Experian and Moody’s Analytics have just released the Q3 2020 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as offer…

Experian and Moody’s Analytics have just released the Q3 2020 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as offer commentary on business credit trends and what they mean for lenders and small businesses.

In a fight for survival, small businesses have turned to layoffs and borrowing as they attempt to reach the other side of COVID-19. The increased borrowing is helping to mask rising late-stage delinquencies and bankruptcy. But these tactics can only mask weakness for so long. With another round of government stimulus unlikely to arrive before year’s end, small businesses will need to borrow for survival again.

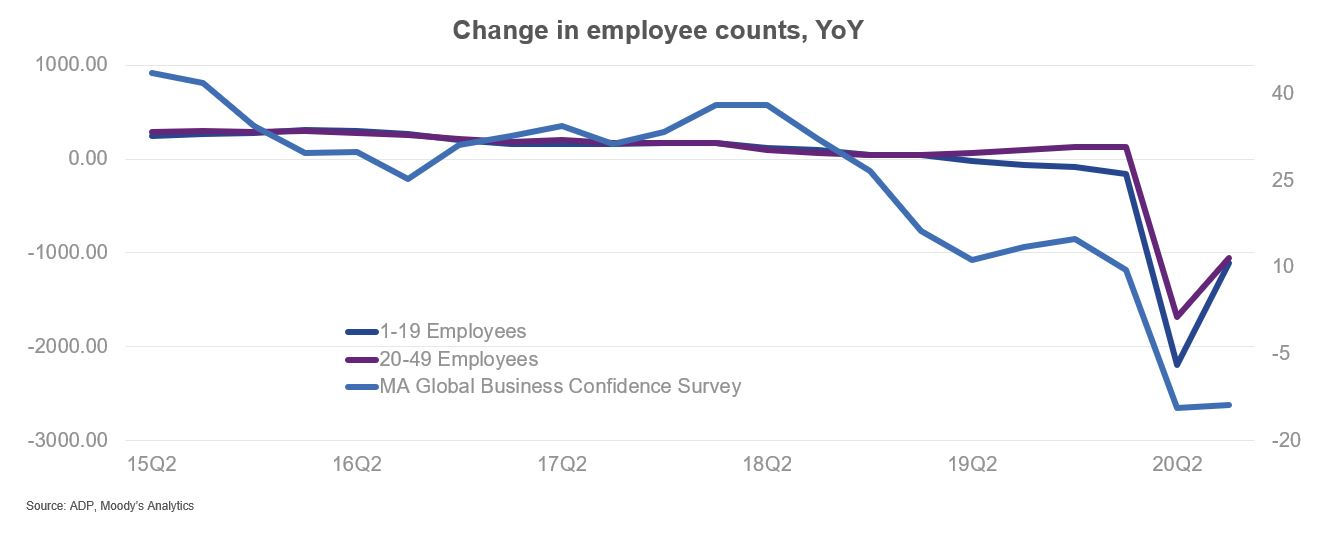

While we did see some jobs come back in Q3, small business payrolls have shrunk by more than 2 million from this time last year. The hardest hit are those businesses with 1-19 and 20-49 employees; both of these groups saw payrolls shrink by 1 million employees.

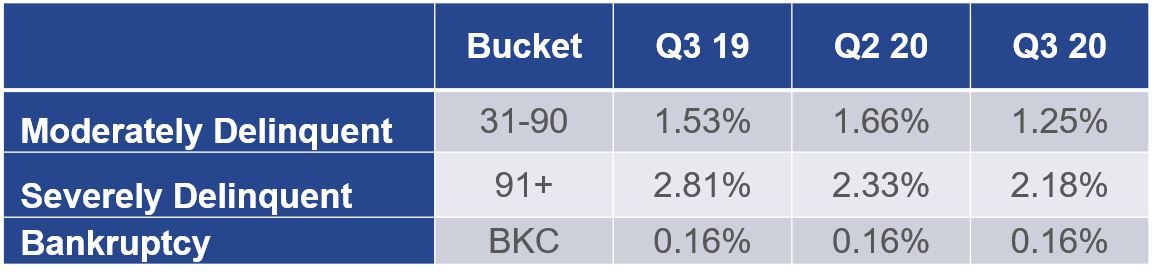

The 31-90 days past due (DPD) delinquency rate on small business credit plunged to 1.25 percent in the third quarter. This ended the streak of increasing delinquency we had observed for the last year. However, this is likely to be short-lived, as the US appears to have entered a new phase of the COVID-19 pandemic with cases again on the rise.

The 31-90 days past due (DPD) delinquency rate on small business credit plunged to 1.25 percent in the third quarter. This ended the streak of increasing delinquency we had observed for the last year. However, this is likely to be short-lived, as the US appears to have entered a new phase of the COVID-19 pandemic with cases again on the rise.

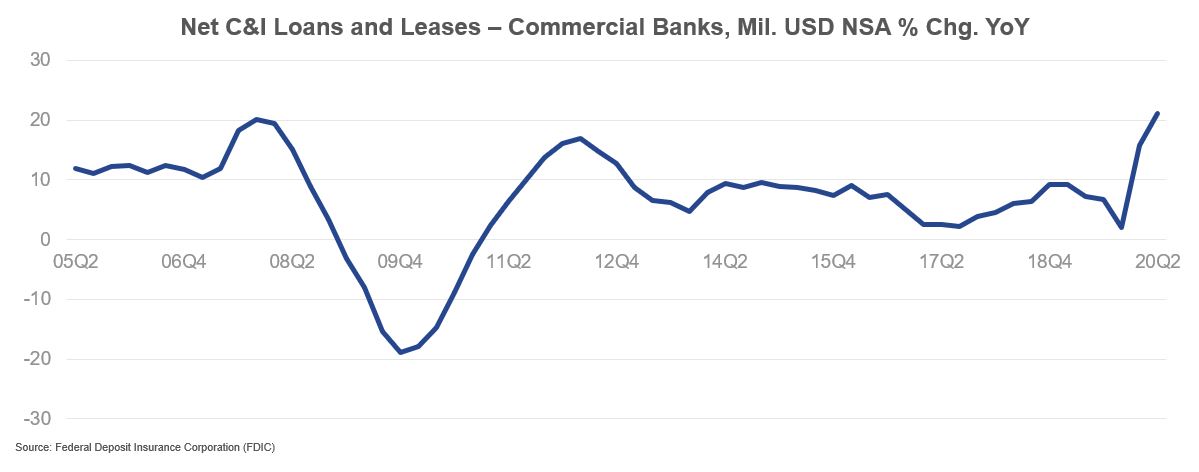

Commercial and Industrial loans continued to run hot. C&I numbers are a lagging indicator, so the latest numbers reflect the second quarter. At that time new C&I lending was 21 percent higher than in the same period a year ago.

If you would like to get the full analysis of the data behind the latest Main Street Report, join us for the Quarterly Business Credit Review webinar.