Credit Management

In this week's guest post, Scott Blakeley shares perspectives on a growing trend in business - Terms Pushback (TPB). Scott is the founder of Blakeley, LLP, a noted expert in the field of creditors’ rights, commercial law, e-commerce and bankruptcy law. Scott regularly speaks to industry groups around the country and via monthly webcasts on the topics of creditors rights and bankruptcy. After a slow sales quarter, a large retail clothing store needs to improve their working capital and cash flow. Before the 2008 recession, the retailer likely would have turned to traditional business credit options. However, after the downturn, lenders changed their qualifications and terms, making traditional credit options a much less desirable option. In some cases, retailers, especially midsize or new businesses, can no longer even qualify for traditional credit sources. Businesses are now increasingly renegotiating their payment terms with suppliers through a program called Terms Pushback (TPB). When a jewelry retailer reviews its payment terms, for example, it sees that the main vendor supplier for jewelry currently requires payment 15 days after delivery. As a deliberate strategy — which is different from a company not having the money to pay its bill — to give the retailer more working capital, they reach out to ask the supplier to change the terms to 30 days. This means they would have access to the money paid to the vendor for 15 days longer; this process is often referred to as trade credit. Credit Today found that the most common extension is for 16 to 30 days, with 45% reporting this range as the most common extension. Impact of Terms Pushback on Suppliers While TPB improves cash flow for customers, it causes issues for suppliers because they must wait longer for their payment. Many consultants are now actively recommending TPB as a best practice. Because international companies more commonly using this strategy, many U.S.-based companies are adopting it due to international influence. Companies operating as middlemen between retailers and manufacturers often face the biggest challenges. Longer terms mean that they have less capital to buy more products and have a higher number of outstanding receivables. Additionally, businesses have lower cash conversion metrics, which can hurt publicly traded companies and cause concern for shareholders. According to Credit Today Bench-marking, 19% of suppliers always or usually say no to requests for extended terms, and 3% usually agree. Interestingly, 4% report that their answer depends on customer size — yes to large customers and no to small customers. However, the majority (63%) of businesses review the requests on their individual merits. However, denying the request often has long-term ramifications. If the business denies the request, the customer must pay or suffer credit damage. Customers often get around this by paying late enough to improve their own cash flow but before credit damage occurs. Even more challenging, suppliers are often hesitant to report customers to credit bureaus because this often permanently damages or even ends the relationship. If a supplier denies the request, the majority of options to get the payment are punitive. For example, the supplier can charge a late fee for payment. However, the customer may still decide that the value of the money for the extra days is worth more than the late fee. Other avenues include implementing a credit hold, having two price lists, terminating credit, firing the customer and reporting the customer to industry groups. However, each of these options permanently damages and probably ends the customer relationship, which may result in loss of a high volume of sales. Effectively Managing Terms Pushback with Supply Chain Finance Programs Supply Chain Finance programs are asset-based lending programs structured to improve a customer’s payment terms, reduce costs and improve cash flow enabling financial institutions to pay suppliers for invoiced services. Suppliers can benefit from SCFP as it receives payment within normal terms or earlier which helps keep the credit team’s credit scoring and risk models consistent. The customers benefits as well as their capital is not tied up in day-to-day operational payments and creates more reinvestment opportunities. When a company receives a TPB request, the first step is evaluating the customer — their credit, the risk, the volume of business and the value of the relationship for the supplier. Often, larger companies have an advantage over smaller companies when negotiating term extensions because their business relationship is worth more to the customer than the monetary value of the shorter term. Here are three best practices to managing TPB requests: Offer incentives for shorter terms. Instead of punitive actions, consider giving customers who pay within shorter terms a discount or an annual volume discount for consistent payment with shorter terms. Actively monitor threshold for customers with extended terms. Suppliers must effectively manage their own cash flow to make payroll and other expenses. By extending too many customer terms, suppliers can jeopardize their own financial stability. Create a team to evaluate requests. By establishing a process to handle the requests and a team to formally evaluate requests, suppliers can more effectively evaluate all aspects of the decision, such as the risks of extending to its own financial health and the risk of losing the client relationship. With a team made representing stakeholders from different departments, all perspectives can be represented and considered. As TPB becomes more common as a strategy, suppliers must proactively create a process to manage requests. Often, extending the terms can improve the customer relationship and even increase the amount ultimately paid. By creating a team and strategy, suppliers can make the smartest decision and actively manage pushback requests. Scott Blakeley is a founder of Blakeley LLP, where he advises companies around the United States and Canada regarding creditors’ rights, commercial law, e-commerce and bankruptcy law. He was selected as one of the 50 most influential people in commercial credit by Credit Today. He is contributing editor for NACM’s Credit Manual of Commercial Law, contributing editor for American Bankruptcy Institute’s Manual of Reclamation Laws, and author of A History of Bankruptcy Preference Law, published by ABI. Credit Research Foundation has published his manuals entitled The Credit Professional’s Guide to Bankruptcy, Serving On A Creditors’ Committee and Commencing An Involuntary Bankruptcy Petition. Scott has published dozens of articles and manuals in the area of creditors’ rights, commercial law, e-commerce and bankruptcy in such publications as Business Credit, Managing Credit, Receivables & Collections, Norton’s Bankruptcy Review and the Practicing Law Institute, and speaks frequently to credit industry groups regarding these topics throughout the country. He is a member on the board of editors for the California Bankruptcy Journal, and is co-chair of the sub-committee of unsecured creditors’ Committee of the ABI. Scott holds an B.S. from Pepperdine University, an M.B.A. from Loyola University and a law degree from Southwestern University. He served as law clerk to Bankruptcy Judge John J. Wilson. He is admitted to the Bar of California.

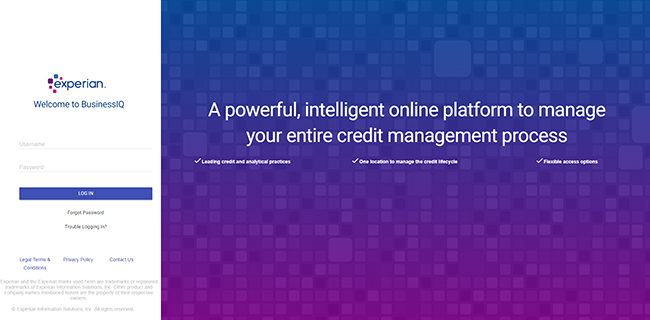

Today we are very proud to be taking the wrapper off the next generation of our flagship commercial credit management application, BusinessIQSM 2.0. To meet the ever-changing needs of our clients, we continue to grow and modernize with them. This innovative and powerful analytical web-based application is designed for commercial enterprise and small-business risk management. From the new interface and side bar navigation to enhanced search and match technology, to judgmental and rules-based scorecards, all the way to custom model scores, Experian’s BusinessIQ 2.0 has something for everyone. Let Experian meet you where you are and take you to where you want to be. BusinessIQ 2.0 Overview In this video we highlight some of the key features of BusinessIQ 2.0. Learn more by going to:

As a Senior Consultant with Experian Advisory Services, Gavin Harding works closely with many of Experian's FinTech and Financial Institution clients to find solutions to complex problems. We sat down recently to talk about bank partnerships, how they come about, what makes them successful, and how Experian supports them. Do you see a lot of collaboration between banks and FinTechs? The latest statistics show that 67 percent of banks and FinTech’s are either currently cooperating, or in discussions about cooperating, or exploring collaboration. So, yes a very significant proportion are considering collaborations. Why collaborate at all? You know it's interesting, they have different skill sets, different assets, different backgrounds. So for example; banks have really deep, broad customer relationships. You know think about your Mom or Dad bringing you to your local bank to open up your first account. Think about your student loan. Think about your mortgage. What kinds of relationships exist? So banks have really deep and broad relationships. But traditionally the experience with banks has not necessarily been great in terms of turnaround, in terms of the friction or pain involved in getting a loan or opening an account. On the other side, FinTech’s are really good at that customer experience. They describe it as either low or no friction. So very quick turnaround times. But they're very much transactional-focused, meaning single products. So FinTech has the technology and the experience, and banks have the depth of relationships with customers. You bring those two parts together and you've got a pretty amazing potential opportunity. There are as many relationship types shapes and sizes as there are people on the planet. Everything from cooperation on basic operations, meaning, a FinTech takes applications for a bank and then passes them on. All the way over to full-fledged integration of systems, personnel, capabilities, skill sets, and so on. So pretty much the broad spectrum. What works well? So it works really well when they are well-matched. So what I mean by that is, when the skill sets from one organization match the other. When one enhances the other, and it works really well when there are long and detailed discussions and preparations for the relationship. Meaning, they align and discuss goals, objectives, what each organization's role is, what each brings to the table, and very specifically how they are going to cooperate. What are the pitfalls? Well, the same pitfalls. So the pitfalls are that the relationship goals differ, or aren't aligned, or that one organization feels like they are bringing more to the relationship and that the partnership is equal, or when it feels as if each partner, each organization is not getting value from the relationship over time, and once again that reinforces the need for those detailed discussions before getting into that partnership or relationship. How does the process work? So it begins with a discussion. I've seen these partnerships start with a discussion over dinner at a conference. I've seen them start through a LinkedIn connection. I've seen them start over coffee. So it really starts with an exploration of who's out there? What organizations may be interested in even discussing some kind of collaboration? So it starts with the conversation at the very basic level, even when we see in the Wall Street Journal major strategic alliances between organizations, starts with people, and starts with that very simple conversation and connection. What are some key elements to be aware of? Well again it comes down to what each party brings to the relationship and what the goals are. So a good alignment of the capacity of skill sets, an alignment of investment in terms of time and resources, and very specifically a definition of who does what, what the accountabilities are, and what everybody's expectations are. They are fundamental to the success of any type of business arrangement or partnership. How does Experian support these partnerships? So the interesting thing is we have very deep relationships with both sides. So we bring data, solutions, consulting expertise to FinTech’s and to banks. So, it's really interesting we find ourselves in the middle of a lot of these conversations, and how we help is by understanding systems, technology, data, the best of both organizations involved in the conversations, and how to bring all of that together for a good focused efficient successful outcome. A couple of years ago this was new meaning that banks saw FinTech’s growing, and kind of looked at them a little bit maybe as competition, as potentially the enemy, FinTech’s saw themselves as disrupting the world and completely innovative and new. What's starting to happen is both sides are coming together, realizing that they are both part of the same financial industry, serving the same customers, maybe in different or new ways with different products. But in the same industry. So there is very much a coming together, an alignment a co-mingling, consolidation of all these various aspects of the industry. And I think it's really positive for consumers. More products, more quickly, and a better experience overall. Do you think a FinTech's ability to create more dynamic mobile experiences is a key element Certainly and so the big question we help banks answer in this space is, do we build it? Do we buy it? Do we partner? and build and buy or partner refers to the technology the infrastructure and the experience. So if you have a pretty big bank and they've got a old website, old process, lots of paper, lots of regulations, lots of pain in the process. Well they can look at one of the more advanced sophisticated mature FinTech’s and essentially use their platform, their engagement, their data, connect that to the bank's customers and in a very very short time transform that experience in a very positive way for their banking customers. Learn about FinTech Lending Solutions

When you’re launching a new product, business line, or starting up a business, you’ve got to move fast and break things. This means taking a minimum viable product (MVP) approach, where you’ve got to sacrifice scalability by implementing manual processes to support the early-stage business. Commonly, a manual process will be in place for credit applications and approvals – pulling the credit report, reviewing the data against a scorecard or policy, and then making the decision. Since this likely takes a day — or often longer — the process decreases your customer’s experience, and can hurt your ability to scale and grow revenue the longer you wait to automate. To grow the business and take it to the next level, you need to migrate away from the paper-pushing approach. The next step is to move toward an automated solution that integrates credit decisions with the back office, such as an ERP, CRM, or another custom system, employing APIs. Using an Application Programming Interface (API) to Connect to Your Decision Engine An API, or Application Programming Interface, is many things. It’s a set of instructions and technical documentation for developers. It’s a collection of services that allow you to interact with a product or service. And it’s a way for businesses to open up and allow for new kinds of innovation – allowing for new business models and application development that wouldn’t be possible without APIs. In the last decade, APIs have become system agnostic, meaning they plug-and-play into nearly any system because they are standardized and popular amongst the development community. Because of this popularity, APIs make it easier for the business to get buy-in from the IT department, which is essential to automating the credit decisioning process. Without an API, the IT department must devote significant resources to the project because more infrastructure to host large database will be required. APIs allow you to pull data in real-time only when you need it, reducing system complexity and decreasing application development costs. Reduced complexity also means less risk because you are more assured that your IT department will be successful with the integration. Often, when IT departments are presented with information about the API, their response is “No problem, this is standard. We have integrated with a very similar API before. We can do this.” How does your decision engine interact with APIs? You can use APIs to get the raw data elements your credit policy or model needs to render a decision, no matter if the data is internal to your business or provided by third parties. Taking Decisions to the Next Level with Machine Learning According to a recent Harvard Business Review project, the key to successfully utilizing machine learning isn’t to get caught up in new and exotic algorithms but to make the deployment of machine learning easier. There are many use cases where machine learning can be employed, but use cases where data-driven decisions are being made, as in the credit approval process, are archetypical. During the early stages of the machine learning process, you train the model by feeding it data from past applications. Then, as you use the engine for real-time processing, the engine learns from past decisions. If the engine was originally approving applications with a borderline credit score but found that these applications often ended up being poor risks, the model would then begin turning down these applications. The key ingredient in making machine learning start to work for your credit department is to have domain experts, credit managers, help the IT department focus on the key variables that can help the machine learning model to predict key outcomes – credit losses, bankruptcies, and business failures, and to put the models through many rounds of testing and validation before putting them into real-life practice. Now is the time to move your manual processes online using an API and machine learning. According to Mary Meeker’s Annual Internet Trend Report, 60 percent of customers pay digitally compared to 40 percent in the store. And it’s likely that the gap will continue to grow. The longer you wait, the further ahead your competitors will be in digitizing the customer experience — and the harder it will be to regain your footing and catch up.

For credit and risk managers, how effectively you manage your book of business can sometimes be the difference between tirelessly chasing after accounts for collections or proactively growing your portfolio. Though there may be many factors that affect your specific credit risk management process, the underlying goal to reduce and manage your exposure to risk does not change. To help you successfully manage your portfolio, we address 4 common mistakes you need to avoid: 1. Not automating your processes By not having an automated, standardized method of assessing your current accounts, overall portfolio exposure to risk increases substantially. The manual review process relies too much on shrinking human capital, requires more time to complete, and can cause inconsistencies across the board. Automating processes where you can will help you focus your resources to the applications and accounts that need attention or manual review. 2. Not setting up triggers that alert you of key events When you know problems are coming, you can take steps to protect yourself and your business. The sooner you know about something, the faster you can act on it. Setting up triggers that notify you of key changes within your customers’ accounts like a rise in late payments, increased number of collection filings, or bankruptcy filings, allows you to keep a close eye on your customers and take immediate action, if necessary. Especially when your portfolio outgrows your resources to manage it, setting up automated triggers can give credit and risk managers the foresight to manage proactively, rather than reactively. 3. Not monitoring for risk (or growth) Managing a large portfolio can be extremely labor-intensive if you don’t apply risk scoring. A traditional risk score, in this case, usually considers the credit, public record and demographic attributes of the account, and applies a value to the results as a means of quantifying risk. This helps you prioritize your time and efforts on the minority of customers with scores that signify increased credit risk, rather than all your customers at the same time. On the flip side, you can target accounts with positive scores for growth opportunities. 4. Not segmenting your portfolio Another common mistake that many portfolio managers make is not segmenting their portfolios to identify insights at a macro level. For instance, leveraging data to segment your customers and accounts by industry, business type, business size, etc., can help you uncover hidden trends not obvious otherwise. This then allows you to apply appropriate treatment strategies to mitigate risk within the accounts. Additionally, you can identify market opportunities for growth using SIC/NAICS codes and other marketing data sources to grow your footprint. Want to talk to an Experian expert regarding your portfolio management strategies? Contact us today.

When a new customer wants to establish credit terms with you, the first thing they’re asked to do is fill out your credit application. When you hand over a paper application, did you know you could be negatively impacting your revenue or creating a poor customer experience? Some companies don’t. More than likely, your customer has filled out at least one digital application in the past. The initial perception your application says about your company is that you’re out of step with technology — which may lead them to wonder where else you may be lagging behind. Digital applications provide a simplicity factor, and by not offering one, your credit approval process is perceived to be more difficult, leaving the customer with more work to do —spending extra time writing their information by hand and returning the application — either by email, fax, or in person. Because many companies have already moved to a digital application, your pen-and-paper process sticks out to the customer — and not in a good way. Not to mention, manually processing a paper application takes longer — often much longer — than a digital application. This means customers leave without a credit approval, giving them time to change their mind about their purchase or find a better deal — meaning you just lost a new sale. And even if they still choose to work with you, their relationship with your company starts out with a less-than-amazing customer experience. After the paper application is completed, the workflow process is often time-consuming, error-prone, and cumbersome. The time involved also means that your company waits longer to receive revenue from the sale. By using a manual process, your team spends hours on processing and decisions that could be better spent directly servicing customers or working on other initiatives to grow business. DecisionIQ from Experian automates consistent real-time decisions, streamlining your entire process from applications to onboarding.

All business customers are not created equal. Even companies that look solid at first glance can hide festering problems that eventually can impact your bottom line. Successful credit management requires you to carefully evaluate the financial health of every business that asks for credit terms. Here are 5 questions you should be able to answer before extending business credit: 1. Is the business what it claims to be? Sometimes, companies needing credit will provide inaccurate information to win approval. Before opening an account, you need to confirm the applicant‘s bona fides, including its location, size, number of employees, annual revenue, years of operation and similar financial indicators. 2. What is its payment history? Although past performance does not guarantee future results, a company’s payment history is often a strong indicator of how it is likely to behave in the future. Pulling a business' credit report can easily provide you a snapshot of a company's payment history as well as other risk measures. 3. Are there hidden factors that could affect its ability to pay? Are there pending judgments, lawsuits, bankruptcies, regulatory citations or other “red flags” that could make it difficult for the applicant to meet its obligations in the future? This is another area where a business' credit report will be a key factor in helping you uncover a potentially risky business. 4. How much credit should you extend? All credit contains an element of risk, but you can mitigate that risk by limiting the amount of credit you extend based on factors such as the customer’s sales volume, debt to-asset ratio and similar aspects. 5. Under what terms should you extend credit to this customer? You can mitigate risk further by carefully calibrating the combination of interest rates, minimum payments and other contract terms based on each customer’s individual financial metrics.

Here at Experian, we work with many clients whose customers and suppliers operate all over the world, and one of the biggest challenges for many is being able to detect financial duress by monitoring companies whose headquarters are outside of the United States. Early identification of negative activity helps your company prevent lost revenue and service interruptions, it also helps minimize reputational damage caused by doing business with a company in violation of U.S. laws. These early notifications can also help mitigate the effects of changing economic conditions while growing new business opportunities with lower risk. Today we are thrilled to announce that Experian’s commercial alerts now enable you to monitor more businesses in more countries with greater precision. Experian now offers 25 alerts on 8 countries in Western Europe, with 8 more countries coming soon! These international alerts offer the ability to stay up to date on changes such as: change in ownership, business name and address, as well as changes in credit limit, balance sheet information, and company status and much more. Proactive notifications empower you to act quickly and mitigate risk, collect on overdue amounts and retain your best customers. Want to know more? Contact us today so we can start helping you reduce the risk in your growing business. International Reports & Resources

This week for Business Chat | Live we interviewed Peter Bolin about business owner wealth, and how lenders are finding new ways to evaluate entrepreneurs in the underwriting process. Gary: Today we're going to have a discussion on business owner wealth and evaluating business owner wealth in risk models. Joining me today is Mr. Peter Bolin. He's the Director of Analytics and Consulting for Experian. Good morning Peter. Peter: Good morning Gary. Good morning everyone. Gary: Let's just kick off this discussion. Business owner wealth and small business owners and evaluating risk. What's it all about? Peter: Yeah, thanks Gary, thanks everyone. As I travel around talking to a hundred clients a year, one theme that always comes back is, "Hey Pete, can you and Experian help us get to yes?" We know that there is a pool of small businesses, a pool of small business owners out there that are small, that are emerging, that are cutting edge, maybe not solid yet, but they don't have a credit file, what we typically call maybe credit invisibles or maybe thin files, but we know that they have a good idea, we know that they've good product and services, but we can't approve them. Is there anything you can do to help us get to yes? At Experian we got to thinking about that. We have a tremendous amount of data assets as everyone know. We looked around and we said, "Hey, there is this new product that we have called the Wealth Opportunity Score," and that estimates, based on our proprietary database, the wealth of an individual. We got to thinking, does wealth of a business owner affect the opportunity to be approved? That's what we're here to talk about today, Gary. Can we use the Wealth Opportunity Score on a business owner based on a sample of our data, we have some great results, and we definitely feel that we can help lenders, wholesalers, target marketers, get to yes. Gary: Okay. So you mentioned getting to yes. What does that mean in terms of say, a new business or a business that has say, a very thin credit file? How does that work? Peter: The first thing that we do when we're evaluating any new data source, and while wealth insights have been at Experian for a year or two, it's new, we're introducing it for the first time to the commercial space for the business owner, the first thing we do is say, "Okay, can we get a predictive lift by using this data?" The answer is yes. In particular, can we use this in the thin file, in the very, very small, emerging businesses that maybe we could refer to as the credit invisibles. It's kind of an overused term. Invisible to who? So, we're using this in this example as credit invisible are a very thin file or maybe have no file on the commercial credit report. We took a sample of business owners in that population and we added this Wealth Opportunity Score as an attribute within our demographic only segment, and we said, "Yes, indeed, this does help the predictive power of that segment." Going from a KS of a 16 to a 23. A KS for those of you who might not know, that's the Kolmogorov-Smirnov statistic, that's the industry standard for measuring the predictiveness of the model, the higher the KS the better the separation between the goods and the bad. We're seeing that yes, by just including this data, on the credit invisible/thin file, that segment was able to improve the predictive power by 43%. Gary: Wow, that's incredible. So, we discussed the better prediction of risk using the owner wealth. What does rank ordering have to do with that, and why is that such a big deal? Peter: As quant jocks sometimes we get overly, overemphasize the KS, the rock, the Genie, area under curve and those are all important statistics, but we can't forget about another critical part, which is the stability of the model. That's where we look at how well it rank orders. We'd like to see a nice, smooth monotonic progression in the rank ordering of the bads throughout the decile. We would like to see a large number of bads pushed down to the riskiest scoring, and fewer number of bads pushed up to the least risky. As you can see, when we added the Wealth Opportunity Score to our demographic only file, we got a nice, more smooth monotonic progression, which says not only do we get lift like we talked about in the first slide, but we're also improving the stability of the model, which is very, very important. As you can see, it's still a little bit choppy. Some of you might say, the skeptics out there might say, "Gee, Pete, this is all pretty choppy." However, keep in mind this is a demographic thin file, not much to go on other than some key demographic items, but by adding the Wealth Opportunity Score we're able to increase the predictiveness and the stability of the model. Gary: Wow. Okay, so there's been a lot of talk about women-owned businesses, minority-owned businesses lately. How does wealth play in the role in accessing credit for minorities, and in particular women-owned businesses? Peter: Absolutely. Gary, that's a huge topic right now, access to credit. Do minority-owned businesses and especially women-owned businesses have access to credit? We're also looking at data to help evaluate that. The next thing we did was, we were curious. Okay, is there a difference between a male-owned business and a female-owned business when it comes to wealth? Really, if you look at the bottom two lines on the curve, you see that there's really not. They're pretty similar. They are fairly similar. There is some blips on the lower side, so if you're looking at the left side of the graph, you do see where that pink line is the female owner, they do tend to have slightly lower wealth, and that's measured on the first Y axis. What we're saying is that there's really no difference. If you're looking at wealth, there isn't much difference between a woman-owned business and a male-owned business, so that should not be a prohibitor in access to credit. The other thing that we looked at on the other, secondary X axis, is the whole concept around annual spend. This is annual spend on the business owner personally, not the business, so I just want to make that clear. We looked at that, and we saw similar trends, that there really wasn't much difference in spending except in the very, very high quadrant up there, there was a little bit of difference in the extremely wealthy. Actually, it says that male owners, male business owners, had much more annual spend. So, not only were we introducing the Wealth Opportunity Score, which is a new concept in commercial lending, we're also looking at the total plastic spend on the business owner personally, which we found is a very powerful indicator, especially when you're trying to target market. Gary: Excellent. Okay, changing gears a little now, to target marketing and how does wealth help with those that are maybe in the market for credit? Peter: Well, it's very interesting Gary, because what we find is that there's an inverse relationship between wealth and in the market, so very, very wealthy owners are not as in the market based on our in the market score. We have a business credit seeker model, which predicts the likelihood that someone's going to open up a new trade, so, that they're in the market. They're really serious about it. We threw these attributes and this scores into that model, and what we found is that intuitively I think that it makes a lot of sense as well. What we see is that lower wealthy business owners are more in the market, right? They don't have any personal wealth. They need capital. They need access to capital. They're anxious to get capital. There's a higher percentage of the lower wealth spectrum that are looking for credit. However, however, that's not to say that the high end, so if you look at the very high end, three million or more in wealth, there's also a percentage, 9.5% of the population that are also looking for credit. They could be a small business, they could have two employees or less, they could be around for two years or less, but they have high net worth. They might be invisible on the commercial side and this Wealth Opportunity Score will definitely help them, help lenders and wholesalers get to yes. Gary: Are there other particular industries that you recommend targeting with the new business credit seeker model? Peter: Sure, that was the other kind of thing that was surprising to me, I'll be very frank. This surprised me, because when we looked at the industries and then we plotted the risk scores, and then we plotted the bad rates, and then we looked at the wealth of the individual, or sorry, not the wealth at this particular point. What we're looking at here is the actual in the market. What we found is that the industries that have the highest in the market percentage, which is measured on the blue bar, and then we look at their average IPV2 score, that's Experian's commercial risk score predict a likelihood of a trade going 91-plus, we see a convergence that the agricultural, wholesale trade and mining industry, which surprised the heck out of me, were the three industries that have the highest percentage and likelihood to be in the market, and also had the highest IP score, which means they have the lowest risk. The mining industry in particular, Gary, is shocking, because over the last eight years, without me getting too politically sensitive, that industry has taken a battering in the last nine years. Big cuts, big cutbacks, in traditional coal mining, and what we're seeing now, with some of the new administration's outlook on mining, the regulations are coming off and we're predicting that this could be a very big growth opportunity for our clients in terms of marketing, in terms of wholesale credit, traditional lines of credit, and traditional term-type credit. The mining industry in the market and a very high IPV2 score, and later on we'll see also some interesting wealth information about that as well. Gary: Excellent. You talked about credit scores. What about bad debt rates and industry targeting? Can you talk a little bit about that? Peter: Yep, very similar results. We also wanted to look and see what the bad rates were for each of these industries to give the viewers an opportunity to see this trend. This is also the exact same thing as you saw with the score, relatively low risk. Agricultural, wholesale trade, mining again, when you look at their bad rates as measured on that secondary axis, but high in the market. Very, very surprising to me, once again, I did not expect to see especially the mining, given the fact that they've been hammered the last nine months, so again, if you're looking about low-risk industries to target, those are the three that I would recommend. Gary: Does owner wealth matter in these industries in particular? Peter: It does, it does, especially again in the mining industry. You see some interesting wealth statistics. If you look at the distribution of the Wealth Opportunity Score, which once again, predicts the wealth of the business owner, or the individual but in this case we scored it with business owners, you see some blips. Those yellow bars, some blips, and as you can see, there's also a tremendous opportunity really up there in that big, look at up there, there's a significant percentage in all three of these industries, but particular mining industry that have extremely high net worth. We already know from previous slides that they have low risk, low bad rates, so again, the mining industry, high wealth, high scores, low bad rates, again, another indication that using this data can help you get to yes. Gary: What about micropreneurs, you know, these businesses that are just emerging, just getting started, they're credit invisible, right? Does the business owner wealth factor come into lending and risk models? Peter: Certainly, and the whole concept of a micropreneur, that's kind of a new term, I'm not even sure it is a word, but maybe we invented it, the micropreneur, a great concept, very, very small businesses. It's not uncommon, Gary, that I get the following statement made to me when I'm talking to clients: "Pete, we don't approve anyone that's been in business for two years or less. We don't approve anyone that has two employees or less. We don't approve anyone who's a sole proprietor. We want to avoid those type of businesses," and I would urge all of the listeners and all of the viewers to think a second time about that, because even if you look at the far right-hand side bar, there are 28% of the population with three million or more in estimated wealth, 28% of that population have been in business or have one or two employees or less. That wealth could be used in your personal guarantee situation, that could be used as collateral. The other nice thing about the Wealth Opportunity Score before I forget is actually evaluating the net worth of an individual. It gives you the opportunity to verify that. It's very common in these situations that if a small business, one or two employees or less, goes in for an application, applies and they have to have a personal guarantee, and they say, "I'm worth $3 million," well, how do you know? Well, with this system you can come to Experian and at least get an estimate that that wealth is right, that you've verified that wealth and that you can set your credit limits, you can set your approval accordingly. So again, what does it mean for the micropreneur? It means that if they have wealth, it's another data point that can help you. Gary: It's helping them get their businesses started. It's helping to drive the economy, which is, at the same time this is good for everybody. It's a win-win situation of, it sounds like to me anyway. Peter: Absolutely. You know Gary, the whole concept of what we're talking about today comes from my personal passion, and I know Experian Business Information Services as an entity's passion, to be an advocate for the small business owners. What we talk about frequently. Through this passion, we're looking at all of our data assets. Can we use our data assets for good? And the good is, as small businesses goes, so goes the United States, and I'm really passionate, and I know Experian Business Information Services is passionate about turning over every leaf, every piece to data, that will fuel small business growth and fuel our economy. Gary: That's awesome. Okay, well this has been excellent Peter. I think if folks are interested in this, we just invite them to drop a comment on the video here if you find this on YouTube, or come to our website, experian.com/b2b. I'm sure we can connect you to Pete and his experts in business information if you want to talk about business owner wealth models. Pete I want to thank you so much for taking time out this morning to come on and talk to us about this topic. I really enjoyed our chat, and we'd love to have you back again in the future. Peter: Thank you Gary. I had a lot of fun. My first live TV spot. Gary: All right, thank you Pete. Have a good day, and- Peter: Thank you. Gary: And have a good day everybody. Thank you so much for coming to our live video. As I said, we're just wading into this. We'd love to have more of these live shows. If you've got ideas for live shows, if there's things about business information, things that would help you be more successful in business or evaluating risk, just send us a note on our YouTube channel. We'd be happy to consider that, and maybe put a show together. Maybe even invite you on as a guest. That's it for today, so thank you everyone and have a good day.