At A Glance

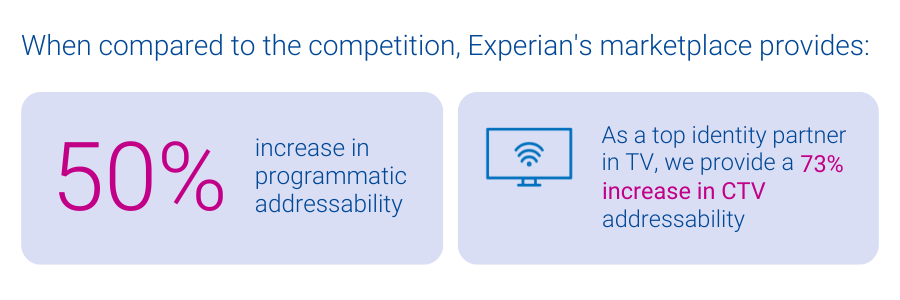

Experian has launched a new data marketplace that brings identity, interoperability, and addressability into one activation-ready platform. Built on verified offline and digital identity, it supports consistent audience activation across CTV, display, and mobile. Marketers and platforms gain broader reach and strong match rates.As marketers face growing signal fragmentation, Experian has launched a data marketplace that brings addressability, interoperability, and identity resolution into one activation-ready platform.

Download the overview to see how our data marketplace connects high-quality identity to scalable activation across all screens.

Why does cross-channel audience consistency matter?

Marketers plan campaigns to reach people wherever they watch, browse, and engage. Consistent identity allows those plans to carry across screens without fragmentation.

Experian’s data marketplace starts with identity. Our data marketplace is built on our best-in-class identity graph which includes 126 million U.S. households, 250 million individuals, and more than four billion active digital IDs. This foundation supports reliable audience connections across channels and devices.

What distinguishes Experian’s data marketplace?

Experian connects the entire ecosystem — TV operators, programmers, supply-side platforms (SSPs), demand-side platforms (DSPs), and brands — with activation-ready audiences that drive measurable performance. Buyers can access data from retail, CPG, healthcare, B2B, location intelligence, and more.

Our audiences are built on verified offline data, which means they’re grounded in real-world accuracy, not just digital assumptions. When you activate through our marketplace, you:

- Reach relevant audiences across screens

- Maintain accuracy at scale

- Support addressability as media environments evolve

Whether you’re running a campaign on connected TV (CTV), mobile, or display, we help you show up in the right place, to the right person, at the right time.

Related reading

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

DISH MediaKemal Bokhari, Head of Data, Measurement & Analytics

Want a quick overview of Experian’s data marketplace?

Watch our video for a quick overview of how Experian’s data marketplace works.

How does Experian’s data marketplace support buyers, sellers, and platforms?

Our data marketplace streamlines how teams plan, distribute, and activate data. Buyers and sellers align workflows while maintaining scale and accountability. Here’s how it delivers:

Which data partners participate in Experian’s data marketplace?

Our data marketplace includes premium data from partners such as Alliant, Attain, Circana, Dun & Bradstreet, and more. Buyers activate these audiences alongside Experian Audiences within one workflow.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

CircanaPatty Altman, President, Global Solutions

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Dun & BradstreetGeorgina Bankier, VP of Platform Partnerships

How Yieldmo drove in-store traffic for an athletic retailer with Experian’s data marketplace

Yieldmo, a leading SSP known for its AI-powered creative formats and privacy-forward inventory, partnered with Experian to support an athletic retailer focused on in-store traffic during key sales periods. The team identified high-intent shoppers and activated them across channels.

Using our data marketplace, Yieldmo combined Experian Audiences with partner segments from Alliant, Circana, Webbula, and Sports Innovation Lab. This approach allowed the team to:

- Identify in-store and conquest segments quickly

- Combine first- and third-party audiencesin one place

- Improve match rates and cross-channel addressability

- Deliver measurable foot traffic lift

“Experian’s data marketplace fills a critical gap, letting us quickly search by brand, build smarter conquest segments, and activate audiences fast. The platform is flexible and the support is hands-on and reliable.”

YieldmoAbby Littlejohn, Director of Sales Planning

The campaign delivered faster setup, tailored audiences, and strong in-store performance with less manual effort.

Get started with Experian’s data marketplace

Experian’s data marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

Talk to our team if you’re interested in learning more about our new data marketplace or becoming an active buyer or seller, or download our overview to learn more.

FAQs

Experian’s data marketplace is a centralized, activation-ready platform that allows TV operators, programmers, supply partners, and demand platforms to access and activate high-quality, privacy-compliant audiences across CTV, mobile, and display. It supports both first-party onboarding and third-party audience activation.

The Experian data marketplace is built for TV operators, programmers, supply partners, and demand platforms looking to improve audience targeting, match rates, and addressability across fragmented digital environments.

The Experian data marketplace offers a mix of Experian proprietary audiences and third-party data partner segments across verticals like retail, CPG, B2B, healthcare, financial services, and location intelligence. Users can activate over 3,500 Experian Audiences and premium partner segments from providers like Alliant, Attain, Circana, Dun & Bradstreet, Webbula, and more.

Experian’s data marketplace is powered by our identity graphs which are rooted in verified offline data, spanning 126 million U.S. households, 250 million individuals, and over four billion active digital identifiers. This foundation ensures that audiences are accurate, actively targetable, and optimized for high match rates across CTV, mobile, and display platforms.

Yes. All data in the Experian data marketplace is subject to Experian’s rigorous partner review process to ensure compliance with federal, state, and local consumer privacy regulations. Privacy and data stewardship are foundational to our data marketplace’s design.

Experian’s data marketplace stands out for its focus on audience accuracy, partner integration, privacy compliance, and deep identity expertise. Here’s how we’re different:

– Accurate audience planning: Unlike many other marketplaces, Experian ensures that all identifiers tied to an audience are verified as active and targetable — improving match rates and reducing waste.

– Seamless partner audience integration: In one platform, you can activate Experian Audiences alongside premium segments from our growing partner network — including Alliant, Attain, Circana, and more.

– Privacy and compliance built in: Every partner and audience goes through Experian’s rigorous review process to meet federal, state, and local consumer privacy laws — so you can activate with confidence.

– Trusted identity foundation: Experian’s identity graph is grounded in decades of offline data expertise, powering more reliable targeting and activation than marketplaces built solely on digital signals.

You can download the overview to explore the capabilities, or contact our team to become an active buyer or seller. The Experian data marketplace is available through Experian’s Audience Engine platform.

Latest posts

The Tapad Device GraphTM Had Twice the Precision and Three Times the Scale as Next Competitor New York, September 14, 2016 – Just-released findings of a Hotels.com® study revealed that Tapad’s (part of Experian) cross-screen marketing technology achieved the highest levels of precision and scale among competitors. According to the leading online accommodation booking website, after a rigorous, three-and-a-half month vendor analysis, Tapad achieved twice the precision of the next highest-scoring cross-screen offering and three times greater scale. The two other companies evaluated were not named. Said Helene Cameron-Heslop, Senior Manager of Analytics of the Hotels.com brand, “Our team implemented an extremely rigorous vetting of open, cross-screen technology vendors. At the outset, we assumed we would have to compromise on either scale or accuracy – particularly given the importance to our brand of operating in a privacy-safe setting. We were surprised to find a complete package, but Tapad’s Device Graph won out on scale, accuracy and privacy; making our choice of partners very clear.” In another metric critical to the Hotels.com brand, The Tapad Device GraphTM was eight times more “unique” than the next closest offering, meaning Tapad’s graph was found to have a much greater number of connections not seen in any of the other graphs. In addition to precision, uniqueness and scale, the Tapad Device GraphTM was found to have: ● 100% higher recall● 47% more incremental matches● 53% higher North American market coverage● 101% higher F-Score* “A valuable cross-device solution should enable partners to get everything they’re looking for from a single vendor,” said Tapad Founder and CEO, Are Traasdahl. “We are deeply impressed with how thorough Hotels.com was in their vetting, and we confidently tackle the complex challenges of the martech industry thanks to our superior technology. Everyone loves a bake-off, and Tapad is no exception – delivering best-in-class results in areas that really count.” *F-score is a statistical measurement that takes precision and recall together. The calculation is 2*(precision*recall)/precision + recall). It gives you one number instead of two numbers to look at and judge performance. Contact us today

Five Norwegian startups selected to establish U.S. presence NEW YORK, Aug. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, has announced its new entrepreneurial mentorship initiative, the Propeller Program. Five early-stage startups from Norway have been chosen by Are Traasdahl, native of Norway and Tapad’s CEO and founder. The selected companies will share Tapad’s New York City workspace, receive C-level guidance and help establish a U.S. presence. The following companies have been selected to participate in the inaugural Propeller Program – a 12-month program beginning September 19, 2016: Bubbly – Developers of a platform that enables in-store customer feedback with dashboards and tools that facilitate real-time store response BylineMe – A marketplace for freelancers, publishers and brands to connect for content creation and distribution services Eventum – A property-sharing group that digitally assists in securing venues for meetings and corporate events Xeneta – A database that organizes the best contracted freight rates in real time and on demand “We are supporting startups that we feel represent the future of service offerings,” said Traasdahl. “It is with incredible pride that we invite these entrepreneurial teams from Norway to join us in New York Citythis year. Mentorship opportunities for early-stage companies are so important, particularly for those based outside the U.S. I look forward to giving the Propeller Program participants access to the expertise of my seasoned team and to our wide network of resources. Hopefully, it will be a game-changing year for many of them.” Contact us today

As partnership deals mount, aggressive hiring underway for unified cross-screen technology leaders NEW YORK, July 19, 2016 /PRNewswire/ – Tapad, the leader in cross-device marketing technology and now a part of Experian, has announced plans for aggressive expansion in the Asia Pacific (APAC) region. This move capitalizes on Tapad's exceptional performance for brands and marketing technology companies in North America and Europe. With it's proprietary Tapad Device Graph™, the company will enable global, regional and local clients and partners to understand, monetize and measure marketing to users across screens. The Tapad Device Graph is recognized as the most accurate, scalable cross-screen solution in the market today. The decision to expand into APAC was based on increased demand from global, as well as local, brands and clients, many of which have a strong market presence throughout the region. In addition to expanding its roster of world-class data partners, plans include building a world-class team in Singapore. Over the next few months, Tapad APAC will also establish local entities in additional markets. To accelerate its ramp-up, Tapad APAC is actively recruiting in many areas, ranging from skilled and experienced solutions engineers to seasoned sales and marketing professionals. "Tapad is thrilled to be answering the call for cross-device excellence in APAC," said Pierre Martensson, GM of Tapad APAC. "Our Device Graph is adding millions of devices daily and achieves unmatched levels of scale and accuracy while protecting consumer privacy. This meets a critical need in the region." Tapad appointed Martensson as General Manager of Tapad APAC in May, kicking off expansion in the region. Martensson comes to Tapad with nearly a decade of operations experience throughout APAC, having transformed, developed and grown global organizations. To learn more about partnership and employment opportunities available with Tapad in APAC, visit www.experian.com/careers. Contact us today