘s campaigns

- Match consumer engagements in a privacy-compliant manner

- Tell the story of the key performance indicators (KPIs) related to their marketing efforts

A solution for measurement across cookied and cookieless environments

Activity Feed is prepared for whatever the future of signal loss holds in store, capable of using third-party cookies and alternative IDs, like UID2.0s, ID5 IDs, hashed emails, and IPs for identity resolution. Experian remains fully committed to exploring a suite of next-generation solutions and prioritizing continued testing of different industry solutions to help customers maintain consumer visibility amidst signal loss. We’ve identified six viable alternatives to third-party cookies, how these alternatives fall short, and how Experian can help you navigate these alternatives.

“Experian’s customer service is extremely efficient and collaborative. We trust them to keep putting our business first long-term.”

Luca Bocchiardi, Director of Product, Cuebiq

Download the full case study to discover how Cuebiq used Activity Feed to overcome their challenges. Your path to maximizing match rates and resolving data from cookieless environments starts here.

Contact us

About Cuebiq

Cuebiq is transforming the way businesses interact with mobility data to providing a high-quality and transparent currency to map and measure offline behavior. They are at the forefront of all industry privacy standards, establishing an industry-leading data collection framework, and making it safe and easy for businesses to use location data for innovation and growth.

To learn more, visit their website at www.cuebiq.com

Latest posts

Dextro clients to achieve increased accuracy in cross-device consumer measurement and engagement NEW YORK, Feb. 6, 2017 /PRNewswire/ — Dextro Analytics, a pure play analytics company that harnesses the power of human learning and artificial reasoning to drive more informed and effective consumer marketing, is partnering with Tapad, the leading provider of unified, cross-screen marketing technology solutions and now a part of Experian. The deal is effective immediately and the scope of the partnership covers North America. Additional terms were not disclosed. Leveraging Tapad's privacy-safe Device Graph™, Dextro Analytics will be able to significantly bolster its insight engine to decode complex customer journeys. Armed with more relevant, actionable insights, marketers can use Dextro's cross-screen, closed-loop measurement systems to reach and engage the right customer at the right time through the right channel. "Being able to accurately map consumer preferences, behaviors and journeys in a privacy-safe and unified way across devices is still one of the biggest pain points for marketers," said Ajith Govind, co-founder of Dextro Analytics. "At the same time, this partnership engages customers with the right message at the right time." "Detecting latent patterns and signals, and tracing backward- and forward-looking behavioral characteristics, are keys to sustaining a competitive advantage in a crowded space," said Manmit Shrimali, co-founder of Dextro Analytics. "With the proliferation of data and devices, connecting the dots is of paramount importance." "Dextro is solving some of the biggest challenges in analytics today," said Pierre Martensson, GM of Tapad's data division. "Our partners consistently see notable improvements in both budget allocation and device optimizations after integrating with the Tapad Device Graph, and I have every confidence that Dextro will be among them." For more information about Dextro Analytics' revolutionary approach to using human learning and artificial intelligence algorithms to solve business and analytical problems, please visit http://dextroanalytics.com/. For more information about Tapad's cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today

NEW YORK & LOS ANGELES / BUSINESS WIRE / Jan. 30, 2017– Tapad, part of Experian, and Rubicon Project (NYSE: RUBI) announced today a new global partnership offering a unified, cross-device campaign delivery solution within an automated advertising marketplace. Tapad is the leading provider of unified, cross-screen marketing technology solutions and Rubicon Projectoperates one of the largest advertising marketplaces in the world. The Tapad Device Graph™, which enables buyers to expand their high-value display data signals to associated mobile devices, will be integrated across Rubicon Project’s leading advertising exchange and Orders platform, significantly improving consumer mobile reach. The new global partnership will empower Buyers within Rubicon Project’s exchange to find and engage audiences across their entire digital experience. Rubicon Project operates one of the world’s largest mobile exchanges connecting to approximately 1 billion unique mobile devices globally. “We’re excited to partner with Tapad to continue to provide our customers the very best data for managing their advertising businesses,” said Harry Patz, Chief Revenue Officer, Rubicon Project. “Cross-device delivery is crucial for buyers today with more than 81% of internet users currently relying on more than one device for digital access[1]. Through our partnership, buyers will be able to extend their desktop private marketplace campaigns to mobile, allowing them to find and engage their audience across devices, anywhere in the world. The net result will also benefit sellers; the increase in mobile reach will better position publishers and app developers to strategically capitalize on their inventory, ultimately increasing bid rates and mobile revenue across the board.” “Our partnership with Rubicon Project marks the first time advertisers and publishers alike are able to use cross-device solutions at significant scale outside of Google and Facebook,” said Pierre Martensson, GM of Tapad’s Data Division and APAC. “Our Device Graph will help Rubicon Project’s advertisers make more informed buying decisions and find the audiences who matter most.” Barry Adams, VP of Commercial Development at Bidswitch, said, “As digital advertising moves away from desktop and increasingly toward a mobile-first model, cross device data becomes critical to finding consumers. The rich data buyers will now be able to leverage at scale through the Tapad and Rubicon Project integration will enable us to provide a state-of-the-art cross-screen solution for the 150+ buying platforms that use our service, and the tens of thousands of advertisers they represent.” For more information about Rubicon Project’s inventory, please visit www.rubiconproject.com. For more information about Tapad’s cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today

Tapad expands linear TV analytics solution, enabling optimal reach and frequency across TV and digital platforms NEW YORK, Jan. 24, 2017 /PRNewswire/ – Tapad, now a part of Experian, has partnered with WideOrbit, the leading provider of advertising management software for media companies, to develop the industry's first programmatic TV-buying platform powered by a device graph. Tapad is the leading provider of unified, cross-screen marketing technology solutions and was first to market with a device graph, the Tapad Device Graph™. WideOrbit's robust supply platform and industry-leading footprint offers access to premium TV inventory on top networks, reaching more than 99 million households across local affiliates. The partnership pairs Tapad's demand-side technology with WideOrbit's supply-side inventory. As a result, marketers can leverage cross-device audiences in their TV buys for the first time. Additionally, integrating the Tapad Device Graph™ with digital feedback loops and audiences both accelerates optimization and enables precise audience discovery for TV marketers. "The integration of WideOrbit's quality TV supply takes orchestrated cross-screen media buys to the next level," said Marshall Wong, Tapad's SVP of TV market development. "Marketers can now optimize TV campaigns within days instead of weeks. This also untethers them from buying against generic demographics like age and gender. By allowing brands to employ their own CRM or third-party data, we can move them much closer to audiences who will take action." "Integrating Tapad's device graph with WideOrbit's programmatic marketplace delivers enormous value to marketers looking to add TV to cross-device campaigns," said Ian Ferreira, EVP of programmatic at WideOrbit. "Television still delivers the most efficient reach of any medium, and Tapad's platform now allows marketers to purchase premium broadcast inventory that extends the power of cross-screen campaigns to TV with a single, unified solution." "Our clients build lasting relationships with consumers through thoughtful and pioneering marketing," said Jeff Giacchetti, VP of digital at Mediavest Spark. "The strategic partnership of demand-side technology and supply-side inventory makes it easier for brands to find efficient, incremental reach and are critical in this endeavor." For more information about Tapad's cross-platform advertising solutions, please visit https://www.experian.com/marketing/consumer-sync. Contact us today