Experian and Moody’s Analytics have just released the Q1 2020 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as offer commentary on business credit trends, and what they mean for lenders and small-businesses.

After just one quarter, there’s no doubt the theme of 2020 is the pandemic, Covid-19. Unrelated to the pandemic, and subsequent shuttering of a swath of economies across the world, delinquencies rose in the first quarter.

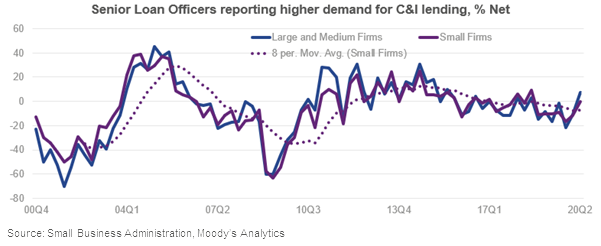

This was occurring as businesses reduced their borrowing. Lower borrowing will not have lasted long though, as government efforts to aid small business have taken the form of SBA lending.

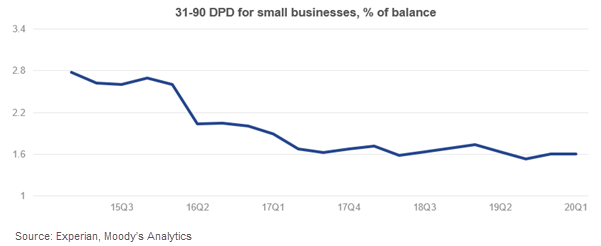

In Q1, the slowing of businesses pursuing credit pushed moderately delinquent balances up to 1.61 percent from 1.60 percent in the fourth quarter of 2019.

| # DPD | Q1 19 | Q4 19 | Q1 20 | |

| Moderately delinquent | 31–90 | 1.74% | 1.60% | 1.61% |

| Severely delinquent | 91+ | 3.35% | 2.29% | 2.68% |

| Bankruptcy | 0.16% | 0.16% | 0.16% |

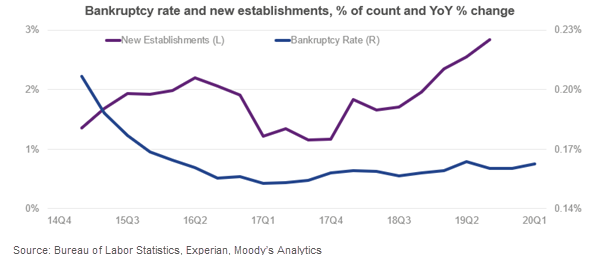

The bankruptcy rate was essentially flat in the first quarter, rising to 16.3 basis points from 16.1 in Q4. But the rate increased as fewer firms were reported as having active credit balances.

The Federal Reserve’s Senior Loan Officer Survey indicates lenders are seeing higher demand than usual for Commercial & Industrial loans. This indicates the beginning of increasing loan demand this year, as small firms look to borrow to ride out lower consumer demand and remain in business.

Watch the Quarterly Business Credit Review

Get the full analysis of the data behind the Main Street Report by watching the experts from Experian and Moody’s in the Quarterly Business Credit Review.