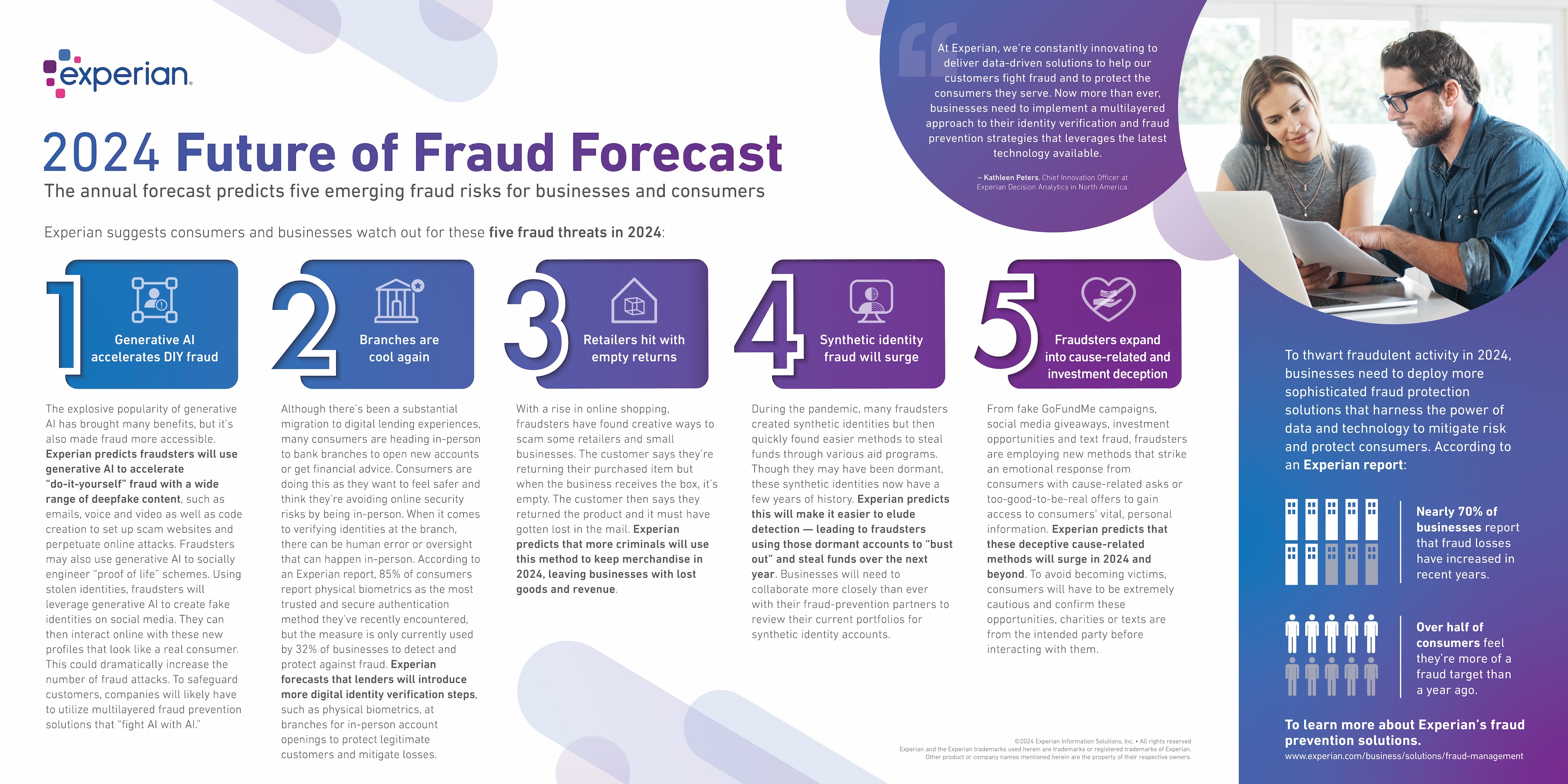

Recent technological advancements are ushering in a new era of innovation for businesses and consumers but can also help perpetuate fraud. Today we released our annual Future of Fraud Forecast, highlighting five fraud threats that businesses and consumers should be wary of this year, which include:

- Generative AI accelerates DIY fraud: The explosive popularity of generative AI has brought many benefits, but it’s also made fraud more accessible. Experian predicts fraudsters will use generative AI to accelerate “do-it-yourself” fraud with a wide range of deepfake content, such as emails, voice and video as well as code creation to set up scam websites and perpetuate online attacks. Fraudsters may also use generative AI to socially engineer “proof of life” schemes. Using stolen identities, fraudsters will leverage generative AI to create fake identities on social media. They can then interact online with these new profiles that look like a real consumer. This could dramatically increase the number of fraud attacks. To safeguard customers, companies will likely have to utilize multilayered fraud prevention solutions that “fight AI with AI.”

- Branches are cool again: Although there’s been a substantial migration to digital lending experiences, many consumers are heading in-person to bank branches to open new accounts or get financial advice. Consumers are doing this as they want to feel safer and think they’re avoiding online security risks by being in-person. When it comes to verifying identities at the branch, there can be human error or oversight that can happen in-person. According to an Experian report, 85% of consumers report physical biometrics as the most trusted and secure authentication method they’ve recently encountered, but the measure is only currently used by 32% of businesses to detect and protect against fraud. Experian forecasts that lenders will introduce more digital identity verification steps, such as physical biometrics, at branches for in-person account openings to protect legitimate customers and mitigate losses.

- Retailers hit with empty returns: With a rise in online shopping, fraudsters have found creative ways to scam some retailers and small businesses. The customer says they’re returning their purchased item but when the business receives the box, it’s empty. The customer then says they returned the product and it must have gotten lost in the mail. Experian predicts that more criminals will use this method to keep merchandise in 2024, leaving businesses with lost goods and revenue.

- Synthetic identity fraud will surge: During the pandemic, many fraudsters created synthetic identities but then quickly found easier methods to steal funds through various aid programs. Though they may have been dormant, these synthetic identities now have a few years of history. Experian predicts this will make it easier to elude detection — leading to fraudsters using those dormant accounts to “bust out” and steal funds over the next year. Businesses will need to collaborate more closely than ever with their fraud-prevention partners to review their current portfolios for synthetic identity accounts.

- Fraudsters expand into cause-related and investment deception: From fake GoFundMe campaigns, social media giveaways, investment opportunities and text fraud, fraudsters are employing new methods that strike an emotional response from consumers with cause-related asks or too-good-to-be-real offers to gain access to consumers’ vital, personal information.Experian predicts that these deceptive cause-related methods will surge in 2024 and beyond. To avoid becoming victims, consumers will have to be extremely cautious and confirm these opportunities, charities or texts are from the intended party before interacting with them.

To mitigate fraud in 2024, businesses need to work with a trusted partner to implement a multilayered approach to identity verification and fraud prevention. Experian offers a full suite of automated tools that harness data and analytics to detect and prevent fraud. Learn more about Experian’s fraud prevention offeringshere and register for our webinar for a deeper dive into these five fraud predictions and other emerging fraud trends.