Small Business Credit Insights

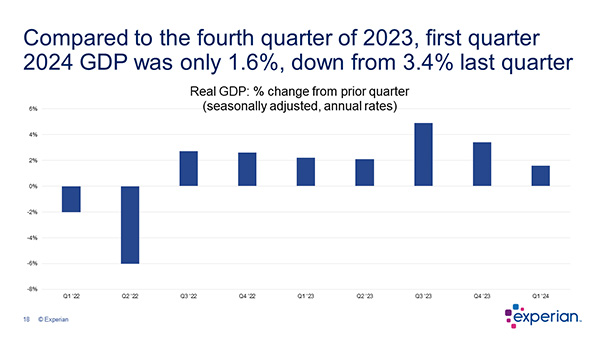

New business formation strong, making accurate credit risk assessment crucial I’m excited to share the current Experian Commercial Pulse Report with you. I have the opportunity each week to analyze data on the millions of U.S. small businesses in Experian’s database and discover actionable insights that benefit our clients. Making these discoveries is rewarding work, and we utilize these insights to guide our recommendations. I thought I would share what I am watching through Experian’s bi-weekly Commercial Pulse Report (just bookmark the link; we will update it on a bi-weekly basis). This week’s report includes a study about the predictive nature of different credit scores, and how well a consumer risk score versus a commercial risk score or a blended risk score works to predict the future risk of a small business. What I am watching: Unemployment increased to 4.1% in June, the first time over 4% since November 2021. The U.S. economy added 206K new jobs in June while job-openings and job-quits continue to trend downward. 424K new businesses opened in May. The high level of new businesses opening makes it critical for lenders to accurately assess credit risk. That’s a quick take – Download the latest report. Download Commercial Pulse Report Commercial Insights Hub

Unemployment inches up as job growth slows I’m excited to share the current Experian Commercial Pulse Report with you. I have the opportunity each week to analyze data on the millions of U.S. small businesses in Experian’s database and discover actionable insights that benefit our clients. Making these discoveries is rewarding work, and we utilize these insights to guide our recommendations. I thought I would share what I am watching through Experian’s bi-weekly Commercial Pulse Report (just bookmark the link; we will update it on a bi-weekly basis). What I am watching: The U.S. population and labor force are experiencing a major transformation Aging Baby Boomers are changing the U.S. labor market. The only age group whose labor force participation rate is projected to rise are people 75 and older. Birth rates declined 50% since 1950. The median employment age is expected to grow from 39.9 in 2002 to 42.8 years old in 2032. That’s a quick take – Download the latest report. Download Commercial Pulse Report

Experian Main Street Report says strength in the economy pushes through inflation. Download for analysis on Q1 small business performance.

Explore effective marketing strategies for insurance agents and brokers to boost ROI and client engagement.

Join Experian for the Q1 2024 Quarterly Business Credit Review as we dive into quarterly small business credit trends June 4th at 10am PT.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

Here are a few quick small business insights from our latest Commercial Pulse Report.

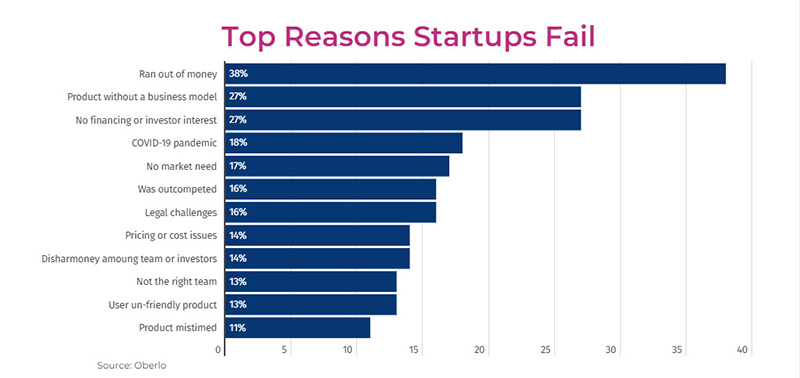

Download our latest Commercial Pulse Report for economic insights and a deep dive on reasons why so many startups fail in first 5 years.

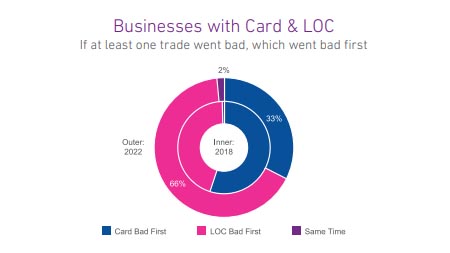

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.