As Earth Day approaches, it’s the perfect opportunity for marketers to explore innovative ways to engage with eco-conscious customers. With a strong and growing interest in sustainable business practices worldwide, green audiences are becoming increasingly influential. In addition to being good for the planet, engaging these customers is great for any brand or organization striving to become more eco-friendly and socially responsible. By taking advantage of this timely event and using appropriate tools, you can create personalized campaigns that will both promote your brand and increase customer loyalty.

Eco-conscious audiences

In this blog post, we’ll cover three eco-conscious audiences to target this Earth Day:

- Solar energy

- GreenAwareTM

- Electric vehicles

Solar energy

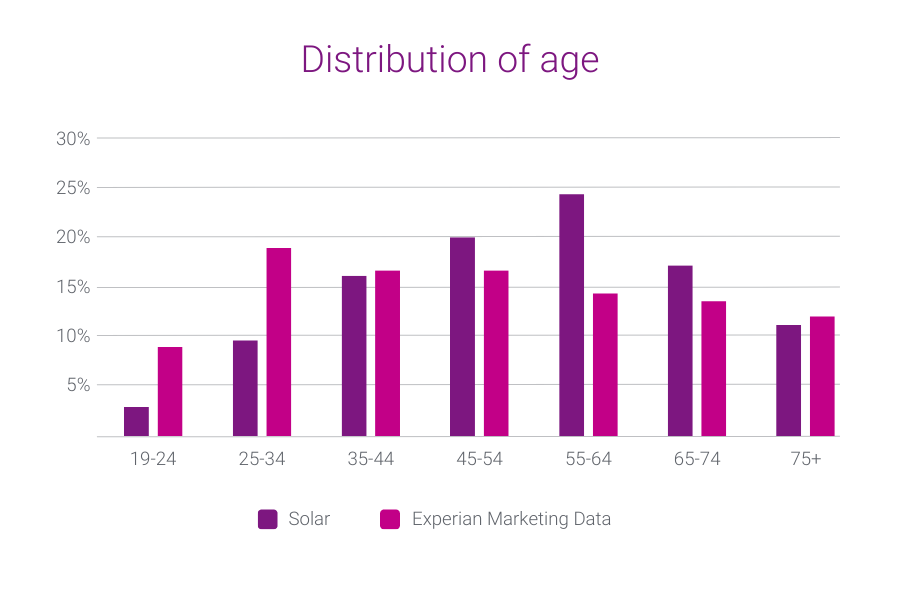

Our first eco-conscious audience is Solar energy. Consumers in this audience show an inclination toward harnessing the power of the sun as a clean, renewable energy source. Our audience data can provide valuable insights into the Solar energy consumer base, including their age, education level, occupation, household income, and communication preferences. Let’s explore these metrics to better understand how to reach this group effectively.

Age and living situation

Consumers in our Solar energy audience are more likely to live in a home with two or more adults and are between the ages of 45-74.

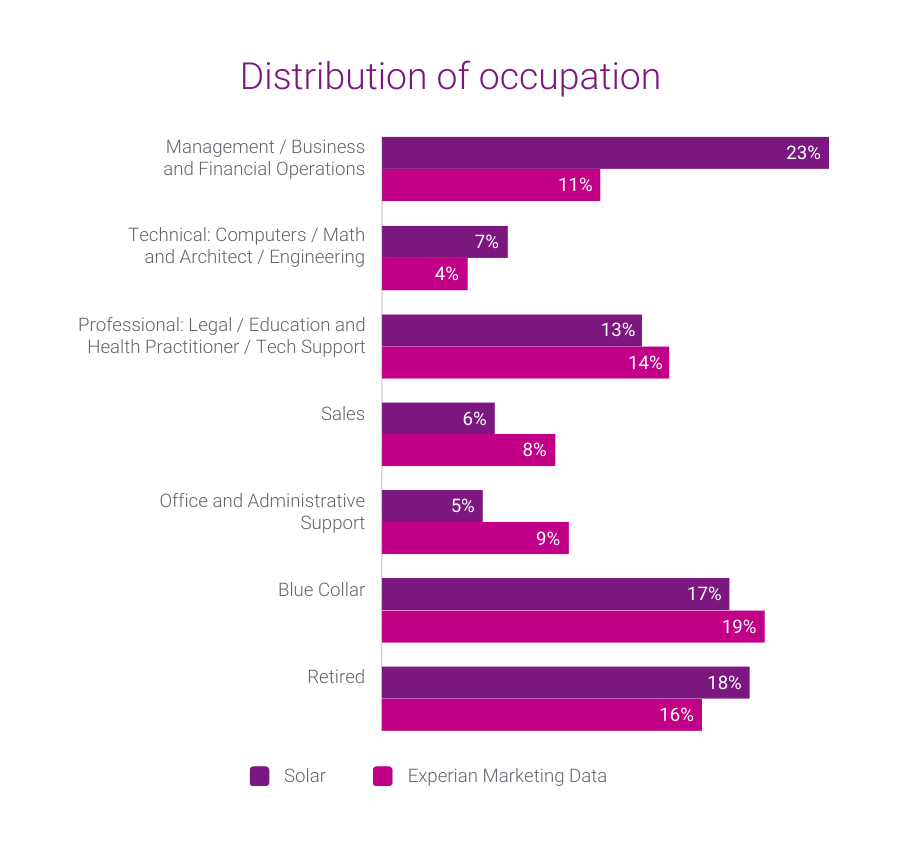

Education level and occupation

Consumers in our Solar energy audience are more likely to have graduated from college or graduate school and work in management-level occupations.

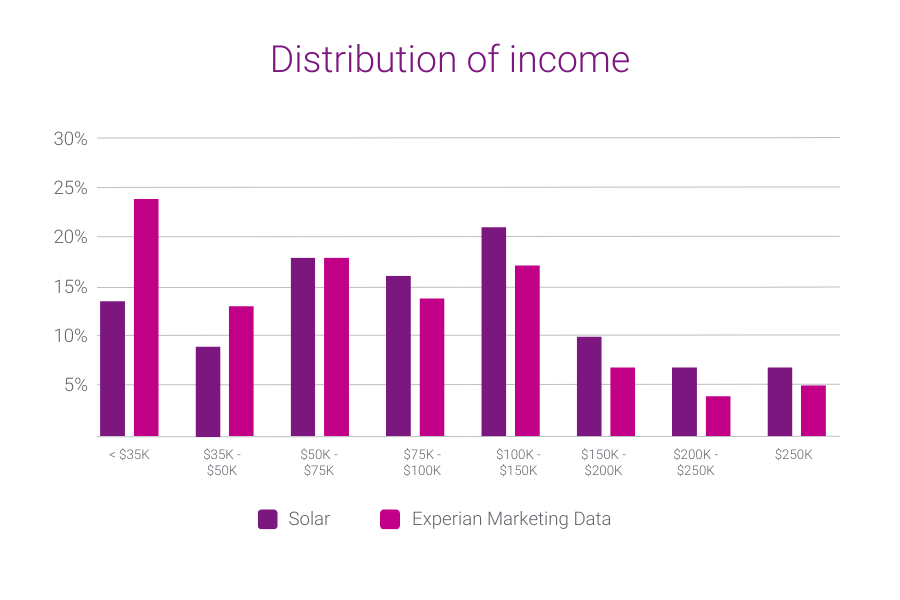

Household income

Consumers in our Solar energy audience have household incomes of more than $75,000 and their homes are valued at over $550,000.

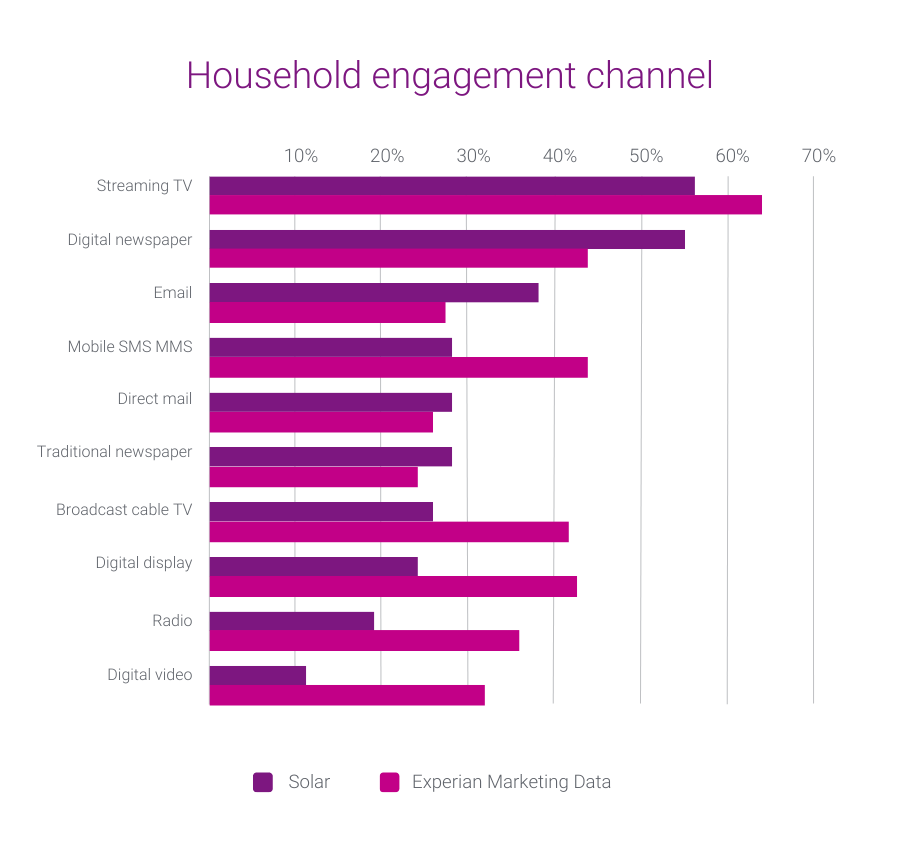

Preferred engagement channels

Consumers in our Solar energy audience are most receptive to ads served through digital channels like digital newspapers and email.

Solar energy audience pairings

Consumers in our Solar energy audience also belong to three of our Mosaic® USA groups:

- Power Elite

- Flourishing Families

- Booming with Confidence

Our consumer segmentation portal of 126 million households and 650 lifestyle and interest attributes empowers marketers like you to precisely target your ideal audience and communicate with them on a personal level. Mosaic’s data segments the U.S. into 19 overarching groups and 71 underlying types, giving you the insights needed to anticipate the behavior, attitudes, and preferences of your most profitable customers and communicate with them on their preferred channels, with messaging that resonates.

GreenAware

Our second eco-conscious audience is GreenAware.

GreenAware segments the 126 million U.S. households within Experian Marketing Data into four distinct groups. Each group differs in their attitudes and behaviors toward purchasing products that are environmentally safe and working with companies that are eco-conscious. We created these groups using an enhanced application of traditional statistical clustering techniques based on environmentally relevant measurements in Simmons’ National Consumer Study.

Based on the distinctive mindset of consumers toward the environment, you can learn how environmental concerns fit into their lives through four major consumer segments:

- Eco-Friendly Enthusiasts

- Sustainable Spectators

- Passive Greenies

- Eco Critics

Let’s dive deeper into each group to understand their unique perspective on the environment and how this impacts their attitudes and behaviors.

Eco-Friendly Enthusiasts

This eco-conscious segment prioritizes a green lifestyle and takes pride in avoiding products that harm the planet. With traditional and liberal values, they embrace optimism and prioritize family. With their children out of the house, they take the time for some well-deserved rejuvenation and are committed to a healthy lifestyle. Some members of this group are transitioning into retirement and welcoming a new chapter in their life.

- Mature adults and retirees

- College graduate or more

- Above average income

- May be married or single

- Typically own their homes

Sustainable Spectators

This segment aspires to be more sustainable, but they struggle with translating their green ideas into action. They have a soft spot for a cozy home. While their love for interior design and taking care of their own space is evident, they’re always looking for new experiences and opportunities to learn. Staying healthy and active is a top priority for this group, so it’s no surprise that they’re always looking for ways to stay fit and feel their best.

- Established and mid-life adults

- College graduate or more

- High income

- Typically married

- Likely to own their homes

Passive Greenies

This is the largest and one of the most youthful groups. Known for their love of exploration and self-discovery, they may not have fully embraced eco-conscious behaviors yet, but they are eager to stay current with the latest technology and trends. With their incredible ability to multitask, they’re always on-the-go, and constantly seek the next best thing.

- Mainly young adults and diverse

- Education ranges from high school through some college

- Below average income

- More likely to be single or divorced

- Typically rent

Eco Critics

This group is not likely to be eco-conscious and may have negative attitudes about the environment. They are confident, driven, and focused on their personal growth. They crave instant gratification, seeking out quick and easy solutions to their everyday decisions. They place a high value on entertainment, their social life, and carefully curate their image.

- Young and established adults

- Education ranges from high school through post-graduate studies

- High income

- Married or single

- Typically own their homes

Let’s take a look at how the GreenAware segments stack up against each other in terms of age, household income, education level, and media preference. How do they compare? Let’s find out.

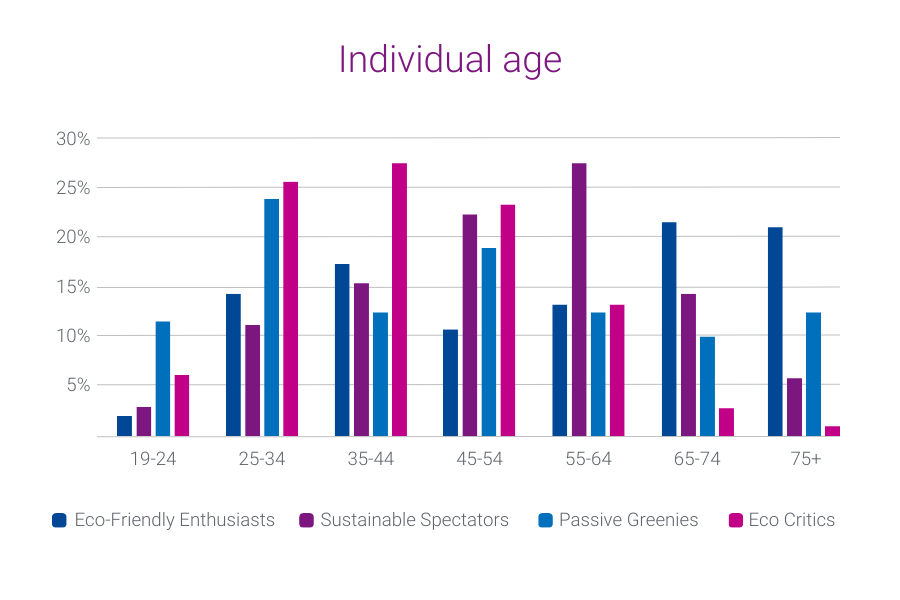

Age

Consumers in the Eco-Friendly Enthusiasts segment are the oldest of the four GreenAware segments – about half of the consumers are 65 or older. Eco Critics are the youngest segment, with over half of consumers in this group between ages 25-44.

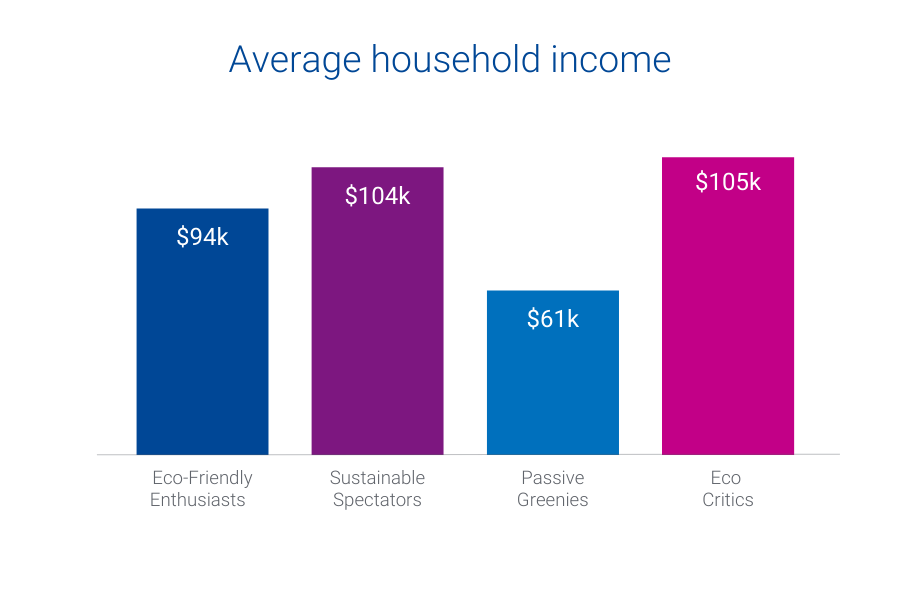

Household income

Sustainable Spectators and Eco Critics are the wealthiest GreenAware segments. The average household income of consumers in these segments is above $100,000. Passive Greenies have the lowest household income, with a majority below $50,000.

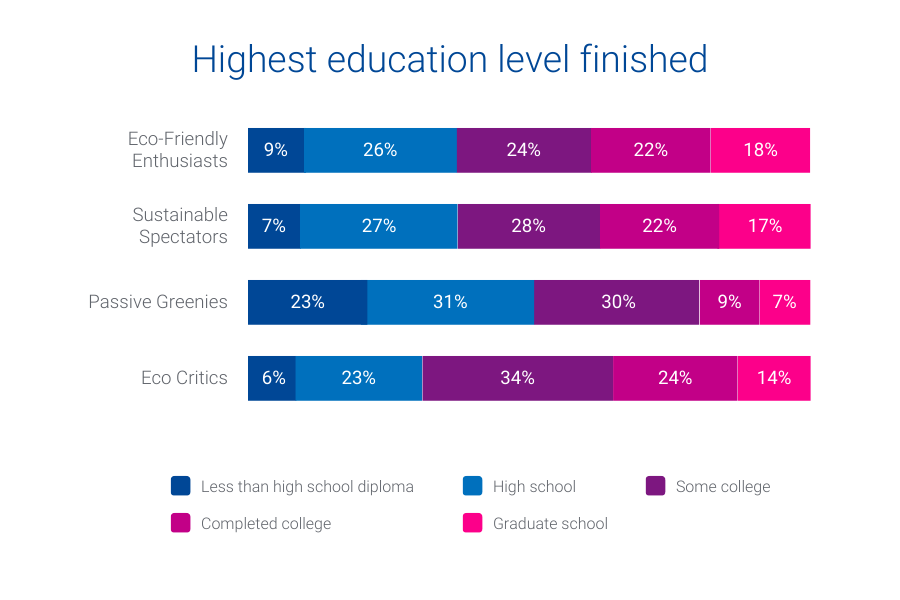

Education level and occupation

Passive Greenies are more likely to work Blue Collar jobs and have the lowest level of education. As the wealthiest segments, Sustainable Spectators and Eco Critics have the highest levels of college degrees and work in management, business, and financial operations. Eco-Friendly Enthusiasts are the most likely to be retired and out of the workforce.

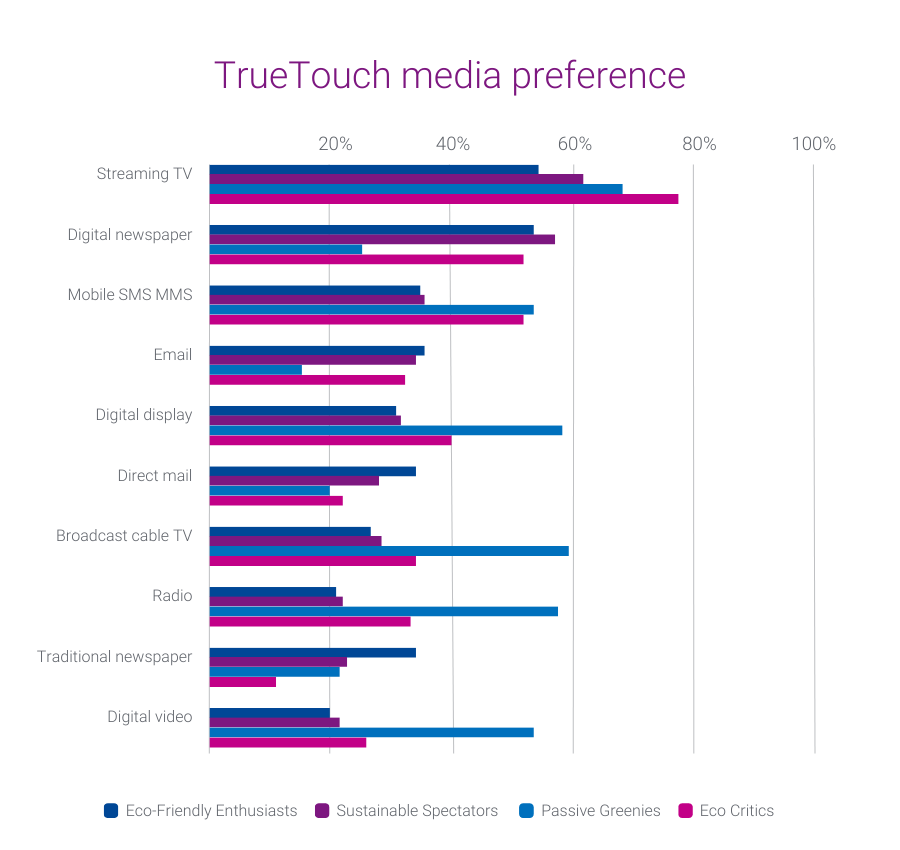

Preferred engagement channels

- Streaming TV is the preferred engagement channel for all GreenAware segments.

- Eco-Friendly Enthusiasts prefer digital channels like digital newspapers, mobile SMS, and email. They also engage with traditional channels like direct mail and newspaper.

- Passive Greenies have a high preference for digital display, mobile SMS, digital video, broadcast cable TV, and radio.

- Eco Critics have a high preference for digital channels like digital newspapers, mobile SMS, and digital display.

- Sustainable Spectators strongly prefer digital newspapers. They don’t show as strong of a preference for mobile SMS and digital display as Eco Critics and Passive Greenies.

GreenAware audience pairings

Six of our Mosaic groups have at least one GreenAware segment with 10% or more of the population. For more precise targeting, below are suggested Mosaic audiences you can pair with each GreenAware segment:

| Eco-Friendly Enthusiasts | Sustainable Spectators | Passive Greenies | Eco Critics |

| Booming with Confidence | Power Elite | Singles and Starters | Power Elite |

| Autumn Years | Booming with Confidence | Golden Year Guardians | Suburban Style |

| Golden Year Guardians | Singles and Starters |

Electric vehicles

Our third eco-conscious audience is electric vehicles.

Electric vehicles (EVs) are having a major moment in the automotive industry. This is no surprise given that new EV models are being released and an increasing number of charging stations are popping up around the country. As EVs become more prominent, it’s essential to stay up to date on relevant trends to make informed decisions about what lies ahead.

The demand for electric vehicles (EVs) is on the rise

Consumers are embracing the EV revolution, showing their desire for a cleaner, greener future. Automotive marketers are increasingly looking to reach in-market EV shoppers and current alternative fuel vehicle owners due to the growing availability of electric vehicles, improved infrastructure, and rising popularity. In 2022, EVs charged up the market and accounted for a remarkable 6% of new retail registrations.

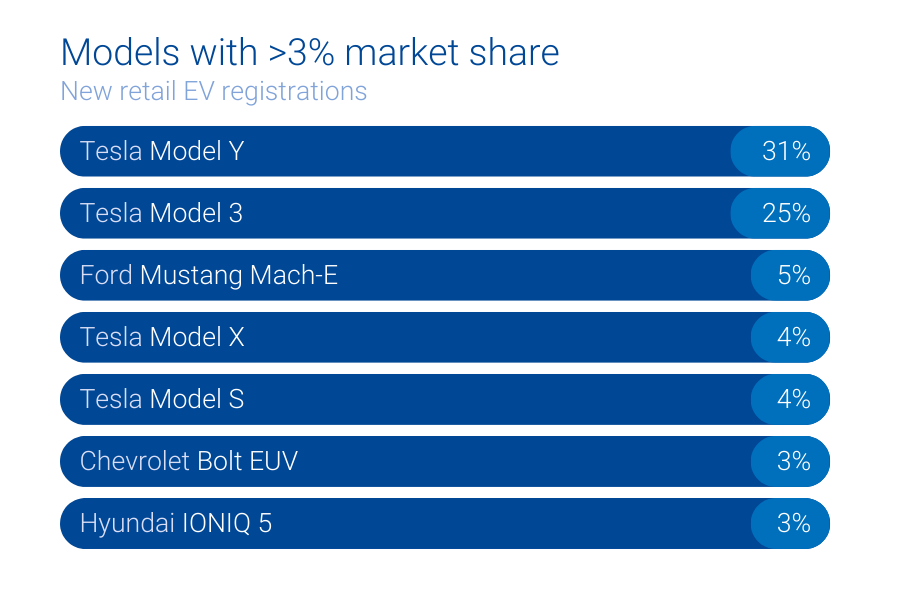

While Tesla continues to dominate the EV market, Ford, Chevrolet, and Hyundai are starting to compete, each holding more than 3% of the market share of new retail EV registrations.

Geography

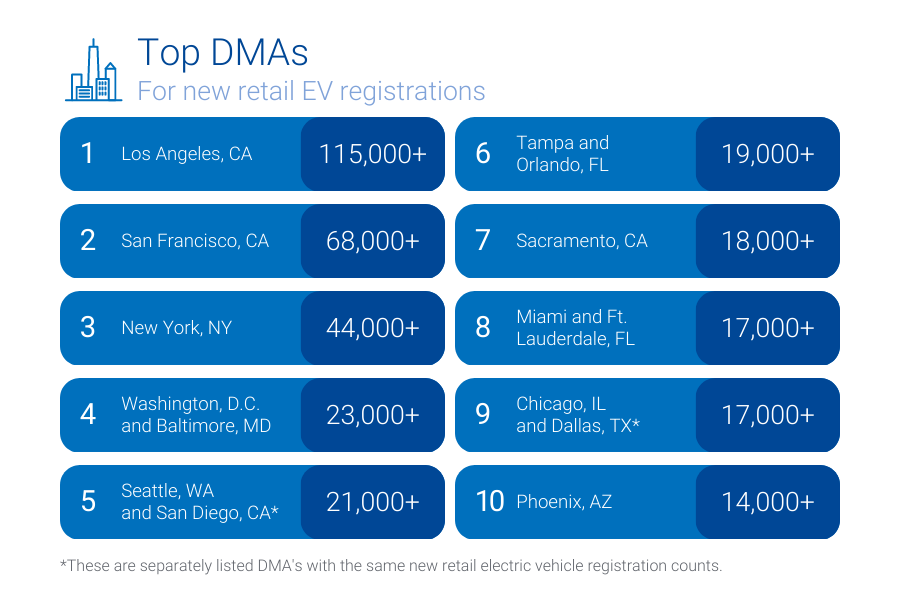

Where are we seeing the most new retail EV registrations? The top designated market areas (DMAs) for new retail EV registrations are mostly located in heavily populated, coastal cities like Los Angeles, CA and New York, NY.

The fastest growing DMAs, however, are in smaller cities like Tucson, AZ and Oklahoma City, OK.

Generational demographics

Gen X and Millennials make up the largest percentage of new retail EV buyers at 37.5% and 34.4%. Gen Z and the Silent generation represent the smallest shares at 5% and 2.1%. Boomers hover between Gen X and Millennials’ share and account for 20.6% of new EV retail purchases.

EV audience pairings

Our top five Mosaic groups for new EV buyers include:

- American Royalty

- Cosmopolitan Achievers

- Philanthropic Sophisticates

- Couples with Clout

- Fast Track Couples

How to target consumers in-market for electric vehicles

We offer 70+ audiences that are focused on likely buyers and owners of EV and plug-in hybrid (PHEV) vehicles. We also offer a subset of 28 audiences focused on individual EV/PHEV vehicle models.

Below is how you can find a few of these audiences on-the-shelf of most trusted advertising platforms:

- Autos, Cars, and Trucks > In Market-Fuel Type > Electric

- Autos, Cars, and Trucks > In Market-Fuel Type > Used Electric

- Autos, Cars, and Trucks > In-Market Make and Models > Tesla

- Autos, Cars, and Trucks > In-Market Make and Models > Chevrolet Bolt EV

We can help you reach eco-conscious consumers

Earth Day is a great opportunity to get creative with your marketing efforts with our three eco-conscious audiences: Solar energy, GreenAware, and electric vehicles. To find out how you can add eco-conscious audiences to your marketing plan, contact us.

Get in touch

Latest posts

With Tapad, part of Experian, technology, AdsWizz AudioMatic is the first Audio buying platform to offer cross-device identity resolution across the U.S. and EMEA NEW YORK and LONDON, July 17, 2019 /PRNewswire/ — Tapad, part of Experian and a global leader in digital identity resolution, today announced a new joint capability with AdsWizz , the leading technology provider for digital audio advertising solutions. The partnership combines Tapad's digital cross-device technology with AdsWizz's AudioMatic buying platform, enabling the ability to connect audio ad experiences across screens. AudioMatic, AdsWizz's audio-centric buying platform, supports programmatic audio buying and entirely new audio ad experiences for listeners. The integration of The Tapad Graph onto its platform enables new opportunities for marketers to reach, engage and measure each interaction with their desired consumers on digital radio and podcasts channels, and across devices. This partnership makes AdsWizz the first audio buying platform to offer this enhanced cross-device identity capability in the US and EMEA markets. "Marketers need privacy-safe digital identity resolution to reach their consumers," says Tom Rolph, VP of EMEA at Tapad. "With audio becoming an increasingly powerful medium for engagement, it's important that our technology extends to this channel, which is why we are excited to announce our integration with AdsWizz's AudioMatic platform." Digital audio is experiencing high growth, with 84% of advertisers and agencies saying it will play a bigger role in their media plans in the future. Today, 60% of digital audio is consumed via a mobile device.* The Tapad Graph is the largest digital identity resolution graph with differentiated global scale. The partnership enables audio advertisers to leverage The Tapad Graph for enhanced attribution, analytics, and targeting. Alexis van der Wyer, CEO at AdsWizz, added, "Digital audio is increasingly becoming ubiquitous in our media consumption and in our daily digital interactions, and because of that, audio advertising offers tremendous opportunity to personally interact with consumers in every moment of their daily lives. By integrating with Tapad, we enable our advertising partners to increase the effectiveness and the relevance of their marketing messages across audio channels." To learn more about Tapad and our digital identity resolution products, visit our identity solutions page. *Digital Audio Exchange, "The Rise of Digital Audio Advertising," https://thisisdax.com/wp-content/uploads/2019/07/DAX-Whitepaper.pdf About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph, and its related solutions, provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Our one-of-a-kind Graph Select offering enables marketers the flexibility and freedom of choice to correlate devices to varied objectives, driving campaign effectiveness and business results. Tapad is recognized across the industry for its product innovation, workplace culture and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore and Tokyo. About AdsWizz: AdsWizz has created the end-to-end technology platform that is powering the digital audio advertising ecosystem. AdsWizz powers well-known music platforms, podcasts and broadcasting groups worldwide with a comprehensive digital audio software suite of solutions that connect audio publishers to the advertising community. From dynamic ad insertion to advanced programmatic platforms to innovative new audio formats, AdsWizz efficiently connects buyers and sellers in digital audio. AdsWizz is headquartered in San Mateo, California, with an IT Development hub in Bucharest, Romania, and presence in 39 markets around the world. About AudioMatic: AdsWizz Demand Side, audio-centric DSP and audio buying platform, AudioMatic, enables programmatic audio buying and entirely new audio ad experiences that are proven to be more engaging and more effective, and have delivered measurable results for agencies and their brands all over the world. All the biggest ad agencies have used our programmatic trading platform, including Omnicom, GroupM, Havas, Publicis, Mobext, and more. Contact us today

Sixty-Nine Percent Organic Sales Growth Spurred by Expanded Business and Continued Investment in The Tapad Graph™ NEW YORK, May 7, 2019 /PRNewswire/ — Tapad, a part of Experian, a global leader in digital identity resolution, today announced a record start to the year, following its highest earning year in the company's history. Since January, Tapad has experienced a 69 percent organic increase in global revenue; with strategic investments in talent, continued high retention rates, and an expanded range of clients across global markets. Globally, Tapad increased its client base across multiple categories and verticals, catering to agencies, brands, telecoms, and data providers. The Tapad Graph™'s varied use cases and differentiated global scale have been instrumental to the company's overall success to-date. With an ongoing investment in product, and expected feature releases slated for 2019, the company anticipates these accomplishments to continue. "Since the inception of our business, Tapad has heavily focused on enabling marketers to boost the performance of their campaigns with the help of our advanced digital identity resolution technologies," said Sigvart Voss Eriksen, CEO at Tapad. "While we continue to grow, creating privacy-safe solutions that solve marketers evolving needs remains integral to our evolution. As pioneers in cross-device, we're constantly innovating and pushing ourselves to be at the forefront of industry change. Our leadership in the space is recognized across the industry, as is evident by our current success." In addition to partner expansions, Tapad also invested in new talent. In February, Tapad announced Ajit Thupil as the company's first Senior Vice President of Identity, deepening the company's commitment to creating ground-breaking digital identity resolution products for brands, agencies and platforms. Tapad's investment in talent has been recognized by One World Identity's 2019 Top 100 Influencers in Identity Award and by ClickZ's 2019 Marketing Technology Awards. To learn more about Tapad and our digital identity resolution products, visit Experian.com Open job opportunities across the globe can be found on Tapad's career page here: https://www.experian.com/careers/ About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph™, and related solutions, provide a privacy-safe approach to connecting device identifiers to brand and marketer data, thereby allowing marketers around the world to maximize campaign effectiveness. Tapad is recognized across the industry for its innovation, growth and workplace culture, and has earned numerous awards, including the TMCnet Tech Culture Award. Based in New York, Tapad also has offices in Chicago, London, Oslo, Singapore and Tokyo, and is a wholly owned subsidiary of Telenor Group. Contact us today

The UK digital advertising market is worth £13.44bn, an increase year-on-year of 15%, reveals the 2018 IAB UK & PwC Digital Adspend Study. Report highlights The majority of all growth is coming from smartphone advertising, which has increased by £1.65bn (35%) from 2017. Smartphone advertising now represents 51% of all UK digital ad spend, up from 45% in 2017. Video is now the largest display format (£2307m), overtaking standard display banners (£1486m). Outstream/social in-feed has increased its majority in total video spend, now occupying a share of 57%, up from 52% in 2017. Social revenue now represents 23% of all digital ad spend. Growth is predicted to slow during 2019, with 5% estimated growth (+9% digital, +11% display, +9% search) compared to 15% in 2018. 2018 marks the tipping point towards a mobile-first ecosystem “For the past few years, industry commentators have been hailing the year of mobile. Each January the predictions come and the waiting commences for evidence to mark a tipping point, a shift to a mobile-first digital ad ecosystem. Well, drumroll… it was 2018! The latest Adspend report from IAB UK and PwC reveals that spend on smartphones outstripped spend on desktop for the first time last year. Brands spent 51% of total spend (which stands at £13.44 billion) on smartphones in 2018, up from 45% in 2017 – a significant milestone in the evolution of digital advertising. “This evidence shows that advertisers are increasingly thinking mobile-first. Growth in investment has historically lagged behind the amount of time spent on the device and we expect to see growth continue at a rapid pace to keep up with audience behaviour – two thirds of time spent online is now on mobile, according to UKOM. Other areas of growth highlighted by the report include video, which accounts for 44% of the total display market, while mobile video now makes up 51% of smartphone display. This is no doubt down to bigger mobile screens, better 4G and more readily available WiFi making video ads an increasingly attractive option. “Across the board, advertisers are investing in digital for longer-term brand building as well as short-term activation, with the direct-to-consumer market helping to drive this trend. What’s more, digital continues to be an accessible and popular route to market for businesses of all sizes, from leading advertisers to SMEs.” Tim Elkington, Chief Digital Officer, IAB UK Content & context crucial for attracting audiences “As people spend more and more of their time on mobile, it’s comes as no surprise that advertisers will follow where audiences are with their marketing spend. “Video has been the driving force in this growth, indicating that engaging visual content is still key in helping brands to achieve great results and to capture consumer attention in a vast sea of digital noise. “Video still has a way to go if it is to reach the level of effectiveness of traditional formats like cinema, but it will be interesting to see how the format develops over the next year or so. Ultimately, brilliant content and properly considered context are crucial for advertisers hoping to attract relevant audiences and build strong brands long term.” Kathryn Jacob OBE, CEO, Pearl & Dean Mobile-first approach driving investment in user experience “As a mobile-first approach has become the norm for many businesses, we’ve seen significant innovation and investment in the user experience that has fuelled the rise in mobile commerce. “Yet, for some years, limitations in the technology and formats available have meant that mobile advertising couldn’t always keep pace with changing consumer behaviours – delivering weaker performance when compared to desktop. “Fortunately, mobile has made huge strides in recent years. Mobile advertising affords great targeting opportunities for brands and a more interactive and immersive experience for consumers. “There is no reason to doubt this trend will continue as advertisers design their media, creative, and targeting strategy with mobile at the heart – optimising performance, enhancing the customer experience, and delivering the best results.” James Cragg, UK Managing Director, Tug New technologies to improve investment efficiency “The UK digital ad market has continued to grow despite the various challenges that the market has faced, including the current socioeconomic climate and general changes in the industry. As spend increases, it’s important to look at how media buying can be made as efficient as possible, minimising waste and maximising the return on investment. “Marketers will start to look to new technologies, like AI, to offer an impartial and more efficient approach to media buying, allowing marketers to measure effectiveness of campaigns and allocate spend accordingly.” Carl Erik Kjaersgaard, Chief Executive, Blackwood Seven Industry going from strength to strength “This significant growth in ad spend is great to see and shows that our industry is going from strength to strength. It’s especially good to see that as advertisers invest more and more in digital advertising, they’re becoming more considered in where they’re spending their money – with a large portion of the growth coming from companies that are part of IAB’s Gold Standard. “At The Trade Desk, we’ve long been ambassadors for the importance of transparency. These findings show that it isn’t just the right thing to do, but makes good business sense as advertisers increasingly choose partners who are demonstrating a commitment to best practice.” Anna Forbes, UK General Manager, The Trade Desk Advertisers embracing mobile “As consumers spend more of their time online, it’s no surprise that digital ad spend has continued its rise, up 15% to £13.4bn. With digital, in every sense, becoming further embedded in our daily lives, it is inevitable that this number is set to rise further next year. “Given the vast majority of people using their smartphone as their primary digital device, evident from site traffic stats we see across the board, the IAB report shows that advertisers have started to fully embrace this shift by following with ad spend. Over the last few years, a combination of faster wireless connectivity along with more capable devices has made it the go-to device for consumers to get online. This is set to continue over the next few years with 5G and even faster, more capable smartphones arriving (i.e. foldables) that will further cement ‘mobile’ as the main digital device to reach consumers.” Wajid Ali, Head of Paid Search, ForwardPMX Budgets must go to professionally produced content “In the IAB’s latest ‘Digital Adspend Study’ it is positive to see that outstream continues to dominate video spend, showing close to a 10% year-on-year increase. “Unsurprisingly, the study highlights that mobile is the most important distribution device (76% of all video spend is on the smartphone), and it’s great to see the format we invented dominating that space. “However, it’s now more pertinent than ever that clients and agencies invest their outstream budgets into professionally produced content and not social infeeds. Budgets must go where content is being produced, rather than aggregators and distributors, where the content is read rather than where a click happened. “We must remember how important local, national, and vertical press are to the global digital ecosystem. By unifying the best publishers at scale, delivering mobile-optimised creativity and outcome-orientated distribution, we are fighting to ensure publishers are getting their fair share of revenue in comparison to the social platforms.” Justin Taylor, UK MD, Teads UK market in robust health “The latest IAB digital ad spend report shows encouraging signs that the UK digital advertising market is in robust health, with mobile advertising continuing its upward trend. “The rise of up-and-coming ad formats like Shopping Ads, Google’s Responsive Search Ads, and Facebook Messenger Ads show that advertisers are looking for ways to capture consumer attention in the evolving digital landscape. As a result, the lines across search, social, and e-commerce are more blurred than ever with the introduction of features like Checkout for Instagram and Shopping ads on Google Images. Furthermore, with the rapid growth of Amazon’s ads business, e-commerce has quickly emerged as a third pillar of digital advertising, making it vital for marketers to have a complete view of the customer journey across channels and devices, if they hope to more accurately understand campaign performance and attribution.” Wesley MacLaggan, SVP of Marketing, Marin Software Digital identity resolution essential in understanding customer journey “Last year’s figures show that UK ad spend is starting to mirror the behaviour of consumers who, according to UKOM data, spend two-thirds of their time online on a smartphone. The fact that mobile ad spend now surpasses that of ad spend on desktop highlights marketers’ understanding that digital identity resolution is essential, not a nice-to-have. “Appreciating the cross-device behaviours of consumers allows brands to gain a better understanding of the customer journey and build stronger relationships with their audiences long term.” Tom Rolph, VP EMEA, Tapad, a part of Experian. Contact us today