Agencies, platforms, and marketers stand at the crossroads of transformation, as privacy regulations tighten, technology accelerates, and consumer behaviors evolve. Yet these challenges also present extraordinary opportunities.

Our 2025 Digital trends and predictions report highlights five trends that will shape 2025 and digs into:

- What’s changing in the market

- How to keep learning about your customers

- How to reach your customers in different places

- How to measure what’s really working along the way

In this blog post, we’ll give you a sneak peek of three of these trends — from cracking the code of signal loss to tapping into the buzz around connected TV (CTV) and stepping up your omnichannel game. Think of it as a taste test before the main course. Ready for the full menu? Download our report to get the lowdown on all five trends.

1. Signal loss: A rich appetizer of alternate ingredients

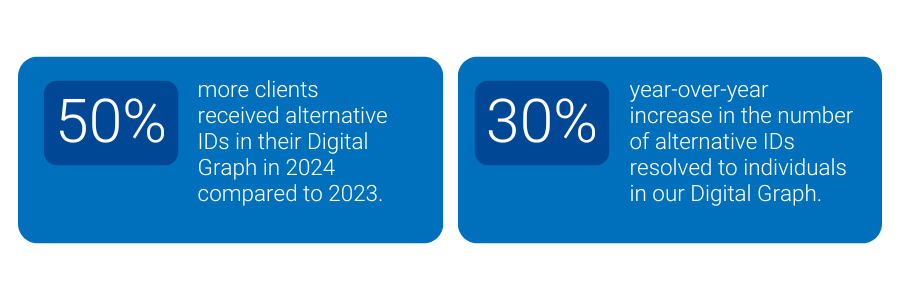

As traditional cookies crumble, marketers need fresh ingredients to keep the flavor coming. Already, about 40% of browser traffic doesn’t support third-party cookies, and marketers are spicing things up with first-party data, alternative identifiers like Unified I.D. 2.0 (UID2) and ID5, and contextual targeting strategies. In fact, 50% more of our clients received alternative IDs (UID2, ID5, Hadron ID) in their Digital Graph in 2024 compared to 2023. The number of alternative IDs resolved to individuals in our Digital Graph increased by 30% year-over-year – as everyone looks beyond the cookie jar.

There is no secret sauce to replace cookies. Instead, expect a multi-ID recipe that brings together different identifiers, unified by an identity graph. This approach turns a fragmented pantry of data into a cohesive meal, giving you a complete view of your customer on every plate.

2. The rising power of CTV: A hearty entrée of opportunities

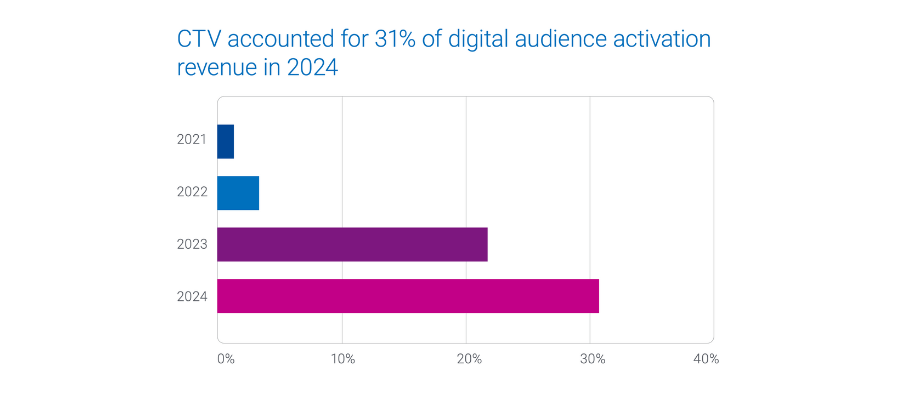

CTV is quickly becoming the main dish on the streaming menu, as viewers load up on their favorite shows. While CTV is slated to make up 20% of daily U.S. media consumption by 2026, advertisers are still holding back on pouring in the ad spend. To unlock its full flavor, marketers need to whip up solutions like frequency capping and unified audience activation.

Although CTV will account for 20% of daily U.S. media consumption by 2026, it’s projected to command only 8.1% of ad spend. Frequency capping and unified audience activation solutions will be key to unlocking CTV’s full potential.

By 2025, nearly half of CTV “diners” will choose free ad-supported streaming TV (FAST). Marketers need strategies to prevent ad overexposure. With 50% of U.S. consumers avoiding products due to ad overload, and 30% of marketers willing to increase their CTV spend if frequency capping improves, unified identity solutions help ensure every impression is served just right.

3. Omnichannel: A flavorful fusion plate

No one likes a one-flavor meal. Marketers are moving beyond single-channel “side dishes” to omnichannel “fusion feasts” that blend direct mail, digital, CTV, and retail media networks (RMNs) into a truly cohesive culinary experience. Even though only 21% of global B2C professionals currently put omnichannel at the top of their shopping list, the growing demand for seamless, audience-first campaigns is heating up.

In 2025, having an audience-first approach will be like having a perfect pairing for every course. Unified identity solutions act as your master sommelier, ensuring that each channel complements the next, and every customer enjoys a well-rounded, memorable journey.

Vertical trends: A dessert sampler from four unique kitchens

Different markets have their own signature flavors.

- In Auto, crossover utility vehicles (CUVs) claim 51% of new vehicle registrations, and consumers in the 35-54 age group and families are the primary buyers. Automotive marketers should prioritize CUV advertising with a strong focus on family-oriented and income-appropriate messaging

- In Financial Services, marketers need to anticipate shifts in consumer behavior tied to economic conditions, such as increasing demand for deposit products when interest rates are high. For insurance, aligning campaigns with life events, like new home purchases or marriage, can maximize engagement.

- In Healthcare, advertisers are prioritizing personalized, regulation-compliant campaigns that address social determinants of health (SDOH).

- In Retail, advertisers are increasingly activating on both CTV and social platforms, with many managing their own in-house campaigns. While larger brands often rely on media agencies, a shift toward in-house media buying is emerging among some bigger players, offering more control over audience targeting and performance metrics.

Our report covers each vertical’s unique menu, helping you select the right “ingredients” for your customers. With the top Experian Audiences on hand, you can create feasts that delight, nourish, and convert.

Download our new 2026 Digital trends and predictions report

Marketing in 2026 will be defined by connection: between activation and measurement, data and AI, platforms and outcomes. These connections are what turn innovation into impact, and they’re where Experian helps marketers lead with confidence.

What you’ll learn

- AI is only as good as its data : Find out why the marketers who shape how AI works, with high-integrity, human-centered data, will be the ones who lead.

- Activation and measurement are coming together: Explore how marketers are shifting from reporting after the fact to guiding performance in the moment.

- First-party data activation is becoming a foundational capability: See how it’s now possible to onboard and activate privacy-compliant audiences across channels, all from a single system.

- Commerce media is no longer just a retail play: Understand why auto, CPG, financial services, and travel brands are now adopting retail-style models to connect data, media, and sales outcomes.

- Curation is the new programmatic standard: Learn how curation brings identity, quality, and control together, allowing marketers to target confidently across connected TV (CTV), audio, and the open web.

Experian’s U.K. 2025 advertising trends

This article highlights the major advertising trends set to shape the U.S. market in 2025, but significant industry changes are happening on a global scale. For a more comprehensive look at worldwide trends, check out Experian’s U.K. 2025 advertising trends.

Contact us

Latest posts

Learn how energy and utility marketers use Experian Audiences to reach households based on energy usage, sustainability interest, and tech adoption.

Learn how first-party data activation improves relevance, efficiency, and measurement in 2026.

Kevin Dunn has been Chief Revenue Officer at Experian Marketing Services for one month. Here are his thoughts on his first 30 days.