Great Tips to Help You File Your Taxes (And Get a Refund)

Join our #CreditChat on Twitter and YouTube every Wednesday at 3 p.m. ET.

It’s tax season — and a great time to talk with tax experts about filing taxes and getting a refund. This week, we discussed common tax mistakes, the difference between deductions and credits, where you can file your taxes for free and much more.

If you have ideas for future topics and guests, please tweet @MikeDelgado.

Questions We Discussed:

- Q1: Have you filed your taxes yet? Why or why not?

- Q2: What do you find challenging and/ or time-consuming about filing taxes?

- Q3: Do you use any software or hire an accountant to help you? How was that process?

- Q4: What are some tax mistakes that are easy to make?

- Q5: What are some overlooked tax deductions?

- Q6: What’s the difference between tax deductions and credits?

- Q7: How can feeding your retirement accounts help reduce your taxes?

- Q8: Where you can you go to get free tax help?

- Q9: What options are available for those who don’t have money to pay taxes?

- Q10: Any final tips for those of us about to file taxes?

Featured Highlights on SlideShare:

Tweetable Tips:

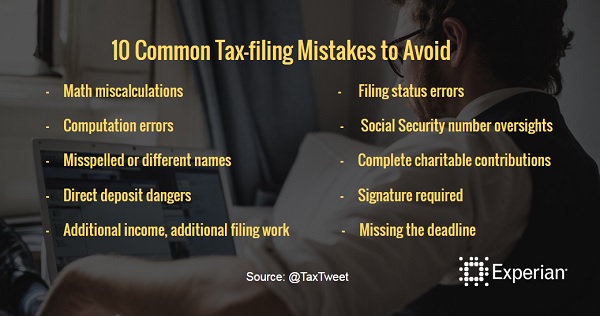

10 Common Tax-Filing Mistakes to Avoid @TaxTweet

[Retweet]

If you are a student who claimed yourself, you can write off your costs on books if you still have your receipts. @Finovera

[Retweet]

Make sure you file even if you don’t have everything. Either file a return or an extension. Not filing is not an option. @DebbiKing

[Retweet]

An extension of time to file is NOT an extension of time to pay. You must still pay all or part of your estimated income tax due.

[Retweet]

Here is the complete #CreditChat Storified: