All posts by Gary Stockton

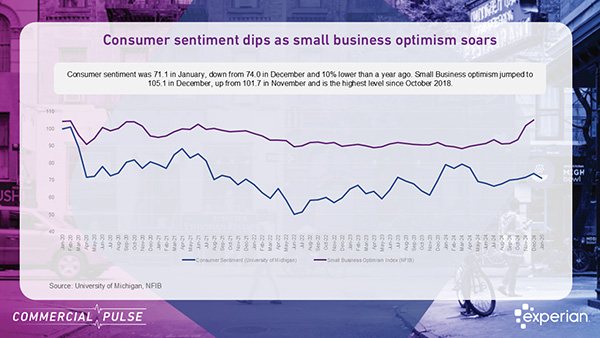

Commercial Pulse Report insights, including small business optimism vs consumer confidence, and the Experian Small Business Index.

The Experian Small Business Index (SBI) declined two points in December to 40.6, following an uptick in November 2025. Follow for updates.

AI is reshaping work, driving small business growth. Discover how AI, corporate shifts, and Gen Z are fueling an entrepreneurial boom.

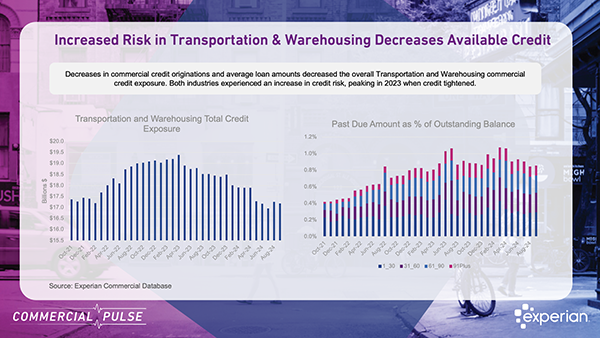

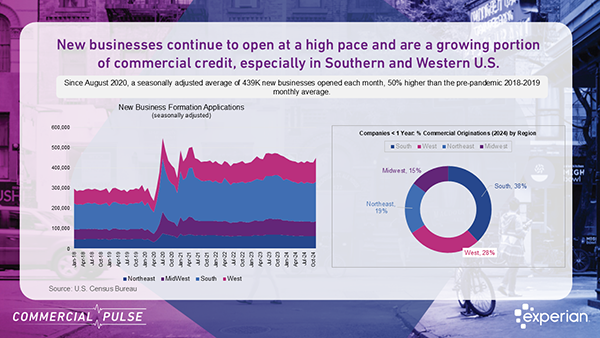

The January 28, 2025, Commercial Pulse Report reveals fascinating insights into the evolving U.S. economy, with a spotlight on the transportation and warehousing sector—a critical backbone of global trade and supply chains. Watch Our Commercial Pulse Update Over the past year, this industry has experienced steady growth, largely fueled by younger businesses. Companies less than two years old now account for a remarkable 50% of new commercial credit accounts in the sector. This entrepreneurial surge reflects the industry's role as a magnet for new opportunities amid expanding global trade. Rising Credit Risks Amid Growth While the sector’s growth is a promising trend, it has come with challenges. Credit risk for transportation and warehousing businesses peaked in 2023, prompting lenders to tighten underwriting standards. This shift has led to a noticeable reduction in the total volume of commercial credit granted within the sector, making it harder for businesses to access the funding they need. Source: Experian Commercial Pulse Report Global Trade and Its Influence The broader trade environment has also played a role in shaping this industry. Global trade expanded by 3.3% in 2024, with services trade leading the way at a 7% increase. However, the U.S. trade deficit widened to $78.2 billion in November, driven by rising imports and geopolitical uncertainties. Tariff adjustments under President Trump’s administration could further impact this industry, introducing a layer of unpredictability for 2025. Looking Ahead The transportation and warehousing sector stands at a crossroads, balancing opportunities for growth with mounting credit constraints and external pressures from the global trade landscape. Businesses operating in this space will need to stay agile, exploring innovative strategies to navigate financial challenges and capitalize on expanding trade networks. For more insights into how these trends are shaping the small business economy download the Commercial Pulse Report, visit Experian’s Commercial Insights Hub or reach out to your Experian account team to explore customized solutions for your business. Download Commercial Pulse Visit Commercial Insights Hub Related Posts

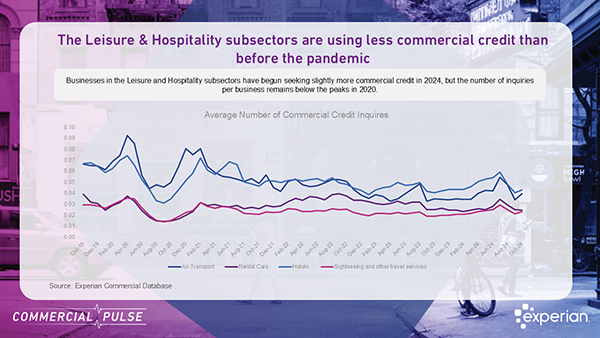

Explore Leisure & Hospitality trends in the commercial pulse report. Insights to help credit managers drive smarter decisions

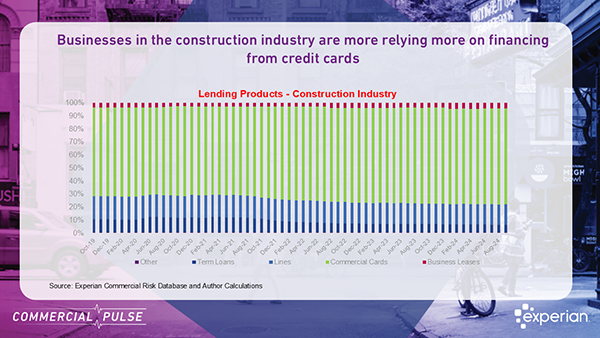

Discover industry-specific risk trends: Construction and Food Services face higher delinquencies, while Retail and Healthcare show stable performance. Learn more!

As small businesses prepare for growth - tariffs take center stage Experian is very pleased to announce the release of the Q3 2024 Main Street Report. Join us for a deep dive on Q3 performance Experian will share key findings from our Q3 Main Street Report in the Quarterly Business Credit Review: Tuesday, December 10th, 10:00 a.m. Pacific | 1:00 p.m. Eastern Register to attend Gain insight on small business health The Q3 2024 Experian Main Street Report offers a deep dive into the economic trends and policy shifts shaping small business performance and their credit outlook. With credit risk managers at the forefront of navigating evolving financial landscapes, the report highlights critical developments in economic stability, global trade, and credit performance. These insights are essential for refining risk assessment strategies and positioning portfolios for a resilient 2025. Download the latest report for more insight. Download Q3 Main Street Report

Discover key trends in housing and construction from Experian’s November 2024 report. Explore rising costs, resilient strategies, and future opportunities!

Join the experts from Experian for a review of quarterly small business credit performance along with a macroeconomic outlook.