At A Glance

Experian and Yieldmo collaborate to help marketers navigate signal loss with privacy-safe contextual advertising. By combining Experian’s identity solutions with Yieldmo’s advanced targeting, this collaboration enables effective audience engagement in a world with fewer traditional signals.Note: While third-party cookies are no longer being phased out, this webinar was recorded in 2023 when cookie deprecation was still a key industry focus. The strategies discussed reflect that time frame and remain relevant for addressing broader signal loss challenges.

With major browsers discontinuing support for third-party cookies, marketers must rethink how to identify and engage their audiences. Contextual advertising offers a privacy-safe solution by combining contextual signals with machine learning to deliver highly targeted campaigns. In a Q&A with our experts with eMarketer, Jason Andersen, Senior Director of Strategic Initiatives and Partner Solutions at Experian, and Alex Johnston, Principal Product Manager at Yieldmo, we discuss how contextual advertising addresses signal loss, improves addressability, and delivers better outcomes for marketers.

The macro trends impacting marketers

How important is it for digital marketers to stay informed about the changes coming to third-party cookies, and what challenges do you see signal loss creating?

Jason (Experian): Third-party cookies have already been eliminated from Firefox, Safari, and other browsers, while Chrome has held out. It’s just a matter of time before Chrome eliminates them too. Being proactive now by predicting potential impacts will be essential for maintaining growth when the third-party cookie finally disappears.

Alex (Yieldmo): Third-party cookie loss is already a reality. As regulations like theGeneral Data Protection Regulation (GDPR) and the California Consumer Privacy Act(CCPA) take effect, more than 50% of exchange traffic lacks associated identifiers. This means that marketers have to think differently about how they reach their audiences in an environment with fewer data points available for targeting purposes. It’s no longer something to consider at some point down the line – it’s here now! Also, as third-party cookies become more limited, reaching users online is becoming increasingly complex and competitive. Without access to as much data, the CPMs (cost per thousand impressions) that advertisers must pay are skyrocketing because everyone is trying to bid on those same valuable consumers. It’s essential for businesses desiring success in digital advertising now more than ever before.

Solving signal loss with contextual advertising

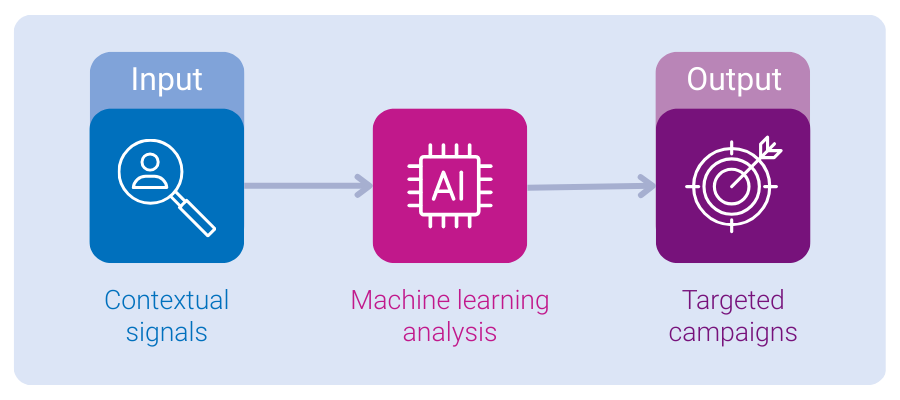

How does contextual advertising help marketers engage audiences with new strategies like machine learning and artificial intelligence (AI)?

Jason (Experian): Contextual advertising helps marketers engage audiences by combining advanced machine learning with privacy-safe strategies. We focus on using AI and machine learning to better understand behavior, respect privacy, and deliver insights. As third-party cookies go away, alternative identifiers are coming to market, like Unified I.D. 2.0 (UID2). These are going to be particularly important for marketers to be able to utilize them. As cookie syncing becomes outdated, marketers will have to look for alternative methods to reach their target audiences. It’s essential to look beyond cookie-reliant solutions and use other options available regarding advertising.

Alex (Yieldmo): There’s been a renaissance in contextual advertising over the last couple of years. Three key drivers are shaping this shift:

- The loss of identity signals is forcing marketers to rethink how they reach audiences.

- Advances in machine learning allow us to analyze more granular contextual signals, identifying patterns that are most valuable to advertisers.

- Tailored models now use these signals to deliver more effective campaigns. This transformation is occurring because of our ability to capture and operate on richer, more detailed data.

Reach consumers with advanced addressability

How does advanced contextual advertising help marketers reach non-addressable audiences?

Jason (Experian): Advanced contextual advertising helps marketers reach non-addressable audiences by taking a set of known data (identity) and drawing inferences from it with all the other signals we see across the bidstream. It’s about using a small seed set of customers, those who have transacted with you before or match your target audience, and training contextual models to make the unknown known. Now we can go out and find users surfing on any of the other sites that traditionally don’t have that identifier for that user or don’t at that moment in time and start to be able to advertise to them based on the contextually indexed data.

Alex (Yieldmo): I think the exciting opportunity for many people in the industry is figuring out how to reach your known audience in a non-addressable space, that is based on environmental and non-identity based signals, that helps your campaign perform. Machine learning advancements allow you to take your small sample audience and uncover those patterns in the non-addressable space. High-quality, privacy-resilient data sets are critical for building these campaigns. Companies like Experian, with deep, rich training data, are well positioned to support advertisers in building extension audiences.

Creative strategies that improve ad performance

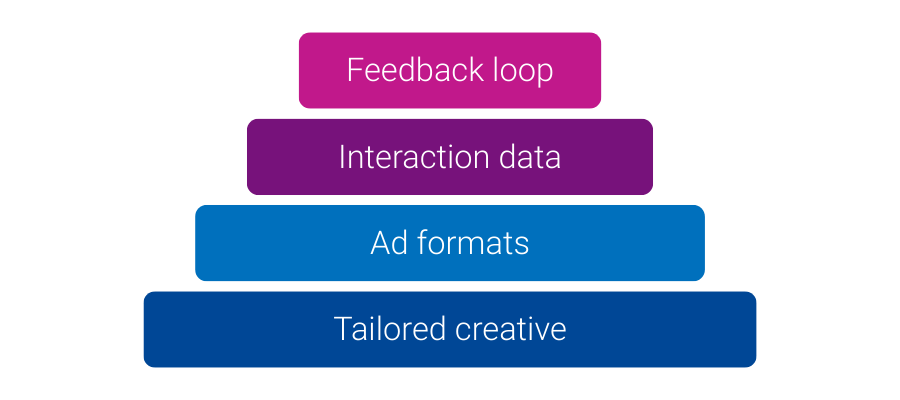

Why does creative strategy remain essential for digital advertising success?

Jason (Experian): Creative strategy remains essential because it provides valuable signals for targeting and engages audiences effectively. In this advanced contextual world, good creative in the proper ad format that you can test and learn from is paramount. It comes back to that feedback loop. We can use that as another signal in this equation to develop and refine the right set of audiences for your targeting needs.

Alex (Yieldmo): Creative and ad formats are powerful signals for understanding audience engagement. At Yieldmo, we collect interaction data every 200 milliseconds, such as scrolling behavior or time spent on an ad. This data fills the gap between clicks and video completions, helping us build models that predict downstream actions. Tailoring creative to specific audience groups has always been one of the best ways to improve performance, and it remains essential in this new era of contextual advertising. Throughout my career, I learned that designing or tailoring your creative to different audience groups is one of the best ways to improve performance. We ran many lift studies with analysis to understand how you can tailor creative customized for individual audiences. That capability and the ability to do that on an identity basis is.

Our recommendations for actionable marketing strategies

Do you have recommendations for marketers building out their yearly strategies or a campaign strategy?

Jason (Experian): My recommendation for marketers building out their yearly strategies is to be proactive and start testing and learning these new solutions now. I mentioned addressability and being in the right place at the right time. That’s easier in today’s third-party cookie world. But as traditional identity is further constricted, you will have these first-party solutions that will not be at scale, so you’re less likely to find your user at the scale you want. It would be best if you thought about how to reach that user at the right place at the right time. They may not be seen from an identity basis. They might not be at the right place at the right time when you were delivering or trying to deliver an ad. But you increase your chance of reaching them by building these advanced contextual targeting audiences using this privacy-safe seed ‘opted-in’ user set; this is a way to cast that wider net and achieve targeted scale.

Alex (Yieldmo): Build your seed lists, test your formats with different audiences, and understand what’s resonating with whom. Take advantage of some of the pretty remarkable advances in machine learning that are allowing us, really, for the first time to fully uncork the potential and the opportunity with contextual in a way that we’ve never done before.

Contact us

About our experts

Jason Andersen

Senior Director, Strategic Initiatives and Partner Solutions, Experian

Jason Andersen heads Strategic Initiatives and Partner Enablement for Experian Marketing Services. He focuses on addressability and activation in digital marketing and working with partners to solve signal loss. Jason has worked in digital advertising for 15+ years, spanning roles from operations and product to strategy and partnerships.

Alex Johnston

Principal Product Manager, Yieldmo

Alex Johnston is the Principal Product Manager at Yieldmo, overseeing the Machine Learning and Optimization products. Before joining Yieldmo, Alex spent 13 years at Google, where he led the Reach & Audience Planning and Measurement products, overseeing a 10X increase in revenue. During his time, he launched numerous ad products, including YouTube’s Google Preferred offering. To learn more about Yieldmo, visit www.yieldmo.com.

About Yieldmo

Yieldmo is an advertising platform that fuses media and creative to meet audiences in the moments that matter. Using proprietary data and AI, Yieldmo uses advanced targeting to deliver context-aware creative when and where it’s most effective, all while respecting user privacy. The result: ads that belong on inventory brands trust. For more information, please visit www.yieldmo.com.

Contextual advertising FAQs

Contextual advertising works by targeting audiences based on the content they’re engaging with, rather than relying on personal identifiers or traditional tracking methods. Yieldmo’s platform uses advanced contextual signals and machine learning to deliver relevant ads in privacy-safe ways.

Contextual advertising addresses signal loss by focusing on environmental and content-based signals instead of relying on thir-dparty cookies or other traditional identifiers. Experian’s identity solutions complement this approach by enabling marketers to connect with audiences in a compliant and scalable way.

Creative is important in contextual advertising because it engages audiences and provides valuable signals for targeting. Yieldmo’s platform collects interaction data, such as scrolling and time spent on ads, to refine campaigns and improve performance.

Marketers can reach non-addressable audience through advanced contextual targeting, which uses known data, like seed audiences, to identify patterns and extend reach. Experian’s identity solutions and contextual data from, Audigent, a part of Experian, help marketers connect with these audiences in privacy-safe and effective ways.

Latest posts

We spoke with industry leaders from Ampersand, AppsFlyer, Audigent, Comcast Advertising, Fox, ID5, and Snowflake to gather insights on how strategic collaboration can expand audience reach, improve targeting precision, and drive measurable advertising success.

We interviewed attendees at RampUp 2025 about AI, data collaboration, and more. Here’s what they had to say.

Navigating the world of data and identity partners feels like scrolling through a dating app. Here’s your guide to finding your perfect match.