In our third installment of our Path to Modernization series, Erikk Kropp, Sr. Product Manager at Experian, shares how we are helping clients to push productivity and transformation through the application of batch append credit scores. As he explains in his latest video, applying certain scores in bulk at the portfolio level can empower businesses to significantly enhance their risk management processes.

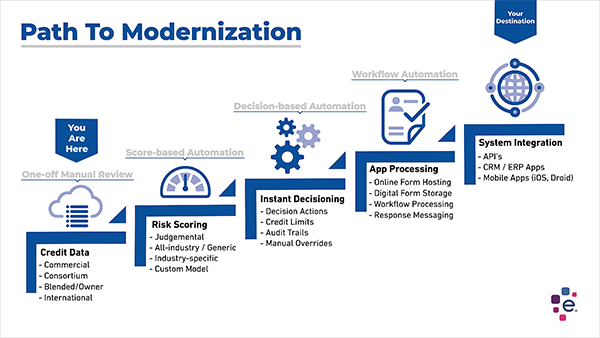

The Path To Modernization Framework

About the framework

The “Path to Modernization” framework is intended to highlight five key areas where Experian can potentially assist clients when introducing digitization and automation to help drive change across their risk management process. The framework is based on observed best practices and common tools frequently used today in the industry. Higher levels of modernization and performance can be achieved with each subsequent step of the process.

Streamlining Risk Assessment with Bulk Processing

One of the cornerstone advantages of using batch append credit scores lies in its bulk processing capability. This approach allows financial institutions and credit issuers to append a comprehensive set of credit scores or additional credit attributes across their entire customer base or portfolio at once. By doing so, it eradicates the need for the labor-intensive and time-consuming process of individually pulling full credit reports and manually analyzing them to decide on subsequent actions for each customer.

Cost Efficiency and Enhanced Operational Efficiency

The process of batch appending credit scores is not only more efficient but also more cost-effective than traditional credit assessment methods. Kropp emphasizes that by utilizing this advanced approach, clients can significantly reduce operational costs associated with credit risk assessment. The savings come not just from the reduced need for manual labor but also from the ability to make quicker, more informed decisions that can mitigate risk and potentially prevent losses.

Unlocking Deeper Insights for Strategic Decision-Making

Beyond the immediate benefits of efficiency and cost savings, the real power of batch append credit scores lies in the depth of insights it unlocks for businesses. With access to a richer dataset, companies can conduct more nuanced segmentation analysis, identifying varying levels of risk and opportunity within their customer base. This detailed understanding allows for the development of tailored strategies to address specific segments, optimizing both risk management and customer relationship strategies.

For example, you might avoid spoiling relationships introducing third-party collections efforts for clients who are able to pay you based on trends in the data indicating they are meeting obligations with other suppliers. Offering this segment incentives to pay on time for example, or raising their limit.

Facilitating Proactive Risk Management

By implementing batch append credit scores, businesses can transition from reactive to proactive risk management. Instead of waiting for delinquencies to occur, companies can identify potential risks early on, based on the comprehensive credit data appended to their portfolios. This early warning system enables the formulation of preventative strategies, minimizing the impact of potential financial setbacks.

Enhancing Customer Relationship Management

Moreover, the insights gained from batch appending credit scores offer the potential to enhance customer relationship management. By understanding the specific risk profiles and credit behaviors of their clients, businesses can tailor their communication and engagement strategies to better meet the needs and preferences of different customer segments, fostering stronger, more loyal relationships. This approach not only streamlines operations and reduces costs but also provides the insights necessary for effective risk segmentation and proactive management. By leveraging the power of batch append credit scores, businesses are well-equipped to navigate the complexities of the modern credit landscape with greater agility and precision.