At A Glance

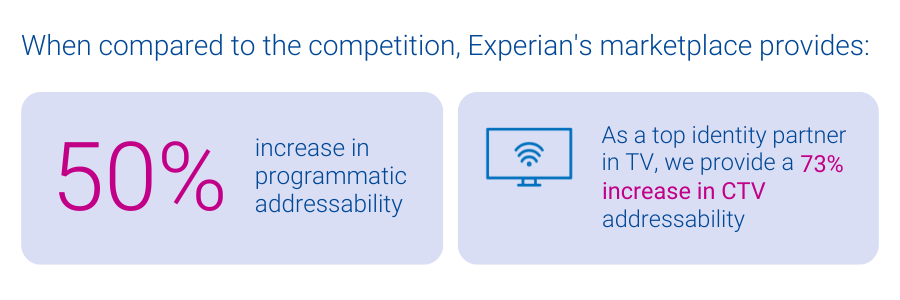

Experian has launched a new data marketplace that brings identity, interoperability, and addressability into one activation-ready platform. Built on verified offline and digital identity, it supports consistent audience activation across CTV, display, and mobile. Marketers and platforms gain broader reach and strong match rates.As marketers face growing signal fragmentation, Experian has launched a data marketplace that brings addressability, interoperability, and identity resolution into one activation-ready platform.

Download the overview to see how our data marketplace connects high-quality identity to scalable activation across all screens.

Why does cross-channel audience consistency matter?

Marketers plan campaigns to reach people wherever they watch, browse, and engage. Consistent identity allows those plans to carry across screens without fragmentation.

Experian’s data marketplace starts with identity. Our data marketplace is built on our best-in-class identity graph which includes 126 million U.S. households, 250 million individuals, and more than four billion active digital IDs. This foundation supports reliable audience connections across channels and devices.

What distinguishes Experian’s data marketplace?

Experian connects the entire ecosystem — TV operators, programmers, supply-side platforms (SSPs), demand-side platforms (DSPs), and brands — with activation-ready audiences that drive measurable performance. Buyers can access data from retail, CPG, healthcare, B2B, location intelligence, and more.

Our audiences are built on verified offline data, which means they’re grounded in real-world accuracy, not just digital assumptions. When you activate through our marketplace, you:

- Reach relevant audiences across screens

- Maintain accuracy at scale

- Support addressability as media environments evolve

Whether you’re running a campaign on connected TV (CTV), mobile, or display, we help you show up in the right place, to the right person, at the right time.

Related reading

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

DISH MediaKemal Bokhari, Head of Data, Measurement & Analytics

Want a quick overview of Experian’s data marketplace?

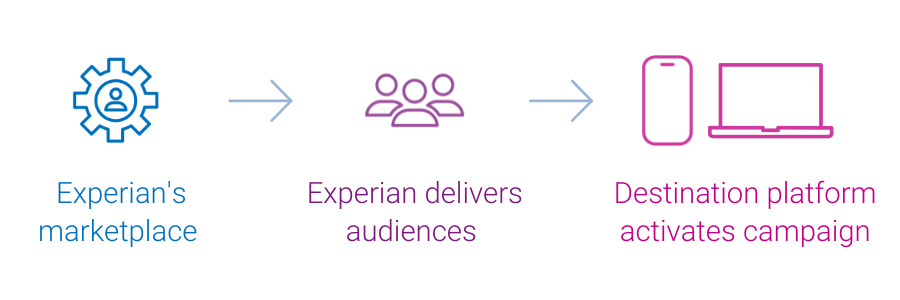

Watch our video for a quick overview of how Experian’s data marketplace works.

How does Experian’s data marketplace support buyers, sellers, and platforms?

Our data marketplace streamlines how teams plan, distribute, and activate data. Buyers and sellers align workflows while maintaining scale and accountability. Here’s how it delivers:

Which data partners participate in Experian’s data marketplace?

Our data marketplace includes premium data from partners such as Alliant, Attain, Circana, Dun & Bradstreet, and more. Buyers activate these audiences alongside Experian Audiences within one workflow.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

CircanaPatty Altman, President, Global Solutions

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Dun & BradstreetGeorgina Bankier, VP of Platform Partnerships

How Yieldmo drove in-store traffic for an athletic retailer with Experian’s data marketplace

Yieldmo, a leading SSP known for its AI-powered creative formats and privacy-forward inventory, partnered with Experian to support an athletic retailer focused on in-store traffic during key sales periods. The team identified high-intent shoppers and activated them across channels.

Using our data marketplace, Yieldmo combined Experian Audiences with partner segments from Alliant, Circana, Webbula, and Sports Innovation Lab. This approach allowed the team to:

- Identify in-store and conquest segments quickly

- Combine first- and third-party audiencesin one place

- Improve match rates and cross-channel addressability

- Deliver measurable foot traffic lift

“Experian’s data marketplace fills a critical gap, letting us quickly search by brand, build smarter conquest segments, and activate audiences fast. The platform is flexible and the support is hands-on and reliable.”

YieldmoAbby Littlejohn, Director of Sales Planning

The campaign delivered faster setup, tailored audiences, and strong in-store performance with less manual effort.

Get started with Experian’s data marketplace

Experian’s data marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

Talk to our team if you’re interested in learning more about our new data marketplace or becoming an active buyer or seller, or download our overview to learn more.

FAQs

Experian’s data marketplace is a centralized, activation-ready platform that allows TV operators, programmers, supply partners, and demand platforms to access and activate high-quality, privacy-compliant audiences across CTV, mobile, and display. It supports both first-party onboarding and third-party audience activation.

The Experian data marketplace is built for TV operators, programmers, supply partners, and demand platforms looking to improve audience targeting, match rates, and addressability across fragmented digital environments.

The Experian data marketplace offers a mix of Experian proprietary audiences and third-party data partner segments across verticals like retail, CPG, B2B, healthcare, financial services, and location intelligence. Users can activate over 3,500 Experian Audiences and premium partner segments from providers like Alliant, Attain, Circana, Dun & Bradstreet, Webbula, and more.

Experian’s data marketplace is powered by our identity graphs which are rooted in verified offline data, spanning 126 million U.S. households, 250 million individuals, and over four billion active digital identifiers. This foundation ensures that audiences are accurate, actively targetable, and optimized for high match rates across CTV, mobile, and display platforms.

Yes. All data in the Experian data marketplace is subject to Experian’s rigorous partner review process to ensure compliance with federal, state, and local consumer privacy regulations. Privacy and data stewardship are foundational to our data marketplace’s design.

Experian’s data marketplace stands out for its focus on audience accuracy, partner integration, privacy compliance, and deep identity expertise. Here’s how we’re different:

– Accurate audience planning: Unlike many other marketplaces, Experian ensures that all identifiers tied to an audience are verified as active and targetable — improving match rates and reducing waste.

– Seamless partner audience integration: In one platform, you can activate Experian Audiences alongside premium segments from our growing partner network — including Alliant, Attain, Circana, and more.

– Privacy and compliance built in: Every partner and audience goes through Experian’s rigorous review process to meet federal, state, and local consumer privacy laws — so you can activate with confidence.

– Trusted identity foundation: Experian’s identity graph is grounded in decades of offline data expertise, powering more reliable targeting and activation than marketplaces built solely on digital signals.

You can download the overview to explore the capabilities, or contact our team to become an active buyer or seller. The Experian data marketplace is available through Experian’s Audience Engine platform.

Latest posts

At Cannes Lions 2025, industry leaders highlighted how privacy-first data practices, supply path optimization, and AI-powered tools are reshaping the advertising ecosystem.

Discover how Experian’s Digital Graph helped a DSP resolve 84% of IDs, increase match rates, and deliver stronger attribution, ROI proof, and client confidence.

Activate Experian’s syndicated audiences this holiday season. Reach shoppers, travelers and entertainers with 3,200+ accurate segments across 200+ platforms.