All posts by Gary Stockton

Join Experian for the Q1 2024 Quarterly Business Credit Review as we dive into quarterly small business credit trends June 4th at 10am PT.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

Explore instant decisioning in business automation, an approach to streamline credit decisions integrating data and automating processes.

Explore how batch append credit scores revolutionize risk management and efficiency in financial services, with insights from Experian's Erikk Kropp.

Data is central to modernizing the credit approval process. We discuss useful formats beyond traditional business credit reports and scores.

We're kicking off a series of posts about the path to modernization framework featuring Sr. Product Manager, Erikk Kropp.

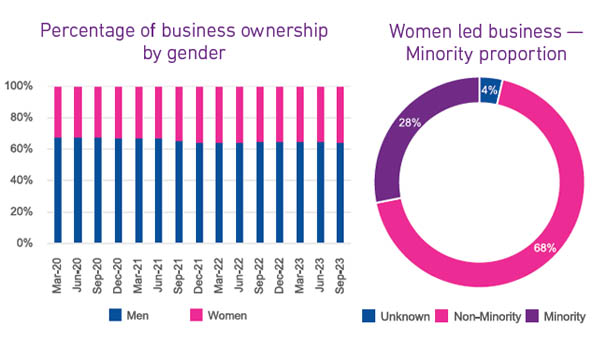

As of recent years, women-owned businesses in the United States have experienced significant growth and have become a substantial force in the economy. It is estimated that there are more than fourteen million women owned business generating over two trillion dollars in annual revenue. The growth in women owned businesses has been fueled by a myriad of reasons, is occurring across all age groups and serves a diverse number of industries. Even with the growth in the number of women owned businesses and the economic impact these business have, women owned businesses are still underserved in the commercial credit markets. Female business owners tend to operate in industries that have a greater need for continuous working capital, thus women owned businesses tend to rely on revolving credit lines. Even with this demand for capital, women business owners are hesitant to apply for financing, and when they do, they are receiving a growing proportion of commercial credit, but the amount of credit granted still trails that of men. The recent growth in women owned businesses could be a driving factor in this disparity. New business have limited to no commercial credit history forcing lenders to evaluate the guarantor’s personal credit. On average, female business owners have a lower consumer credit score, which could be because they are carrying more personal debt to fund their businesses, ultimately decreasing their access to commercial credit. There are a number of factors that when combined, are limiting equal access to commercial credit for female business owners. The good news is that the number of successful women owned businesses continues to climb, and more grants and loans are available to women business owners. What I am watching While inflation in the U.S. is easing, it is still above the Fed’s 2% target. It is widely expected that the Federal Reserve will begin to lower interest rates later this year. It appears that the anticipated recession which led lenders to tighten credit will not occur. Therefore, lenders will likely begin to loosen credit criteria and potentially provide more opportunities for women-owned businesses to obtain the credit they need to operate and expand.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

Retail sales reached a 4-year high of over $615B in December 2023 with yearly retail sales growing 4.6%. At the same time, lenders are tightening credit and businesses within the retail sector are showing signs of stress with higher late-stage delinquency rates and falling commercial credit scores. We see retailers seeking commercial credit less often, new originations slowing and lower lines over the past several months. As retail sales continue to rise so does the proportion of online retail sales. Online sales peaked during the COVID-19 pandemic and fell slightly once the lockdowns were lifted. Online retail sales remain approximately 56% higher than pre-pandemic levels and are trending up and may soon exceed 2020 levels. Growth in online retail sales has led to growth in retail returns. Retail returns peaked in 2022 at over $800MM and over 16% of total retail sales. Prior to 2021, retail returns as a percentage of retail sales averaged 8.9%, since 2021 that rate has grown to 14.6%. As returns increase so do fraudulent returns. Retailers have implemented strategies and solutions to address retail returns which resulted in a decrease in return dollars between 2022 and 2023 yet the percentage of returns that were fraudulent increased from 10.2% to 13.7% or over $100B. Increases in both legitimate and fraudulent returns are prompting retailers to identity solutions and operational strategies to slow growth across all returns. What I am watching: The U.S. economy expanded 3.3% in Q4 2023, and 2023 real GDP increased 2.5% over 2022. Strong consumer spending fueled the economy. Multiple sources are expecting The Federal Reserve to cut interest rates up to six times in 2024 with the rate cuts beginning in Q2 2024 and continuing into 2025. Lower interest rates likely means that consumer spending will continue at an elevated rate. As spending continues to increase, specifically in the retail sector, the need for commercial credit could continue to slow as cash-flows satisfy operational capital requirements. Cash on hand should begin to satisfy outstanding delinquencies, improving commercial credit scores resulting in improved access to commercial credit.