Monthly Archives: October 2021

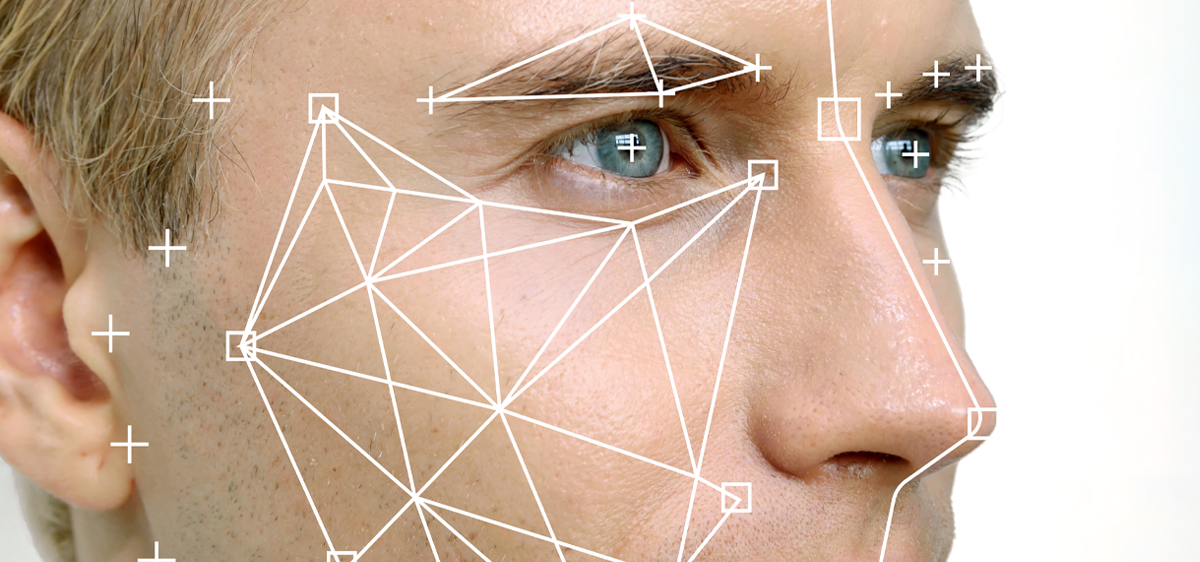

What is a deepfake? Fraudsters can distort reality by manipulating existing imagery to replace someone’s likeness. How does AI deepfake technology work? Artificial neural networks are computer systems that recognise patterns in data. A deepfake can be created by feeding hundreds of thousands of images into the artificial neural network, which tarins the data to identify and reconstruct face patterns. Adoption of more advanced AI means less images and videos are needed allowing fraudsters to use these tools at scale. How to detect a deepfake Jerky movement. Shifts in lighting from one frame to the next. Shifts in skin tone. Strange blinking or no blinking at all. Poor lip synch with the subject's speech. What businesses can do Use emerging authentication technology in video. Deploy AI and machine learning to detect deepfakes. Apply a layered fraud defence strategy to better identify deepfakes.

One of the most exciting things about financial services innovation is our growing ability to deliver personalized customer experiences. For example, consider a customer who enters a shopping center during the holiday season. By leveraging decisioning software, lenders can proactively offer that customer more credit—in real-time. The person has the financial ability to get what they need and doesn't have to experience a rejected transaction based on previous credit availability. What's behind such personalized offers? They are powered by the latest data—information that goes far beyond traditional credit ratings and references. For the holiday shopper, that may include geolocalization and behavior data that project a customer's likelihood of reaching a credit limit while shopping. The information empowers lenders to provide that personalized experience at the exact right time. But to make that possible, the data must be interoperable across systems, analytical and operational environments, and third-party data providers. Looking ahead, the financial service companies that enable this interoperability will be able to innovate faster, compete better, and scale their personalization to ultimately win more business. Why interoperability matters Our most recent Global Decisioning Research Report denotes consumers' evolving expectations and the increasingly vital role data and analytics play in meeting their needs. Financial service companies must leverage data to understand customer circumstances better, changing risk profiles and emerging credit needs, especially as we move out of the pandemic. Indeed the right data can help lenders support customers across their entire journey. But utilizing data to improve the customer experience is not as straightforward as it seems. The amount and diversity of the data available are huge. And the data required to power personalized products and experiences are not always readily accessible, well-formed, or high quality. As a result, data integration projects often take longer and cost more than many financial service companies anticipate. Legacy systems add to the complexity and expense. The evolving open standards for data interoperability are helping alleviate some of these challenges. But companies still need to determine which standards and platforms to use. Selecting the right ones can accelerate innovation and prevent expensive stops, starts, and detours down the road. Cultivating a healthy ecosystem The good news is that these challenges are surmountable. The first step is to understand where your organization is in its data interoperability journey. Then you can create a strategy that makes data-based innovation easier, faster, and more cost-effective. For example, consider: Prioritizing industry-leading open standards for interoperability. Requiring CSV and JSON data formats is smart; both are currently ubiquitous across the industry. Using standard APIs to share data. For example, Rest APIs using Swagger provide a description of the API, the data and facilitate the discoverability and use of the API. Exploring API aggregation services and marketplace platforms. These make it easy for developers to add services and for your organization to put them to use. Leveraging low-code data integration tooling. This helps you remove data silos and empower staff to navigate older, traditional data integration methods until they evolve to use open standards. These actions can make a significant impact on your company's ability to take advantage of various data sources now, as well as set your organization up for the future. Data meets decisioning Selecting the right decisioning software is a crucial way to facilitate the steps noted above. As you consider decisioning solutions, look for products that allow you to publish and consume data using open APIs and simple visual drag and drop approaches. In addition, evaluate the core data management capabilities of potential solutions, and prioritize those that can natively also support semi-structured data. For instance, applications that allow you to leverage frequently changing data sources ensure that when a source evolves, only the specific areas loading the data are impacted—not the wider solution. Lastly, as mentioned above, solutions that provide lightweight, low-code middleware allow you to leverage third-party data no matter where you’re at in your interoperability journey. Those new sources of data will inform and enhance your customer's experience. Stay in the know with our latest research and insights:

Did you miss these September business headlines? We’ve compiled the top global news stories that you need to stay in-the-know on the latest hot topics and insights from our experts. Lending in a Two-Lane Economy Harry Singh, Senior VP, Global Decisioning, features on this CU Management podcast, discussing ways in which Credit Unions can best serve their customers with loans and other products within what Experian's latest research refers to as the two-lane economy. The deepfake-scape: How to fight fraud in the digital age This Biometric Update article by David Britton, VP of Industry Solutions, looks at why deepfakes are a big risk to businesses and consumers, and how fighting fire with fire in the form of artificial intelligence and machine learning can be the best form of defence for organizations. Focus on Data, Advanced Analytics and Decisioning Creates a Winning Strategy for Experian Global Banking and Finance announce that Experian has been ranked number 11 in the IDC FinTech Rankings Top 100 which highlights the top 100 global providers of financial technology, with the piece referring to Experian as a “rising star.” The Rise Of Voice Cloning And DeepFakes In The Disinformation Wars Forbes's Jennifer Kite-Powell uncovers that although deepfake fraud is dominant in social media, it is quickly moving into business sectors. Kite-Powell talks to David Britton, VP of Industry Solutions, about what businesses can do to counteract deepfake fraud tactics like voice-cloning. Shri Santhanam talks AI in lending On this Fintech One to One podcast from Lendit FinTech News, Shri Santhanam, Global Head of Advanced Analytics and AI, talks about how lenders in the FinTech space should be using AI and machine learning, and what key trends he has encountered through the years, and what we might expect to see in the future. Stay in the know with our latest insights:

The pandemic accelerated the number of digital interactions in finance. Typical methods of managing finances, connecting with lenders, and buying goods and services were much harder due to lockdown measures, so consumers went digital, including large numbers of non-digital natives. As the demand for online banking and services has intensified – moving from a necessity to a preference for many - pressure on businesses is twofold. They must rapidly build new and better models to onboard customers and create a more dynamic customer journey. In many markets, doing so is the biggest competitive differentiator right now. Creating a dynamic digital journey and understanding the customer With Millennial customers becoming a bigger influence in the space, organizations were always going to have to plan for a slicker and quicker digital customer experience to keep up with expectations. The pandemic simply accelerated this, forcing businesses to rapidly react. In fact, although 9 in 10 businesses have a digital customer journey strategy, 49% of those businesses only put this in place as Covid-19 began according to research in our Global Decisioning Report 2021. This did help them improve in some areas, including access to quicker customer service responses online. But without the right technology in place, it is not surprising that 55% of customers surveyed said they expect more from their digital experiences. Such a rapid shift has exposed weaknesses around agility, leaving traditional institutions trailing Fintech competitors further down the digital transformation road. However, whilst Fintechs have the benefits of agility, traditional, established lenders have large amounts of customer data from which they can target and tailor existing customer journeys more effectively. Improve the digital onboarding process Optimizing the digital experience for new customers from the beginning encourages usage and, ultimately, loyalty. A stress-free and fast onboarding process is an expectation for the younger generation but can also capture the ‘new to digital’ group migrating online. Bio-metric recognition technology, instant document verification, and auto-filling customer data are far more appealing than entering hundreds of data points, and can boost efficiency and reduce friction. The problem is businesses rightly want to make sure they can remove any bad actors to reduce risk and prevent fraud. The key is doing so without disrupting the genuine, low risk customers. Building better models to onboard customers Covid continues to shift population demographics due to factors such as job losses, furlough schemes and migration of workers to alternative sectors. There is also the realization of pent-up demand for property and vehicles, in particular - among those fortunate enough to be less impacted - such as those able to save more as they work from home. This has led to a change in the demand for finance with a need to tailor experiences to specific customer requirements. As the number of credit needs grow, lenders must have a structure in place that allows them to scale and handle the increased volume. New models must also be introduced to allow organizations to access extensive data insights and ensure they are reflecting the ‘new normal’. As businesses move away from sampling towards models that are based on full populations there must be a marriage of technology with data. Data is ultimately captured for the benefit of the lenders, helping them to gauge risk and tackle fraud. But a blended, multi-layered approach in which customers are only asked for the information specific to their individual circumstances – at the appropriate time – can provide a positive and tailored onboarding process. Having solutions in place that combine risk-based authentication, identity proofing, credit risk decisioning and fraud detection into a single platform ensures all checks can be carried out in one place with minimal disruption to the onboarding journey. Putting businesses in first place Online experience and credit and fraud risk management need to be more closely entwined. As the demand for a simple and fast experience intensifies, a digital-first approach that puts businesses ahead of the game must involve embracing the right technology that supports the entire customer journey. Download a copy of the eBook here. Stay in the know with our latest research and insights: