In our last few blog posts, we’ve talked about customer segmentation and different ways to segment your target audience into smaller chunks like demographic and psychographic segmentation to connect with the right people. Customer segmentation enables marketers to focus their marketing efforts on their target customers, improving their marketing targeting strategy.

But what if there was a subset of users that had an even bigger impact when targeted? Enter Super Users – the strategic players who can give your ROI numbers a major boost! It may take some trial-and-error testing to pinpoint these super segments accurately, but knowing how these key individuals interact is essential for any successful marketing targeting strategy.

What is a Super User?

As technology progresses and media consumption grows, a unique group is rising to the top.

Activate Consulting’s Technology & Media Outlook 2023 found that Super Users are powering the digital world, with a strong presence across all major media and technology verticals. This select crowd is made up of young, educated individuals who lead affluent lifestyles – spending more time and money than any other user group!

Why should you add Super Users to your marketing targeting strategy?

Super Users are a highly influential audience with the potential to drive major business growth. They stand out from other users in their commitment and dedication across four key areas:

- Time spent with media

- Spend

- Technology and media adoption

- Emerging eCommerce behaviors

“Over the next years, the imperative for technology and media companies will be to identify, reach, and super-serve Super Users – the single group of power users whose time and spend far surpass those of other users.”

Activate consulting’s technology & media outlook 2023

You can use Super Users as a subset of your marketing targeting strategy. While you may need to reach beyond Super Users to achieve your goals, it’s worthwhile to consider:

- Targeting them separately

- Spending more on media

- Reaching them at a higher frequency

Time spent with media

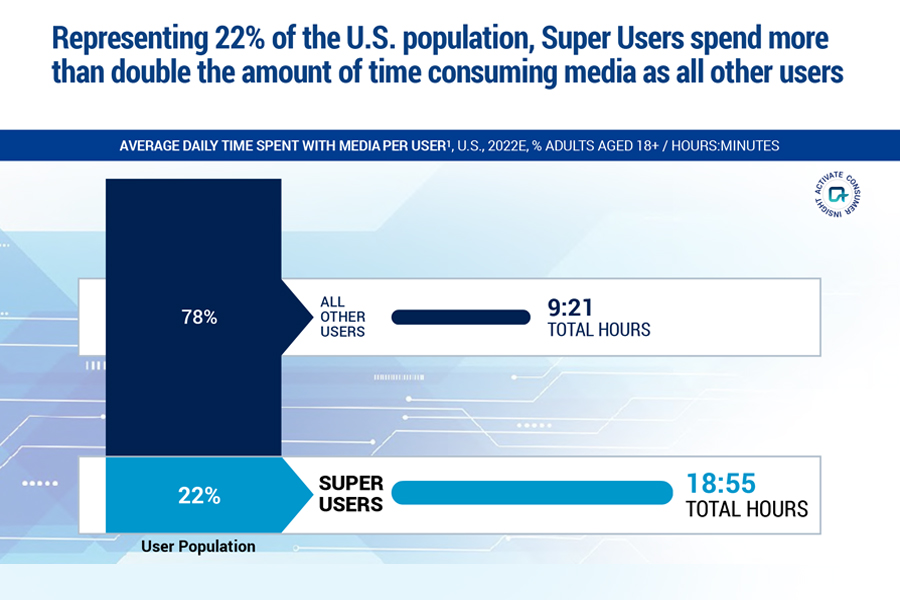

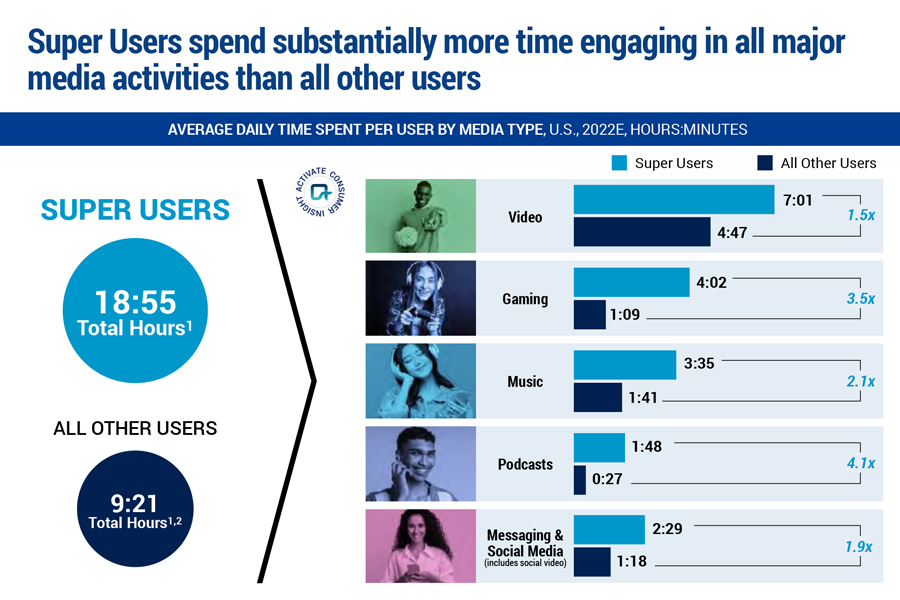

Super Users make a powerful impact, despite comprising only 22% of the U.S. population. They are incredibly influential in terms of media consumption and engagement – spending more than double the amount of time interacting with content compared to other users.

Inclined to multitask

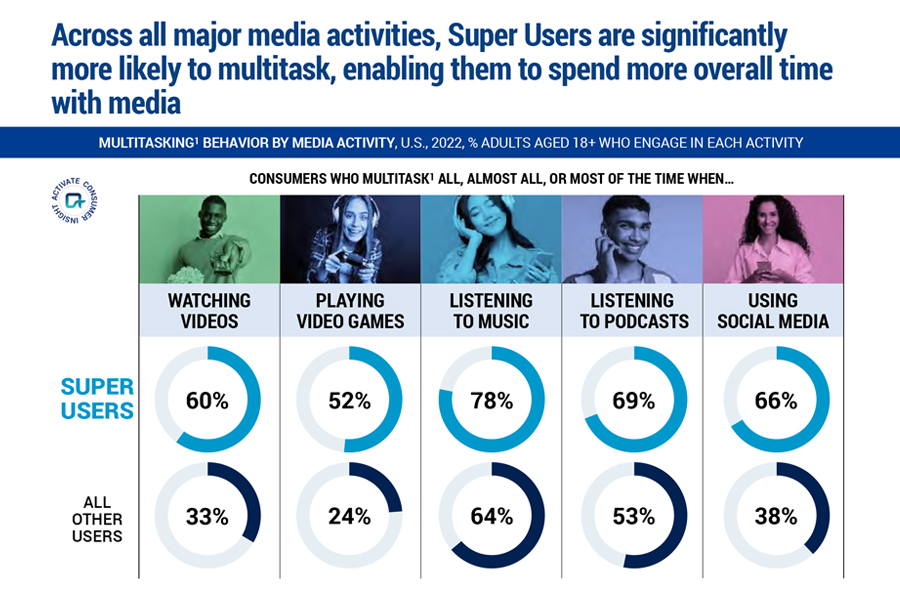

Super Users take multitasking to the next level. Not only do they spend more time with electronics, but they excel in the art of juggling multiple activities. While watching videos and playing video games on one device, Super Users might also be busy engaging with social media on another. This makes them an unstoppable force when it comes to getting the most out of their digital experiences!

High share of dollar spend

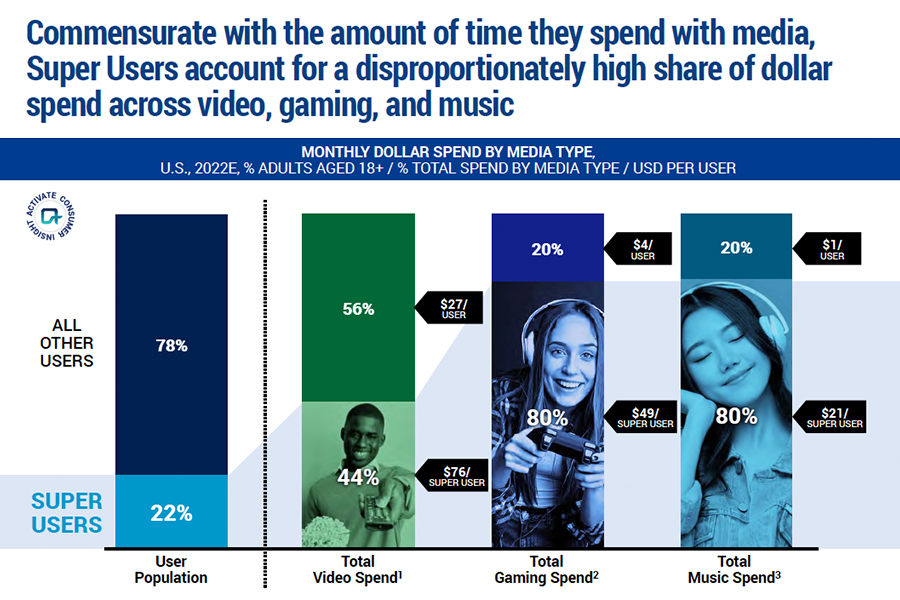

Super Users are big spenders when it comes to media, particularly in gaming and music. Compared with all other users, Super Users’ average video spend is close to triple the amount ($76 vs $27). However, their biggest increases come from gaming and music; they’re collectively spending 12x more on games and shelling out 21x as much for tunes!

With 60% of eCommerce spend coming from Super Users, they are driving the industry forward with their enthusiasm and willingness to test out cutting-edge shopping trends like buying through social media, live streaming purchases, and trying on products virtually. Super Users are setting the tone for this dynamic industry.

Technology and media adoption

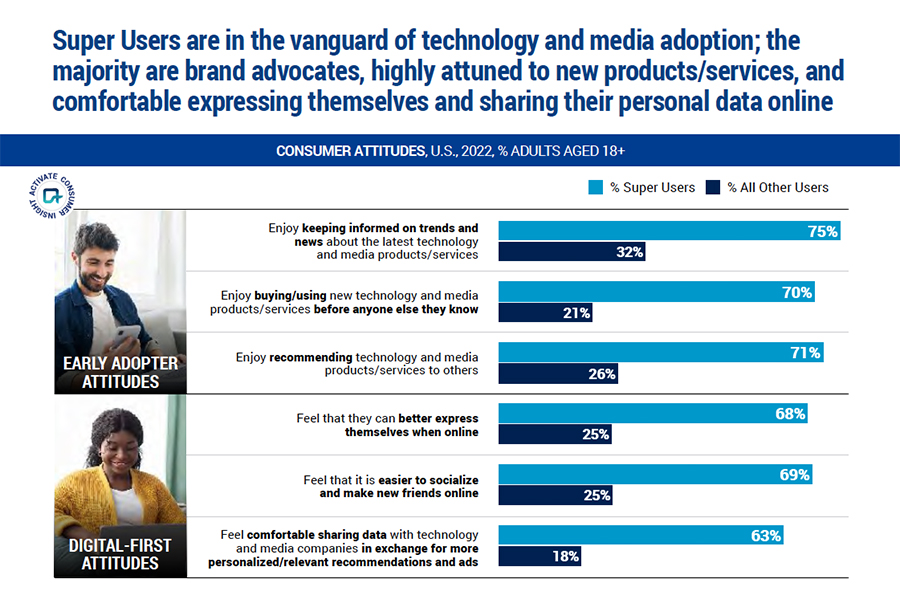

Most Super Users are brand advocates. They’re trendsetting individuals who stay ahead of the curve on media and technology. They eagerly take advantage of new products, services, and data-sharing opportunities to receive tailored ads that fit their lifestyle.

Crypto & NFTs

Super Users blaze the trail for cryptocurrency and non-fungible tokens (NFTs)! This group is five times more likely to explore, engage with, and embrace new digital-monetary technologies.

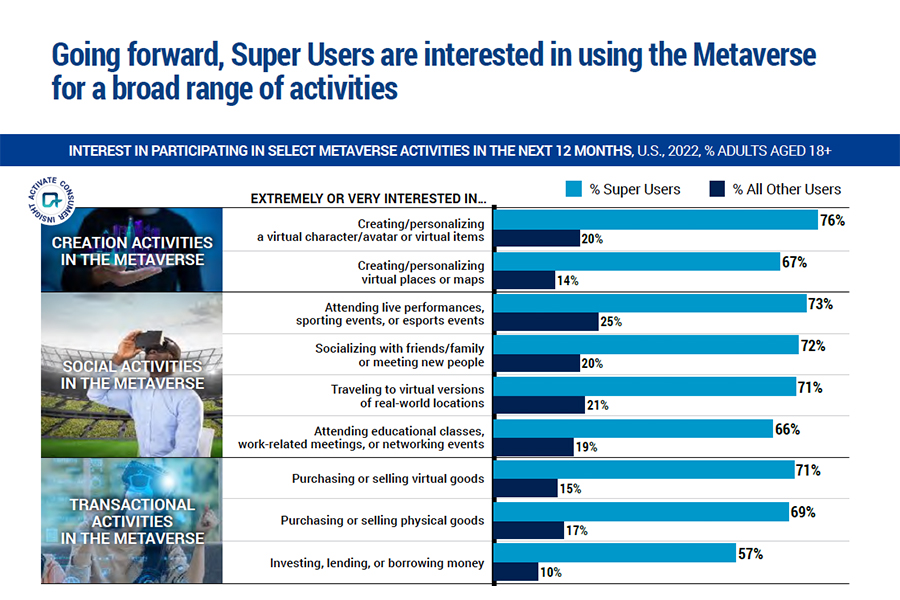

Pioneers of the Metaverse

As Metaverse usage continues to rise, Super Users are leading the way. Over 80% of these trailblazers have embraced these digital spaces within just the last year. We’re seeing accelerated interest from them as they seek out new opportunities for creativity, connections, and transactions within their favorite Metaverses. Many express interest in Metaverse experiences such as purchasing physical items to creating virtual havens. In fact, they’re 5x more interested in all things meta-related!

How Experian can help you identify and target Super Users

So how can you find your Super Users and include them in your marketing targeting strategy? Whether you want to build or acquire highly addressable audiences, we can help you precisely reach the right individuals and households in any channel you desire with Consumer View.

Consumer View

It all starts with data. Delivering the right message in the right place at the right time means truly knowing your prospects and customers as individuals – their lifestyles, behaviors, and shopping preferences. Consumer View data can provide a deeper understanding of your customers.

Consumer View is the world’s largest consumer database that contains over 3,900 attributes for 250 million adult consumers in the U.S. with coverage of 126 million (98%) of U.S. households. Consumer View can help you find out:

- What do your customers look like?

- What do your customers do?

- How and when should you reach your customers?

- What motivates your customers?

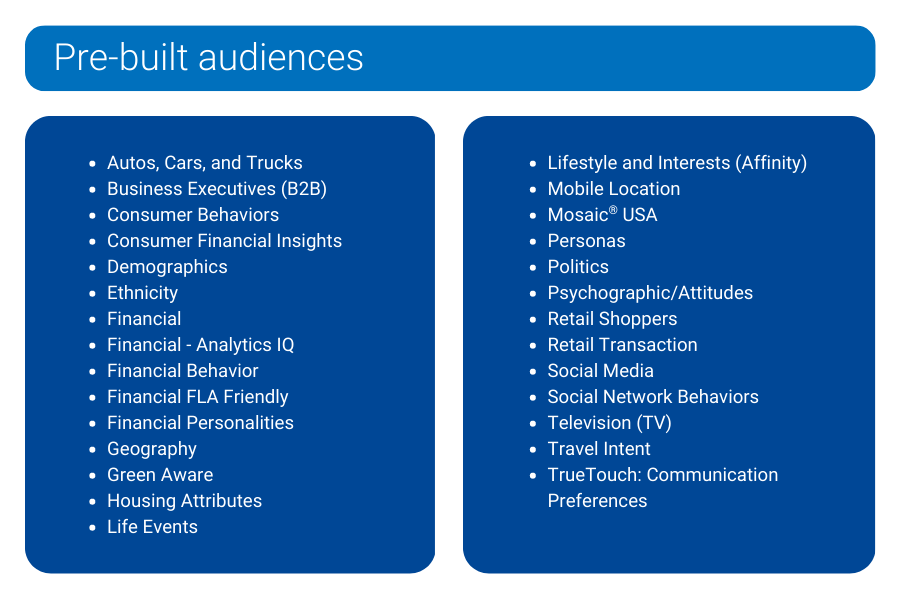

Modeled and syndicated audiences

We have over 2,500 pre-built audiences that are privacy-safe and built using advanced data science and the most comprehensive consumer data available. These digital audiences are readily available via major publishers, data management platforms (DMPs), advanced TV operators, and demand-side platforms (DSPs).

Our pre-built audiences can be used consistently across multiple distribution partners – making sure you can quickly find the right audience for the right campaign without having to build your own consumer personas. In addition to being available as digital audiences, our segmentation products are also available to use across all consumer touchpoints to enable consistent omnichannel campaign targeting.

There are infinite data combinations and selections we can help you with for optimal audience targeting. Using our comprehensive inventory of data, we can find even the most unusual of audiences to help you connect with new prospects. From demographics to behavioral and psychographic information, we draw on a massive base of knowledge accumulated during five decades in business.

Mosaic® USA

Experian’s Mosaic® USA is a household-based consumer lifestyle segmentation system that classifies all U.S. households and neighborhoods into 71 unique types and 19 overarching groups, providing a 360-degree view of consumers’ choices, preferences, and habits. Using Mosaic lifestyle segmentation, you can anticipate the behavior, attitudes, and preferences of your best customers and reach them in the most effective traditional and digital channels with the right message in the right place at the right time.

Tailored Segmentation uses a sophisticated data-driven clustering system that leverages the 71 Mosaic types that match to first-party data like yours. Tailored Segmentation allows you to regroup Mosaic types based on the attributes you weigh as more impactful to your business. Have you designed your own segments in-house? You can apply Tailored Segmentation to those segments for deeper insights through a tailored analysis. Are you still looking for a way to segment your market even though you understand your typical best customer? Tailored Segmentation can weigh these attributes and develop a custom clustering and analysis of your market.

We can help you find your Super Users

Super Users are an important segment of any market. Marketers need to be able to identify them quickly and act upon their insights. Our marketing solutions provide the necessary data and analytical capabilities to easily find and target your potential Super Users for an effective marketing targeting strategy.

With Experian, you can deliver messages that are more in line with what matters to this influential group of customers. We understand how challenging it can be to find these customers and ensure they get the tailored, personalized messaging they deserve – so let us help you do just that! We can provide deep insights beyond the generic customer persona that allows marketers to look into the effectiveness of their marketing strategies from multiple angles. We want to help you gain an edge over your competitors by helping you identify, target, and engage Super Users for increased revenue growth. Ready to find your Super Users?

Get in touch

Sources

Activate Technology & Media Outlook 2023. Activate Consulting.

Latest posts

Commerce media networks have had a strong start. Growth has been fast, demand has been strong, and brands have made it clear they want closer access to commerce-driven audiences. But as more networks mature and enter the space, many are starting to feel the same pressure point: scale. Most commerce media networks were built as managed service businesses. That model works well early on. High-touch, white-glove partnerships make sense when you’re working with a handful of strategic brands. But there’s a ceiling. There are only so many teams, only so much inventory, and only so many advertisers that model can realistically support. It’s one thing for a large retailer to build custom programs for a P&G. It’s another to do that at scale for hundreds or thousands of brands. At some point, growth slows, not because demand disappears, but because the model can’t stretch any further. The scale problem no one likes to talk about That’s where many commerce media leaders find themselves today. Pausing to assess what comes next. For a long time, growth has been measured almost entirely through media dollars. That mindset is understandable. Media is familiar, it's easy to quantify. It shows up clearly in negotiations and revenue reports. But viewing commerce media networks purely as media sales engines creates long-term risk. It can strain brand relationships, limit innovation, and distract from what commerce media networks actually do better than almost anyone else: understand consumers deeply. Signals are the real asset Commerce platforms sit close to decision-making. They see what people search for, what they consider, what they buy, and when those behaviors change. Those signals are incredibly powerful. And yet, most networks only activate them inside their own walled environments. That’s a missed opportunity. Curation represents the next area of growth for commerce media networks, and it doesn’t require replacing or diminishing existing media revenue. In fact, it complements it. No single commerce media network has all the data needed to give advertisers the scale and reach they're looking for. And no advertiser wants to recreate the same audience in dozens of disconnected platforms. That friction creates inefficiency and slows decision-making. Why collaboration supports sustainable growth The opportunity is to look beyond first-party data alone and start thinking about collaboration. Second-party data. Data partnerships. Signal sharing done responsibly and transparently. Imagine an advertiser defining an audience once and being able to understand and reach that audience across multiple commerce environments. Not through a series of disconnected buys, but through a more consistent approach built on shared understanding leading to increased reach and more impactful campaigns. That’s easier for advertisers to manage, and it creates an additional revenue stream for commerce media networks that complements media sales rather than competing with them. Curation strengthens media, it doesn't replace it Media will always play an important role. There is clear value in custom experiences tied directly to a commerce environment. Think buyouts, sponsored experiences, custom creative integrations. Those are situations where brands want to work closely with the network itself. But the signals commerce media networks hold don’t need to be limited to those moments. Those signals can be monetized independently through data products, co-ops, and partnerships that extend their value into other channels. That’s how curation adds value without undercutting existing revenue. A practical path forward for commerce media leaders For commerce media leaders thinking about their next phase of growth, the focus should be on sustainability. Building a massive media operation takes time and investment. Data-driven revenue streams can be introduced more quickly, require fewer internal resources, and provide steadier margins. It’s a practical approach. Use signal-based revenue to fund growth. Let that revenue support investment in tooling, talent, and media innovation over time. Bootstrapping, in the truest sense. Why transparency matters early There’s also a broader responsibility here. In many advertising channels, transparency followed growth, often after pressure from the market. Commerce media networks have an opportunity to do this differently. To lead with transparency from the start. To be clear with brands and consumers about how data is used, how signals are created, and how value flows through the ecosystem. Because the reality is this: commerce media networks are holding some of the most valuable intent signals in the market today. But those signals don’t retain their value in isolation. If they aren’t enhanced, combined, and made accessible in the right ways, someone else will step in to do it. And when that happens, control shifts away from the source. The bottom line The next chapter of commerce media isn’t just about selling more media alone. It’s about recognizing the value of the signals already in hand, working together to make them more useful, and building additional revenue streams that support long-term growth. That’s how commerce media networks grow without eating their own lunch. About the author Kevin Dunn Chief Revenue Officer, Experian Kevin Dunn joins Experian Marketing Services with more than 20 years of leadership experience across marketing and advertising technology, most recently serving as Senior Vice President of Brands and Agencies at LiveRamp. In that role, he led growth across retail, CPG, travel, hospitality, financial services, and healthcare, overseeing new business, account expansion, and channel partnerships. Kevin is known for building cohesive, accountable teams and leading with optimism, clarity, and a strong sense of shared purpose. His leadership philosophy centers on empowering people, driving positive outcomes for clients and fostering a culture where teams can grow, take smart risks, and succeed together. Latest posts

Learn why programmatic curation is becoming the standard for privacy-first, performance-driven media buying in 2026.

Learn how energy and utility marketers use Experian Audiences to reach households based on energy usage, sustainability interest, and tech adoption.