Data analysis surrounding lending practices for commercial lenders falls into 4 distinct buckets that define scope, usability, and purpose. In this post we will discuss how they differ in terms of value and complexity.

Descriptive Analytics

Descriptive analytics provide the current state of a commercial lender’s acquisitions, portfolio, or other parts of the lending lifecycle. This is “Reporting” in its simplest form. Defining and creating metrics can be as simple as a snapshot of the firmographic and performance elements of a portfolio to complex retro trends that define the effectiveness and success of a lender. Full coverage of the target market and accurate data play a big part in the success of this type of analysis. Selecting the wrong element, when creating a view, can lead the lender to a sub-optimal understanding of the state of their business.

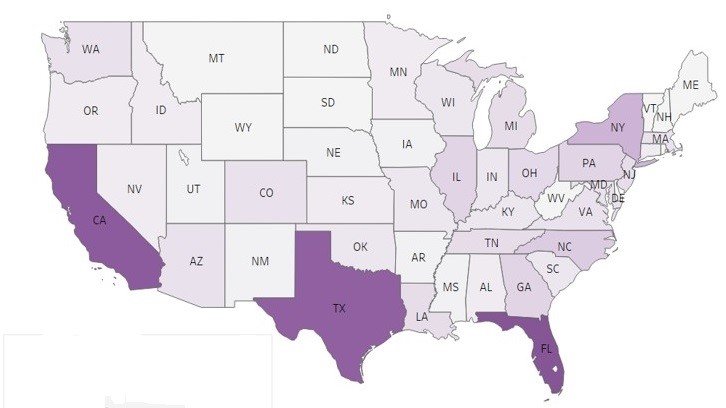

Looking at a competitor’s metrics can inform market share and pricing decisions. Experian commercial clients use Portfolio Benchmarking reports as an empirical view into the health of their business compared to their market peers. Adding data visualization on top of the descriptive-analytic reporting quickly closes the gap to a diagnosis. In the map below Texas, California, and Florida have higher rates of account opening and would be attractive target regions for acquisition.

Diagnostic Analytics

A Diagnostic view of lending performance will look at the portfolio health of a lender and its peers and determine what are the key success and opportunity drivers within comparable products. Larger financial institutions have been performing this type of analysis for years. Several years ago, fintech lending hit its stride challenging the large commercial lenders by providing targeted products in niche lending spaces with little or no traditional commercial credit data. Large commercial lenders used benchmarking and market analysis to understand where the fintechs were being successful. Large lenders use of alternative data sources and market intelligence helped them to recognize the gaps in identifying and evaluating the risk of those underserved businesses. Fintech use diagnostic analysis, to their advantage, to make fast decisions and pivot to market demand.

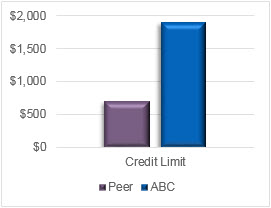

In the chart above, you can see that ABC bank is able to identify where they are offering higher credit limits than their competitors. This client had similar bad rates to its peers causing the lender to have higher losses due to improperly assigned credit limits.

Predictive Analytics

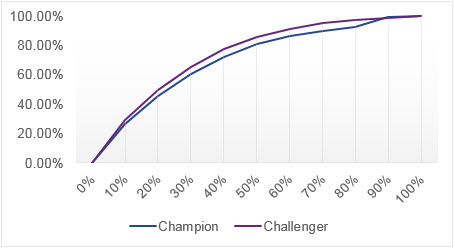

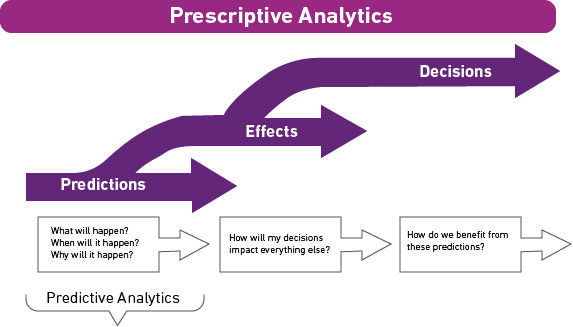

Predictive analytics can help to scope the effectiveness of a strategic decision and plan for the long-term impacts of credit decisions. Financial institution use this type of analysis to forecast loan performance and plan for impacts to cash flow as economic and market conditions change. Machine learning is used in predictive analysis to be nimbler in the evaluation of vast amounts of data to provide more accurate prediction of future outcomes. Large financial institutions will use Machine Learning in predicting response to an offer through the lifecycle to the collection of outstanding debt.

Prescriptive Analytics

Predicting potential outcomes within a commercial lender’s strategies only gets them half way to a successful outcome. Providing insight on top of the analytic content is what drives the decisions to stay the course or pivot to an alternate course of action. Prescriptive analytics provides that direction. Machine learning can be used as a tool in prescriptive analytic engagements to develop models that can learn and pivot with changes to the market and behaviors of businesses within that market. Having the capability to adjust actions associated with outcomes allows the model to stay relevant and predictive over a longer period.

As customer experience drives lending practices, commercial lenders look to use varying levels of analysis as stepping stones to better serve their small business clients.

Got a question about analytics? We would be delighted to answer your questions.