At A Glance

Audigent, Dun & Bradstreet, and Experian simplify B2B marketing by combining trusted business data, curated audience activation, and advanced identity resolution. This partnership helps marketers reach verified decision-makers across channels like CTV and display, ensuring accurate targeting, consistent audience identity, and measurable results while maintaining privacy compliance.Audigent, a part of Experian, Dun & Bradstreet, and Experian are collaborating to help business-to-business (B2B) marketers target more effectively. Now, B2B marketers can reach verified decision-makers, keep the same audience across channels, and activate on connected TV (CTV) and digital via the Experian data marketplace. Together, Dun & Bradstreet’s trusted business data, Audigent’s curation and Deal ID activation, and Experian’s identity resolution drive efficient, measurable results.

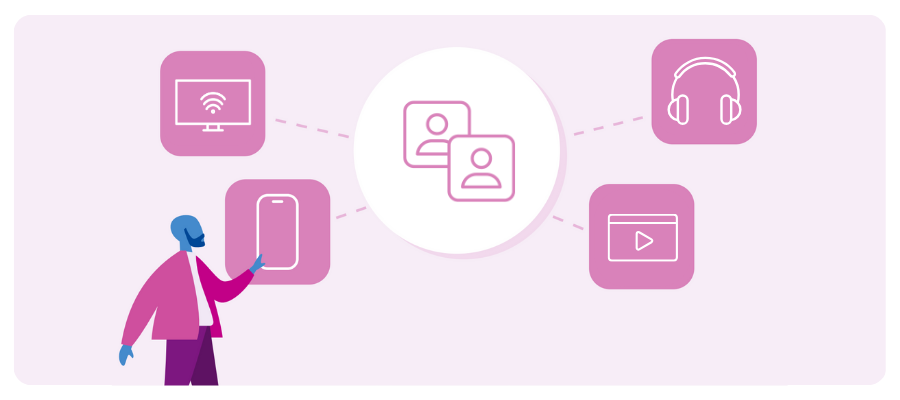

Unify identity and engage B2B audiences

With Audigent, Dun & Bradstreet, and Experian working together, you get one dependable way to recognize the same companies and roles everywhere you run. Dun & Bradstreet’s D-U-N-S® Number, serves as a stable company identifier, so offline business details map to the right digital profiles, and you can reach verified decision-makers with confidence.

Through Audigent and Experian, you can access 400+ Dun & Bradstreet B2B audience segments, matched to a Deal ID and activated via Audigent’s curation engine and Experian’s data marketplace. This provides real-time B2B targeting across connected television (CTV), display, native, audio, and online video (OLV).

Utilize differentiated data

Dun & Bradstreet audiences are built on verified offline signals (e.g., company, industry, size, role, seniority) linked to the proprietary D-U-N-S® Number for deterministic matching. High-quality firmographic attributes become actionable segments you can activate in leading programmatic platforms. The result: privacy-compliant, performance-driven campaigns with omnichannel B2B targeting.

Three ways unified B2B identity improves media performance

- Target with accuracy: Use deterministic firmographics. Dun & Bradstreet’s D-U-N-S® Number anchors a consistent way to recognize the same company, linking offline signals to authenticated business entities.

- Reduce waste: Activate curated PMPs for efficient spend. Audigent’s curation engine packages those audiences into Deal IDs and routes through cleaner, more predictable supply paths, so more budget reaches the buyers that matter. Publishers see up to 75% net revenue increase after fees, while brands save 36–81% on data segments and achieve 10–30% higher video completion rates.

- Stay consistent: Maintain identity across all channels. Use the same audience criteria across CTV, display, native, audio, social, and OLV to improve match consistency without relying solely on third-party cookies.

Improve addressability with Experian’s Digital Graph

Advertisers can use Dun & Bradstreet’s off-the-shelf segments to target specific audiences accurately across channels. By connecting Experian’s Digital Graph with Dun & Bradstreet’s company and contact data, marketers gain a clear advantage: one durable identity that improves match rates, keeps reach consistent across CTV and digital, and aligns targeting with measurement.

What that means in practice:

- Higher match rates without third-party cookies.

- Expect consistent reach across CTV and digital with one audience anchored to the same identity.

- Cleaner measurement because activation and identity stay in sync.

Suggested use cases

Below are simple ways to put this to work, using Dun & Bradstreet business data and Audigent Deal IDs so the same audience runs and measures the same everywhere.

Achieve more with Audigent, Dun & Bradstreet, and Experian

Together, Audigent, Dun & Bradstreet, and Experian allow marketers to activate high-quality B2B audiences with confidence, delivering relevant and efficient campaigns. By pairing Dun & Bradstreet’s trusted business data and proprietary D-U-N-S® Number with Audigent’s curation engine, you get deterministic, privacy-compliant targeting at scale, now boosted by Experian’s identity for consistent cross-channel reach.

Ready to activate your next B2B audience? Talk to an Experian expert today

FAQs

Dun & Bradstreet’s data is anchored by the D-U-N-S® Number, a persistent business identifier that links offline signals like company size, industry, and role to digital environments. This ensures accurate, scalable, and privacy-compliant targeting.

Experian’s Digital Graph connects devices and IDs at the household level, enabling consistent audience identity across channels, even in cookieless environments. This ensures higher match rates and reliable measurement.

Audigent’s curation engine creates audience-aligned Deal IDs and PMPs, optimizing supply paths for efficient media buying. This reduces waste and improves campaign performance with cleaner, more predictable targeting.

Marketers can build role-based segments (e.g., IT Directors at mid-sized companies) and activate them across CTV and digital channels. Sequential messaging tailored to buying stages helps accelerate pipeline and drive engagement.

Latest posts

Experian and M3 MI explore how the MARS Consumer Health Study helps healthcare advertisers build precise, privacy-safe audiences that drive stronger engagement and better campaign results.

Discover the top 2026 consumer insights shaping data-driven marketing—from personalization and trust to identity and activation.

Discover Experian and Madhive’s impact on local advertising, enabling teams to validate campaigns and optimize budgets for success.