The Commercial Pulse Report | 2/25/2025

The latest Experian Commercial Pulse Report provides a snapshot of the evolving U.S. economic landscape, highlighting key macroeconomic trends and the growing impact of minority-owned businesses. As inflation persists and credit markets tighten, small businesses are navigating a complex financial environment. However, within this challenge lies a significant opportunity—supporting minority-owned businesses, a rapidly expanding sector generating over $2 trillion in annual revenue.

Watch Our Commercial Pulse Update

Macroeconomic Highlights: Inflation, Employment, and Consumer Trends

- Inflation and Interest Rates – Inflation remains a key concern for small businesses, rising to 3.0% in January, marking the fourth consecutive monthly increase and the highest level since June 2024. Core inflation, which excludes food and energy, also increased to 3.3%, signaling persistent pricing pressures across industries. Rent inflation showed some relief, dropping to 4.4%, but food inflation remained high at 2.5%, while energy inflation increased for the first time in six months.

- Employment and Wages – The U.S. labor market is showing mixed signals. The unemployment rate stands at 4.0%, slightly down from December, yet job creation has slowed dramatically. Only 143,000 jobs were added in January, a significant drop from 307,000 in December, marking the weakest growth in three months. At the same time, wages have risen to $30.84 per hour, which may contribute to inflationary pressures for businesses.

- Consumer Spending and Retail Sales -Retail activity has softened, with January retail sales declining 0.9% month-over-month, the largest drop since March 2023. However, year-over-year sales remain up 4.2%, indicating that while consumers are spending more cautiously, demand is still present.

- Small Business Sentiment and Credit Markets – The NFIB Small Business Optimism Index declined to 102.8 in January from 105.1 in December, reflecting growing concerns among business owners. The uncertainty index surged 14 points to 100, the third-highest level on record, suggesting businesses are wary about future economic conditions. Credit access remains a major concern, reflected in the Experian Small Business Index, which dropped to 40.5, down from 42.9 last month and 11 points lower year-over-year. This decline underscores the increasing difficulty small businesses face in securing credit to fund growth and operations.

The Opportunity: Minority-Owned Businesses Are Thriving but Need More Support

One of the most compelling insights from this month’s Commercial Pulse Report is the remarkable growth of minority-owned small businesses. These enterprises are expanding at a much faster rate than non-minority-owned businesses and now represent a significant share of new commercial account originations.

Key Growth Trends

- Over 8 million minority-owned businesses contribute more than $2 trillion in annual receipts, representing a powerful economic force.

- Between 2014 and 2019, the number of minority-owned businesses increased by 35%, compared to just 4.5% growth among non-minority businesses.

- Minority-owned businesses make up 41% of new commercial accounts, up from 37% in 2021, underscoring their increasing role in the broader business ecosystem.

Funding Gaps and Credit Access Challenges

Despite this rapid growth, minority-owned businesses continue to face challenges in accessing credit:

- On average, they receive 7% – 37% less funding across most commercial lending products.

- Businesses under six years old account for 44% of new commercial accounts for minority-owned firms, compared to just 31% for non-minority firms, yet they struggle to secure the funding they need to scale.

- This funding gap is not due to higher credit risk—minority-owned businesses exhibit comparable commercial credit performance to their non-minority counterparts.

Industries Driving Minority Business Growth

Minority-owned businesses are expanding into high-growth sectors such as:

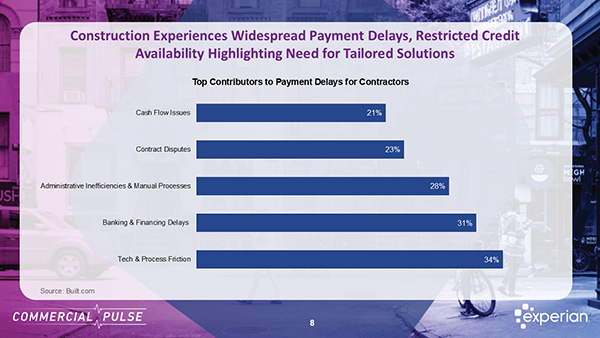

🏗 Construction

🛍 Retail

🍽 Accommodation & Food Services

💡 Technology & Healthcare

These industries require significant upfront capital for expansion, making access to credit crucial for long-term success.

What This Means for Lenders and Policymakers

The disconnect between strong minority business growth and limited access to funding presents a major opportunity for lenders.

- For Lenders: Expanding lending opportunities for minority-owned businesses represents a high-growth market with proven credit performance. Bridging this funding gap can unlock billions in economic activity while serving an underserved business community.

- For Policymakers: Addressing structural barriers to credit access can further accelerate job creation, economic expansion, and financial inclusion in communities nationwide.

Final Thoughts: Investing in the Future of Small Business

The U.S. small business landscape is evolving. While macroeconomic headwinds—such as rising inflation and uncertain credit markets—present challenges, minority-owned businesses are demonstrating resilience, expansion, and growing demand for capital. For lenders, this is a $2 trillion opportunity to support a fast-growing sector with proven potential and unmet capital needs. By addressing credit access barriers, financial institutions can drive both economic growth and financial inclusion in the years ahead.