There’s a lot of commentary in the press today as a result of a report the Federal Trade Commission issued this morning about the accuracy of credit reports.

This gives me the opportunity to share some insight into Experian’s business and how we actively manage the integrity of our data.

After thoroughly reviewing the FTC report issued today, we believe it confirms that consumer credit reports are predominately accurate and serving lenders and consumers well.

The report shows that the vast majority of errors on credit reports have no bearing on credit scores, for example outdated information on a consumer’s phone number or address.

About 2.2% of reports contained an identified error that shifted consumers to a more favorable lending tier when the data furnisher corrected the inaccuracy.

That said, Experian is not satisfied with this result and we continue to work toward ensuring credit reports are 100% accurate. We take all errors seriously, and invest millions of dollars every year in ways to maintain the integrity of our data by updating our systems to keep data as fresh and accurate as possible.

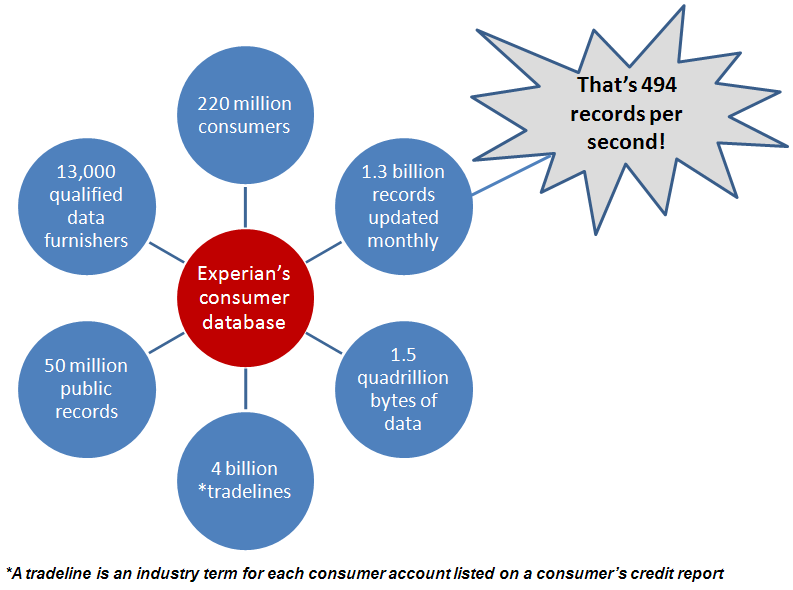

Experian manages information on 220 million consumers and 25 million businesses here in the U.S. There’s no question that’s a challenging job, but one that’s the cornerstone of what we do and therefore critically important. Given the immense significance of credit data in the lending process, we constantly invest the time and resources to improve the integrity of our data, keeping it as fresh and accurate as possible.

Credit data powers lending, commerce and our economy, and enables consumers to have access to reasonably priced credit to get the things they need to live a productive life. Lenders need accurate data so they can make objective lending decisions, and consumers should reasonably expect that the information reported about them is an accurate description of how they have handled their credit obligations.

All participants in the credit and lending process, including Experian, bear a responsibility to ensuring credit reports are accurate to help keep this process balanced, harmonious and thriving for everyone.

Other research on credit report accuracy has also been conducted and published. The Policy and Economic Research Council (PERC) issued the results of its study in May 2011 (PDF); after extensive scientific research, it found that consumers were negatively affected less than one percent of the time by an error in their credit report.

Further, the Consumer Financial Protection Bureau (CFPB) issued a report (PDF) that analyzed credit scoring models and found that between 1.3 percent and 3.9 percent of all consumers disputed information on their credit report. Experian’s comments on that report are here.

Maintaining Integrity of Our Data

The illustration below provides some context on the size of our credit databases.

Our goal is to maintain the massive amounts of data flowing through the credit reporting system and ensure credit reports are 100% accurate. Admittedly, this goal has not yet been achieved. We still have work to do, and we invest millions of dollars every year in ways to maintain the integrity of that data by updating our systems to keep it as fresh and accurate as possible.

Experian maintains an inventory of more than 400 data quality rules that are customized to the unique needs of clients. Each data furnisher’s submission is checked by these rules to make sure the data is historically consistent and logical before it is loaded to our database. For example, a data furnisher in the auto industry should not be reporting a mortgage account. Our system would catch this, and it would be flagged for one of our data management specialists to investigate.

Again, we still have work to do. But we remain vigilant and committed to making improvements.

How to Dispute an Error

We understand how stressful it can be to find incorrect information on your credit report, especially if the incorrect information is found while applying for credit. Our consumer assistance agents make it a priority to have disputes resolved as quickly and as easily as possible.

In fact, to better serve consumers and make sure they have the opportunity to ask questions to understand how inaccuracies occur and how the resolution process works, our consumer assistance center established our “Stop the Clock” program. Instead of measuring the success of our customer service by the number of calls answered or the speed which those calls are handled, our agents are empowered to provide excellent customer service and spend time with each consumer to make sure their questions are answered and they understand any next steps if needed.

To accommodate consumer preferences, we provide options on how consumers can initiate a dispute — either online, by telephone or by mail. Most consumers choose to utilize the online dispute system since it simplifies the process by providing choices for the most common dispute reasons and provides a way to check the status of the dispute during the process.

In 1996, the credit reporting industry implemented an online dispute resolution system to drive greater accuracy and efficiency into the dispute resolution process. As a result, consumer disputes are sent to data furnishers online daily rather than relying on written documents sent by mail. Our online dispute resolution systems have been enhanced by numerous technology improvements, such as Live Chat assistance for online consumers which have led to faster dispute resolution times – now averaging 14 days. This is less than half the time allowed by federal law.

Consumers should be satisfied that we have an effective dispute resolution process that allows them to correct errors through multiple channels. In fact, the PERC study noted above found that 95% of consumers who went through a dispute process were satisfied with the outcome.

Experian also invests in consumer education and financial literacy. We want consumers to fully understand the fundamental credit concepts so they can engage effectively in the credit reporting process and play an active role in ensuring information is accurate and complete. The “Live Credit Smart” website is just one example of Experian’s consumer education outreach.

Experian’s Commitment

We live in a world with balanced interests, and believe consumers, credit grantors and the credit reporting industry all benefit from playing an active role in the credit system. Without this system in place, credit grantors would not be able to assess risk, credit would be harder to get and more costly, lending would slow and as a result, the economy could stall.

We know all consumers rely on the ability to lock into a new mortgage rate, get a retail store card to afford that key purchase, or leave the auto dealer with a new car for your family. We take our role in this process seriously, and as a company, we continually challenge ourselves to exceed the highest standards in the industry, both in managing the integrity of our data and helping consumers understand and manage their credit. The success of our business depends on it.

Photo: Shutterstock