Experian Health Blog

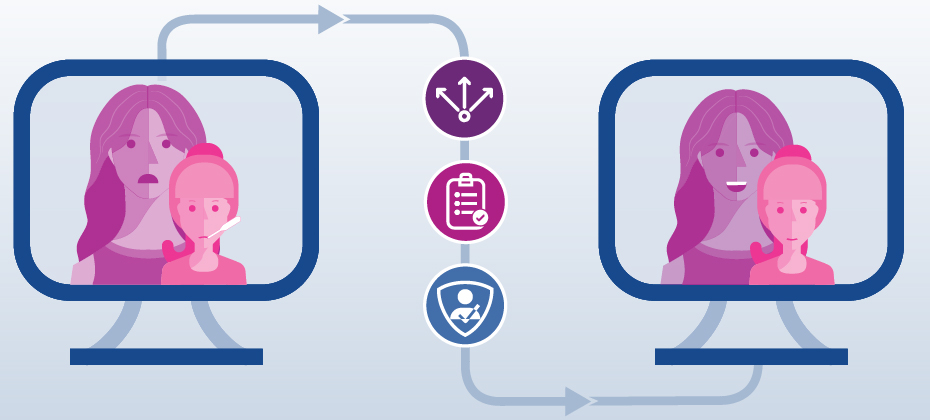

Due to COVID-19 and the subsequent delay of elective procedures, many healthcare providers today are struggling to ensure their patient populations are getting the care they need. While online scheduling and referral coordination solutions can no doubt help improve patient access, especially as those who cancelled or postponed appointments look to reschedule, it’s the use of automated outreach combined with the ability to schedule appointments in real-time that can take it one step further and help providers close gaps in care. Automated outreach via interactive voice response (IVR) and text messaging (SMS) is now effectively closing gaps in care and streamlining the entire scheduling process from start to finish. Healthcare organizations leveraging automated outreach are seeing numerous benefits. Among them: Extended Outreach Capabilities – An automated and technologically advanced outreach system has far greater capacity to reach patients, when compared to the bandwidth of traditional call centers. The system enables thousands of automated calls per day that don’t require an agent to personally facilitate. Increased Appointment Bookings – Reaching more patients means more successfully booked appointments, and in turn, fewer gaps in care. Our technology successfully automates the process all the way through the booking itself, scheduling far more appointments with much less effort. Higher Patient Satisfaction – Automated outreach ensures that patients are notified on-time about any necessary follow-up care, and then provides the opportunity to quickly and easily book appointments that fit their schedule. This convenience and simplicity fosters patient engagement and satisfaction. Using a targeted outreach list, an automated calling and texting system manages the bookings, coordination and follow-up, completely lifting the burden off of the organization and its call center. Additionally, this type of technology can track metrics (i.e. response rates, booking rates, opt-outs, etc.) in real-time, allowing health plans to easily identify areas for improvement and make the necessary changes to their processes. For these reasons – as well as the benefits outlined above – a growing list of both providers, payers and ACOs are choosing to employ automated outreach technology today. Learn more about automated outreach and how it fits into an omnichannel access strategy. Learn more Contact us

Download our free eBook to find out how digital health solutions can help your organization improve the patient journey now and beyond COVID-19. You can also check out our free COVID-19 Resource Center, where you can get free access to telehealth payer policy alerts to help avoid payment denials and delays.

With so many complexities surrounding deductibles, premiums, copays and more, consumers sometimes struggle to understand the financial components of their health plans and are often unaware of the out of pocket for their healthcare needs. Recognizing that confusion about healthcare costs can make it difficult for consumers to ask the right questions, define priorities and take a more active role in their healthcare, Silver Cross Hospital made a point to educate and provide its patient base with health care estimates prior to service being rendered. With the Self-Service Patient Estimates tool from Experian Health, patients of Silver Cross Hospital now have a consumer-friendly, easy-to-use and accessible path to obtain out of pocket cost estimates. The Self-Service Patient Estimates tool works both with the hospital’s electronic medical record (EMR) and as a standalone tool for the community to use when needed. Integrating with Silver Cross Hospital’s EMR, the solution calculates estimates based on the hospital’s charge master pricing information and payer contracted rates and utilizes each patient’s individual eligibility and benefits information to create specific out of pocket costs. The tool also allows for detailed and accurate estimate creation using historical claims data to determine the typical procedures and related charges to generate average out of pocket cost estimates by health plan. Accessible via the hospital’s website, the tool acts as a digital front door in the patient exploratory process. Patients can obtain an out-of-pocket estimate any time of day or night, and as part of the process are then connected to the next place of service, whether that be to schedule an appointment, ask additional questions or obtain more information. Since implementing Patient Estimates, Silver Cross Hospital has: Increased point of service (POS) collections by bringing more awareness and education of out of pocket costs to patients upfront Reduced inbound calls and queries to the organization regarding cost estimates Integrated the solution into scheduling and pre-registration workflows within the EMR Reduced time spent training staff on other systems or workflows Learn more about Patient Estimates and how we can help create accurate estimates of authorized services for patients before, or at the point-of-service. “Patient Estimates acts a great digital front door for Silver Cross Hospital, facilitating that first step in the patient exploratory process.” – Miguel Vigo IV, Administrator Director Revenue Cycle, Silver Cross Hospital

Financial recovery after COVID-19 is likely to be a slow burn for most healthcare organizations, according to a recent survey. Nearly 90% of healthcare executives expect revenue to drop below pre-pandemic levels by the end of 2020, with one in five anticipating a hit greater than 30%. While the return of elective procedures will be a lifeline for many hospitals and health systems, the road to financial recovery remains fraught with obstacles: Five months of canceled and postponed procedures need to be rescheduled Worried patients must be reassured of hygiene measures, so they feel safe to attend appointments Patient intake and payment processes must be modified, in order to minimize face-to-face contact As the rate of infection continues to grow, providers must find new ways to also grow their revenue and protect against a further dent in profits. The healthcare industry is unlikely to see the recovery curve hoped for across the wider economy, but digital technology, automation and advanced data analytics could help provider finances to bounce back more quickly. 4 ways technology can accelerate your post-pandemic financial recovery 1. Easy and convenient patient scheduling unlocks your digital front door Patients want to reschedule appointments that were postponed or canceled over the last few months. To manage the backlog and minimize pressure on staff, consider using a digital patient scheduling platform, so patients can book their appointments online. A self-scheduling system that incorporates real-time scheduling and calendar reminders will help to create a positive consumer experience, while offering analytics and behind-the-scenes integration to keep your call center operations running smoothly. 2. Secure and convenient mobile technology can enhance your telehealth services Telehealth is the top choice for many hospitals looking to boost revenue growth and counter the impact of COVID-19, with two-thirds of executives expecting to use telehealth at least five times more than before the coronavirus hit. Many new digital tools and strategies designed to improve the patient journey as a whole can support telehealth delivery, and help to meet growing consumer demand for virtual care. For those beginning their telehealth journey, our COVID-19 Resource Center, which offers free access to telehealth payer policy alerts, may be the place to start. 3. A digital patient intake experience can lessen fears of exposure Although many providers are starting to open up for routine in-person appointments again, patients may wonder if it’s safe. Proactive communication about the measures in place to protect staff and patients will be essential. Another way to minimize concern is to allow as many patient intake tasks as possible to be completed online. Automating patient access through the patient portal can give patients quicker and more convenient ways to complete pre-registration, while contactless payment methods are a safe way to settle bills without setting foot in the provider’s office. 4. Optimize collections to bolster financial recoveryAutomation can also play a huge role in helping providers tighten up their revenue cycle, find new ways to enhance accounts receivable collections and avoid bad debt. Tools such as Coverage Discovery and Patient Financial Clearance enable providers to find missing or forgotten coverage, and help the patient manage any remaining balances in a sensitive and personalized way. Palo Pinto General Hospital uses automated coverage checks to find out whether a patient is eligible for charitable assistance within three seconds, so self-pay accounts can be directed to the most appropriate payment plan before the patient even comes in for treatment. With fewer accounts being written off, Palo Pinto has seen a noticeable improvement to their bottom line. The pandemic has been a wake-up call for an industry that has been traditionally slow to adopt new technologies. Ahead of a second wave of COVID-19, providers must move now to take advantage of automation and digital strategies to speed up financial recovery. Contact us to find out how we can help your organization use technology to improve the patient experience, increase efficiencies and kickstart your revenue cycle.

The focus on improving health plan member engagement and overall experience has been steadily growing over the years, much of it being driven by the push towards a more consumer-friendly healthcare experience. James Beem, Managing Director, Global Healthcare Intelligence at J.D. Power, states, “health plans are doing a good job managing the operational aspects of their businesses, but they are having a harder time addressing the expectations members have based on their experiences in other industries where their service needs are more effectively addressed with better technology.” His remarks are based off of findings from the annual Commercial Member Health Plan Study, which also found that care coordination between different providers and care settings is a top challenge health plans are facing today. Most of our conversations with health plan prospects and customers revolve around how digital technology can improve health plan member engagement and close gaps in care. From our experience, here are five key digital strategies that health plans can employ to better engage members and improve satisfaction. Call centers remain a cornerstone of member engagement. From onboarding new members to closing gaps in care, the call center is where the rubber meets the road between health plans and their members. At Experian Health, we focus on making it easier for call center agents to find and book appointments on behalf of members – specifically, we eliminate the need for three-way calls with providers by giving agents access to a digital scheduling platform. It automates providers’ scheduling rules, while also protecting their calendars, and allows health plans to schedule appointments for members without having to call the provider office. In some cases, once our platform is in place, we’ve seen scheduling rates increase by 140%, call times cut in half, and show rates go up. A large factor in social determinants of health is the availability of transportation – are your members physically able to make it to and from their appointment? While members may know what care they need and are able to book an appointment, they may not be able to show up for that appointment due to unreliable or non-existent transportation. The member doesn’t show, the care gap remains, and health plans take a hit on quality metrics. What’s worse, the member puts themselves at risk for readmission or other, costly trips to the ED for care that remains unaddressed – all an expensive medical cost for the plan. We are proud to work with transportation vendors and ultimately, include the ability to schedule transportation in a workflow while booking an appointment. By facilitating easy access to transportation as part of the appointment scheduling process, we are ensuring a better outcome for everyone. Why not offer the functionality that consumers are accustomed to in nearly every other industry? Booking a hotel, flight, or dinner reservation can all be done online via a mobile device, so why not an appointment? Imagine being able to extend this type of convenience and consumer-friendly experience to your members. They come to the health plan’s site or app to search for an in-network provider and can then schedule an appointment in real-time, on the spot, day or night, no phone call required. Instead of simply sending members text and phone call reminders to schedule care, health plans can use automated outreach to send those messages with the ability to schedule an appointment via self-service. The member would receive a text message or phone call, and after confirming their identity, would receive their personal health-related message along with the ability to schedule an appointment as part of the outreach process. In a few clicks, or with a few verbal responses, the appointment is scheduled, and the care gap is closed with very minimal effort. The struggle to find and maintain accurate contact info for members is real. Fortunately, Experian Health has unprecedented access to consumer data. With the largest consumer database, collected on more than 300 million consumers, we can provide a deeper understanding of your current members or prospects in your markets. These data assets can enable the most effective marketing and communication strategies to improve enrollment rates as members are more successfully identified and reached. The data can also be leveraged to enhance internal analytics, like member risk score algorithms or other models, to improve member outcomes. Learn more about how a digital care coordination platform can help your organization improve member engagement and the member experience.

Many patients today are forced to call the doctor to schedule an appointment. These phone calls are often inconvenient: patients are required to call during a provider’s business hours, a single call can sometimes take up to 20 minutes, or the patient may end up playing phone tag until an appointment is finally booked. The entire process bodes for a poor patient experience, but also hinders access to care as staff are only able to manage a number of phone calls per day. Like many healthcare organizations today, The Iowa Clinic wanted to improve access to care for its patients, removing the many barriers that come with having to call to schedule an appointment. Requiring a solution that could both improve patient satisfaction and operational efficiencies, the clinic, which schedules more than 600,000 appointments per year across multiple specialties, turned to online self-scheduling. With online self-scheduling, patients of The Iowa Clinic have the ability to self-schedule directly into provider’s calendars in real time from a computer or mobile device. During the booking process, patients are asked a series of brief questions and their answers are used to guide them to the right provider and appointment based on their specific care need. Appointments can be booked any time of day or night. Since implementing online self-scheduling, The Iowa Clinic has not only improved access for patients, but has enhanced operations throughout the call center, seen growth in patient acquisition and has achieved higher than average show rates. Results include: At least 15% of all appointments booked came from online during the first eight monthsThe centralized call center has seen a 30% reduction in the number of scheduling callsAt least 8 new patient appointments are booked online per provider per month Patient show rates are at 97% for appointments scheduled online Learn more about online self-scheduling and how it can help to improve patient access for your organization. “Patient Schedule allows us to improve the experience by offering a simple, convenient way to schedule an appointment online.”- C. Edward Brown, CEO, The Iowa Clinic

With a vaccine for COVID-19 thought to be at least a year away, healthcare providers are steeling themselves for even more cases in the fall. The big worry is that a surge in cases will hit the health system just as flu season takes hold. In a recent interview, Dr. Robert Redfield, Director of the Centers for Disease Control and Prevention (CDC), warned that “the assault of the virus on our nation next winter [may] actually be even more difficult than the one we just went through… we’re going to have the flu epidemic and the coronavirus epidemic at the same time.” Healthcare organizations are accustomed to an influx of sick patients between October and March: around 62,000 people died and more than 700,000 were hospitalized during last winter’s flu season. With 130,000 Americans losing their lives to COVID-19 in just four months, what could happen when the two respiratory diseases collide? Large numbers of patients with either virus (or potentially with both) will put renewed pressure on staff and services that are already under immense strain. Hospitals will need to prepare to manage both groups of patients as efficiently and safely as possible. Five ways to ease stress, paperwork and patient concerns ahead of a dual epidemic 1. Use data to drive your patient engagement strategy Create a flu preparedness patient engagement strategy to keep patients informed of how best to protect themselves in the context of a dual epidemic. As a result of the coronavirus pandemic, patients may be more familiar with telehealth services as a “contact-free” alternative to in-person appointments, so you’ll want to continue to promote these to minimize the spread of infection. With consumer data, you can segment patients according to risk and automate your communications, so they get the most relevant message at the most convenient time. 2. Relieve pressure on staff with automated patient scheduling Digital scheduling gives patients the option to book appointments online, at a time and place that suits them. This reduces pressure on call center staff and can give providers control over the volume and timing of in-person appointments, thus helping to reduce the spread of germs. An online patient scheduling platform can automate the entire scheduling process, integrating in real-time with your records management systems and connecting to your referral providers’ systems for a seamless patient and staff experience. 3. Screen patients proactively to discover their needs ahead of time Asking patients to fill out electronic questionnaires before their visit means their access needs can be identified and addressed before they come in. Do they need help to find transportation? Will they face any challenges in picking up a prescription? Is there something that could stand in the way of follow-up care? Screening for social determinants of health can answer these questions so you can direct patients to the most appropriate care and support. 4. Enable digital patient registration for a quick and easy intake experience Speed up the registration process by giving patients the option to complete their intake admin by phone or through their patient portal. Not only will this reduce the spread of infection in busy waiting rooms, it’ll make for a more enjoyable patient experience and free up limited staff resources for other priorities. With automated registration and consumer-facing mobile experiences, you can improve the patient experience, operational efficiencies and data accuracy all at the same time. 5. Minimize in-person interactions with contactless payments Encourage patients to clear their balances without having to hand over cash or access payment kiosks. Self-service digital payment tools allow patients to make contactless payments through their patient portal or from their mobile device. “The combined pressure from two viruses hitting health systems at once means it’s even more important for providers to leverage data for speed and accuracy. Automated workflows can help accelerate operational efficiency, as well as create a better patient experience during what’s already an extremely stressful time.” Victoria Dames, Vice President of Product Management for Experian Health Find out more about how Experian Health’s expertise in data and analytics can help your organization prepare for the coming flu season so you can offer your patients a safe, accessible and stress-free experience. We have also developed a checklist of action items for providers to consider as you prepare for both flu and COVID-19. How ready are you? Which actions is your organization instituting now?

By January 2021, millions of those who suffered job losses in the wake of COVID-19 will see their unemployment insurance end. Medicaid and subsidized coverage under the Affordable Care Act (ACA) will be a safety net for many, but nearly 2 million Americans could find themselves stuck in the ‘coverage gap’, where their household income exceeds the eligibility threshold for Medicaid, yet falls below the lower limit required to receive ACA marketplace subsidies. Without large group or government coverage, these consumers will be left uninsured or forced to purchase individual plans with high deductibles. Considering this will likely contribute to larger patient balances and more struggles with patient collections, many are bracing for a hit to their bottom line. To help minimize accounts receivable and avoid bad debt write-offs, choosing the right data model should be a top priority. Here, we look at one piece that’s often missing from the patient collections puzzle: credit data. Don’t overlook credit data in your self-pay collections strategy Many providers already use demographic and behavioral data to power patient collections, but there can be gaps in what’s known about a consumer’s ability to pay. Credit data can help fill in the blanks. Here are three ways this can be used to optimize your collections strategy: 1. Get a complete view of your patients’ financial situation for faster decision-making Credit data can reveal how a patient is managing other financial obligations, giving you insights about how to handle their healthcare account for a greater chance of payment. Have they just maxed out a credit card? Have they missed a student loan payment or fallen behind on their mortgage? If so, they’re probably going to find it difficult to pay off their medical bill. Knowing this, you can move quickly to help them find alternative coverage or offer a more manageable payment plan. Conversely, if they’ve just bought a new car or paid off a personal loan, there’s a high chance they’re in a good position to pay their medical bills too, so contacting them with a straightforward and easy payment plan means they can clear their balance promptly. 2. Segment patient accounts and allocate them to the right payment pathway The sooner you can get patients onto the right payment pathway, the more robust your cashflow will be. Credit data can help you segment accounts quickly and accurately. Experian Health data shows that when patients are segmented according to propensity to pay, collections increase by around 2% when credit data is included, compared to segmentation without credit data. Novant Health used Collections Optimization Manager to segment patients and check for available charity support or Medicaid eligibility. By getting patients on the right pathway and making sure agencies were focusing on the right accounts, they increased recovery rates by 5% and saw a rolling average return on investment of 8.5:1. 3. Create a more compassionate patient financial experience Using credit data also helps create a more compassionate patient financial experience. Instead of adding to a patient’s financial worries by chasing payments they’ll never be able to cover, you can run charity checks to see if there’s any missed coverage and quickly connect them to the right financial assistance program. A tool such as Collections Optimization Manager lets you segment patients based on their individual circumstances, for a more patient-friendly approach to collections. You can then personalize their communications and payment options so they can manage their expenses with less anxiety and more confidence. Discover why 60% of US hospitals are already using Experian Health’s advanced collections software and unrivaled datasets to optimize patient collections, and find out how we can help you build a resilient revenue cycle as self-pay accounts continue to rise.

For many healthcare consumers, visiting patient portals to check medical records, schedule appointments, renew prescriptions and pay bills is a no-brainer. Accessible from multiple devices at any time of day, patient portals allow patients to manage their health from the comfort and convenience of their own home. COVID-19 has been a catalyst for even more patients to consider remote and virtual healthcare services. But with large healthcare data breaches increasing by nearly 200% between 2018 and 2019, one concern continues to lurk in the background: how do providers keep patient data safe? Knowing the industry is prone to dated cybersecurity measures, hackers zero in on the lucrative medical identities market, with their top targets including: patient medical records billing information log-in credentials authentication credentials, and clinical trial information. As COVID-19 encourages more patients online, the digital doors are open for even more identity thieves to try to steal – and profit from – sensitive data. Healthcare organizations need to be confident that the person logging on is who they say they are, both to reduce the risk of a data breach and minimize HIPAA penalties. One way to balance consumer convenience with data security is to automate the patient portal enrollment process with robust patient identification protocols, making it harder for hackers to access patient information but without burdening patients. 2 ways to automate patient portal enrollment 1. Ditch activation codes that are easily misplaced Many healthcare organizations give new patients an activation code to use the first time they log in to their patient portal. Unfortunately, these tiny bits of paper or codes hidden at the bottom of lengthy enrollment documents are easily lost or forgotten. The patient has to call the office, taking up valuable staff time and resources to figure out how to log on – the opposite of streamlined and scalable. Instead, providers should consider an automated portal sign-up process. Using a combination of out-of-wallet questions, device recognition, risk models and cross-checks with linked patient data, portal access can be secured through a single platform. It’s easier and more reassuring for patients, and with far fewer calls to IT support. 2. Find quicker ways to integrate patient identity tools with existing systems The more people who need to see patient data, the more opportunities there are for cyber thieves to sneak in and access that sensitive information. Being able to share data securely between multiple providers and across different platforms is essential. During the current COVID-19 crisis, integrating authentication tools with other healthcare information systems (HIS) quickly is a huge advantage. One example is Precise ID, which can now integrate directly with Epic’s MyChart portal, Allscripts’ FollowMyHealth platform and many other HIS systems within two weeks. Jason Considine, senior vice president and general manager of Experian Health’s Patient Experience Solutions says: “Patients want to feel reassured that their data won’t wind up in the wrong hands. That’s even more important right now, as COVID-19 means more patients are choosing online services instead of face-to-face contact. With staff and cashflow under pressure, it’s even more important to get systems up and running as fast as possible. That’s why we’ve integrated with leading HIS systems to help them achieve interoperability within just two weeks.” Patient portals have the power to transform the healthcare experience for patients, but only if they can trust that their data will be kept safe. Providers can protect their patients from identity theft by adopting a multi-layered solution that incorporates best practice and cutting-edge data security technologies. Find out more about how Experian Health can help you automate patient portal security to avoid medical identity theft, so you can save money, avoid reputational damage and create a positive patient experience.

Medical expenses are often a source of anxiety for many patients, whether they are unsure about the amount owed or how they’ll ultimately pay for it. Unfortunately, intimidating collections processes don’t help, and a crisis like COVID-19 only exacerbates this stress. A more compassionate billing approach could help patients better navigate their financial obligations and also build long-term loyalty—a necessity for providers today looking to retain patient volume during a time of crisis. Consumers overwhelmingly want to understand the cost of healthcare services, prior to services being performed. Effective price transparency involves offering patients clear, accessible, and easy-to-understand estimates of their financial responsibility for services before they are performed. Give patients clarity from the start with precise pricing estimates and up-front info about what they’ll have to pay can reduce sticker shock, help them plan and create an overall better patient financial experience. By empowering your patients with financial expectations, their feeling of control increases, improving their engagement and the likelihood that you will collect payments faster and more efficiently. Just as you don’t provide identical medical treatment to every patient, processing all patient accounts the same way doesn’t make sense. Every patient is different. Using comprehensive data and advanced analytics, providers can better understand an individual's propensity to pay and make the payment process a positive one by assessing and assigning each patient to the appropriate financial pathway based on their unique financial situation. Medical bills are often the most direct contact providers have with patients after a service is rendered. Unfortunately, money is often a sensitive topic for patients and statements are often overwhelming and difficult for patients to read. Tailoring communications at each stage can convey compassion and increase patient satisfaction. Customizing patient statements gives providers the ability to simplify and customize bills quickly and easily, turning an often confusing process into one that adds value. Including relevant, personalized messages and educational updates can turn billing statements into a useful resource, all with the potential to drive revenue. In addition to offering personalized payment options, providers can also find out whether a patient prefers to discuss billing by phone or email. Minimizing friction at the point of payment is crucial to fostering compassionate collections. Providers should offer flexible options that include in-person, telephone, mobile and online patient portals, so they can pay in a way that’s most convenient for them. This also frees up staff to help those patients who may need a little extra help understanding their statement. Want to learn more? Check out Experian Health’s Collections Optimization Manager which helps providers segment patients based on an individual’s propensity to pay and payment preferences, informing a compassionate patient engagement strategy and improving collections.

With COVID-19 leading to postponed and cancelled medical appointments, more consumers are turning to “contactless care”. Recent figures suggest telehealth adoption has shot up from just 11% in 2019 to 46% over the course of the pandemic, and some providers are seeing up to 175 times the number of telehealth patients than pre-COVID. As they grapple with the surge in patient volumes alongside regulatory change, many are playing catch-up. For patients, rushed implementation means the telehealth experience can fall short of expectations. Compared to the easy one-click services available with online retail and finance platforms, telehealth can feel clunky and frustrating. Technical issues, not knowing how to prepare for appointments, and a lack of awareness of available services can all taint the consumer experience. Providers looking to launch (or re-launch) a patient-friendly telehealth service ahead of a possible second wave should aim to check off these four considerations before rolling it out. 1. Prioritize easy online scheduling for virtual care Allowing patients to book telehealth appointments when it suits them will help to reduce no-shows and minimize delays. A telehealth platform that integrates with physician calendars and other patient management and record management systems will keep things running smoothly at the operational level, while creating a convenient and secure way for patients to schedule care. For example, when Benefis Health System implemented Patient Schedule, more than 50% of patients chose to book their appointments out of normal working hours. Sam Martin, digital developer and web specialist at Benefis, says: “If you’re not allowing your patients to schedule online, you’re behind the times. You can only benefit from it. We’re seeing the number of online bookings continue to grow every month, confirming that this solution is working for patients.” 2. Include quick and reliable coverage checks With the pandemic and resulting unemployment putting both provider and patient cashflow under strain, any available commercial or government coverage must be identified quickly. Providers should run automated coverage checks to find any missing coverage and select the right financial pathway for each patient as soon as possible. Not only will this create a more compassionate patient financial experience, it’ll allow the collections team to focus their attention on the right accounts and minimize the risk of write-offs. Automated Coverage Discovery screens for eligibility through Medicare, Medicaid or commercial plans, without any collections agency getting involved. With this tool, Essentia Health were able to find coverage for 16,990 accounts that were assumed to be self-pay or uninsured. Kathryn Wrazidlo, Patient Access Director, says: “This has helped patients because we’re actually billing their insurance versus billing them for self-pay. It’s helping staff because they’re billing the insurance company much quicker. There’s less rework.” 3. Get telehealth claims right first time Given that the pandemic may cost hospitals an estimated $200 billion between March and June 2020, there’s no room for the added financial burden of claim denials. But as telemedicine expands, so does its regulatory framework. Providers must keep track of changing payer updates and coding rules so that claims are submitted right first time. An automated, data-driven claims management tool can help providers analyze claims with greater confidence and spot any errors well in advance of submission. Telehealth alerts can be included as customized edits, to confirm whether the patient’s current plan includes virtual care. To help providers manage this process, Experian Health is offering free access to telehealth payer policy alerts through our COVID-19 resource center. 4. Protect patient data As with any part of the digital patient experience, a multi-layered approach to protecting sensitive information is a must. Ideally, this will include two-factor patient identity authentication, device recognition and out-of-wallet checks whenever a log-in attempt looks suspicious. Automating this process with a tool such as Precise ID allows providers to integrate multiple data points to check that a patient is who they say they are, in a way that’s HIPAA-compliant. This makes it harder for thieves to access patient data, without burdening the patient with extra checks as they manage their information. Retaining patient volume and rebuilding revenue through “contactless” care won’t be possible unless the entire telehealth journey is as seamless as possible. From scheduling to payment, Experian Health can help you create a virtual patient experience that’s convenient, secure and reliable. To learn more about how to build a better digital patient journey, download our free eBook.

Consumers today expect fast and convenient access to almost everything, healthcare included. While still only offered by a fraction of healthcare providers out there, online scheduling is catching on throughout the market – especially as more providers turn to telehealth solutions during COVID-19. Still, despite the uptick in online self-scheduling, there are patients who prefer to call to schedule an appointment and call centers may be overwhelmed as a large number of patients rush to reschedule appointments that were cancelled or postponed due to COVID-19. To best prepare, providers will want to ensure the best possible patient experience for those calling to schedule an appointment. This can be done by enabling online scheduling throughout the call center. Here are five ways to make patient scheduling easy through your call center: Save timeWith a manual scheduling process, patients often have to sit on the phone – sometimes for upwards of twenty minutes – while also being put on hold or having to wait to be called back to confirm an appointment. It’s not only an awful patient experience but imagine what all that time adds up with the number of scheduling calls providers receive every single day? By reducing call times you’re making the process more efficient for more routine scheduling calls while also opening up call center agents to focus on those patients who need more attention. Automate the rulesThe key to reducing time spent scheduling an appointment is automating the scheduling protocols and business rules of the providers in the scheduling platform. Call center agents traditionally have to manually navigate expansive spreadsheets or three-ring binders of business rules with the scheduling criteria for each provider. Experian automates all those rules in our system and translates them to easy Q&A prompts for the scheduler while on the phone with a patient. In short, rules automation equals quicker scheduling (while maintaining accuracy). Improve trainingBecause the rules are automated, the training process for call center agents is made much more efficient. Where agents would have had to learn the various nuances of scheduling complex specialty care for a variety of providers, they now just need to learn how to use the scheduling platform. The scheduling protocols are automated and help dialogues will pop-up to explain and guide agents through the scheduling process for every provider and care type. Where it may have taken 60 to 90 days to master scheduling for a new specialty, schedulers can now be experts for that specialty in as little as one hour. IntegrationIn order to get the most out of any scheduling solution it needs to integrate into the provider’s practice management system. Leveraging APIs or HL7 bi-directional connectivity, all bookings occur in real-time. This prevents any double-bookings and also removes any calendar maintenance by staff to block and recheck time for providers. With the integration, bookings from the call center transact the same as if a staff member was logged in at the providers office and scheduling on the spot. Automated outreachProviders can use automated outreach to augment their call center capabilities. With it they can send text message and IVR campaigns to patients with the ability for patients to schedule an appointment in real-time on the phone. Check out Patient Schedule to learn more or download our free guide about how scheduling can be made easier for your patients through all of your access channels.